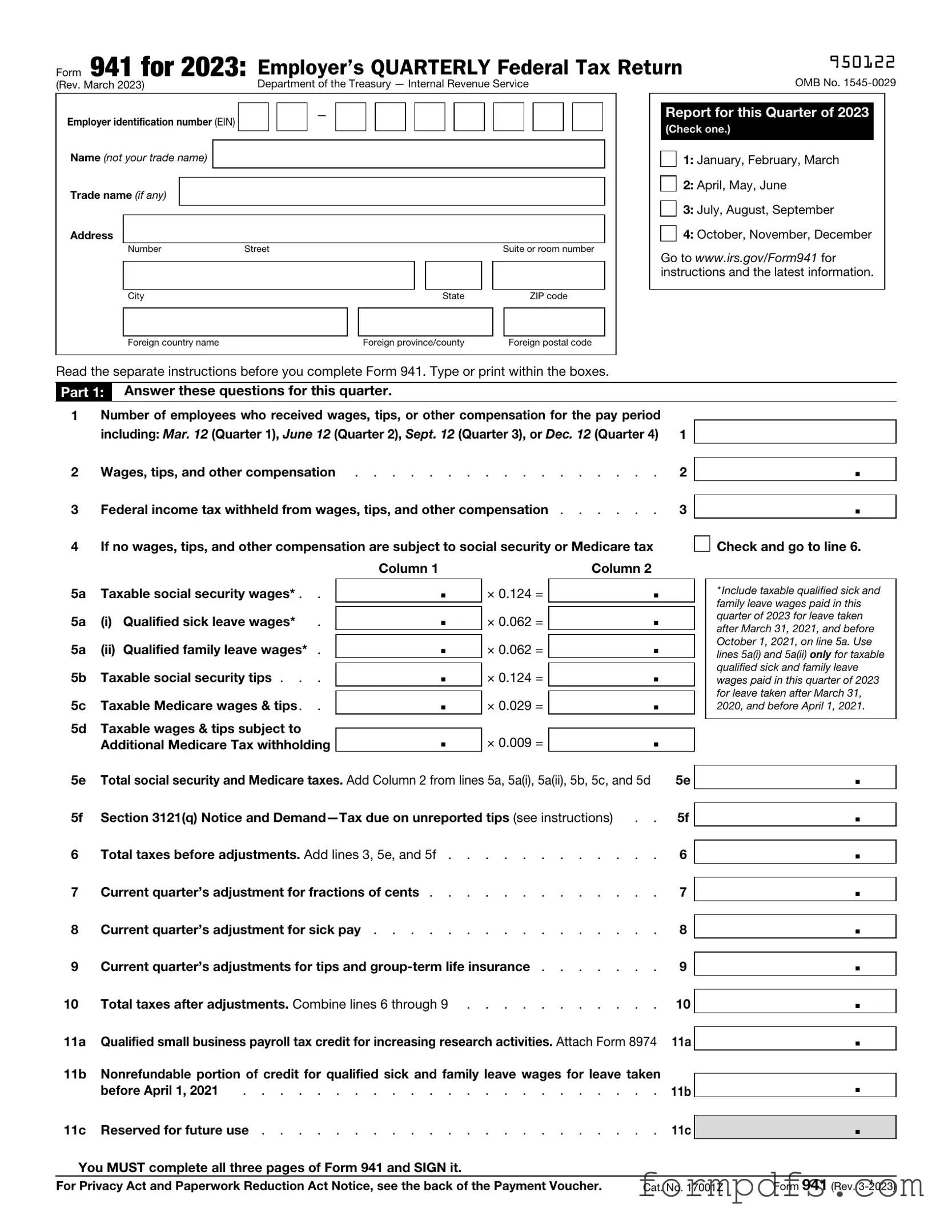

Blank IRS 941 PDF Form

The IRS 941 form, officially known as the Employer's Quarterly Federal Tax Return, plays a crucial role in the landscape of payroll tax compliance for businesses across the United States. Every quarter, employers are required to report the wages paid to their employees and the federal income tax withheld from those earnings. This form also serves as a means to report Social Security and Medicare taxes, ensuring that both employers and employees contribute appropriately to these vital programs. Understanding the nuances of the 941 form is essential for any business owner, as it not only reflects the financial health of the company but also impacts employees' tax obligations. Additionally, the form includes sections for calculating adjustments, credits, and any overpayments, making it a comprehensive tool for managing payroll taxes. Missing deadlines or errors on this form can lead to penalties, which is why familiarity with its requirements is key to maintaining compliance and fostering a positive relationship with the IRS.

More PDF Templates

Hunter Permission - Hunters must adhere to rules set by the landowner while hunting.

A properly executed Last Will and Testament form not only provides peace of mind regarding the distribution of assets but also allows individuals to express their wishes clearly, making it easier for loved ones to navigate the complexities of estate management. For those interested in creating such a document, resources like smarttemplates.net/fillable-last-will-and-testament offer valuable guidance in ensuring these important wishes are formally documented.

Music Contract Template - Local laws govern the performance of this agreement, ensuring its validity and adherence.

Documents used along the form

The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for businesses that withhold income taxes and social security from employee wages. However, several other forms and documents often accompany Form 941 to ensure comprehensive reporting and compliance with federal tax regulations. Below is a list of these forms, each serving a specific purpose in the payroll and tax process.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. Employers use it to report and pay unemployment taxes on employee wages, which fund unemployment benefits.

- Form W-2: The Wage and Tax Statement is issued to employees at the end of the year. It reports an employee's annual wages and the amount of taxes withheld, which they need for their personal tax returns.

