Valid LLC Share Purchase Agreement Template

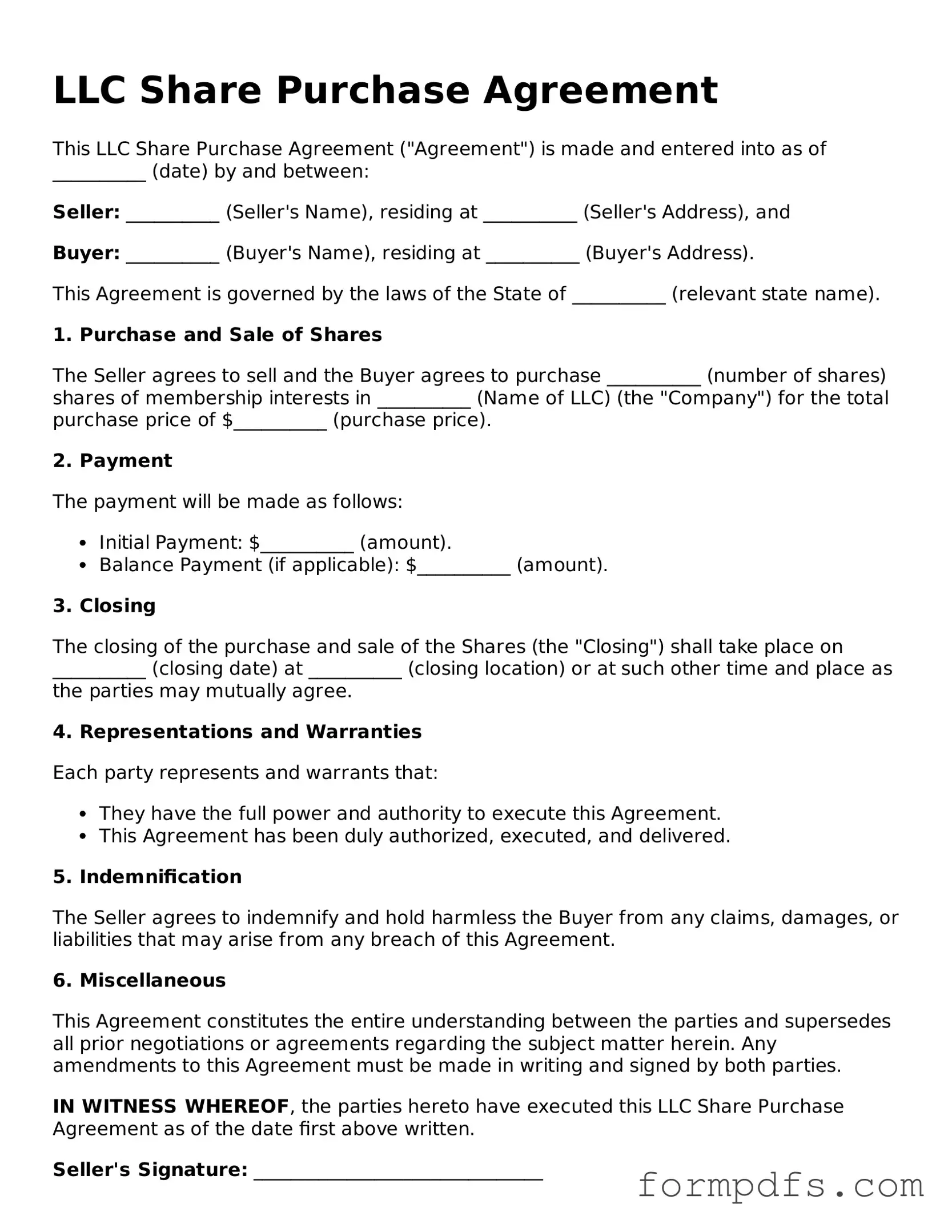

The LLC Share Purchase Agreement is a critical document for individuals or entities looking to buy or sell ownership interests in a limited liability company (LLC). This form outlines the terms and conditions of the sale, ensuring that both parties understand their rights and obligations. Key aspects typically included in the agreement are the purchase price, payment terms, and the number of shares being transferred. Additionally, it addresses representations and warranties, which are statements made by the seller regarding the LLC’s financial status and operational condition. The agreement may also specify any conditions that must be met before the sale can be finalized, such as obtaining necessary approvals or consents. Moreover, provisions for confidentiality and dispute resolution are often included to protect the interests of both parties. By clearly delineating these elements, the LLC Share Purchase Agreement serves as a foundational document that facilitates a smooth transaction while minimizing potential misunderstandings or conflicts between the buyer and seller.

More Forms:

Druid Spell Chart - Backstory: A narrative that outlines the character’s history, motivations, and experiences.

Identification Affidavit of Identity - This form is a useful resource for those engaged in legal disputes.

When finalizing the sale of a motorcycle in California, it is vital to ensure all details are documented accurately in the Motorcycle Bill of Sale. This form not only serves to confirm the transaction for both the buyer and seller but also plays a critical role in the transfer of ownership. To simplify the process, you can download and complete the form to ensure that all necessary information is captured effectively.

Cg2010 Endorsement Definition - Understanding this endorsement is vital for compliance with contractual obligations.

Documents used along the form

When entering into a transaction involving the purchase of shares in a Limited Liability Company (LLC), several additional documents may be necessary to ensure a smooth process. These documents help clarify the terms of the agreement, protect the interests of the parties involved, and facilitate compliance with legal requirements. Below are six commonly used forms and documents associated with an LLC Share Purchase Agreement.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It defines the rights and responsibilities of the members, ensuring that all parties understand their roles within the company.

