Printable Lady Bird Deed Form for the State of Michigan

The Michigan Lady Bird Deed is a powerful tool for property owners looking to simplify the transfer of their real estate while retaining control during their lifetime. This unique deed allows individuals to transfer property to their beneficiaries without the need for probate, ensuring a smoother transition after death. One of its standout features is the ability for the original owner to maintain the right to live in and manage the property until they pass away, offering peace of mind and flexibility. Additionally, this deed can help protect the property from certain creditors and provide tax benefits, making it an appealing option for many. Understanding the nuances of the Lady Bird Deed is essential for anyone considering estate planning in Michigan, as it combines the advantages of both life estate and outright transfer, all while minimizing complications for loved ones. By exploring its major aspects, property owners can make informed decisions that align with their personal and financial goals.

Check out Other Common Lady Bird Deed Templates for Different States

Ladybird Deed North Carolina - Lady Bird Deeds can be an effective tool for Medicaid planning, protecting property from recovery claims.

In California, having a comprehensive understanding of the various forms involved in vehicle transactions is essential for both sellers and buyers. A well-structured California Vehicle Purchase Agreement form is pivotal in this process, as it serves to clarify the sale terms and protect the interests of both parties. For those looking to navigate the requirements efficiently, refer to All California Forms to ensure all necessary documentation is in order.

Documents used along the form

The Michigan Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. When utilizing this deed, several other forms and documents may also be relevant to ensure a comprehensive estate plan. Below is a list of commonly used documents that complement the Lady Bird Deed.

- Will: A legal document that outlines how a person's assets will be distributed after their death. It can also name guardians for minor children.

- Durable Power of Attorney: This document allows someone to make financial and legal decisions on behalf of another person if they become incapacitated.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document specifically grants someone the authority to make medical decisions for another person when they are unable to do so.

- Living Will: A type of advance directive that outlines a person's preferences regarding medical treatment in situations where they cannot communicate their wishes.

- New York Bill of Sale: This form is essential for anyone looking to legally document the sale or transfer of personal property in New York. For more information, you can visit smarttemplates.net/fillable-new-york-bill-of-sale/.

- Trust Agreement: A legal document that creates a trust, allowing a trustee to manage assets on behalf of beneficiaries, often used to avoid probate.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, like life insurance policies or retirement accounts, directly upon the owner’s death.

- Quitclaim Deed: A document used to transfer property ownership without any guarantees about the title. It’s often used between family members.

- Affidavit of Heirship: A sworn statement that establishes the heirs of a deceased person, which can be important for transferring property without a will.

- Property Tax Exemption Forms: These forms allow homeowners to apply for tax exemptions, which can be crucial for maintaining financial stability during estate planning.

- Estate Tax Return: A form that may need to be filed with the IRS to report the value of an estate and calculate any taxes owed after someone passes away.

Each of these documents serves a specific purpose in the estate planning process. By understanding and utilizing them alongside the Michigan Lady Bird Deed, individuals can create a more effective plan that addresses their unique needs and circumstances. Proper documentation can help ensure that wishes are honored and that loved ones are taken care of after one's passing.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Michigan Compiled Laws, specifically under MCL 565.451. |

| Benefits | It helps avoid probate, allowing for a smoother transition of property ownership upon death. |

| Requirements | The deed must be signed by the property owner and notarized to be valid in Michigan. |

More About Michigan Lady Bird Deed

What is a Michigan Lady Bird Deed?

A Michigan Lady Bird Deed is a type of transfer deed that allows property owners to transfer their real estate to their beneficiaries while retaining the right to live in and control the property during their lifetime. This unique arrangement helps avoid probate and can simplify the transfer of property upon the owner's death.

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains full control of the property, including the right to sell, mortgage, or change the beneficiaries. Upon the owner’s death, the property automatically transfers to the named beneficiaries without going through probate, which can save time and costs associated with the probate process.

What are the benefits of using a Lady Bird Deed in Michigan?

There are several advantages to using a Lady Bird Deed. First, it allows for a smooth transfer of property upon death, avoiding the lengthy probate process. Second, the property owner retains control and can make changes to the deed or beneficiaries as needed. Additionally, it can provide tax benefits, as the property may receive a step-up in basis for the beneficiaries, potentially reducing capital gains taxes when they sell the property.

Who can create a Lady Bird Deed?

Any individual who owns real estate in Michigan can create a Lady Bird Deed. This includes homeowners, co-owners, and individuals who hold property in trust. It is essential that the property owner is of sound mind and understands the implications of the deed.

Are there any limitations on who can be named as a beneficiary?

Generally, beneficiaries can be individuals, such as family members or friends, or entities, like trusts or charities. However, it’s important to ensure that the beneficiaries are legally capable of receiving the property. Consulting with an attorney can help clarify any specific limitations that may apply.

Do I need an attorney to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without an attorney, it is highly recommended to seek legal assistance. An attorney can ensure that the deed is correctly drafted, meets all legal requirements, and reflects the property owner's intentions. This can prevent potential disputes or complications in the future.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or changed at any time while the property owner is alive and mentally competent. The owner can simply create a new deed that revokes the previous one or modify the existing deed to change the beneficiaries or terms. It is advisable to document any changes properly to avoid confusion later.

What happens if the beneficiary predeceases the property owner?

