Valid Letter of Intent to Purchase Business Template

When considering the purchase of a business, a Letter of Intent (LOI) to Purchase Business serves as an essential first step in the negotiation process. This document outlines the preliminary understanding between the buyer and the seller, setting the stage for a potential transaction. It typically includes key details such as the purchase price, payment terms, and a timeline for due diligence. Additionally, the LOI may address confidentiality agreements, exclusivity periods, and any contingencies that need to be met before finalizing the sale. By clearly stating the intentions and expectations of both parties, the Letter of Intent helps to minimize misunderstandings and paves the way for a smoother negotiation process. While it is generally non-binding, it reflects the serious intent of the buyer and seller to move forward, making it a crucial component in the journey toward business ownership.

Other Letter of Intent to Purchase Business Templates:

Letter of Intent to Purchase Real Estate - Express your company’s interest in a vendor’s products or services with this letter.

Creating a well-structured document is critical, and a thorough understanding of the formal Letter of Intent process can significantly streamline negotiations and agreements between parties.

Documents used along the form

When considering the purchase of a business, a Letter of Intent (LOI) is often just the starting point. Accompanying documents play a crucial role in outlining the terms of the transaction and protecting the interests of both parties. Here’s a list of commonly used forms and documents that may accompany the LOI.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains private. Both parties agree not to disclose any proprietary information to third parties.

- Purchase Agreement: Once negotiations progress, this legally binding contract outlines the final terms of the sale, including price, payment terms, and any contingencies.

- Due Diligence Checklist: This list helps buyers assess the business’s financial health and operational status. It includes items like financial statements, contracts, and employee records.

- Asset Purchase Agreement: If the buyer intends to purchase specific assets rather than the entire business, this document details which assets are included in the sale.

- Tennessee Homeschool Letter of Intent: This essential form is required for parents or guardians wishing to formally notify their school district about their intention to homeschool. For more information, you can visit Templates Online.

- Stock Purchase Agreement: For transactions involving the purchase of shares in a corporation, this agreement specifies the number of shares being sold and the terms of the sale.

- Letter of Intent to Lease: If real estate is involved, this document outlines the terms for leasing property associated with the business, including rental rates and duration.

- Non-Compete Agreement: This agreement prevents the seller from starting a competing business for a specified time and within a certain geographic area after the sale.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document outlines the terms of the loan or financing arrangement.

- Transition Services Agreement: This agreement may be necessary if the seller will assist in the transition process post-sale, detailing the services to be provided and duration.

Each of these documents serves a specific purpose in the business acquisition process. Understanding their roles can help ensure a smoother transaction and protect the interests of all parties involved.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Letter of Intent (LOI) to Purchase Business outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. |

| Purpose | The LOI serves to clarify the intentions of both parties before entering into a formal purchase agreement. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it does not legally obligate either party to complete the transaction. |

| Key Components | Common elements include purchase price, payment terms, and timelines for due diligence and closing. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive business information during negotiations. |

| State-Specific Variations | LOIs may vary by state, with different requirements based on local laws. For example, in California, the LOI must comply with the California Commercial Code. |

| Governing Law | The governing law for the LOI should be specified, indicating which state's laws will apply in case of disputes. |

| Due Diligence | The LOI often outlines the due diligence process, allowing the buyer to assess the business's financial and operational health. |

More About Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a document that outlines the preliminary understanding between a buyer and a seller regarding the potential sale of a business. It typically includes key terms and conditions that both parties agree upon before moving forward with a formal purchase agreement. The LOI serves as a roadmap for negotiations and helps clarify the intentions of both parties.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding, meaning it does not create a legal obligation to complete the transaction. However, certain provisions within the LOI, such as confidentiality agreements or exclusivity clauses, can be binding. It’s important to clearly specify which parts of the LOI are intended to be binding and which are not.

What should be included in a Letter of Intent?

An effective LOI should include several key components: the purchase price, payment terms, a timeline for due diligence, any contingencies, and the proposed closing date. Additionally, it may outline any conditions that must be met before the sale can proceed, such as financing or regulatory approvals. Clear communication of these details helps prevent misunderstandings later on.

How does a Letter of Intent help in negotiations?

The LOI helps facilitate negotiations by providing a clear framework for discussions. It allows both parties to express their intentions and expectations, which can lead to a more efficient negotiation process. By having a written document, both the buyer and seller can refer back to the agreed-upon terms, reducing the likelihood of disputes.

Can a Letter of Intent be modified?

Yes, a Letter of Intent can be modified if both parties agree to the changes. Any amendments should be documented in writing to ensure clarity. This flexibility allows both the buyer and seller to adjust terms as negotiations progress or as new information comes to light during due diligence.

What happens after a Letter of Intent is signed?

Once the LOI is signed, both parties typically move forward with due diligence. This process involves a thorough examination of the business's financials, operations, and legal matters. If due diligence goes well, the parties will proceed to draft a formal purchase agreement that includes detailed terms of the sale.

Do I need a lawyer to draft a Letter of Intent?

