Printable Articles of Incorporation Form for the State of Michigan

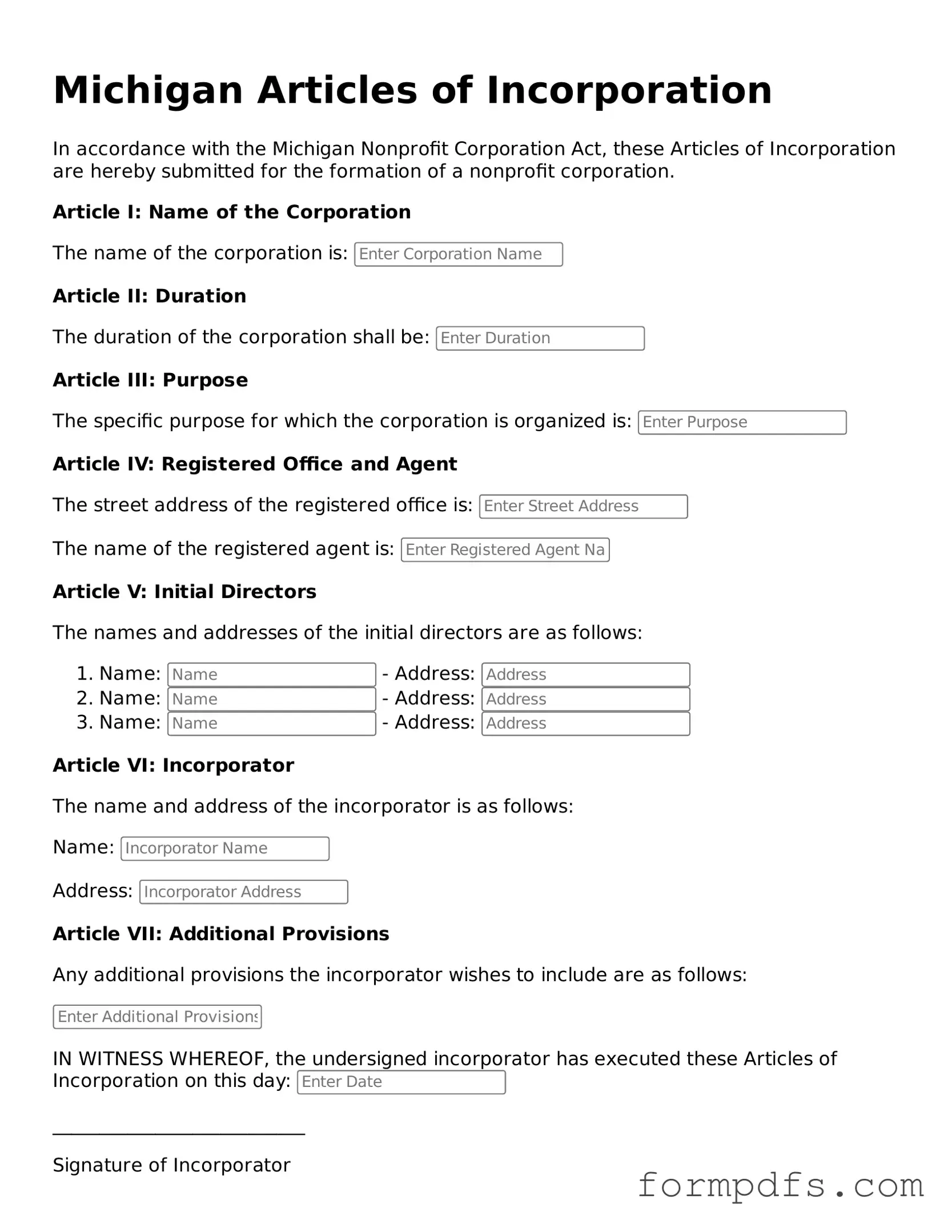

The Michigan Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form serves as the official request to create a corporation and outlines essential information about the business. Key elements include the corporation's name, which must be unique and comply with state regulations. Additionally, the form requires the designation of a registered agent, someone who will receive legal documents on behalf of the corporation. The purpose of the business must also be clearly stated, providing insight into its operations. Furthermore, the form includes provisions regarding the number of shares the corporation is authorized to issue, which is vital for understanding ownership and investment opportunities. Completing this form accurately is vital, as it lays the foundation for the corporation's legal existence and compliance with state laws.

Check out Other Common Articles of Incorporation Templates for Different States

Ga Corporation - This form may outline how disputes among shareholders will be resolved.

How to Get a Copy of Your Articles of Incorporation - The purpose should be clear and concise.

The ATV Bill of Sale is a crucial document for anyone looking to facilitate the sale of an All-Terrain Vehicle in California. For more information on how to properly complete this essential transaction, visit our guide on the efficient ATV Bill of Sale process.

Ohio Llc Fees - Filing fees vary by state and are due at the time of submission.

How to Incorporate in Nc - Key stakeholders often rely on the Articles for corporate governance.

Documents used along the form

When forming a corporation in Michigan, the Articles of Incorporation is a crucial document. However, there are several other forms and documents that you may need to complete the incorporation process. Here’s a brief overview of five essential documents often used alongside the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and regulations for your corporation. Bylaws govern how the corporation will operate, including details about meetings, voting procedures, and the roles of officers and directors.

- Initial Board of Directors Resolution: This resolution is used to appoint the initial directors of the corporation. It officially recognizes the individuals who will manage the company during its early stages.

