Valid Lady Bird Deed Template

The Lady Bird Deed, also known as an enhanced life estate deed, is a legal instrument that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This form is particularly notable for its ability to avoid probate, simplifying the transfer process upon the owner's death. Unlike traditional life estate deeds, the Lady Bird Deed permits the property owner to sell, mortgage, or change the beneficiaries without the need for consent from the recipients. This flexibility can be beneficial for individuals who wish to maintain control over their property while planning for the future. Additionally, the Lady Bird Deed can help minimize tax implications and protect the property from creditors, making it a valuable tool in estate planning. Understanding the nuances of this form is essential for anyone considering its use, as it involves specific requirements and implications that can significantly impact estate management.

Other Lady Bird Deed Templates:

United States Tod - Transfer-on-Death Deeds can also help avoid potential taxation issues upon inheritance in some states.

Additionally, for those looking to create a formal transaction record, you can find a template for a Trailer Bill of Sale at https://toptemplates.info/bill-of-sale/trailer-bill-of-sale/, making the process of buying or selling a trailer more straightforward and legitimate.

Printable Quitclaim Deed - Can be executed for a variety of property types.

Gift Deed Rules - Documenting a gift through the Gift Deed helps maintain transparency among family members and potential heirs.

Lady Bird Deed Forms for Specific US States

Documents used along the form

A Lady Bird Deed is a powerful estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. However, it is often used in conjunction with other documents to ensure a comprehensive estate plan. Below are some common forms and documents that complement the Lady Bird Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can include specific bequests, appoint an executor, and name guardians for minor children, ensuring that all wishes are legally documented.

- Durable Power of Attorney: This form allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated. It is crucial for managing affairs when the property owner can no longer do so.

- Power of Attorney for a Child: This important legal document allows a parent or guardian to grant temporary parental rights to another adult, ensuring a child's needs are met during their absence. For further details, refer to All California Forms.

- Healthcare Proxy: This document appoints someone to make medical decisions for an individual if they are unable to communicate their wishes. It ensures that healthcare choices align with the individual’s values and preferences.

- Beneficiary Designation Forms: Used for accounts like life insurance policies or retirement accounts, these forms specify who will receive the benefits upon the account holder's death. They play a vital role in ensuring that assets transfer smoothly outside of probate.

Incorporating these documents alongside a Lady Bird Deed can create a well-rounded estate plan, providing clarity and peace of mind for both the property owner and their loved ones. Each document serves a unique purpose, ensuring that wishes are honored and legal matters are handled effectively.

PDF Overview

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed is a type of deed that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Benefits of a Lady Bird Deed | This deed helps avoid probate, allows for tax benefits, and provides flexibility in managing the property. |

| Governing Law | Lady Bird Deeds are primarily recognized in states like Florida and Texas, where specific laws govern their use. |

| How It Works | The property owner retains the right to sell, lease, or mortgage the property without needing consent from the beneficiaries. |

More About Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their real estate to their beneficiaries while retaining control during their lifetime. This type of deed provides the owner the ability to sell, mortgage, or otherwise manage the property without needing the consent of the beneficiaries. Upon the owner’s death, the property automatically transfers to the named beneficiaries, avoiding the probate process.

Who can benefit from using a Lady Bird Deed?

Anyone who owns real estate and wishes to simplify the transfer of their property upon death may find a Lady Bird Deed beneficial. It is particularly useful for individuals who want to avoid probate, ensure a smooth transition of property to heirs, and retain control over their property while still living. This deed is often favored by seniors looking to pass on their homes to children or other loved ones without complications.

Are there any tax implications associated with a Lady Bird Deed?

Generally, a Lady Bird Deed does not trigger immediate tax consequences. The property remains in the owner's name for tax purposes, meaning the owner continues to pay property taxes. However, when the property transfers to the beneficiaries, they may receive a step-up in basis, which can reduce capital gains taxes if they decide to sell the property later. It’s wise to consult a tax professional to understand the specific implications based on individual circumstances.

How do I create a Lady Bird Deed?

