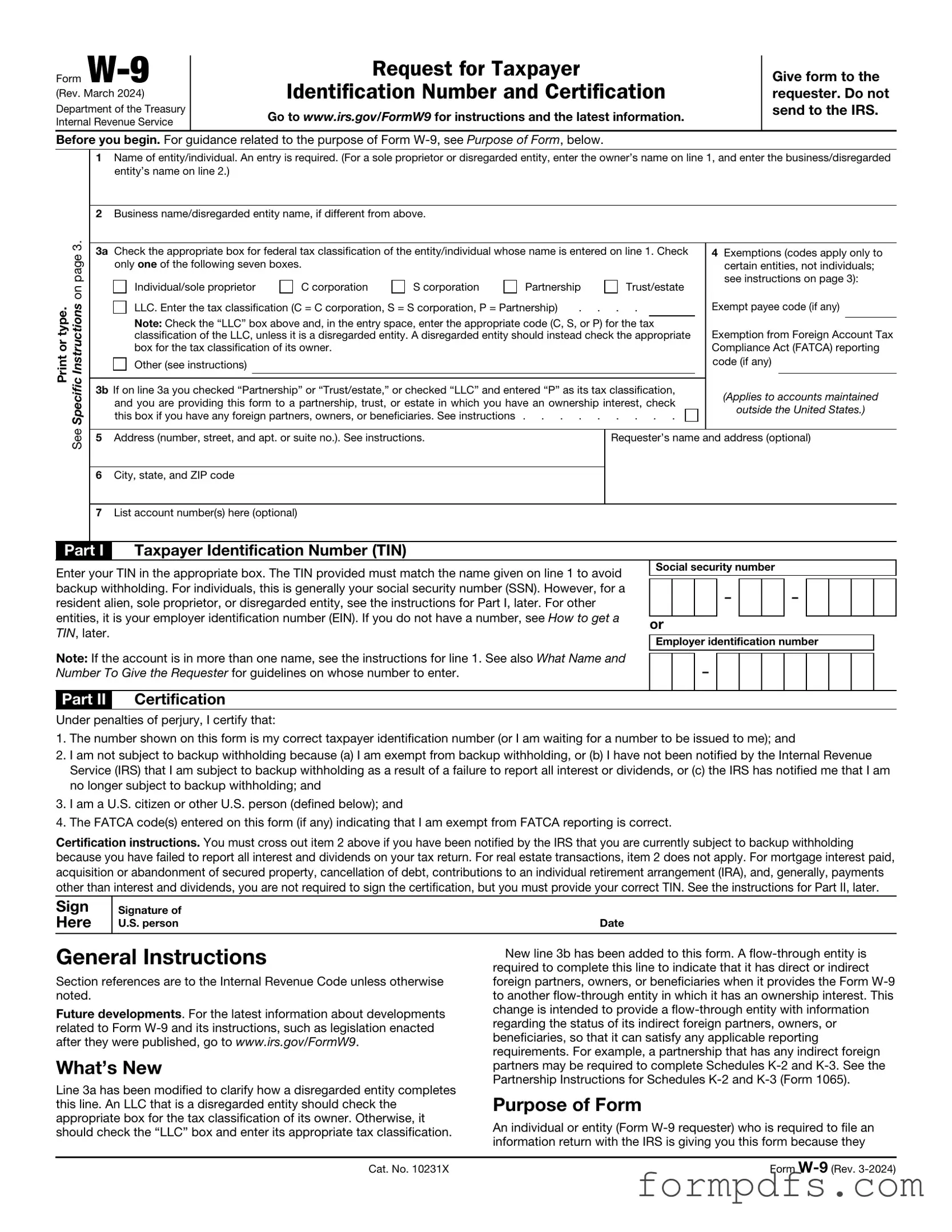

Blank IRS W-9 PDF Form

The IRS W-9 form is an essential document for anyone who works as an independent contractor, freelancer, or has other income sources that require reporting to the Internal Revenue Service. This form serves as a request for taxpayer identification information, allowing businesses and individuals to accurately report payments made to you. By filling out the W-9, you provide your name, business name (if applicable), address, and your taxpayer identification number, which can be your Social Security number or Employer Identification Number. The information collected helps ensure compliance with tax regulations and simplifies the process for those who need to issue you a 1099 form at the end of the tax year. Understanding the importance of the W-9 is crucial, as it not only aids in tax reporting but also protects both you and the payer from potential issues with the IRS. Whether you're a seasoned freelancer or just starting, knowing how to properly fill out and submit the W-9 form is a key step in managing your financial responsibilities effectively.

More PDF Templates

Da Form 7666 - The DA 7666 makes the process of tracking personal property straightforward and effective.

Apartment Owners Association Forms - The background check will help confirm your reliability as a tenant.

For those needing assistance with claims, the Asurion F-017-08 MEN form acts as a pivotal tool to ensure your device-related issues are addressed promptly and accurately. Initiating your claim is streamlined with this form, enhancing your overall experience in the claims process.

How to Get a Pay Stub From Adp - It may include retirement contributions, such as 401(k) deductions.

Documents used along the form

The IRS W-9 form is commonly used to provide taxpayer information to entities that will report income paid to individuals or businesses. However, several other forms and documents often accompany or relate to the W-9. Below is a list of these documents, each with a brief description.

- IRS Form 1099-MISC: This form reports miscellaneous income, such as payments made to independent contractors. It is often issued to individuals who have provided services and received payments that meet the reporting threshold.