If a named beneficiary passes away before the property owner, the property will not automatically transfer to that individual. Instead, the property owner may need to create a new deed to designate a different beneficiary. It’s crucial to regularly review and update the Lady Bird Deed to reflect any changes in circumstances.

Is a Lady Bird Deed valid in other states?

While the Lady Bird Deed is recognized in Michigan, other states may have different laws regarding property transfer and deeds. Some states may not allow this type of deed or may have different requirements. If you own property in multiple states, it is essential to consult with an attorney familiar with the laws in each state to ensure compliance.

Michigan Lady Bird Deed: Usage Steps

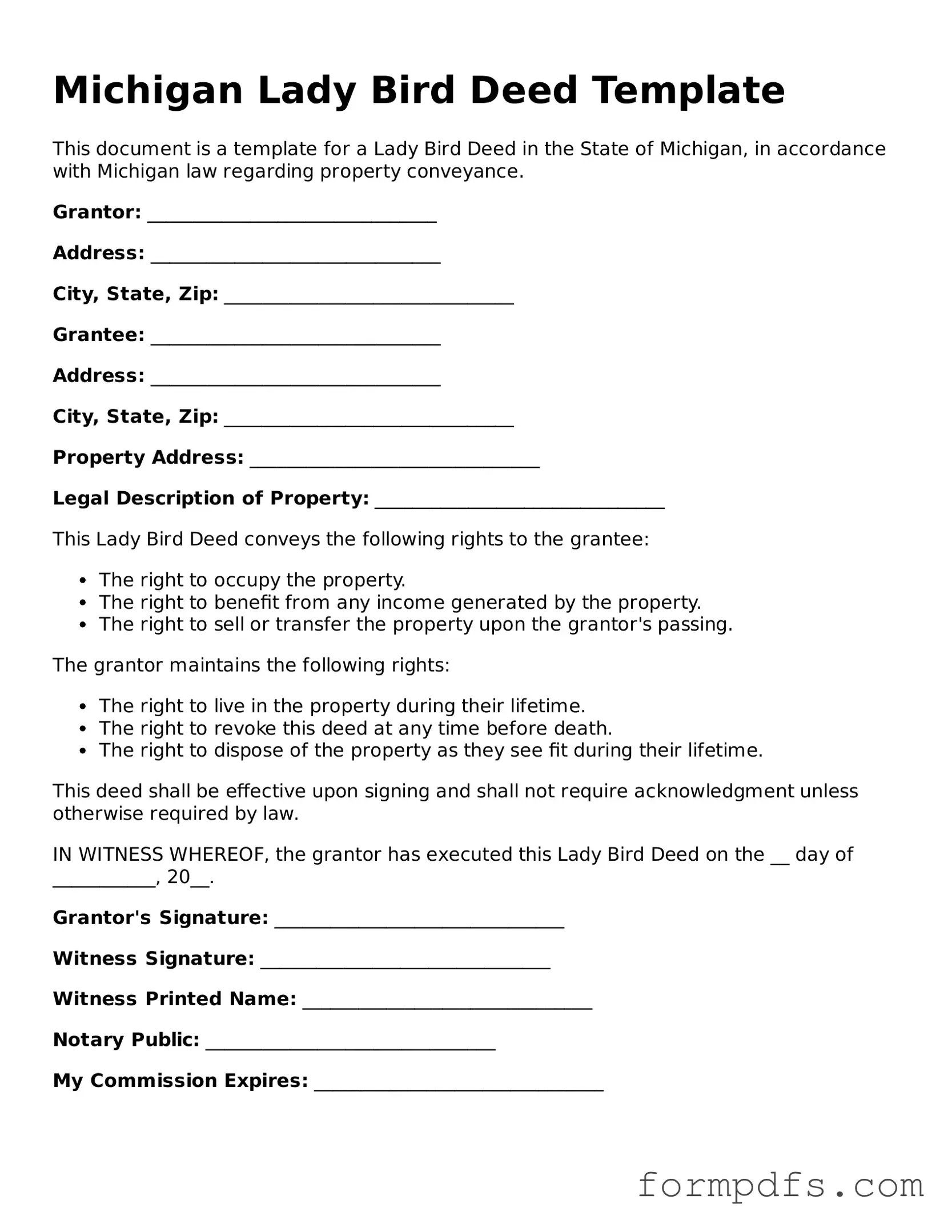

Filling out the Michigan Lady Bird Deed form is a straightforward process that requires attention to detail. After completing the form, it is essential to ensure that it is filed correctly with the appropriate county register of deeds. This will ensure that the deed is legally recognized and enforceable.

- Obtain the Michigan Lady Bird Deed form from a reliable source, such as a legal website or local government office.

- Begin by entering the names of the property owners at the top of the form. This includes the current owners who will be transferring the property.

- Next, provide the address of the property being transferred. Ensure that this information is accurate and complete.

- Indicate the legal description of the property. This may involve referencing the property’s parcel number or including a detailed description as found in previous deeds.

- Specify the names of the beneficiaries who will receive the property upon the owner’s passing. List these individuals clearly.

- Include any additional terms or conditions that may apply to the transfer. This may involve specifying rights of use or limitations on the property.

- Sign and date the form. Ensure that all property owners sign in the designated area.

- Have the form notarized. A notary public must witness the signatures to validate the document.

- File the completed form with the county register of deeds where the property is located. Pay any applicable filing fees.