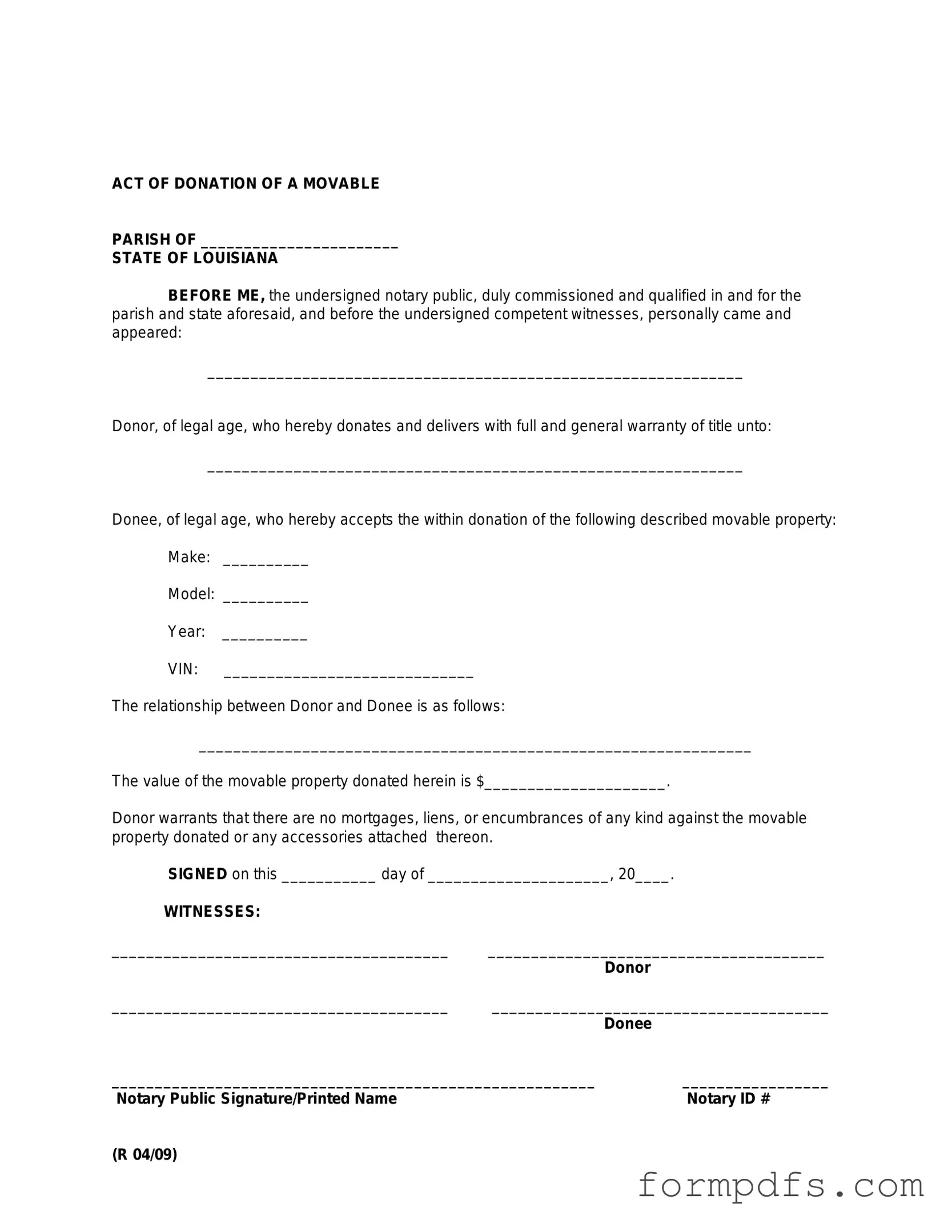

Blank Louisiana act of donation PDF Form

The Louisiana Act of Donation form serves as a vital legal instrument for individuals wishing to transfer ownership of property without the exchange of monetary compensation. This form is particularly significant in the context of familial relationships, where parents may choose to donate property to their children or other relatives. Essential components of the form include the identification of the donor and the recipient, a detailed description of the property being donated, and any conditions or limitations that may apply to the donation. Furthermore, the form must be executed in accordance with Louisiana law, which often necessitates the presence of witnesses or notarization to ensure its validity. By providing a clear framework for property transfer, the Act of Donation facilitates not only the smooth transition of assets but also helps to mitigate potential disputes among heirs in the future. Understanding the intricacies of this form is crucial for anyone considering a property donation in Louisiana, as it lays the groundwork for both legal compliance and familial harmony.

More PDF Templates

Joint Tenancy Death - It should include relevant details, such as the full names of both the deceased and surviving tenant.

For those navigating the legal system in California, understanding the importance of utilizing the appropriate documentation is crucial. The California Judicial Council form provides essential guidance in this process, and it is recommended to explore All California Forms to ensure compliance and clarity when filing necessary forms. By leveraging resources available, individuals can better equip themselves to meet the standards set forth by the judicial system.

Lease Agreement Florida Template - Liability for damage or loss of personal belongings is limited for landlords.

Documents used along the form

When dealing with the Louisiana Act of Donation, several other forms and documents may be necessary to ensure a smooth and legally compliant process. Each of these documents serves a unique purpose and can help clarify intentions, protect rights, or fulfill legal requirements. Below is a list of commonly used forms associated with the Act of Donation.