- IRS Form 1099-NEC: Used specifically for reporting non-employee compensation. This form became a separate document starting in the 2020 tax year, primarily for independent contractors.

- IRS Form 1040: The standard individual income tax return form. Taxpayers report their annual income, deductions, and tax liability using this form, which may include income reported on 1099 forms.

- IRS Form 8821: This form allows taxpayers to authorize an individual to receive confidential tax information from the IRS. It is often used by tax professionals on behalf of their clients.

- Arizona ATV Bill of Sale: This form is essential for documenting the transfer of ownership of an all-terrain vehicle in Arizona. To avoid any ambiguities during the transaction, be sure to utilize the Top Document Templates for guidance.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). Businesses that hire employees or operate as a corporation or partnership need this number for tax purposes.

- IRS Form 4506-T: This form is a request for a transcript of tax return information. It is often used when applying for loans or verifying income.

- IRS Form 941: This is the Employer's Quarterly Federal Tax Return, used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

- IRS Form 990: This form is used by tax-exempt organizations to provide the IRS with information about their financial activities. It is essential for maintaining tax-exempt status.

- State Tax Forms: Depending on the state, various tax forms may be required for reporting income and paying state taxes. These forms vary widely by state.

Understanding these forms and their purposes is crucial for anyone involved in financial transactions that require reporting to the IRS. Using the W-9 and related documents properly can help ensure compliance and avoid potential issues with tax reporting.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The W-9 form is used to provide your taxpayer identification number (TIN) to entities that will report income paid to you to the IRS. |

| Who Uses It | Individuals, sole proprietors, and businesses that need to report income or payments made to you will request a W-9. |

| Information Required | You must provide your name, business name (if applicable), address, and TIN, which can be your Social Security number or Employer Identification Number. |

| Submission | The completed W-9 form is typically submitted to the requester, not the IRS. Keep a copy for your records. |

| State-Specific Forms | Some states have their own versions of the W-9 form. For example, California has the 590 form for withholding exemption claims. |

| Legal Requirement | While you are not legally required to fill out a W-9, failing to do so may result in backup withholding on your payments. |

| Validity Period | The W-9 form does not expire, but it is good practice to update it if your information changes, such as a name or address change. |

More About IRS W-9

What is the IRS W-9 form?

The IRS W-9 form is a document used in the United States by individuals and businesses to provide their taxpayer identification information. This includes your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN). The form is typically requested by a business or individual who needs to report payments made to you to the IRS.

Who needs to fill out a W-9 form?

Any individual or entity that receives income from a business, such as freelancers, independent contractors, or vendors, may be required to complete a W-9 form. If you are providing services or goods and expect to be paid, the requesting party will likely ask for this form to ensure they can accurately report the payments to the IRS.

When should I submit a W-9 form?

You should submit a W-9 form when a business or individual requests it, typically before they issue payment for your services. It’s best to provide this form promptly to avoid any delays in payment processing.

How do I fill out a W-9 form?

Filling out a W-9 form is straightforward. You will need to enter your name, business name (if applicable), address, and taxpayer identification number. If you are an individual, this is usually your SSN. If you are a business entity, you will provide your EIN. Finally, sign and date the form to certify that the information is accurate.

Is the W-9 form submitted to the IRS?

No, the W-9 form is not submitted directly to the IRS. Instead, it is provided to the requester (the business or individual paying you). They will use the information from your W-9 to complete their own tax forms, such as the 1099-MISC or 1099-NEC, which they will submit to the IRS.

What happens if I don't submit a W-9 form?

If you do not submit a W-9 form when requested, the business or individual may withhold taxes from your payments. This is known as backup withholding. The withholding rate is currently set at 24%, which can significantly reduce your earnings until you provide the necessary information.

Can I refuse to fill out a W-9 form?

You can refuse to fill out a W-9 form, but doing so may impact your ability to receive payment. Businesses require this form to comply with IRS regulations, and without it, they may choose not to engage your services or may withhold taxes from your payments.

How often do I need to submit a W-9 form?

You typically only need to submit a W-9 form once per requester, unless your information changes. If you change your name, address, or taxpayer identification number, you should submit a new W-9 form to ensure that the information on file is current.

What should I do if I make a mistake on my W-9 form?

If you make a mistake on your W-9 form, it’s important to correct it as soon as possible. You can fill out a new W-9 form with the correct information and submit it to the requester. It’s a good practice to inform them of the change to avoid any confusion.

Where can I find the W-9 form?

The W-9 form can be found on the IRS website. It is available for download in PDF format. You can also request a copy from the person or business asking you to complete it, as they may have their own version to provide.

IRS W-9: Usage Steps

Once you have the IRS W-9 form in hand, you'll need to complete it accurately to ensure that your information is processed correctly. Follow these steps to fill out the form properly.

- Begin by downloading the IRS W-9 form from the IRS website or obtaining a physical copy.

- In the first section, provide your name as it appears on your tax return. If you have a business name, include it in the next field.

- Next, check the appropriate box to indicate your tax classification. Options include individual, corporation, partnership, or other types.

- Enter your address in the designated fields. This should include your street address, city, state, and ZIP code.

- If applicable, provide your taxpayer identification number (TIN). This could be your Social Security number (SSN) or Employer Identification Number (EIN).

- In the next section, you may need to certify that the information provided is accurate. Read the certification statement carefully.

- Finally, sign and date the form at the bottom. Ensure that your signature matches the name you provided at the top.

After completing the form, submit it to the requester as instructed. Keep a copy for your records, as it may be useful for future reference.