- Shareholder Agreement: A shareholder agreement details the relationship between the shareholders, including voting rights, transfer of shares, and dispute resolution processes. It helps prevent misunderstandings and conflicts among shareholders.

- Due Diligence Checklist: This checklist is a tool used to evaluate the financial and operational aspects of the LLC before the purchase. It typically includes items such as financial statements, contracts, and legal compliance documents.

- Vehicle Release of Liability: To facilitate a seamless transition of ownership, it's important to complete the https://toptemplates.info which ensures the seller is released from any future liability related to the vehicle after the sale.

- Purchase Price Allocation: This document specifies how the purchase price will be allocated among the various assets and liabilities of the LLC. Proper allocation can have significant tax implications for both the buyer and seller.

- Closing Statement: A closing statement summarizes the financial transactions that occur at the closing of the sale. It includes details about the purchase price, adjustments, and any fees or expenses incurred during the transaction.

- Consent of Members: This document may be required to obtain the approval of existing members for the sale of shares. It serves to ensure that all necessary consents are in place before the transaction is finalized.

Each of these documents plays a critical role in the overall transaction process. It is essential to ensure that all necessary paperwork is completed accurately and thoroughly to protect the interests of all parties involved.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement outlines the terms under which shares of an LLC are bought and sold. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom are usually members of the LLC. |

| Governing Law | The agreement is governed by the laws of the state where the LLC is formed, such as Delaware or California. |

| Purchase Price | The purchase price for the shares must be clearly stated in the agreement. |

| Payment Terms | Details about how and when payment will be made should be included in the agreement. |

| Representations and Warranties | Both parties may make representations and warranties regarding the shares and the LLC. |

| Closing Conditions | The agreement should outline any conditions that must be met before the sale can be finalized. |

| Confidentiality | Confidentiality clauses may be included to protect sensitive information related to the LLC. |

| Dispute Resolution | The agreement can specify how disputes will be resolved, such as through mediation or arbitration. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties. |

More About LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase shares in a Limited Liability Company (LLC). This agreement details the rights and obligations of both the buyer and the seller, ensuring clarity and legal protection for both parties involved in the transaction.

Why is an LLC Share Purchase Agreement important?

This agreement is crucial because it helps prevent misunderstandings between the parties. It provides a clear framework for the sale, including the purchase price, payment terms, and any representations or warranties made by the seller. By having a written agreement, both parties can refer back to the document if disputes arise in the future.

What key elements should be included in the agreement?

Several key elements should be included in an LLC Share Purchase Agreement. These typically encompass the purchase price, payment method, closing date, and the number of shares being sold. Additionally, the agreement should address representations and warranties, indemnification clauses, and any conditions that must be met before the sale is finalized.

Who should draft the LLC Share Purchase Agreement?

While it is possible for individuals to draft their own agreements, it is highly advisable to seek the assistance of a legal professional. An attorney experienced in business transactions can ensure that the agreement complies with state laws and adequately protects the interests of both the buyer and seller.

Can an LLC Share Purchase Agreement be modified after it is signed?

Yes, an LLC Share Purchase Agreement can be modified after it is signed, but this typically requires the consent of both parties. Any changes should be documented in writing and signed by both parties to ensure that the modifications are legally binding. Verbal agreements regarding changes may not hold up in court.

What happens if one party breaches the agreement?

If one party breaches the LLC Share Purchase Agreement, the non-breaching party may have several options. They can seek damages, which may include financial compensation for losses incurred due to the breach. Alternatively, they might pursue specific performance, which is a legal remedy that compels the breaching party to fulfill their obligations under the agreement.

Is an LLC Share Purchase Agreement necessary for all transactions?

While it is not legally required to have an LLC Share Purchase Agreement for every transaction, it is highly recommended. Even in informal arrangements, having a written agreement can help protect the interests of both parties and provide a clear understanding of the transaction. Without one, parties may find themselves in difficult situations if disputes arise.

How can parties ensure that the agreement is enforceable?

To ensure that the LLC Share Purchase Agreement is enforceable, parties should make sure that it is clear, comprehensive, and compliant with state laws. Both parties should sign the agreement voluntarily and have the capacity to enter into a contract. Additionally, it may be beneficial to have the agreement reviewed by a legal professional to confirm its validity and enforceability.

LLC Share Purchase Agreement: Usage Steps

Once you have the LLC Share Purchase Agreement form in hand, it’s time to fill it out accurately. Follow these steps to ensure that all necessary information is provided correctly. This will help facilitate a smooth transaction.

- Start with the Date: Write the date on which the agreement is being executed at the top of the form.

- Identify the Parties: Fill in the names and addresses of the buyer and seller. Make sure to include any relevant business names.

- Specify the LLC Details: Provide the name of the LLC and its registered address. This should match the official documents.

- Describe the Shares: Indicate the number of shares being purchased and their class, if applicable.

- Purchase Price: Clearly state the total purchase price for the shares. Include any payment terms, such as payment method and schedule.

- Include Representations and Warranties: Fill out any sections that require the seller to confirm details about the LLC and the shares being sold.

- Signatures: Ensure both parties sign and date the agreement at the bottom of the form. This may also require a witness or notary, depending on your state’s requirements.

After completing the form, review it carefully for any errors or omissions. Proper documentation will help prevent misunderstandings and ensure that the transaction is legally binding.