- Form W-3: This is the Transmittal of Wage and Tax Statements, which summarizes all W-2 forms issued by an employer. It is sent to the Social Security Administration along with the W-2 forms.

- Form 1099: Various versions of this form report income other than wages, salaries, and tips. For example, Form 1099-MISC is used for reporting payments to independent contractors.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It allows taxpayers to request an extension for filing their personal tax returns, which may indirectly affect payroll reporting timelines.

- Trader Joe's Application Form: This form is essential for individuals seeking job opportunities at Trader Joe's, covering personal details, employment history, and availability. For more information, you can visit OnlineLawDocs.com.

- Form 941-X: This is the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. Employers use this form to correct errors made on previously filed Form 941 submissions.

- Form 944: The Employer's Annual Federal Tax Return is designed for smaller employers who have a lower annual payroll tax liability. It allows them to file just once a year instead of quarterly.

- Form 1095-C: This form provides information about health insurance coverage offered to employees. Employers with 50 or more full-time employees must file it to comply with the Affordable Care Act.

- Form SS-4: The Application for Employer Identification Number (EIN) is necessary for businesses to obtain an EIN, which is required for tax reporting and opening a business bank account.

- Form 8822: This is the Change of Address form. Businesses use it to notify the IRS of any changes to their address, ensuring that all tax documents are sent to the correct location.

Understanding these forms and documents is essential for any business owner or payroll administrator. Proper completion and timely submission help maintain compliance with tax regulations and avoid potential penalties. Each form plays a vital role in the overall tax reporting process, ensuring that both the employer and employees fulfill their tax obligations efficiently.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. |

| Filing Frequency | Employers must file Form 941 quarterly, with deadlines typically falling on the last day of the month following the end of each quarter. |

| Penalties for Non-Compliance | Failure to file Form 941 on time may result in penalties, which can include fines and interest on unpaid taxes. |

| State-Specific Forms | Many states have their own payroll tax forms that complement the IRS Form 941. For example, California requires Form DE 9, governed by California Revenue and Taxation Code. |

More About IRS 941

What is the IRS 941 form?

The IRS 941 form, officially known as the Employer's Quarterly Federal Tax Return, is a tax form used by employers to report payroll taxes. This includes the federal income tax withheld from employees' wages, as well as Social Security and Medicare taxes. Employers must file this form quarterly, providing essential information about their payroll tax liabilities and payments.

Who needs to file Form 941?

Any employer who pays wages to employees and is required to withhold federal income tax, Social Security tax, or Medicare tax must file Form 941. This applies to businesses of all sizes, including corporations, partnerships, and sole proprietorships. If you have no employees during a quarter, you still need to file a return indicating that there were no wages paid.

When is Form 941 due?

Form 941 is due four times a year, specifically on the last day of the month following the end of each quarter. For example, the due dates are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. It's crucial to adhere to these deadlines to avoid penalties.

What information do I need to complete Form 941?

To fill out Form 941, you will need various pieces of information, including your business's name, address, and Employer Identification Number (EIN). You will also report the total number of employees, wages paid, and the amounts withheld for federal income tax, Social Security tax, and Medicare tax. Additionally, you may need to provide details about any adjustments for the current quarter.

What if I make a mistake on Form 941?

If you discover an error after submitting Form 941, you can correct it by filing Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund. This form allows you to amend the original return and correct any discrepancies. Be sure to provide accurate information to avoid further complications.

Can I file Form 941 electronically?

Yes, you can file Form 941 electronically using the IRS e-file system or through various authorized e-file providers. Electronic filing is often faster and more efficient, reducing the chances of errors. It also allows for quicker processing of your return and any refunds due.

What happens if I don’t file Form 941?

Failing to file Form 941 can lead to significant penalties and interest on unpaid taxes. The IRS may impose fines for late filing, and continued non-compliance can escalate to more severe consequences, including audits. It's essential to stay compliant to avoid these issues.

How do I pay the taxes reported on Form 941?

Employers can pay the taxes reported on Form 941 through various methods, including electronic funds transfer (EFTPS), credit or debit card payments, and checks or money orders. Ensure that payments are made on time to avoid penalties and interest charges.

Where can I find Form 941?

You can obtain Form 941 directly from the IRS website. The form is available for download in PDF format, along with detailed instructions on how to fill it out. Additionally, many tax software programs include Form 941, making it easier for employers to complete their filings.

IRS 941: Usage Steps

Completing the IRS Form 941 is an important task for employers who need to report their payroll taxes. Once you have gathered the necessary information, you can proceed with filling out the form. Follow these steps to ensure you complete it accurately.

- Start by entering your employer identification number (EIN) at the top of the form. This number is unique to your business.

- Fill in your business name and address in the designated fields. Make sure to use the name that matches your EIN.

- Indicate the quarter for which you are filing. The form is divided into four quarters, so select the appropriate one.

- Provide the total number of employees who received wages during the quarter. This number helps determine your tax obligations.

- Report the total wages, tips, and other compensation paid to employees during the quarter. Be thorough to ensure accuracy.

- Calculate and enter the total federal income tax withheld from employees’ paychecks. This amount is crucial for your tax reporting.

- Complete the section on taxable social security and Medicare wages. Include the appropriate amounts for each category.

- Calculate the total taxes owed by adding the amounts from the previous sections. This total will help you determine your payment obligations.

- If applicable, report any adjustments for fractions of cents or sick pay. These adjustments are important for accurate reporting.

- Sign and date the form. Ensure that the person signing has the authority to do so on behalf of the business.

- Submit the completed form to the IRS by the deadline. You can do this electronically or via mail, depending on your preference.