Printable Mobile Home Bill of Sale Form for the State of Michigan

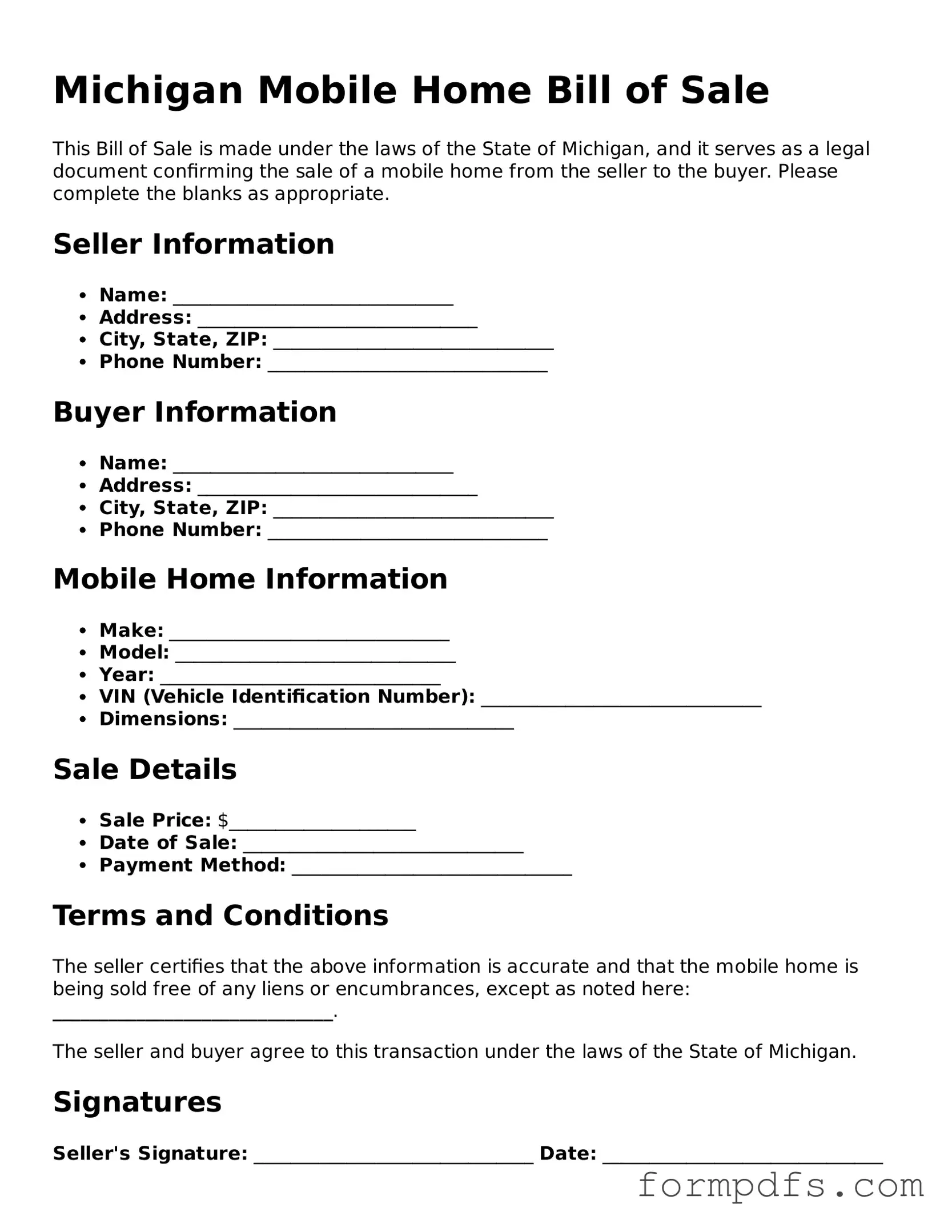

The Michigan Mobile Home Bill of Sale form serves as a crucial document for anyone involved in the buying or selling of mobile homes in the state. This form not only facilitates the transfer of ownership but also provides essential details about the mobile home itself, including its make, model, year, and Vehicle Identification Number (VIN). It outlines the sale price and specifies the terms of the transaction, ensuring that both the buyer and seller have a clear understanding of their responsibilities. Additionally, the form includes spaces for the signatures of both parties, confirming their agreement to the terms laid out. Having a properly completed Bill of Sale is vital, as it can help protect both parties in case of disputes and is often required for titling the mobile home with the state. By understanding the significance of this form, individuals can navigate the process of mobile home transactions with greater confidence and clarity.

Check out Other Common Mobile Home Bill of Sale Templates for Different States

Bill of Sale Mobile Home - It can also specify the date of the sale, making it official.

How to Write a Bill of Sale for a Mobile Home - Consult local laws to ensure your Bill of Sale is compliant and correct.

Obtaining an Emotional Support Animal Letter form can be a crucial step for individuals seeking comfort and companionship from their animals, as it provides essential legal recognition of their needs. This document, prescribed by a licensed mental health professional, not only enhances the therapeutic relationship between the individual and their ESA but also allows for certain legal protections under existing regulations. For more detailed information on how to acquire this letter, you can visit onlinelawdocs.com/.

Mobile Home Registration - May be required for leasing arrangements in parks.

Documents used along the form

When buying or selling a mobile home in Michigan, several important documents may accompany the Mobile Home Bill of Sale. Each document serves a unique purpose and helps ensure a smooth transaction. Below is a list of forms commonly used in conjunction with the Mobile Home Bill of Sale.

