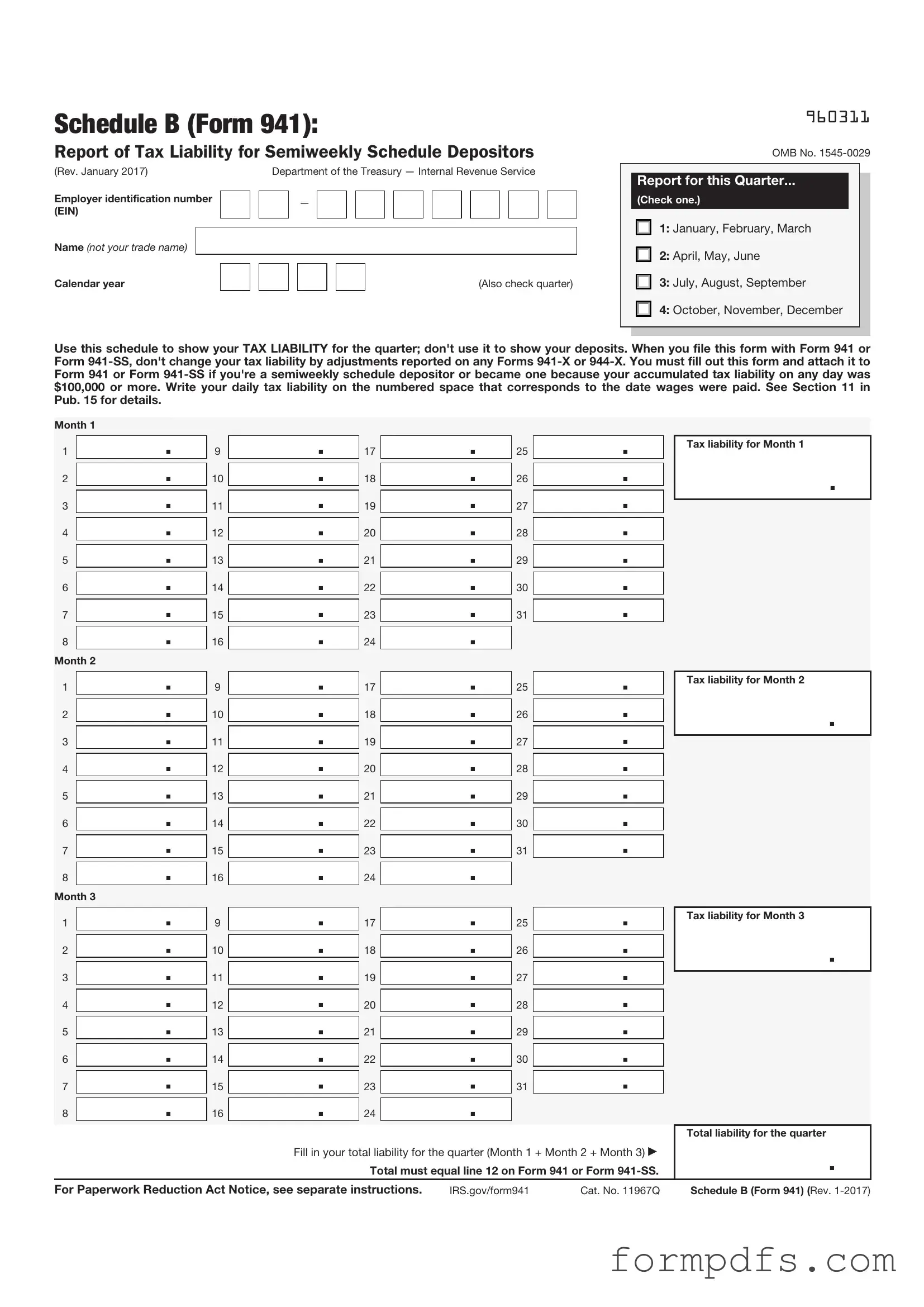

Blank IRS Schedule B 941 PDF Form

The IRS Schedule B (Form 941) is an essential document for employers who are required to report their federal payroll taxes. This form provides a detailed account of the taxes withheld from employees' wages, including Social Security and Medicare taxes, as well as any additional amounts owed. It is particularly important for businesses that have a history of tax liabilities or those that have made adjustments to their payroll tax calculations. Completing Schedule B accurately ensures compliance with federal regulations and helps avoid potential penalties. Employers must submit this form alongside their quarterly Form 941, which summarizes total wages paid and taxes withheld. Understanding the nuances of Schedule B, such as the reporting of tax liabilities, can significantly impact a business's financial health and its relationship with the IRS.

More PDF Templates

Test Drive Agreement Pdf - Feel free to ask us questions during your test drive for the best experience.

Tenancy Agreement Addendum - All potential charges related to the lease are explicitly covered to avoid surprises.

