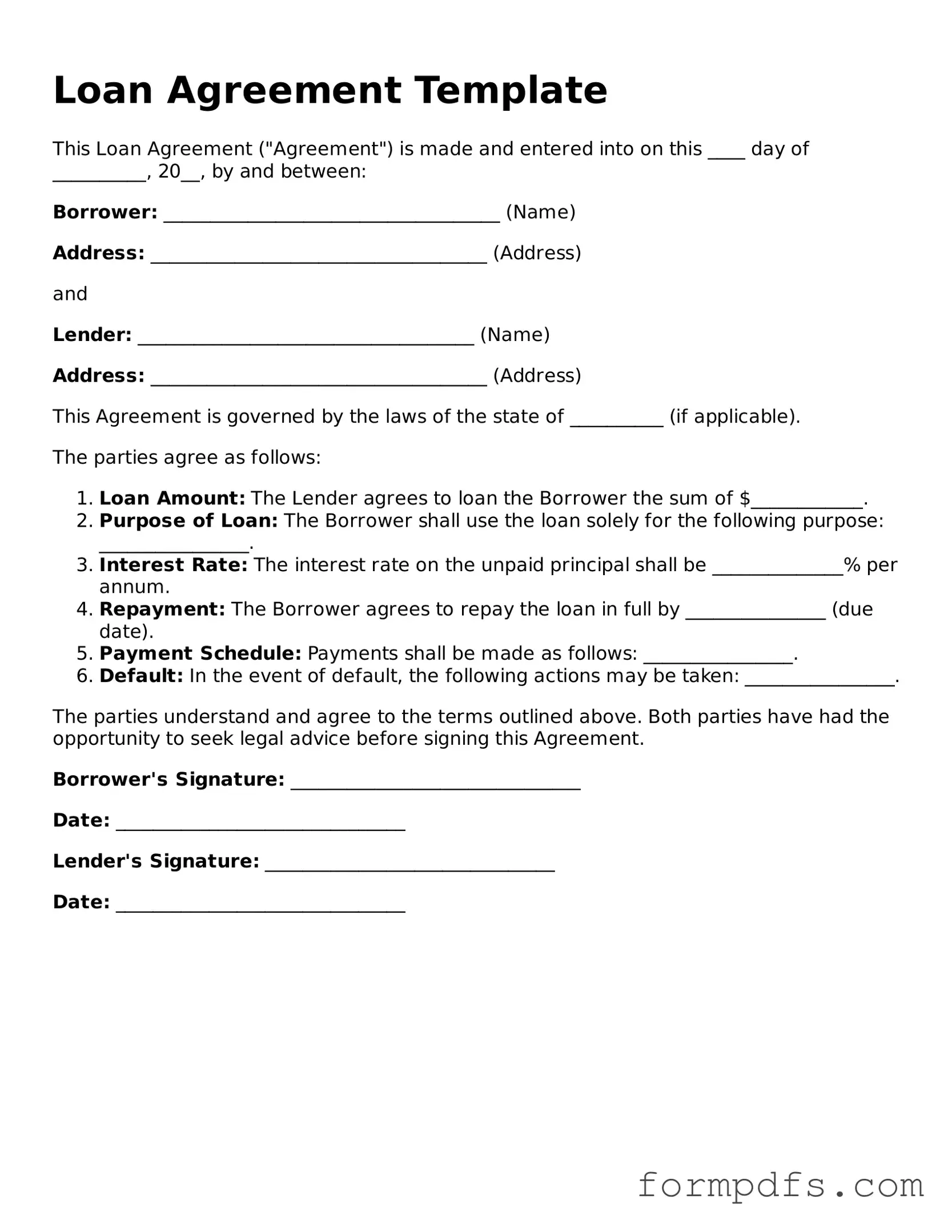

Valid Loan Agreement Template

When entering into a financial arrangement, clarity and mutual understanding are paramount. A Loan Agreement form serves as a crucial document that outlines the terms and conditions of a loan between a borrower and a lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it addresses the rights and responsibilities of both parties, ensuring that everyone is on the same page regarding expectations and obligations. By specifying the consequences of default and outlining any fees or penalties, the Loan Agreement form helps protect both the lender’s investment and the borrower’s interests. Understanding the various components of this form can empower individuals to navigate the borrowing process with confidence and security.

More Forms:

Megger Test Report - Final approval is noted by a designated authority for reliability.

Before embarking on their journey to matrimony, couples must ensure they have completed the Florida Marriage Application Form, a fundamental requirement that can be accessed through All Florida Forms. This form not only details the necessity of obtaining a marriage license within 60 days of the intended wedding date but also serves to collect essential personal information from both parties for legal and statistical purposes.

