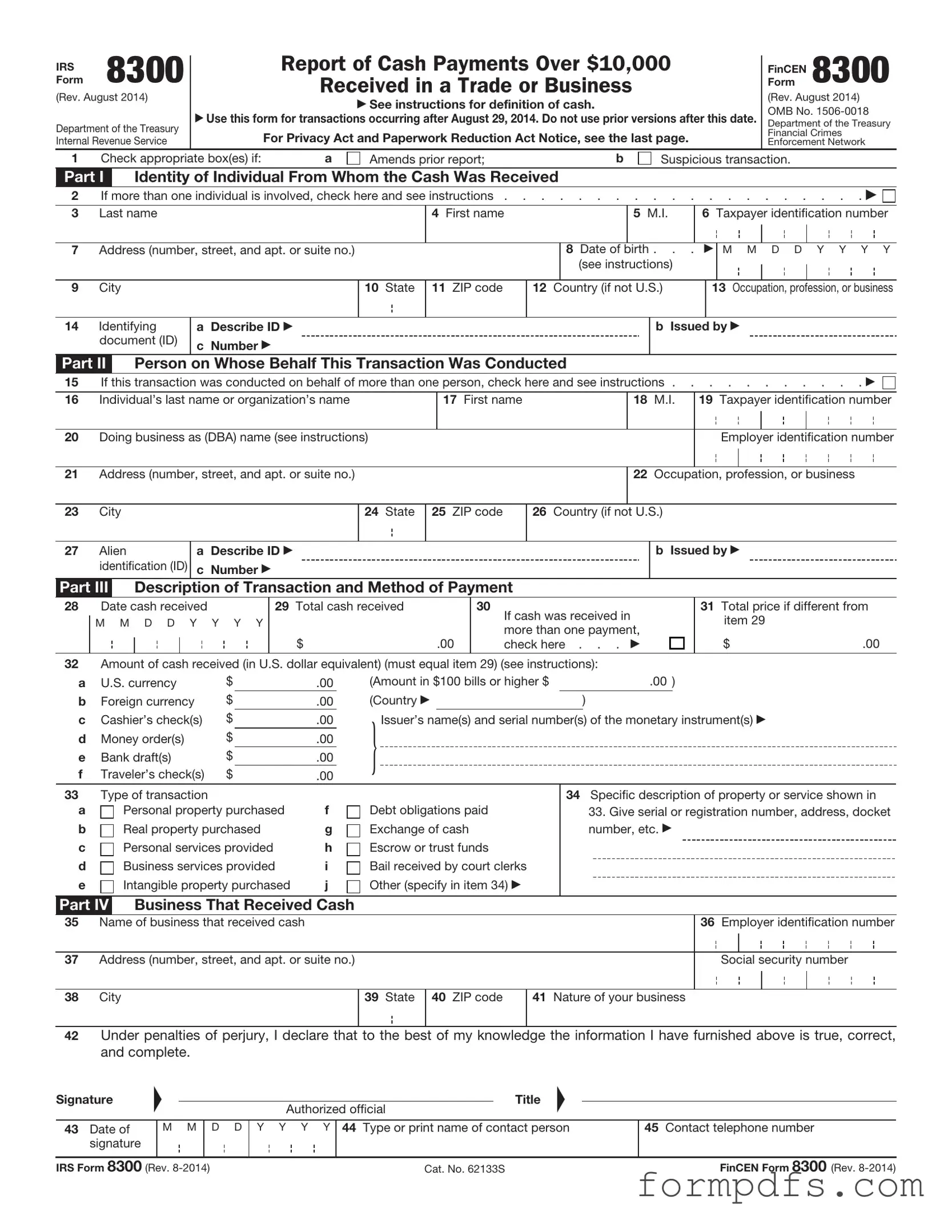

Blank IRS 8300 PDF Form

The IRS 8300 form plays a crucial role in the landscape of financial reporting and compliance, particularly for businesses and individuals who engage in cash transactions exceeding $10,000. This form is designed to help the Internal Revenue Service track large cash payments and prevent money laundering and other illicit activities. When a business receives such a payment, it is required to report the transaction within 15 days, ensuring transparency in financial dealings. The information collected through the form includes details about the payer, such as their name, address, and taxpayer identification number, along with specifics about the transaction itself. Furthermore, it is essential to understand the penalties associated with failing to file the form or providing inaccurate information, as these can lead to significant financial repercussions. By adhering to the requirements of the IRS 8300 form, businesses not only comply with federal regulations but also contribute to the integrity of the financial system.

More PDF Templates

How to Transfer a Car Title to a Family Member in Louisiana - Proper completion of this form can help prevent misunderstandings between donors and recipients.

This essential guide to the Motor Vehicle Bill of Sale provides prospective buyers and sellers with vital insights into completing the necessary documentation. Ensuring a smooth transaction is crucial, so we recommend reviewing our information about the necessary Motor Vehicle Bill of Sale requirements to facilitate a legally binding agreement.