While it is not legally required to have a lawyer draft a Letter of Intent, it is highly advisable. A legal professional can ensure that the document accurately reflects your intentions and protects your interests. They can also help clarify any binding provisions and ensure compliance with applicable laws.

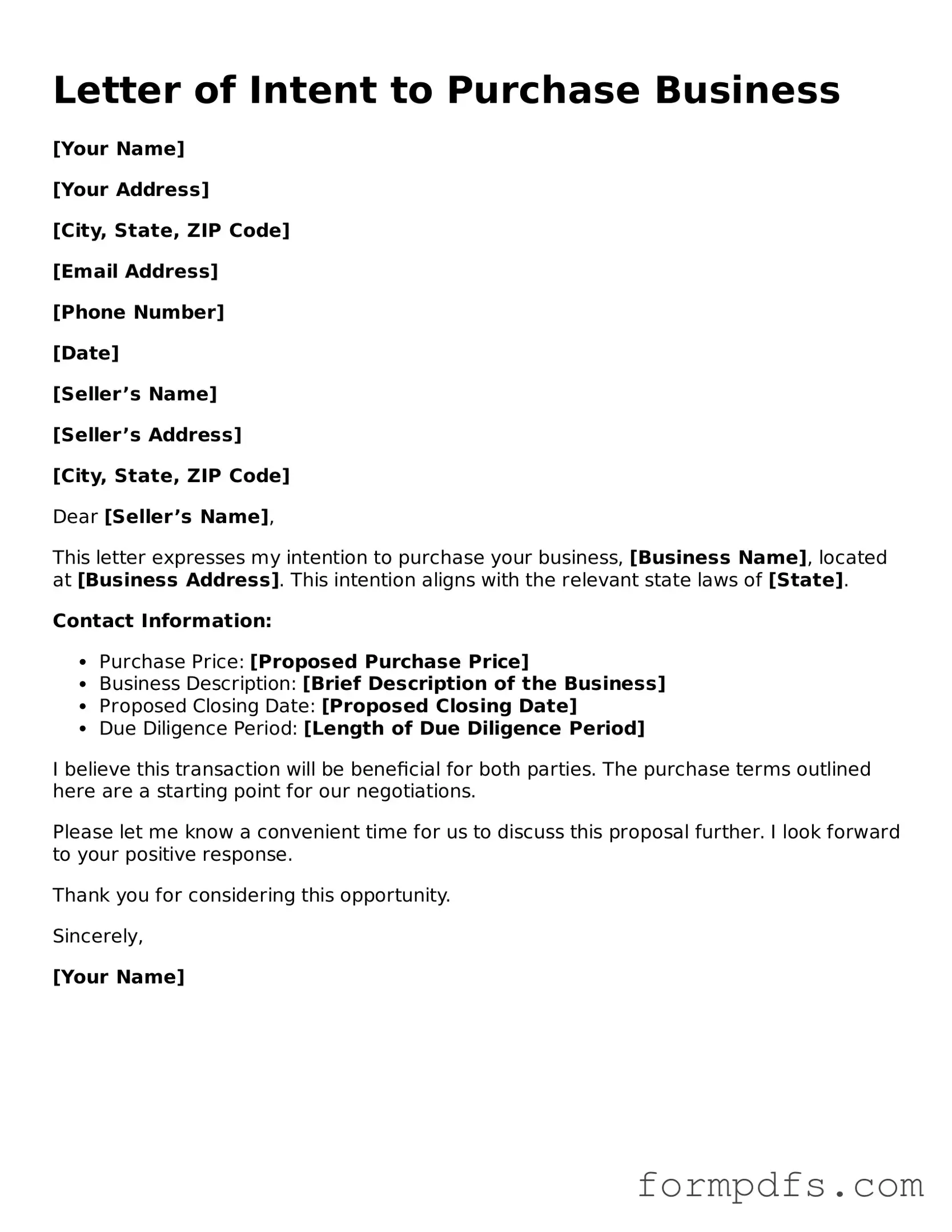

Letter of Intent to Purchase Business: Usage Steps

After gathering all necessary information, you are ready to fill out the Letter of Intent to Purchase Business form. This document will help outline your intentions and the terms of the potential purchase. Follow these steps carefully to ensure that all required details are included.

- Provide Your Information: Fill in your name, address, and contact details at the top of the form.

- Business Information: Enter the name and address of the business you intend to purchase.

- Purchase Price: Clearly state the proposed purchase price for the business.

- Payment Terms: Outline how you plan to pay for the business, including any financing arrangements.

- Due Diligence Period: Specify the time frame you need to conduct your due diligence before finalizing the purchase.

- Confidentiality Agreement: Indicate if you require a confidentiality agreement to protect sensitive information.

- Expiration Date: Set a date by which the offer will expire if not accepted.

- Signature: Sign and date the form to confirm your intent.

Once you have completed the form, review it for accuracy. Ensure that all information is clear and correct. After that, you can present the form to the business owner or their representative for consideration.