Printable Last Will and Testament Form for the State of Michigan

Creating a Last Will and Testament is an important step for individuals looking to ensure their wishes are honored after their passing. In Michigan, this legal document serves several key purposes, including the distribution of assets, appointment of guardians for minor children, and the designation of an executor to manage the estate. The form allows individuals to specify who will inherit their property and possessions, helping to prevent disputes among family members. Additionally, it provides a framework for addressing debts and taxes, ensuring that these obligations are met before any distribution occurs. Understanding the structure and requirements of the Michigan Last Will and Testament form is essential for anyone wishing to create a clear and enforceable will. By carefully considering each section of the form, individuals can express their intentions and provide peace of mind to their loved ones during a difficult time.

Check out Other Common Last Will and Testament Templates for Different States

Last Will and Testament Template Georgia - Encourages open communication among family members about final wishes.

Will Template Illinois - With a will, you can appoint guardians for your minor children, ensuring their care aligns with your wishes.

Obtaining a Doctor's Excuse Note is essential for individuals needing to formally document their health-related absences, and detailed guidance on acquiring such a note can be found at https://onlinelawdocs.com, which outlines the importance and requirements of this critical document.

Nc Will Template - A will can define what happens to any family business you own after you die.

Will Template Ohio - May include directions for the care of pets or other dependents.

Documents used along the form

When preparing a Last Will and Testament in Michigan, several other documents may also be necessary to ensure that your estate is managed according to your wishes. These documents help clarify intentions, designate responsibilities, and facilitate the legal process after death. Below is a list of common forms and documents that are often used alongside a will.

- Durable Power of Attorney: This document allows you to appoint someone to make financial decisions on your behalf if you become incapacitated. It remains effective even if you are unable to make decisions for yourself.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this form designates a trusted individual to make medical decisions for you if you are unable to do so. It ensures your healthcare preferences are honored.

- Bill of Sale: A smarttemplates.net/fillable-new-york-bill-of-sale/ can be essential for recording the sale or transfer of personal property, providing necessary details that safeguard both parties involved in the transaction.

- Living Will: A living will outlines your wishes regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and loved ones about your preferences in critical situations.

- Revocable Trust: A revocable trust allows you to transfer assets into a trust during your lifetime. You can change or revoke it at any time. This document helps avoid probate and can provide privacy for your estate.

- Beneficiary Designations: These designations specify who will receive certain assets, such as life insurance policies or retirement accounts, upon your death. They can override the instructions in your will.

- Letter of Intent: This informal document can accompany your will. It provides additional instructions and personal messages to your loved ones, offering guidance on your wishes and preferences.

- Asset Inventory: An asset inventory lists all your belongings, including property, investments, and personal items. It helps your executor manage your estate and ensures nothing is overlooked.

Each of these documents plays a crucial role in estate planning. Together, they create a comprehensive plan that reflects your wishes and protects your loved ones. It’s important to consider these forms when drafting your Last Will and Testament to ensure a smooth transition of your estate.

PDF Overview

| Fact Name | Details |

|---|---|

| Legal Requirement | In Michigan, a Last Will and Testament must be in writing and signed by the testator. |

| Witnesses | The will must be signed in the presence of at least two witnesses who are not beneficiaries. |

| Governing Law | Michigan Compiled Laws, Act 386 of 1978, Section 700.2501 governs the execution of wills. |

| Revocation | A will can be revoked by a subsequent will or by destroying the original document with the intent to revoke. |

More About Michigan Last Will and Testament

What is a Last Will and Testament in Michigan?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Michigan, this document allows individuals to specify beneficiaries for their property, appoint guardians for minor children, and designate an executor to manage the estate. It ensures that a person's wishes are followed, providing clarity and direction for loved ones during a difficult time.

Who can create a Last Will and Testament in Michigan?

Any individual who is at least 18 years old and of sound mind can create a Last Will and Testament in Michigan. This includes residents and non-residents. It is important to understand that the person creating the will, known as the testator, must be capable of making decisions about their estate and understand the implications of their choices.

What are the requirements for a valid Last Will and Testament in Michigan?

For a Last Will and Testament to be valid in Michigan, it must be in writing and signed by the testator. Additionally, it should be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must sign the document in the presence of the testator. Following these requirements helps ensure that the will is legally enforceable and reduces the likelihood of disputes.

Can I change or revoke my Last Will and Testament in Michigan?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive and of sound mind. To make changes, you can create a new will or add a codicil, which is an amendment to the existing will. If you wish to revoke the will entirely, you can do so by physically destroying it or stating your intention to revoke in writing. It is advisable to inform your executor and witnesses about any changes made.

What happens if I die without a Last Will and Testament in Michigan?

