Blank Letter To Purchase Land PDF Form

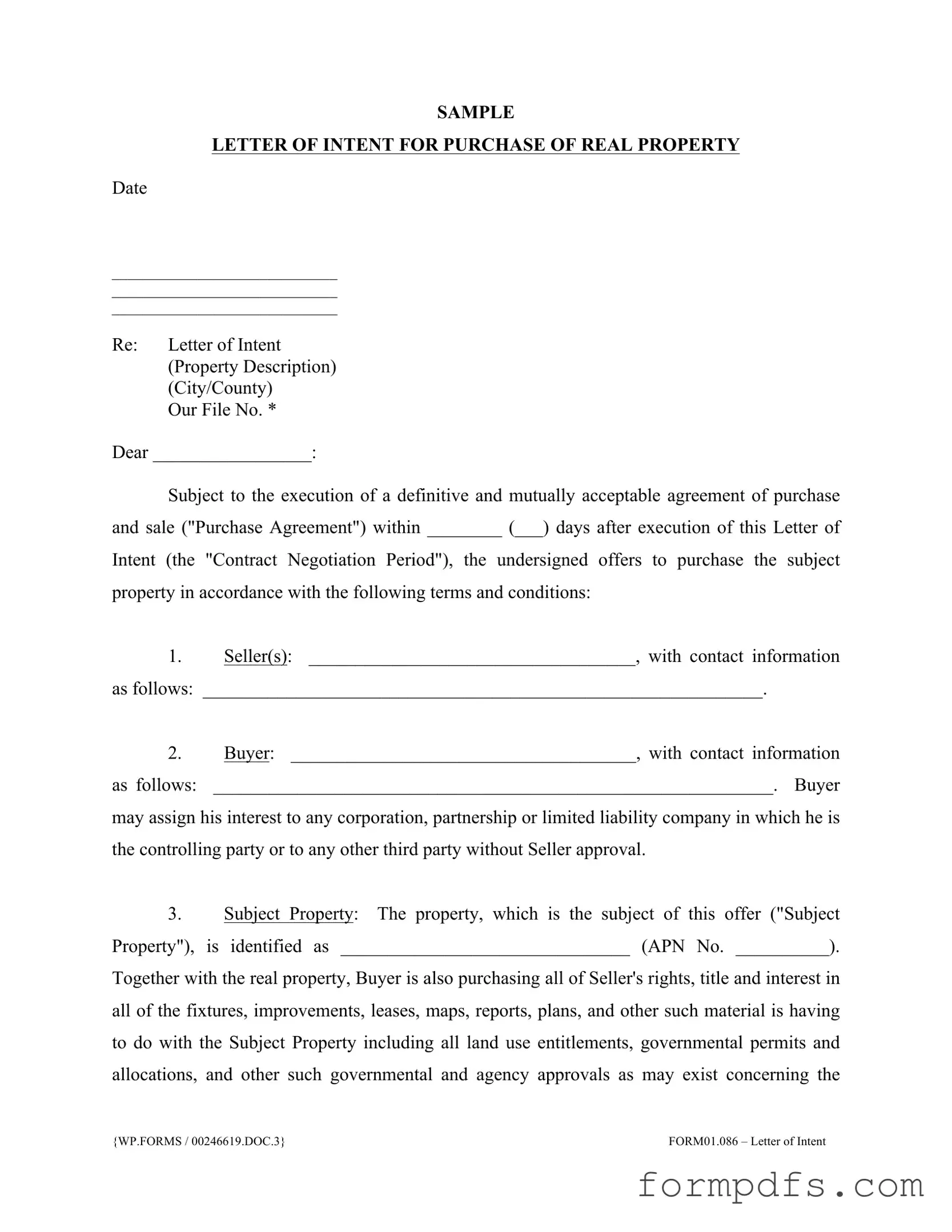

The Letter to Purchase Land form serves as a crucial preliminary document in real estate transactions, establishing a framework for negotiations between a potential buyer and seller. This form outlines the essential terms and conditions under which the buyer expresses their intent to purchase a specific property, including the identification of the property, the proposed purchase price, and the timeline for negotiations. It includes details about the parties involved, such as their contact information, and specifies the rights and interests being transferred along with the property, such as fixtures and improvements. Importantly, the form also addresses the financial aspects of the transaction, detailing initial and second deposits, along with provisions for escrow and feasibility periods. These sections ensure that both parties understand their obligations and the conditions under which the buyer can back out of the deal. Moreover, the Letter to Purchase Land establishes the expectation that a more formal Purchase Agreement will follow, allowing for further due diligence and investigation into the property's viability. By laying out these foundational elements, the form not only facilitates smoother negotiations but also helps protect the interests of both parties during the initial stages of the transaction.

More PDF Templates

What Does Continuance Mean in Court - This motion assists in maintaining fairness in legal proceedings.

Understanding the importance of the standardized process for legal submissions, individuals and attorneys must familiarize themselves with the available resources, including All California Forms, to ensure they are using the correct documentation in their court proceedings.

Report Writing Security Guard Daily Report Sample - An organized report promotes efficient communication among security teams.

Documents used along the form

When considering the purchase of land, it's essential to have a clear understanding of the various documents involved in the process. Alongside the Letter to Purchase Land, there are several other important forms that play a crucial role in ensuring a smooth transaction. Here’s a brief overview of four commonly used documents.

- Purchase Agreement: This is a formal contract that outlines the terms and conditions of the sale. It includes details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized. Both the buyer and seller must sign this document to make the agreement legally binding.

