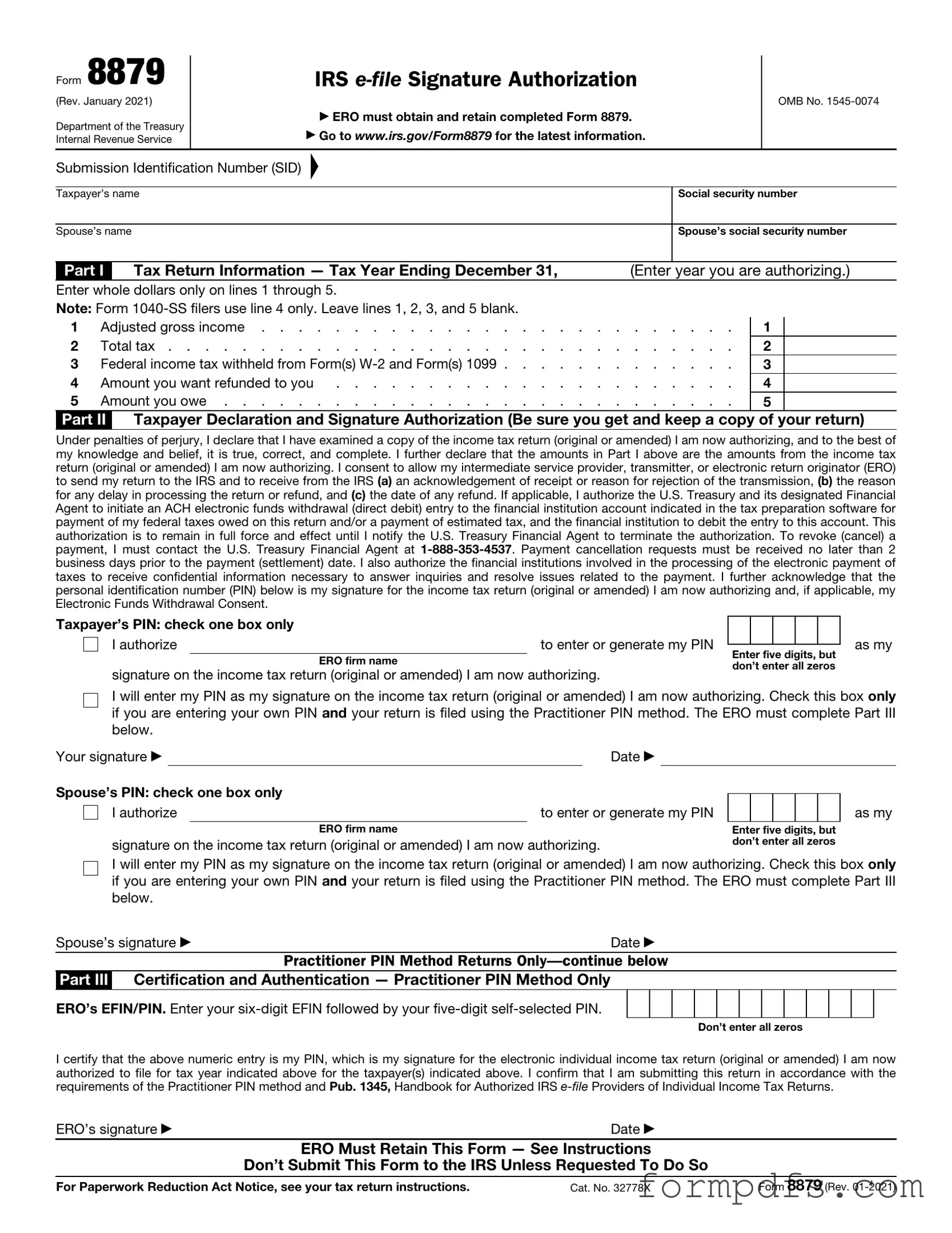

Blank IRS 8879 PDF Form

The IRS 8879 form plays a crucial role in the tax filing process for many individuals and businesses. This form serves as an e-signature authorization for taxpayers who choose to file their returns electronically through a tax professional. By completing the IRS 8879, taxpayers confirm that they have reviewed their tax return and authorize their preparer to submit it on their behalf. The form includes important information such as the taxpayer's name, Social Security number, and the tax year being filed. Additionally, it requires the preparer's details, ensuring that all parties are clearly identified in the process. Understanding the significance of the IRS 8879 form can help taxpayers navigate the complexities of electronic filing and ensure compliance with IRS requirements. Proper completion of this form is essential for a smooth and efficient tax filing experience, as it helps to safeguard against potential issues that may arise during the submission of electronic returns.

More PDF Templates

Army 1380 - A proper audit trail is established through the completion of this form.

Completing the Trader Joe's application form is essential for those eager to join the team, as it not only allows candidates to showcase their qualifications but also ensures they follow the necessary procedures for submission. For more insights on how to fill out the application effectively, you can refer to resources like OnlineLawDocs.com, which provide valuable guidance throughout the application process.