In addition to the important details outlined in the California Form REG 262, it is crucial for individuals engaging in vehicle or vessel transactions to be aware of the various regulations and documentation needed. For comprehensive guidance on all necessary forms and requirements, you can refer to All California Forms, which provides a complete resource for residents navigating these processes.

Trafer Joes - Outgoing personality that thrives on interaction and connection with others.

Documents used along the form

The IRS Schedule B (Form 941) is an important document for employers, detailing the number of employees and the total wages paid during a specific quarter. However, it is often accompanied by several other forms and documents that help ensure compliance with tax regulations. Below is a list of related forms that you may encounter when dealing with payroll taxes and employee reporting.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It reports income taxes, Social Security tax, and Medicare tax withheld from employee paychecks and the employer's portion of Social Security and Medicare taxes.

- Form 940: This form is used for reporting annual Federal Unemployment Tax Act (FUTA) taxes. Employers must file this form to report their unemployment tax liability.

- Form W-2: The Wage and Tax Statement is provided to employees at the end of the year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Durable Power of Attorney Form: For appointing a trusted individual to manage your finances, consider the essential Durable Power of Attorney form resources to secure your affairs.

- Form W-3: This is the Transmittal of Wage and Tax Statements. It summarizes the information reported on all W-2 forms submitted by an employer to the Social Security Administration.

- Form 1099-MISC: Used to report payments made to independent contractors or other non-employee compensation. This form is essential for reporting income that isn’t subject to withholding.

- Form 1096: This is a summary form that accompanies certain information returns, such as 1099 forms, when they are submitted to the IRS. It provides a summary of the total amounts reported.

- Form 8822: This form is used to notify the IRS of a change of address. Employers should file this form if their business address changes to ensure that all correspondence is sent to the correct location.

- Form 941-X: This is the Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund. It is used to correct errors made on previously filed Form 941 returns.

Understanding these forms and their purposes can help streamline your payroll processes and ensure that you remain compliant with federal regulations. Keeping accurate records and submitting the necessary documentation on time will help you avoid penalties and maintain a good standing with the IRS.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule B (Form 941) is used to report the allocation of tax withheld from employee wages and to reconcile the total tax liability with the amounts reported on Form 941. |

| Filing Frequency | This form must be filed quarterly, along with Form 941, which is the Employer's Quarterly Federal Tax Return. |

| Who Must File | Employers who withhold federal income tax, Social Security tax, or Medicare tax from employee wages are required to file this form. |

| Due Dates | Schedule B must be filed by the last day of the month following the end of the quarter. For example, for the first quarter, it is due by April 30. |

| Record Keeping | Employers must maintain records of all wages paid and taxes withheld to support the information reported on Schedule B. |

| State-Specific Forms | Some states may have their own versions of Schedule B, governed by state-specific laws regarding payroll and tax withholding. |

| Penalties | Failure to file Schedule B on time may result in penalties imposed by the IRS, which can increase over time. |

| Electronic Filing | Employers are encouraged to file Schedule B electronically, which can simplify the process and reduce errors. |

More About IRS Schedule B 941

What is the IRS Schedule B (Form 941)?

The IRS Schedule B (Form 941) is a form used by employers to report their payroll tax liabilities. It provides detailed information about the amount of federal income tax withheld and the total taxable wages paid to employees. This form is typically filed quarterly along with Form 941, which summarizes your payroll taxes for the quarter.

Who needs to file Schedule B?

When is Schedule B due?

How do I fill out Schedule B?

What if I don’t need to file Schedule B?

Can I e-file Schedule B?

What happens if I make a mistake on Schedule B?

Where can I find more information about Schedule B?

IRS Schedule B 941: Usage Steps

Completing the IRS Schedule B (Form 941) is an essential step for employers who need to report their payroll taxes. Once you have gathered the necessary information, you can proceed to fill out the form accurately. Following these steps will help ensure that your submission is complete and correct.

- Begin by downloading the latest version of Form 941 and Schedule B from the IRS website.

- Fill in your employer identification number (EIN) at the top of the form.

- Enter your business name and address in the designated fields.

- Indicate the quarter for which you are filing the form.

- In Part I, report the total number of employees who received wages during the quarter.

- Next, provide the total wages, tips, and other compensation paid to employees.

- Calculate the total taxes withheld and enter that amount in the appropriate section.

- In Part II, detail the tax liability for each month of the quarter. This includes federal income tax withheld and Social Security and Medicare taxes.

- Complete Schedule B by listing the dates when you made tax deposits during the quarter.

- Review all entries for accuracy and completeness before signing and dating the form.

- Submit the completed form to the IRS by the due date for the corresponding quarter.

Once you have submitted the form, keep a copy for your records. This will help you maintain accurate financial documentation and ensure compliance with tax regulations.