Real Estate Purchase Agreement - Identifies the closing costs and their allocation between parties.

What Is a Form 8300 Used For? - Detailed record-keeping is recommended alongside filing Form 8300.

Loan Agreement Types

Documents used along the form

When entering into a loan agreement, several other forms and documents may be necessary to ensure clarity and protect the interests of all parties involved. Below is a list of commonly used documents that accompany a Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, and repayment schedule.

- Notice to Quit: Should any lease violation arise, it's essential to provide proper notification using the Notice to Quit form to ensure all parties are informed of the potential for eviction proceedings.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets that back the loan. It outlines the rights of the lender in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party. This document holds the individual personally liable for the loan if the borrower defaults.

- Disclosure Statement: This document provides essential information about the loan terms, fees, and any other costs associated with the loan. It ensures transparency between the lender and borrower.

- Loan Application: This form collects information about the borrower’s financial status and creditworthiness. It is often used by lenders to assess the risk before approving the loan.

Understanding these documents is crucial for both borrowers and lenders. Each serves a specific purpose and helps to create a clear framework for the loan transaction. Make sure to review all related documents carefully before signing any agreements.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement outlines the terms under which a lender provides funds to a borrower. |

| Parties Involved | The agreement typically includes the lender and the borrower, both of whom must sign. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applied to the loan, which can be fixed or variable. |

| Repayment Terms | Details about how and when the borrower will repay the loan are included. |

| Governing Law | The agreement will reference the state law that governs the loan, such as California or Texas law. |

| Default Conditions | It outlines what constitutes a default and the consequences for the borrower. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties. |

More About Loan Agreement

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount borrowed, interest rates, repayment schedule, and any collateral involved. This form serves to protect both parties by clearly defining their rights and obligations.

Who needs a Loan Agreement?

Anyone who is borrowing or lending money should consider using a Loan Agreement. This includes individuals, businesses, and organizations. A formal agreement helps prevent misunderstandings and provides a clear record of the transaction.

What information is typically included in a Loan Agreement?

A Loan Agreement usually includes the loan amount, interest rate, repayment terms, due dates, and any fees associated with the loan. It may also specify the consequences of late payments or defaults, as well as any collateral that secures the loan.

How is interest calculated in a Loan Agreement?

Interest can be calculated in various ways, including simple interest and compound interest. The agreement should specify the method used, the rate, and how often it is applied. Understanding this helps borrowers anticipate the total cost of the loan over time.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified, but both parties must agree to the changes. It’s advisable to document any modifications in writing to ensure clarity and legal validity. This protects both the lender and the borrower in case of future disputes.

What happens if the borrower defaults on the Loan Agreement?

If a borrower defaults, the lender may take specific actions outlined in the agreement. This could include charging late fees, accelerating the loan (demanding full repayment), or taking possession of collateral if applicable. It’s important to understand these consequences before signing.

Is it necessary to have a lawyer review a Loan Agreement?

While it is not mandatory, having a lawyer review a Loan Agreement can be beneficial. A legal expert can help identify potential issues, ensure compliance with state laws, and provide guidance on the implications of the terms. This can be especially important for larger loans or complex agreements.

Where can I obtain a Loan Agreement form?

Loan Agreement forms can be found online through legal document websites, financial institutions, or legal offices. Many templates are available for free or for purchase. However, it’s crucial to ensure that the chosen form complies with local laws and fits the specific needs of the transaction.

Loan Agreement: Usage Steps

Once you have the Loan Agreement form in hand, it’s time to complete it accurately. Following these steps will help ensure that all necessary information is included, making the process smoother for both parties involved.

- Start by entering the date at the top of the form. This is important for record-keeping.

- Fill in the names of both the borrower and the lender. Make sure to include full legal names to avoid confusion.

- Provide the address of the borrower. This should be the current residential address.

- Next, include the address of the lender. If the lender is a business, use the business address.

- Specify the loan amount. Clearly state the total amount being borrowed.

- Indicate the interest rate. This should be the agreed-upon rate for the loan.

- Set the repayment terms. Include the duration of the loan and the schedule for payments.

- List any collateral if applicable. This is any asset that secures the loan.

- Include any additional terms or conditions. Be specific about any obligations or rights of either party.

- Sign and date the form. Both the borrower and lender must sign to make the agreement official.

After completing the form, review all entries to ensure accuracy. Once both parties have signed, keep a copy for your records. This will help in managing the loan and any future communications.