Purpose of Nda - This contract emphasizes the significance of structured business relationships.

Documents used along the form

The IRS Form 8300 is used to report cash payments over $10,000 received in a trade or business. When dealing with significant cash transactions, several other forms and documents may be necessary to ensure compliance with tax laws and regulations. Below is a list of related forms that may be used alongside the IRS 8300 form.

- Form 1099-MISC: This form reports miscellaneous income, including payments made to independent contractors and other non-employee compensation. It is often used to document payments that may also appear on the IRS 8300.

- Form W-9: This form is used to request a taxpayer identification number (TIN) from individuals or businesses. It is essential for ensuring that the information reported on Form 1099-MISC is accurate.

- California Vehicle Purchase Agreement: This crucial document outlines the terms and conditions of a vehicle sale in California, ensuring protection for both buyer and seller. For more details, visit https://onlinelawdocs.com.

- Form 1040: This is the individual income tax return form. If cash transactions reported on Form 8300 affect an individual’s income, they must be reported on this form during tax filing.

- Form 1065: Used by partnerships to report income, deductions, and other important financial information. Partnerships receiving cash payments must consider how these transactions impact their tax obligations.

- Form 941: This form is used to report payroll taxes. If cash payments are made to employees, employers must ensure proper reporting of those payments, especially if they exceed the reporting threshold.

- Form 990: This is the return for tax-exempt organizations. Nonprofits that receive large cash donations may need to report these on Form 990, especially if they exceed the reporting limits.

Understanding these related forms can help ensure that all cash transactions are reported accurately and in compliance with IRS regulations. Proper documentation is crucial for avoiding potential penalties and maintaining transparent financial records.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 8300 is used to report cash payments exceeding $10,000 received in a trade or business. |

| Filing Deadline | Form 8300 must be filed within 15 days of receiving the cash payment. |

| Penalties | Failure to file Form 8300 can result in significant penalties, including fines up to $25,000 for willful neglect. |

| State-Specific Laws | Some states may have additional reporting requirements. For example, California's Business and Professions Code Section 21600 mandates similar disclosures for cash transactions. |

More About IRS 8300

What is the IRS 8300 form?

The IRS 8300 form is a document that businesses must file when they receive cash payments exceeding $10,000 in a single transaction or related transactions. This form helps the IRS track large cash transactions to prevent money laundering and tax evasion.

Who needs to file the IRS 8300 form?

Any business that receives cash payments over $10,000 must file the IRS 8300 form. This requirement applies to various types of businesses, including retail establishments, service providers, and any other entity that deals in cash transactions.

What constitutes a cash payment?

Cash payments include physical currency, such as coins and paper money, as well as certain negotiable instruments like cashier's checks, money orders, and traveler's checks. Payments made by credit card or debit card do not qualify as cash payments for this purpose.

When is the IRS 8300 form due?

The IRS 8300 form must be filed within 15 days of the transaction that triggers the reporting requirement. If the transaction occurs over multiple days and totals more than $10,000, the form should be filed within 15 days of the last cash payment.

How can the IRS 8300 form be submitted?

Businesses can submit the IRS 8300 form electronically through the IRS website or by mailing a paper form to the appropriate address provided by the IRS. Electronic filing is generally faster and can help reduce errors.

What are the penalties for not filing the IRS 8300 form?

Failure to file the IRS 8300 form can result in significant penalties. The IRS may impose fines for late filings, and the penalties can increase based on the duration of the delay. Additionally, failure to report could lead to further scrutiny or audits by the IRS.

Are there any exceptions to filing the IRS 8300 form?

Certain exceptions apply, such as transactions conducted by financial institutions or transactions involving foreign governments. However, most businesses that receive cash payments exceeding the threshold must file the form without exception.

What information is required on the IRS 8300 form?

The IRS 8300 form requires detailed information, including the name, address, and taxpayer identification number of the person making the cash payment. Additionally, businesses must provide their own information and details about the transaction, including the amount and date of the payment.

IRS 8300: Usage Steps

Once you have gathered the necessary information, you can begin filling out the IRS Form 8300. This form must be submitted to report cash transactions over $10,000. Completing it accurately is crucial for compliance with federal regulations.

- Obtain a copy of IRS Form 8300. You can download it from the IRS website or request a paper form.

- Provide your business name, address, and Employer Identification Number (EIN) in the designated fields at the top of the form.

- Enter the date of the transaction in the appropriate section.

- Fill in the amount of cash received, making sure it exceeds $10,000.

- Include the name, address, and Taxpayer Identification Number (TIN) of the individual or entity from whom you received the cash.

- Indicate the method of payment, whether it was cash, check, or money order.

- List any additional information required, such as the nature of the transaction or any related parties.

- Review the completed form for accuracy. Make sure all fields are filled out correctly.

- Sign and date the form. This certifies that the information provided is true and complete.

- Submit the form to the IRS. You can file it electronically or send a paper copy to the designated address.