- Donation Agreement: This document outlines the terms of the donation, including what is being donated, the parties involved, and any conditions attached to the donation.

- Affidavit of Heirship: This affidavit establishes the heirs of a deceased individual, which can be important when determining who has the right to accept a donation.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf, which can be useful if the donor is unable to complete the donation process personally.

- Title Transfer Document: This form is necessary for transferring ownership of property, ensuring that the recipient has clear title to the donated item or property.

- Notice of Donation: This document serves to inform relevant parties, such as creditors or family members, about the donation, helping to avoid future disputes.

- Tax Documents: Depending on the value of the donation, various tax forms may be required to report the gift for tax purposes and ensure compliance with IRS regulations.

- Gift Deed: A gift deed is a legal document that formally transfers property ownership without any exchange of money, often used in conjunction with donations.

- Letter of Intent: This informal document expresses the donor's wishes and intentions regarding the donation, providing clarity and context for the act.

- Consent Forms: If the donation involves minors or individuals unable to consent, specific consent forms may be needed to authorize the donation.

- Articles of Incorporation: This essential form is necessary for establishing a corporation in New York and includes crucial details such as the corporation's name and purpose. For more information, visit https://smarttemplates.net/fillable-new-york-articles-of-incorporation/.

- Record of Donation: This document serves as a permanent record of the donation, detailing what was donated, when, and to whom, which can be useful for future reference.

Understanding these documents can significantly enhance the donation process under the Louisiana Act of Donation. Being well-prepared with the right forms can help prevent misunderstandings and ensure that the donor's wishes are honored. Always consider consulting with a legal professional to navigate this process effectively.

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation is a legal document used to transfer ownership of property from one person to another as a gift. |

| Governing Law | This act is governed by the Louisiana Civil Code, specifically Articles 1466 to 1473. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (upon death). |

| Requirements | The form must be in writing and signed by both the donor and the donee. |

| Notarization | While notarization is not mandatory, it is highly recommended to enhance the document's validity. |

| Revocation | Donations can be revoked under certain conditions, such as ingratitude or non-fulfillment of conditions. |

| Tax Implications | Donations may have tax implications for both the donor and the donee, including gift tax considerations. |

| Property Types | The act can be used for various property types, including real estate, personal property, and financial assets. |

| Legal Capacity | Both the donor and donee must have the legal capacity to enter into the agreement, meaning they must be of sound mind and legal age. |

More About Louisiana act of donation

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to formally transfer ownership of property from one person to another without any exchange of money. This act is often utilized for gifts between family members or friends.

Who can use the Act of Donation Form?

Any individual who wishes to donate property, such as real estate or personal belongings, can use this form. Both the donor (the person giving the gift) and the donee (the person receiving the gift) must be legally capable of entering into a contract.

What types of property can be donated using this form?

The Act of Donation Form can be used for various types of property, including real estate, vehicles, and personal items. However, it is important to ensure that the property is legally owned by the donor and is free of liens or encumbrances.

Is the Act of Donation Form legally binding?

Yes, once properly executed, the Act of Donation Form is legally binding. It creates a formal record of the donation, which can help prevent disputes in the future. To ensure validity, it is recommended that the form be notarized.

Do I need a lawyer to complete the Act of Donation Form?

While it is not legally required to have a lawyer, consulting with one can provide valuable guidance. A legal professional can help ensure that the form is filled out correctly and that all necessary steps are followed.

Are there any tax implications for donations made using this form?

Yes, there may be tax implications for both the donor and the donee. Donors should be aware of potential gift tax liabilities, while donees may need to consider how the donation affects their own tax situation. Consulting a tax advisor is advisable.

Can the donation be revoked after the form is signed?

Generally, once the Act of Donation Form is signed and executed, the donation cannot be revoked. However, there may be specific circumstances under which a donation can be contested or reversed. Legal advice should be sought if revocation is being considered.

What if the donor wants to impose conditions on the donation?

Conditions can be included in the Act of Donation Form. However, these conditions must be clearly stated and agreed upon by both parties. It is essential to ensure that the conditions are lawful and enforceable.

How do I properly execute the Act of Donation Form?

To execute the Act of Donation Form, both the donor and donee must sign it in the presence of a notary public. It is also advisable to keep copies of the signed document for both parties' records.

Where can I obtain a Louisiana Act of Donation Form?

The Act of Donation Form can be obtained from various sources, including legal document websites, local courthouse offices, or through an attorney. Ensure that you are using the most current version of the form to comply with Louisiana laws.

Louisiana act of donation: Usage Steps

Filling out the Louisiana Act of Donation form is an important step in transferring ownership of property or assets. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Once the form is completed, it will need to be signed and notarized before it can be submitted.

- Begin by downloading the Louisiana Act of Donation form from the official state website or obtain a physical copy from a local legal office.

- At the top of the form, enter the names and addresses of both the donor (the person giving the property) and the donee (the person receiving the property).

- Clearly describe the property or assets being donated. Include details such as the type of property, location, and any identifying information.

- Specify the terms of the donation. This may include any conditions or restrictions that apply to the transfer.

- Indicate the date of the donation. This is the date when the transfer of ownership takes effect.

- Both the donor and donee should sign the form in the designated areas. Ensure that signatures are clear and legible.

- Have the form notarized. This step is crucial as it verifies the identities of the signers and confirms that they signed willingly.

- Make copies of the completed and notarized form for both the donor and donee’s records.

- Submit the original form to the appropriate local government office, if required, to finalize the donation process.