Annual Summary and Transmittal of U.S. Information Returns - Businesses and entities must file Form 1096 when they submit paper copies of certain forms to the IRS.

Documents used along the form

The IRS 8879 form, also known as the IRS e-file Signature Authorization, is an important document for taxpayers and tax professionals. It allows taxpayers to authorize electronic filing of their tax returns. Several other forms and documents often accompany the IRS 8879, each serving a specific purpose in the tax filing process.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. It reports income, deductions, and tax liability for the year.

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld from those wages. It is essential for accurately completing the Form 1040.

- Form 1099: This form reports various types of income received by individuals, such as freelance earnings or interest income. It helps taxpayers account for all sources of income when filing their returns.

- Last Will and Testament: A critical document for outlining asset distribution after death, ensuring that your estate is handled according to your wishes. For more information, visit https://smarttemplates.net/fillable-last-will-and-testament/.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It allows taxpayers to request additional time to file their returns, but not to pay any taxes owed.

These documents are crucial for ensuring accurate and timely tax filings. Familiarity with them can help streamline the process and reduce the likelihood of errors or delays.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 8879 is used to authorize an electronic return originator (ERO) to file a tax return electronically on behalf of a taxpayer. |

| Signature | This form requires the taxpayer's signature, which can be provided electronically, allowing for a faster filing process. |

| Eligibility | Any taxpayer who wishes to file their federal tax return electronically can use Form 8879. |

| Filing Process | The ERO must retain the signed Form 8879 for three years after the return is filed. |

| Form Availability | Form 8879 can be downloaded from the IRS website or obtained through tax preparation software. |

| State Forms | Some states may have their own version of the authorization form, which may be governed by state tax laws. |

| Amendments | If a tax return is amended, a new Form 8879 must be signed and submitted for the amended return. |

| Identification | Taxpayers must provide their Social Security Number (SSN) or Employer Identification Number (EIN) on the form. |

| Electronic Signature | The electronic signature on Form 8879 is legally binding and holds the same weight as a handwritten signature. |

| Submission Deadline | Form 8879 must be signed and submitted before the electronic return is filed to ensure compliance with IRS regulations. |

More About IRS 8879

What is the IRS 8879 form?

The IRS 8879 form, also known as the "IRS e-file Signature Authorization," is a document that allows taxpayers to authorize their tax preparers to electronically file their tax returns on their behalf. This form is essential for ensuring that the e-filing process is secure and that the taxpayer's consent is documented. By signing this form, you confirm that the information provided in your tax return is accurate and complete.

Who needs to sign the IRS 8879 form?

Any taxpayer who is having their tax return electronically filed by a tax preparer must sign the IRS 8879 form. This includes individuals, married couples filing jointly, and businesses. Each taxpayer listed on the return must provide their signature on the form, ensuring that all parties agree to the filing and the information contained within it.

How do I complete the IRS 8879 form?

To complete the IRS 8879 form, you will need to provide basic information, including your name, Social Security number, and the tax year for which you are filing. Your tax preparer will assist you in filling out the form, ensuring that all necessary details are included. After reviewing your tax return, you will sign the form, either electronically or by hand, depending on the method used by your tax preparer.

Is the IRS 8879 form required for all e-filed returns?

While the IRS 8879 form is not required for every e-filed return, it is mandatory when a tax preparer is involved. If you are filing your return on your own using tax software, you may not need this form. However, if you have a tax professional preparing your return, they will require the signed IRS 8879 to complete the e-filing process.

What happens if I do not sign the IRS 8879 form?

If you do not sign the IRS 8879 form, your tax preparer will not be able to electronically file your tax return. This could lead to delays in processing your return and receiving any potential refunds. It is crucial to ensure that this form is signed and submitted alongside your tax return to avoid any complications.

IRS 8879: Usage Steps

After you have gathered all necessary information and completed your tax return, you will need to fill out Form 8879. This form allows you to electronically sign your tax return and authorize the e-filing process. Follow these steps to complete the form accurately.

- At the top of the form, enter your name and Social Security number (SSN) as they appear on your tax return.

- Provide your spouse's name and SSN if you are filing jointly.

- Fill in the tax year for which you are filing the return.

- Indicate whether you are filing as an individual or jointly by checking the appropriate box.

- Enter the total amount of your refund or the amount you owe, as stated on your tax return.

- Review the declaration statement carefully. This confirms that the information provided is accurate and complete.

- Sign and date the form in the designated areas. If filing jointly, your spouse must also sign and date the form.

- Provide your preparer's information if applicable, including their name, PTIN (Preparer Tax Identification Number), and signature.

Once you have completed the form, ensure that it is securely submitted along with your tax return. This will finalize the e-filing process and help ensure timely processing of your return.