- Title Transfer Document: This form officially transfers ownership of the mobile home from the seller to the buyer. It is essential for registering the mobile home in the new owner's name.

- Affidavit of Ownership: This document verifies that the seller is the rightful owner of the mobile home. It may be required if the title is lost or not available.

- Purchase Agreement: This is a contract outlining the terms of the sale, including the price and any conditions. It protects both the buyer and seller by clearly stating their responsibilities.

- Durable Power of Attorney Form: To manage your financial affairs effectively, consider using the essential Durable Power of Attorney resource that allows you to appoint someone you trust for financial decisions.

- Inspection Report: An inspection report details the condition of the mobile home. It can help buyers make informed decisions and negotiate repairs or price adjustments.

- Loan Agreement: If financing is involved, a loan agreement outlines the terms of the loan, including interest rates and repayment schedules. It is crucial for both parties to understand their financial obligations.

- Bill of Sale for Personal Property: This document may be used to sell personal items included with the mobile home, such as appliances or furniture. It ensures that all items are accounted for in the sale.

- Insurance Policy: Proof of insurance may be required before the sale is finalized. This document protects the buyer against potential damages or liabilities associated with the mobile home.

- Tax Clearance Certificate: This certificate confirms that all property taxes on the mobile home have been paid. It prevents any future tax liabilities from falling on the new owner.

- Utility Transfer Forms: These forms facilitate the transfer of utility services, such as water, electricity, and gas, to the new owner. It ensures that the buyer can access essential services immediately.

Having these documents ready can streamline the buying or selling process of a mobile home in Michigan. Each form plays a critical role in protecting the interests of both parties involved in the transaction.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Mobile Home Bill of Sale form is used to document the sale of a mobile home between a seller and a buyer. |

| Governing Law | This form is governed by the Michigan Compiled Laws, specifically Act 96 of 1987, which regulates mobile homes in the state. |

| Parties Involved | The form requires the full names and addresses of both the seller and the buyer to ensure clear identification. |

| Mobile Home Description | A detailed description of the mobile home is necessary, including its make, model, year, and vehicle identification number (VIN). |

| Sale Price | The agreed-upon sale price must be clearly stated in the form to avoid any disputes later on. |

| Payment Terms | Any specific payment terms, such as whether the payment is made in full or through installments, should be included. |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction and confirm their agreement to the terms. |

| Notarization | While notarization is not always required, it can provide an extra layer of security and legitimacy to the transaction. |

| Record Keeping | Both parties should keep a copy of the completed Bill of Sale for their records, as it serves as proof of the transaction. |

| Transfer of Ownership | Completing this form is an important step in the transfer of ownership, which may also require additional paperwork for titling the mobile home. |

More About Michigan Mobile Home Bill of Sale

What is a Michigan Mobile Home Bill of Sale form?

The Michigan Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. It serves as proof that the seller has sold the mobile home and the buyer has purchased it. This document is essential for both parties to ensure a smooth transaction and to establish a clear record of ownership.

What information is typically included in the form?

The form generally includes key details such as the names and addresses of both the buyer and seller, a description of the mobile home (including make, model, year, and vehicle identification number), the sale price, and the date of the transaction. Additionally, both parties may need to sign the document to validate the sale.

Do I need to have the form notarized?

While notarization is not always required for a Mobile Home Bill of Sale in Michigan, it is often recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes in the future. If you plan to register the mobile home with the state, check with local authorities to see if notarization is necessary.

How do I complete the form?

To complete the Michigan Mobile Home Bill of Sale form, start by filling in the required information accurately. Ensure that the details about the mobile home are correct, as any discrepancies could lead to issues later on. Both the seller and buyer should review the completed form together before signing to confirm all information is accurate and agreed upon.

What should I do with the completed form?

Once the form is completed and signed, the seller should provide a copy to the buyer for their records. It is advisable for both parties to keep a copy of the signed document. The buyer will typically need to present the Bill of Sale when registering the mobile home with the Michigan Department of State or local authorities.

Are there any fees associated with the sale of a mobile home?

Yes, there may be fees associated with the sale of a mobile home in Michigan. These can include title transfer fees, registration fees, and possibly sales tax. It is important for both the buyer and seller to be aware of these costs and to discuss who will be responsible for them during the transaction.

Michigan Mobile Home Bill of Sale: Usage Steps

Once you have obtained the Michigan Mobile Home Bill of Sale form, it is essential to fill it out accurately to ensure a smooth transfer of ownership. This document will serve as proof of the sale and should be completed with care. Follow the steps outlined below to complete the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full names and addresses of both the seller and the buyer. Ensure that all information is current and accurate.

- Clearly describe the mobile home being sold. Include details such as the make, model, year, and vehicle identification number (VIN).

- Indicate the sale price of the mobile home. This should reflect the agreed-upon amount between the seller and buyer.

- Include any additional terms of the sale if applicable. This may involve payment arrangements or conditions that both parties have agreed upon.

- Both the seller and buyer must sign and date the form at the designated areas. This confirms that both parties agree to the terms outlined in the document.

- Make copies of the completed form for both the seller and buyer for their records.

After filling out the form, ensure that both parties retain a copy for their records. It is advisable to check with local authorities for any additional requirements related to the transfer of ownership of the mobile home.