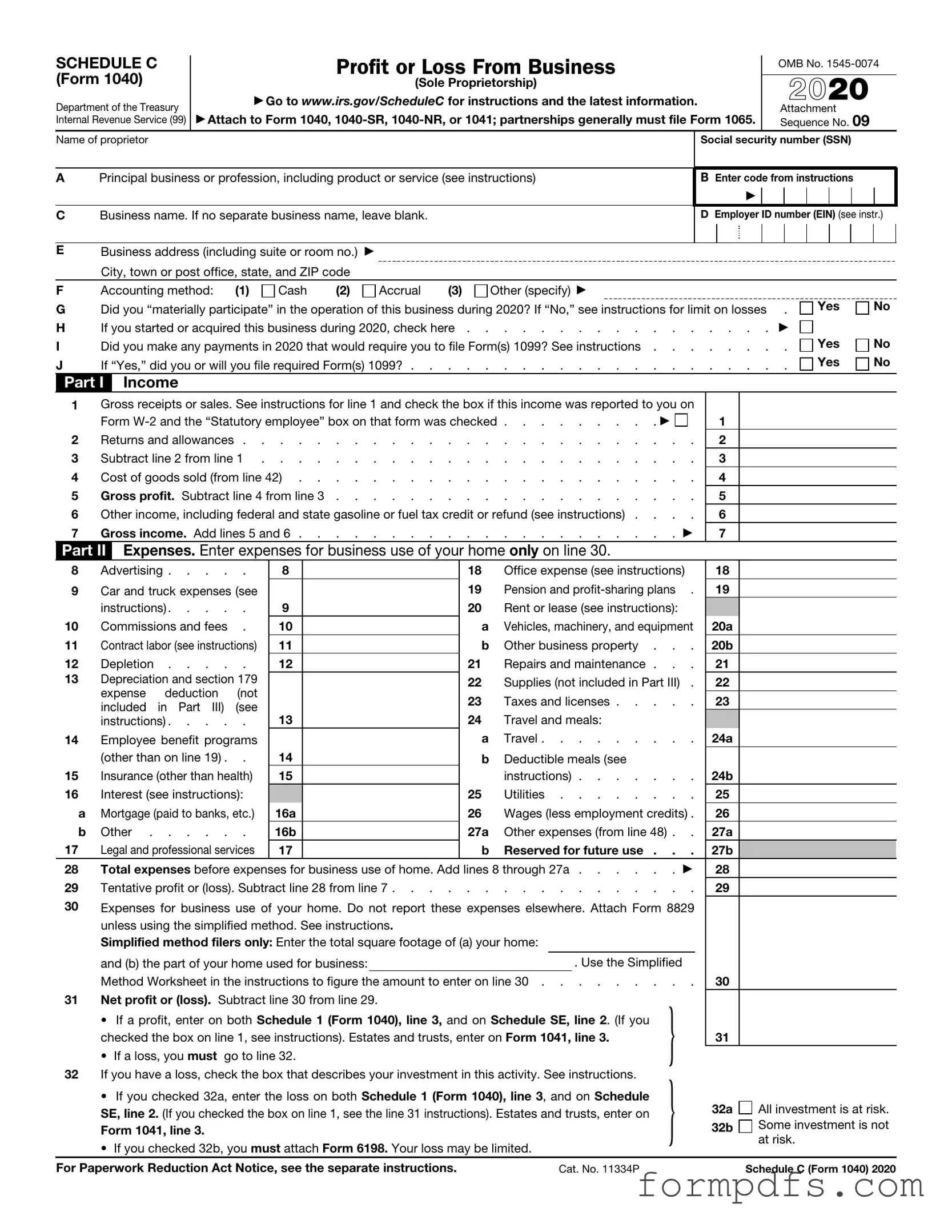

Blank IRS Schedule C 1040 PDF Form

The IRS Schedule C (Form 1040) is a crucial document for self-employed individuals and small business owners, serving as a comprehensive tool to report income and expenses from their business activities. This form allows taxpayers to detail their earnings, providing a clear picture of their financial performance over the year. It encompasses various sections where you can list your gross receipts, cost of goods sold, and operating expenses, such as advertising, utilities, and supplies. Additionally, the Schedule C enables you to claim deductions for business-related expenses, which can significantly reduce your taxable income. Understanding how to fill out this form accurately is essential, as it not only impacts your tax liability but also ensures compliance with IRS regulations. By taking the time to gather necessary documentation and carefully complete each section, you can maximize your deductions and minimize potential issues with the IRS. Whether you’re a freelancer, a consultant, or a small business owner, mastering the Schedule C is a vital step in managing your finances and fulfilling your tax obligations.

More PDF Templates

Tb Risk Assessment Form - This form is for documenting the tuberculosis skin test process.

Where to Submit I 864 Affidavit of Support - The I-864's requirements can vary based on the sponsor’s location.

For those looking to understand the process of forming a corporation, this guide on essential aspects of the Articles of Incorporation can be invaluable. Completing this document is necessary to efficiently set up your business legally and enjoy the associated benefits. For further insights, check the details in our guide to Articles of Incorporation and their importance.

