Valid Last Will and Testament Template

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. This legal document allows you to specify how your assets should be distributed, who will care for your minor children, and who will manage your estate. It can also address specific bequests, such as personal belongings or financial assets, ensuring that your loved ones receive what you intend for them. Additionally, the form provides a space for appointing an executor, the person responsible for carrying out your wishes and managing your estate's affairs. Without a properly executed will, state laws will dictate how your assets are divided, which may not align with your intentions. Thus, understanding the components of the Last Will and Testament form is essential for anyone looking to secure their legacy and provide peace of mind for their family. Taking the time to create this document can prevent confusion and conflict among loved ones during a challenging time.

More Forms:

Dekalb County Water New Service - Provide your information for timely water service activation.

To ensure a smooth transfer of ownership, it's essential to use a proper document; consider using a reliable resource for guidance on your California bill of sale requirements available at California Bill of Sale requirements.

Promissory Note Auto Loan - Identifies the vehicle being financed for clarity.

Last Will and Testament Forms for Specific US States

Last Will and Testament Types

Documents used along the form

A Last Will and Testament is a crucial document for outlining how a person's assets should be distributed after their passing. However, there are several other forms and documents that often accompany a will to ensure a comprehensive estate plan. Below is a list of these important documents, each serving a specific purpose.

- Living Will: This document specifies a person's wishes regarding medical treatment in case they become unable to communicate their preferences. It guides healthcare providers and family members in making decisions about life-sustaining measures.

- Durable Power of Attorney: This form allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated. It ensures that someone trusted can manage affairs without court intervention.

- Bill of Sale Form: When handling personal property transactions, ensure you have the necessary detailed bill of sale documentation to protect your interests and comply with legal requirements.

- Healthcare Power of Attorney: Similar to a durable power of attorney, this document specifically grants someone the authority to make healthcare decisions for an individual if they are unable to do so themselves.

- Trust Agreement: A trust is a legal arrangement where one party holds property for the benefit of another. A trust agreement outlines the terms and conditions under which the trust operates, helping to manage assets during and after a person's lifetime.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, like life insurance policies or retirement accounts, upon a person's death. They supersede instructions in a will, making them critical for ensuring assets are distributed as intended.

- Letter of Instruction: While not legally binding, this letter provides personal guidance to heirs about the deceased's wishes, funeral arrangements, and the location of important documents. It can help reduce confusion and stress for family members.

- Inventory of Assets: This document lists all assets owned by an individual, including real estate, bank accounts, and personal belongings. It serves as a reference for the executor and beneficiaries during the estate settlement process.

- Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes or updates without having to create an entirely new will, simplifying the process of keeping estate plans current.

- Affidavit of Heirship: This legal document establishes the heirs of a deceased person, particularly when there is no will. It can be used to facilitate the transfer of property and clarify ownership among family members.

Having these documents in place alongside a Last Will and Testament can provide clarity and ease during a difficult time. Each document plays a vital role in ensuring that a person's wishes are honored and that their loved ones are supported in managing their affairs.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. |

| Governing Law | The laws governing Last Wills and Testaments vary by state. For example, in California, the relevant law is the California Probate Code. |

| Requirements | Most states require the testator (the person creating the will) to be at least 18 years old and of sound mind. |

| Witnesses | Typically, a will must be signed in the presence of at least two witnesses, who must also sign the document to validate it. |

| Revocation | A Last Will can be revoked or amended at any time, as long as the testator is alive and mentally competent. |

| Probate Process | After death, the will usually goes through a legal process called probate, which involves validating the will and distributing assets according to its terms. |

More About Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It specifies who will inherit property, appoints guardians for minor children, and can even name an executor to manage the estate. This document serves as a crucial tool for ensuring that an individual's wishes are honored and can help prevent disputes among family members after passing.

Who can create a Last Will and Testament?

Generally, any adult who is of sound mind can create a Last Will and Testament. This typically means being at least 18 years old and capable of understanding the implications of the document. Individuals should be clear about their intentions and the distribution of their assets. Some states may have specific requirements regarding mental capacity or the formalities of signing the will.

What happens if someone dies without a Last Will and Testament?

When a person dies without a Last Will and Testament, they are said to have died "intestate." In such cases, state laws dictate how the deceased's assets will be distributed. This process can lead to outcomes that may not align with the deceased's wishes. It can also result in delays and additional costs, as the court may need to appoint an administrator to manage the estate.

Can a Last Will and Testament be changed or revoked?

Yes, a Last Will and Testament can be changed or revoked at any time while the individual is alive, as long as they have the mental capacity to do so. This can be accomplished by creating a new will or by making a codicil, which is an amendment to the existing will. It is important to follow legal formalities when making changes to ensure that the new document is valid and enforceable.

Do I need a lawyer to create a Last Will and Testament?

While it is not strictly necessary to hire a lawyer to create a Last Will and Testament, consulting with one can be beneficial. A lawyer can provide guidance on state-specific laws, help ensure that the will is properly drafted, and address any unique circumstances that may arise. For straightforward estates, individuals may choose to use online resources or templates, but caution is advised to avoid potential legal pitfalls.

What should I include in my Last Will and Testament?