- California 1285.65 Form: This form is essential for requesting modifications to Wage and Earnings Assignment Orders, especially in circumstances such as changes in custody or the emancipation of a child. For more information, visit All California Forms.

- Employer Identification Number (EIN) Application: An EIN is required for tax purposes. This form is submitted to the IRS to obtain a unique number that identifies your business for tax filings and other official documents.

- State Business License: Depending on your business activities, you may need to apply for specific licenses or permits at the state or local level. This ensures compliance with local regulations and industry standards.

- Annual Report: After incorporation, many states, including Michigan, require corporations to file an annual report. This document provides updated information about the business, including any changes in directors or registered agents.

Completing these forms can help ensure that your corporation is set up correctly and operates smoothly. Each document serves a specific purpose and contributes to the overall success of your business venture.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Articles of Incorporation form is used to officially create a corporation in the state of Michigan. |

| Governing Law | This form is governed by the Michigan Business Corporation Act, specifically MCL 450.1101 et seq. |

| Filing Requirements | To file the Articles of Incorporation, you must submit the completed form along with the required filing fee to the Michigan Department of Licensing and Regulatory Affairs (LARA). |

| Information Needed | The form requires essential information such as the corporation's name, purpose, registered office address, and details of the incorporators. |

| Types of Corporations | The form can be used for various types of corporations, including profit corporations, non-profit corporations, and professional corporations. |

| Processing Time | Once submitted, the processing time for the Articles of Incorporation can vary, but it typically takes a few business days to a few weeks. |

| Amendments | If changes are needed after filing, amendments can be made through a separate form, which also requires a filing fee. |

More About Michigan Articles of Incorporation

What are Articles of Incorporation in Michigan?

Articles of Incorporation are legal documents that establish a corporation in Michigan. They provide essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it can issue. Filing these documents is a crucial step in forming a corporation and gaining legal recognition.

Who needs to file Articles of Incorporation?

Any individual or group looking to create a corporation in Michigan must file Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations. It's an essential requirement for anyone wanting to operate as a legal entity separate from its owners.

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the corporation's name, the purpose of the corporation, the duration of the corporation (if not perpetual), the address of the registered office, the name and address of the registered agent, and the number of shares the corporation is authorized to issue. Additional information may also be necessary depending on the type of corporation being formed.

How do I file Articles of Incorporation in Michigan?

To file Articles of Incorporation in Michigan, you can complete the form online through the Michigan Department of Licensing and Regulatory Affairs (LARA) website, or you can download a paper form, fill it out, and submit it by mail. There is a filing fee that must be paid at the time of submission, which varies based on the type of corporation.

What is the filing fee for Articles of Incorporation?

The filing fee for Articles of Incorporation in Michigan varies depending on the type of corporation. As of October 2023, the fee for a standard for-profit corporation is typically around $50. Non-profit corporations may have a different fee structure. It’s advisable to check the latest fee schedule on the LARA website for the most accurate information.

How long does it take to process Articles of Incorporation?

The processing time for Articles of Incorporation can vary. Generally, online submissions are processed faster than paper filings. You can expect a turnaround time of a few business days to a few weeks, depending on the volume of applications being processed. If expedited service is needed, there may be an option for faster processing for an additional fee.

Can I change the Articles of Incorporation after filing?

Yes, changes can be made to the Articles of Incorporation after they have been filed. This is typically done by submitting an amendment to the original Articles. The amendment must be filed with the Michigan Department of Licensing and Regulatory Affairs, and there may be a fee associated with this process. It’s important to ensure that any changes comply with state laws and regulations.

Do I need a lawyer to file Articles of Incorporation?

While it is not legally required to have a lawyer to file Articles of Incorporation in Michigan, seeking legal advice can be beneficial. A lawyer can help ensure that the Articles are completed correctly and that all necessary legal requirements are met. This can be especially important for complex businesses or specific types of corporations.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a certificate of incorporation from the state. Following this, you will need to fulfill additional requirements, such as obtaining an Employer Identification Number (EIN), setting up corporate bylaws, and holding an initial board meeting.

Where can I find more information about Articles of Incorporation in Michigan?

For more detailed information about Articles of Incorporation in Michigan, you can visit the Michigan Department of Licensing and Regulatory Affairs (LARA) website. They provide resources, guidelines, and access to necessary forms. Additionally, local business development centers and legal aid organizations can offer assistance and guidance.

Michigan Articles of Incorporation: Usage Steps

Once you have your Michigan Articles of Incorporation form ready, you can begin filling it out. This process is straightforward, and following the steps will help ensure that you provide all the necessary information. Make sure to have your business name and details handy as you go through the form.

- Choose Your Business Name: Make sure it’s unique and complies with Michigan naming rules.

- Provide Your Purpose: State the primary purpose of your corporation. Be clear and concise.

- List the Registered Agent: Include the name and address of your registered agent who will receive legal documents.

- Specify the Duration: Indicate whether your corporation will exist indefinitely or for a specific period.

- Include the Address: Provide the principal office address of the corporation.

- Detail the Incorporators: List the names and addresses of the individuals who are forming the corporation.

- Sign and Date: Ensure that the incorporators sign and date the form to validate it.

- Submit the Form: Send the completed form to the Michigan Department of Licensing and Regulatory Affairs, along with any required fees.

After submitting your Articles of Incorporation, you’ll receive confirmation from the state. This means your corporation is officially recognized. Keep an eye out for any additional requirements, such as obtaining an Employer Identification Number (EIN) or any necessary licenses specific to your business type.