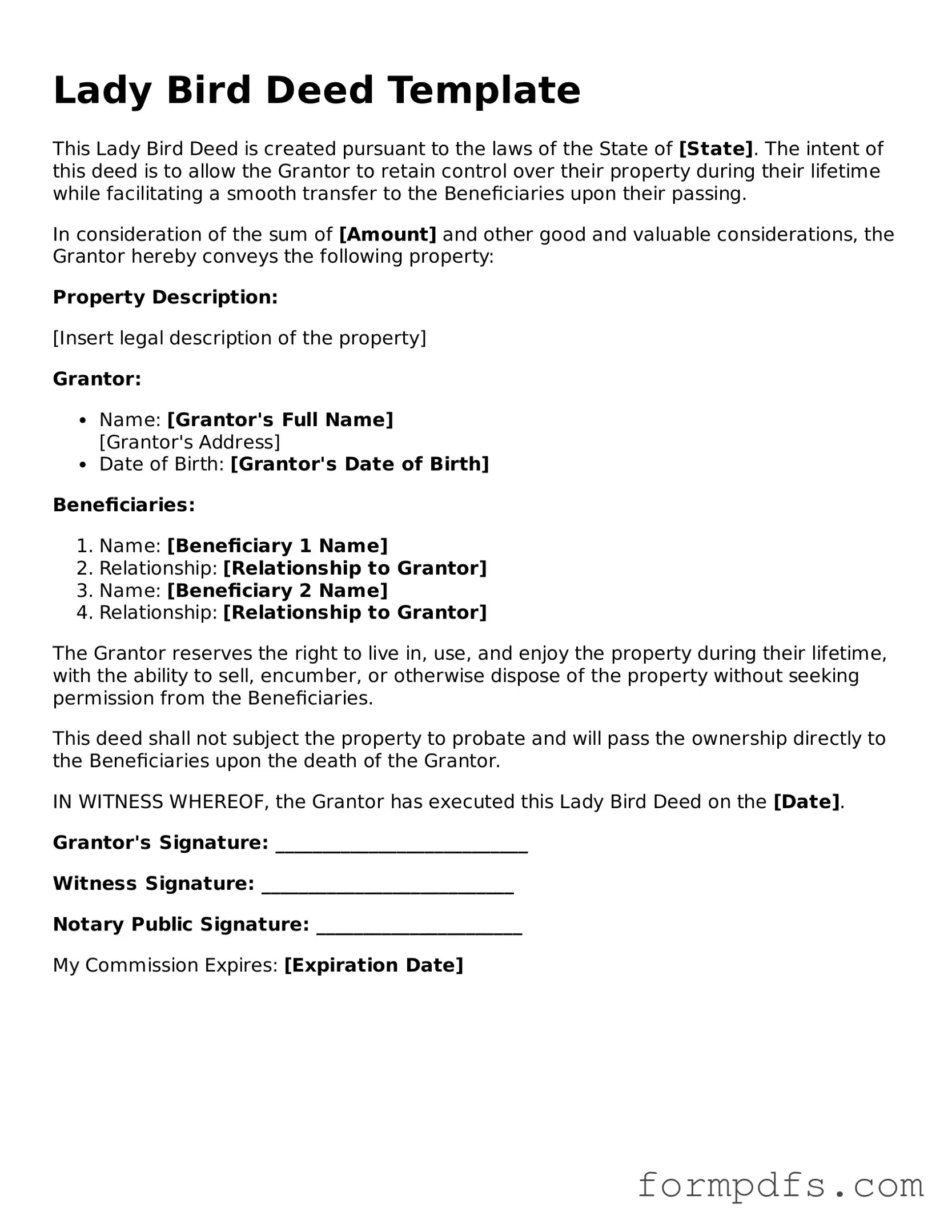

Creating a Lady Bird Deed involves drafting the document to include specific details such as the names of the current property owners, the beneficiaries, and a clear description of the property. While templates are available online, it is advisable to work with a legal professional to ensure that the deed complies with state laws and accurately reflects your intentions. Once completed, the deed must be signed, notarized, and recorded with the appropriate county office.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time while the original owner is still alive. This flexibility allows property owners to change beneficiaries or adjust terms as their circumstances or intentions change. To revoke a Lady Bird Deed, the owner must create a new deed that explicitly states the revocation or creates a new deed with updated terms and beneficiaries, which must then be properly executed and recorded.

Lady Bird Deed: Usage Steps

Filling out the Lady Bird Deed form is an important step in managing property transfer while retaining certain rights. Follow these steps carefully to ensure that the form is completed correctly.

- Begin by entering the full name of the property owner. This should be the person who currently holds the title to the property.

- Next, provide the address of the property. Include the street address, city, state, and zip code.

- List the name of the beneficiaries. These are the individuals who will receive the property upon the owner’s passing.

- Indicate the relationship of each beneficiary to the property owner. This helps clarify the intent of the transfer.

- Sign and date the form. The signature must be that of the property owner, and the date should reflect when the form is completed.

- Have the form notarized. A notary public will need to witness the signature to validate the document.

- Make copies of the completed and notarized form for your records and for the beneficiaries.

- Finally, file the original form with the appropriate county office where the property is located. This may be the county clerk or recorder's office.