In a Last Will and Testament, individuals should include several key components. First, clearly identify yourself and state that the document is your will. Next, specify how your assets should be distributed, naming beneficiaries and detailing what they will receive. If applicable, appoint a guardian for minor children and designate an executor to manage the estate. Lastly, include a statement revoking any prior wills to avoid confusion.

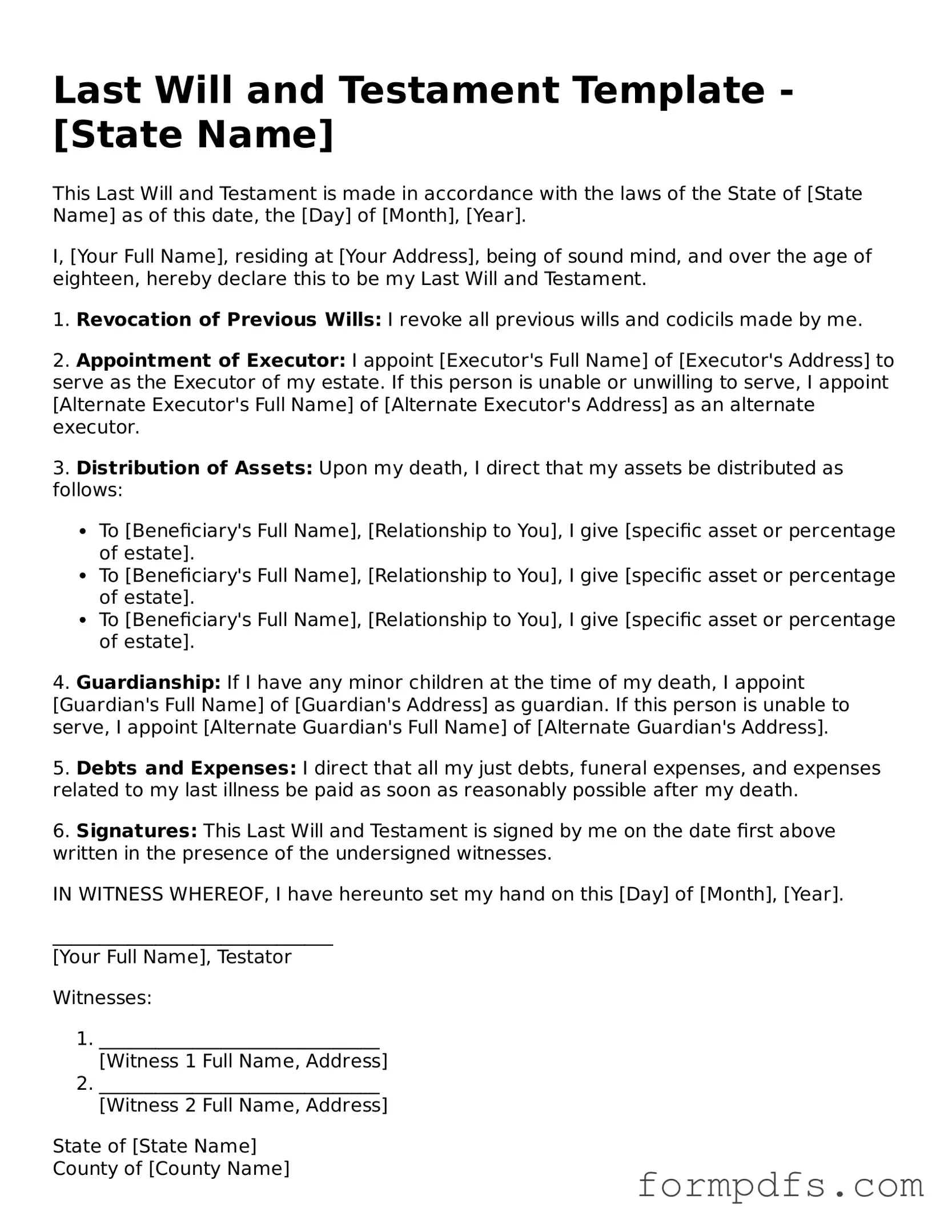

Last Will and Testament: Usage Steps

Filling out a Last Will and Testament form is an important step in ensuring your wishes are honored after you pass away. Once you have completed the form, you will need to sign it in front of witnesses and possibly have it notarized, depending on your state’s requirements. Follow these steps to accurately fill out the form.

- Gather Necessary Information: Collect details about your assets, beneficiaries, and any specific wishes you want to include.

- Begin with Your Personal Information: Write your full name, address, and date of birth at the top of the form.

- Declare Your Intent: Clearly state that this document is your Last Will and Testament.

- Identify Beneficiaries: List the names and relationships of the people or organizations you wish to inherit your assets.

- Detail Your Assets: Describe your property, bank accounts, investments, and any other significant assets.

- Appoint an Executor: Choose a trusted person to manage your estate and carry out your wishes.

- Include Guardianship Provisions: If you have minor children, name a guardian to care for them.

- Sign the Document: Sign and date the form in the presence of witnesses as required by your state.

- Store the Will Safely: Keep the completed will in a secure location and inform your executor where it can be found.