Parent Consent Letter for Travel - Provides crucial details about the adults accompanying the minor.

Documents used along the form

When filing your taxes as a sole proprietor, the IRS Schedule C (Form 1040) is essential for reporting income and expenses from your business. However, there are several other forms and documents that often accompany this form to ensure a complete and accurate tax return. Understanding these additional documents can help streamline the filing process and ensure compliance with tax regulations.

- IRS Form 1040: This is the standard individual income tax return form used by taxpayers to report their annual income. Schedule C is attached to Form 1040 to report business income and expenses, making it a crucial component of the overall tax return.

- IRS Schedule SE: This form is used to calculate self-employment tax for individuals who earn income from self-employment. If you report a profit on Schedule C, you will likely need to complete Schedule SE to determine how much self-employment tax you owe.

- California Civil Form: Crucial for legal proceedings, this form covers applications for various civil court actions, ensuring compliance with procedural standards. For more information, visit All California Forms.

- IRS Form 4562: This form is necessary for claiming depreciation on business assets and for reporting any Section 179 expense deductions. If your business purchases equipment or property, Form 4562 helps you account for these expenses over time.

- IRS Form 8829: If you use part of your home for business purposes, this form allows you to deduct home office expenses. Form 8829 helps you calculate the allowable deductions based on the size of your home office and the total expenses of maintaining your home.

By understanding these forms and how they relate to Schedule C, you can ensure that you are accurately reporting your income and expenses, maximizing your deductions, and fulfilling your tax obligations. Each document plays a vital role in presenting a complete picture of your financial situation to the IRS.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income or loss from their business. This form helps individuals calculate their taxable income from self-employment activities. |

| Eligibility | Any individual who operates a sole proprietorship can use Schedule C. This includes freelancers, independent contractors, and small business owners. |

| Filing Deadline | Schedule C must be filed by the tax return deadline, typically April 15th, unless an extension is requested. It's important to adhere to this timeline to avoid penalties. |

| Expenses Deduction | Taxpayers can deduct various business expenses on Schedule C, such as supplies, utilities, and travel costs. This deduction can significantly reduce taxable income. |

| Net Profit or Loss | The form calculates the net profit or loss from the business. This figure is then transferred to the main Form 1040, impacting overall tax liability. |

| Record Keeping | Maintaining accurate records is essential when completing Schedule C. Documentation of income and expenses supports claims and can be crucial in case of an audit. |

| State-Specific Considerations | Some states require additional forms or have specific laws regarding self-employment income. For instance, California has its own requirements under the California Revenue and Taxation Code. |

More About IRS Schedule C 1040

What is IRS Schedule C (Form 1040)?

IRS Schedule C is a tax form used by self-employed individuals to report income and expenses related to their business. This form is filed along with Form 1040, the individual income tax return. If you operate a sole proprietorship, you will typically use Schedule C to detail your business's financial performance. The information provided helps determine your net profit or loss, which is then included in your overall taxable income.

Who needs to file Schedule C?

If you are self-employed or run a business as a sole proprietor, you will need to file Schedule C. This includes freelancers, independent contractors, and anyone else earning income from a business that is not incorporated. Additionally, if you are involved in a partnership or LLC that is treated as a disregarded entity for tax purposes, you may also need to complete this form. It's essential to accurately report all income earned and expenses incurred to ensure compliance with tax laws.

What expenses can be deducted on Schedule C?

Schedule C allows you to deduct various business expenses that are ordinary and necessary for your trade. Common deductible expenses include costs for supplies, advertising, vehicle expenses, and home office deductions if applicable. Additionally, you can deduct expenses related to utilities, rent, and professional services. Keeping detailed records of all expenses is crucial to substantiate your claims in case of an audit.

How do I report my income on Schedule C?

To report your income on Schedule C, you will start by listing your total gross receipts or sales from your business. This figure should reflect all income earned during the tax year. You will then subtract any returns or allowances to arrive at your net income. It's important to maintain accurate records of all income sources, including invoices and bank statements, to ensure your reported figures are correct and complete.

IRS Schedule C 1040: Usage Steps

Filling out the IRS Schedule C 1040 form can seem daunting, but it’s a straightforward process if you take it step by step. This form is essential for reporting income and expenses from a business you operate as a sole proprietor. Let’s break it down into manageable steps.

- Gather your business information, including your business name, address, and Employer Identification Number (EIN) if you have one.

- Fill in your name and Social Security number at the top of the form.

- In Part I, report your income. Enter your gross receipts or sales from your business.

- In Part II, list your business expenses. Common categories include advertising, car and truck expenses, and supplies.

- Calculate your total expenses and subtract this from your total income to find your net profit or loss.

- Complete the remaining sections as required, such as Part III for cost of goods sold if applicable.

- Review your completed form for accuracy and completeness.

- Sign and date the form before submitting it with your tax return.

After you finish filling out the form, make sure to keep a copy for your records. This will help you in future tax years and provide a reference if needed. Good luck!