- Lottery Retailer Authorization: To operate as a lottery retailer in Florida, businesses must complete the necessary applications and comply with various legal requirements. This includes submitting the All Florida Forms to ensure compliance with state regulations.

- Escrow Instructions: These are detailed guidelines provided to the escrow agent on how to handle the transaction. They specify the responsibilities of both parties, the timeline for the transaction, and how funds will be managed. This document ensures that all parties are on the same page regarding the process.

- Title Report: This document provides information about the ownership history of the property, including any liens, easements, or encumbrances that may exist. A clear title is crucial for the buyer to ensure they are acquiring the property without any legal issues that could arise in the future.

- Disclosure Statements: Sellers are typically required to provide disclosure statements that inform buyers of any known issues with the property, such as zoning restrictions, environmental hazards, or structural problems. This transparency helps buyers make informed decisions and protects sellers from potential legal disputes.

Understanding these documents can significantly enhance your confidence when navigating the land purchase process. Each form serves a specific purpose and contributes to a successful transaction. Being well-informed will empower you to make the best decisions for your investment.

Form Breakdown

| Fact Name | Description |

|---|---|

| Date Requirement | The form requires a date to be filled in at the top, indicating when the letter is written. |

| Parties Involved | It identifies the seller and buyer, including their contact information, ensuring clear communication. |

| Property Description | The specific property being purchased must be described, including its APN (Assessor's Parcel Number). |

| Purchase Price | The form requires the buyer to specify the proposed purchase price of the property. |

| Escrow Opening | Escrow must be opened at a designated title company within three business days after the letter is executed. |

| Feasibility Period | A timeframe is provided for the buyer to conduct due diligence on the property before finalizing the purchase. |

| Expiration of Offer | The letter serves as an open offer until a specified date, after which it automatically terminates if not accepted. |

More About Letter To Purchase Land

What is a Letter To Purchase Land form?

A Letter To Purchase Land form is a preliminary document that outlines the intentions of a buyer to purchase a specific piece of property. It serves as a starting point for negotiations between the buyer and seller and includes essential details such as the property description, purchase price, and terms of the agreement.

What information do I need to include in the Letter To Purchase Land?

The form requires various details, including the names and contact information of both the buyer and seller, a description of the property, the proposed purchase price, and any specific terms or conditions related to the sale. Additionally, it should state the timeline for negotiations and any deposits required.

Is the Letter To Purchase Land legally binding?

This letter is generally not a legally binding contract. Instead, it acts as a Letter of Intent, indicating the buyer's serious interest in purchasing the property. The formal agreement, known as the Purchase Agreement, must be executed within a specified period for the terms outlined in the letter to take effect.

What is the purpose of the feasibility period mentioned in the letter?

The feasibility period allows the buyer to conduct due diligence on the property. This includes investigating zoning laws, environmental concerns, and other factors that may affect the property's value or usability. The buyer can terminate the letter or the purchase agreement if they find any issues during this period.

What happens if the Purchase Agreement is not executed within the specified time?

If the Purchase Agreement is not signed within the designated Contract Negotiation Period, the Letter of Intent automatically expires. At that point, neither party has any further obligations to each other regarding this offer, and the seller may consider other offers.

Can the buyer assign their interest in the property to someone else?

Yes, the buyer has the option to assign their interest in the property to a corporation, partnership, or limited liability company in which they are the controlling party. This can also include assigning to a third party, which does not require the seller's approval.

What are the implications of the initial deposit mentioned in the letter?

The initial deposit is a sum of money that the buyer places into escrow when the letter is executed. This deposit is refundable and serves as a sign of good faith toward the purchase. It will be applied to the purchase price if the transaction goes through, ensuring that both parties are committed to the agreement.

What should I do if I want to terminate the Letter of Intent?

If the buyer wishes to terminate the Letter of Intent, they can do so anytime before the end of the feasibility period. A written notification must be sent to both the seller and the escrow holder, instructing them to release the initial deposit back to the buyer within five business days.

Letter To Purchase Land: Usage Steps

Completing the Letter To Purchase Land form is a crucial step in initiating the process of acquiring property. This letter outlines the intent of the buyer to purchase the specified land and sets the stage for further negotiations. Once the form is filled out and signed by both parties, it will guide the next steps toward formalizing the purchase agreement.

- Date: Write the current date at the top of the form.

- Recipient Information: Fill in the name and address of the seller in the appropriate section.

- Subject Property: Provide a detailed description of the property, including the APN (Assessor's Parcel Number) and any specific items included in the sale.

- Seller Information: Enter the seller's name and contact information.

- Buyer Information: Fill in the buyer's name and contact details.

- Purchase Price: Clearly state the proposed purchase price, including the dollar amount.

- Terms of Purchase: Describe the terms of the purchase in detail, including any contingencies.

- Escrow Information: Indicate the title company where escrow will be opened and the timeline for doing so.

- Deposit Details: Specify the initial and second deposits, including amounts and conditions for each.

- Feasibility Period: State the deadline for the buyer to conduct feasibility studies and due diligence.

- Buyer's Conditions: List any conditions that must be met for the buyer to close escrow.

- Close of Escrow: Indicate the proposed closing date for the transaction.

- Other Provisions: Mention any additional terms or provisions that may apply.

- Expiration of Offer: Specify the date by which the seller must execute the letter for it to remain valid.

- Signatures: Ensure that both the buyer and seller sign and date the letter at the end.