Printable Durable Power of Attorney Form for the State of Michigan

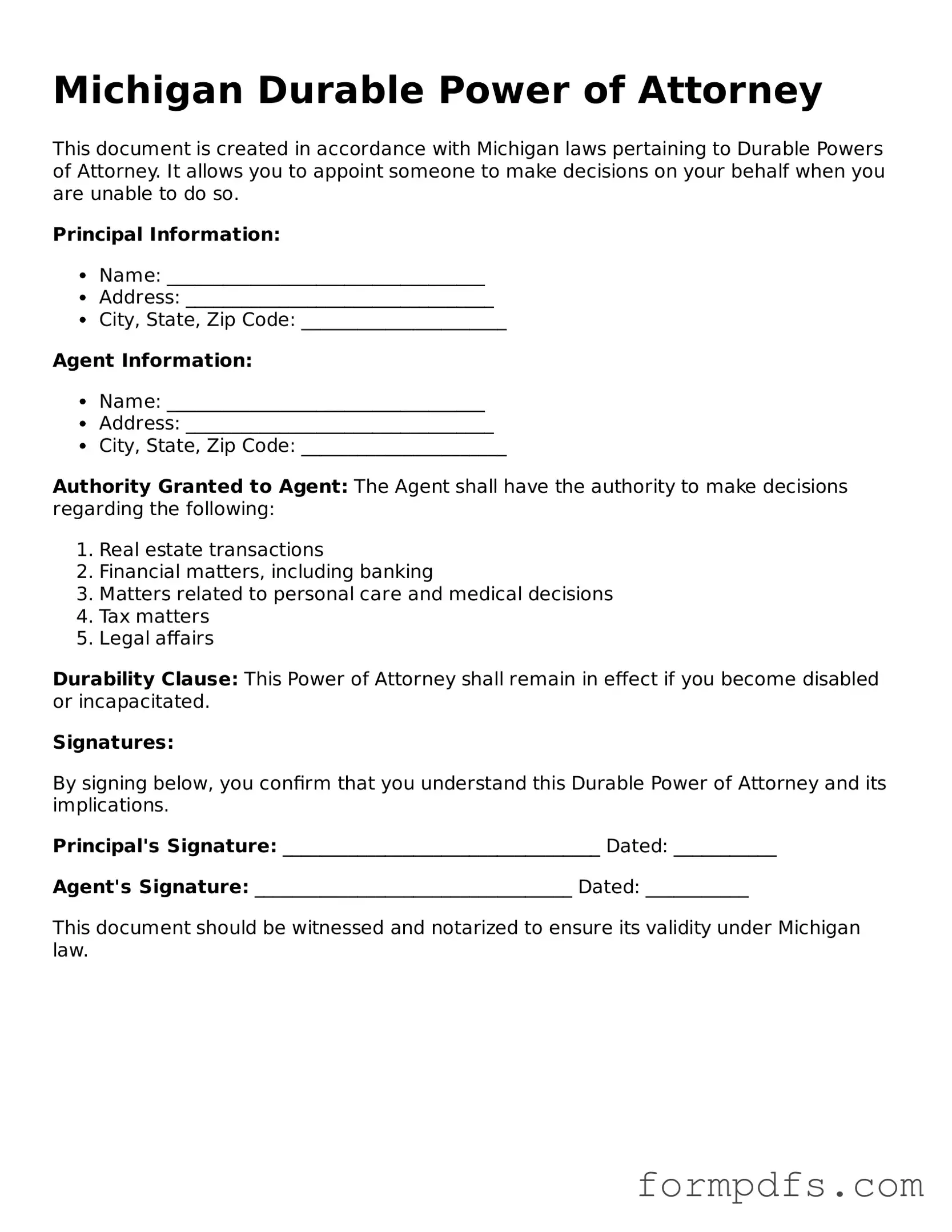

The Michigan Durable Power of Attorney form serves as a crucial legal document that empowers individuals to designate another person, known as an agent, to make decisions on their behalf in various matters, including financial and healthcare-related issues. This form is particularly significant because it remains effective even if the principal becomes incapacitated, ensuring that their wishes are honored during challenging times. By completing this document, individuals can outline specific powers granted to their agents, which may include managing bank accounts, handling real estate transactions, or making medical decisions. It is important to note that the powers can be broad or limited, depending on the preferences of the principal. Additionally, the Michigan Durable Power of Attorney form requires the signatures of both the principal and the agent, along with the notarization or witness signatures, to ensure its validity. Understanding the intricacies of this form can provide peace of mind, as it allows individuals to maintain control over their affairs even when they are unable to do so themselves.

Check out Other Common Durable Power of Attorney Templates for Different States

Free Power of Attorney Form Nc - The Durable Power of Attorney can make life easier during transitions in care.

For those navigating the complexities of family law in California, understanding the California 1285.65 form is essential, especially when it comes to requesting changes to a Wage and Earnings Assignment Order. Effective modifications can help adjust child or spousal support payments when life circumstances shift, such as the emancipation of a child or changes in custody arrangements. To ensure you are using the correct documentation, refer to All California Forms for more information on this crucial process.

Power of Attorney in Ohio Requirements - It establishes legal authority for your chosen representative immediately.

Documents used along the form

A Michigan Durable Power of Attorney form allows individuals to appoint someone to make financial and legal decisions on their behalf. This document is often used alongside other forms to ensure comprehensive planning and protection of interests. Below is a list of additional forms and documents that are commonly associated with the Durable Power of Attorney in Michigan.

- Durable Power of Attorney for Health Care: This document designates an individual to make medical decisions on behalf of someone who is unable to do so. It focuses specifically on health care choices.

- Homeschool Letter of Intent: Before beginning the homeschooling process, it's important to complete the necessary Homeschool Letter of Intent form to ensure compliance with state requirements.

- Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. It complements the Durable Power of Attorney for Health Care.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document allows someone to manage financial matters. However, it may not remain effective if the principal becomes incapacitated unless specified as durable.

- Will: A will is a legal document that states how a person’s assets will be distributed after their death. It is important for estate planning and works in tandem with a Durable Power of Attorney.

- Trust Document: A trust can manage assets during a person's lifetime and after death. It allows for more control over asset distribution and can help avoid probate.

- HIPAA Release Form: This form allows individuals to authorize the sharing of their medical information with designated persons, ensuring that those with a Durable Power of Attorney for Health Care can access necessary health information.

- Beneficiary Designation Forms: These forms are used to specify who will receive assets like life insurance policies or retirement accounts upon the individual's death, ensuring clarity in asset distribution.

- Asset Inventory List: This document provides a comprehensive list of a person's assets, helping the appointed agent understand what needs to be managed or distributed.

- Financial Disclosure Statement: This statement outlines a person's financial situation, including debts and assets. It aids the agent in making informed decisions on behalf of the principal.

Using these documents in conjunction with a Michigan Durable Power of Attorney can help ensure that an individual's wishes are honored and that their financial and medical affairs are managed effectively. Proper planning can provide peace of mind and clarity for both the individual and their appointed agents.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A Michigan Durable Power of Attorney allows an individual to appoint someone else to make financial or legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The form is governed by the Michigan Compiled Laws, specifically MCL 700.5501 to MCL 700.5503. |

| Durability | This power of attorney remains effective even if the principal becomes incapacitated, which is a key feature of the "durable" designation. |

| Principal | The person creating the power of attorney is referred to as the principal, who retains the right to revoke or modify the document at any time while competent. |

| Agent | The agent, or attorney-in-fact, is the individual designated to act on behalf of the principal. This person must act in the best interest of the principal. |

| Signing Requirements | The document must be signed by the principal and witnessed by at least one person or notarized to be valid. |

| Limitations | The agent cannot make healthcare decisions unless specifically granted that authority in a separate document, such as a medical power of attorney. |

| Revocation | The principal can revoke the durable power of attorney at any time, provided they are mentally competent to do so. |

More About Michigan Durable Power of Attorney

What is a Durable Power of Attorney in Michigan?

A Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This authority continues even if the principal becomes incapacitated. It is particularly useful for managing financial matters, healthcare decisions, or both, depending on how the document is drafted.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney provides peace of mind. It ensures that someone you trust can manage your affairs if you are unable to do so due to illness or injury. This document can prevent potential disputes among family members and streamline decision-making during challenging times.

Who can be my agent under a Durable Power of Attorney?

In Michigan, your agent can be anyone you trust, such as a family member, friend, or even a professional like an attorney or financial advisor. However, it is crucial to choose someone responsible and capable of making decisions in your best interest. The agent must be at least 18 years old and competent to handle the responsibilities assigned to them.

What powers can I grant to my agent?

The powers you grant can vary widely. You may choose to give your agent broad authority to handle financial matters, such as managing bank accounts, paying bills, and making investment decisions. Alternatively, you can limit their powers to specific tasks or decisions. It’s essential to clearly outline these powers in the document to avoid confusion later on.

How do I create a Durable Power of Attorney in Michigan?

To create a Durable Power of Attorney in Michigan, you must complete a written document that meets state requirements. This includes clearly identifying yourself and your agent, specifying the powers granted, and signing the document in front of a notary public. It’s advisable to consult with an attorney to ensure the document is valid and tailored to your needs.

Do I need to have my Durable Power of Attorney notarized?

Yes, in Michigan, a Durable Power of Attorney must be signed in the presence of a notary public to be legally valid. Notarization helps to verify your identity and confirms that you are signing the document voluntarily. This step adds an additional layer of protection against potential challenges to the document’s legitimacy.

Can I revoke or change my Durable Power of Attorney?

Absolutely. You have the right to revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. To revoke it, you should create a written notice of revocation and inform your agent and any relevant institutions. If you decide to change your agent or the powers granted, you will need to create a new document that reflects those changes.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may have to go through a court process to appoint a guardian or conservator to manage your affairs. This can be time-consuming, costly, and may not reflect your wishes. Having a Durable Power of Attorney in place helps avoid this situation and ensures your preferences are honored.

Is a Durable Power of Attorney only for financial matters?

No, a Durable Power of Attorney can cover both financial and healthcare decisions. You can create separate documents for each or include both types of powers in one document. If you want your agent to make medical decisions on your behalf, consider also creating a healthcare power of attorney or advance directive to ensure your healthcare wishes are clear.

Can I use a Durable Power of Attorney from another state in Michigan?

While Michigan generally recognizes Durable Power of Attorney documents from other states, it is advisable to consult with a Michigan attorney to ensure that the document complies with state laws. Different states have varying requirements, and having a Michigan-specific document can help avoid potential complications.

Michigan Durable Power of Attorney: Usage Steps

Filling out a Michigan Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. Once you have completed the form, it will need to be signed and witnessed to be legally binding. Follow these steps carefully to ensure that everything is filled out correctly.

- Begin by downloading the Michigan Durable Power of Attorney form from a reliable source or obtain a physical copy.

- In the first section, fill in your full name and address. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This person will have the authority to make decisions on your behalf.

- Specify the powers you wish to grant your agent. You can choose to give broad powers or limit them to specific areas, such as financial decisions or real estate transactions.

- Include the date on which the powers will start. This can be immediate or effective upon your incapacity.

- Sign the document in the presence of a notary public or two witnesses, as required by Michigan law. Make sure that the witnesses are not related to you or the agent.

- Provide a copy of the signed form to your agent and keep the original in a safe place.

Once you have completed these steps, your Durable Power of Attorney will be ready to use. It’s wise to review the document periodically, especially if your circumstances change or if you wish to appoint a different agent.