If you die without a Last Will and Testament, known as dying "intestate," Michigan law dictates how your assets will be distributed. Generally, your estate will be divided among your closest relatives, such as your spouse and children, according to state intestacy laws. This may not align with your wishes, making it crucial to have a will in place to ensure your preferences are honored.

Michigan Last Will and Testament: Usage Steps

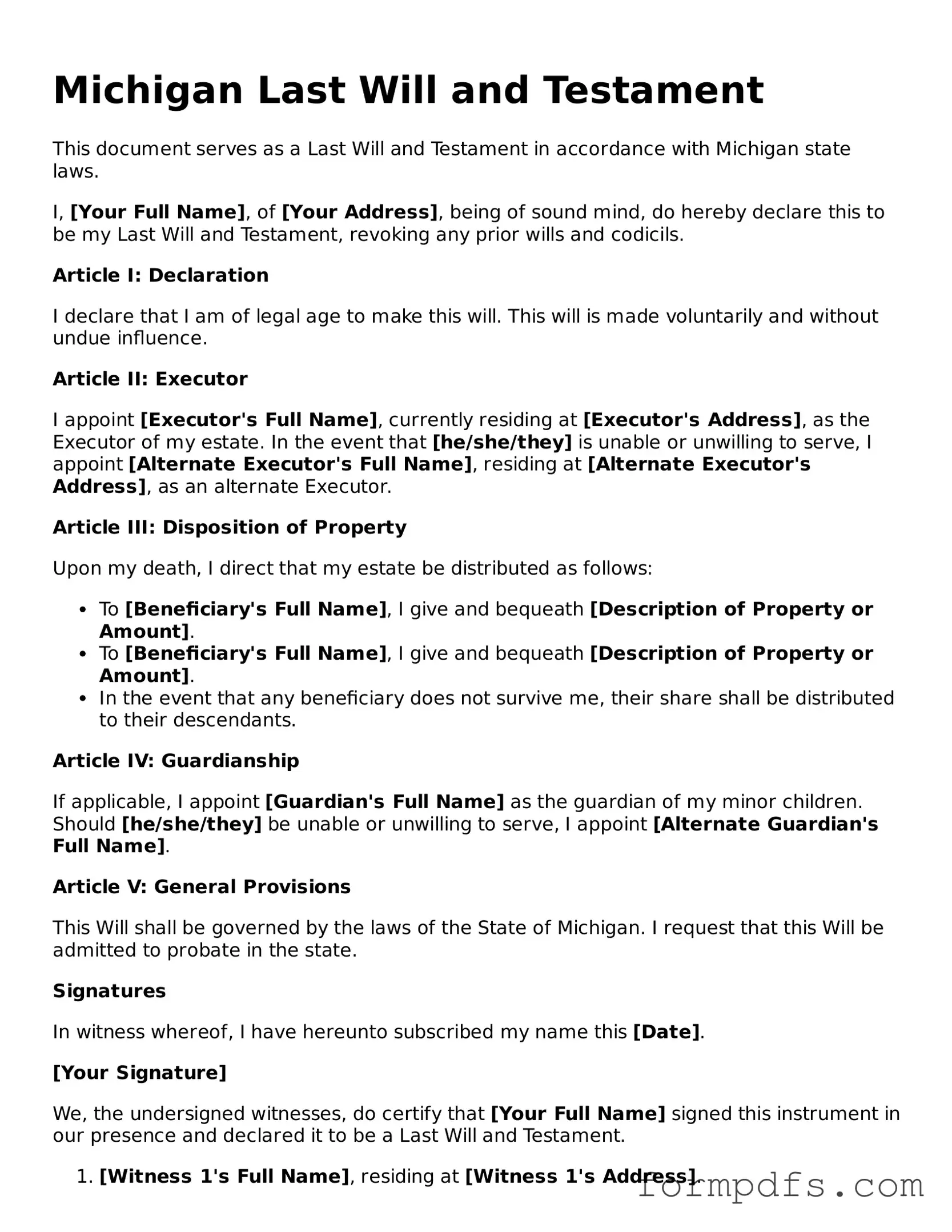

Completing the Michigan Last Will and Testament form requires careful attention to detail. After filling out the form, you will need to ensure it is properly signed and witnessed to make it legally binding. Follow these steps to accurately complete the form.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- State your date of birth to confirm your identity.

- Designate an executor by naming the person you trust to carry out your wishes.

- List your beneficiaries, specifying who will inherit your assets. Include their full names and relationships to you.

- Detail the specific assets you wish to bequeath to each beneficiary.

- Include provisions for any minor children, if applicable, naming guardians and outlining care arrangements.

- Review your entries for accuracy and completeness.

- Sign the document in the presence of at least two witnesses, who must also sign the form.

- Make copies of the completed and signed will for your records and for your executor.