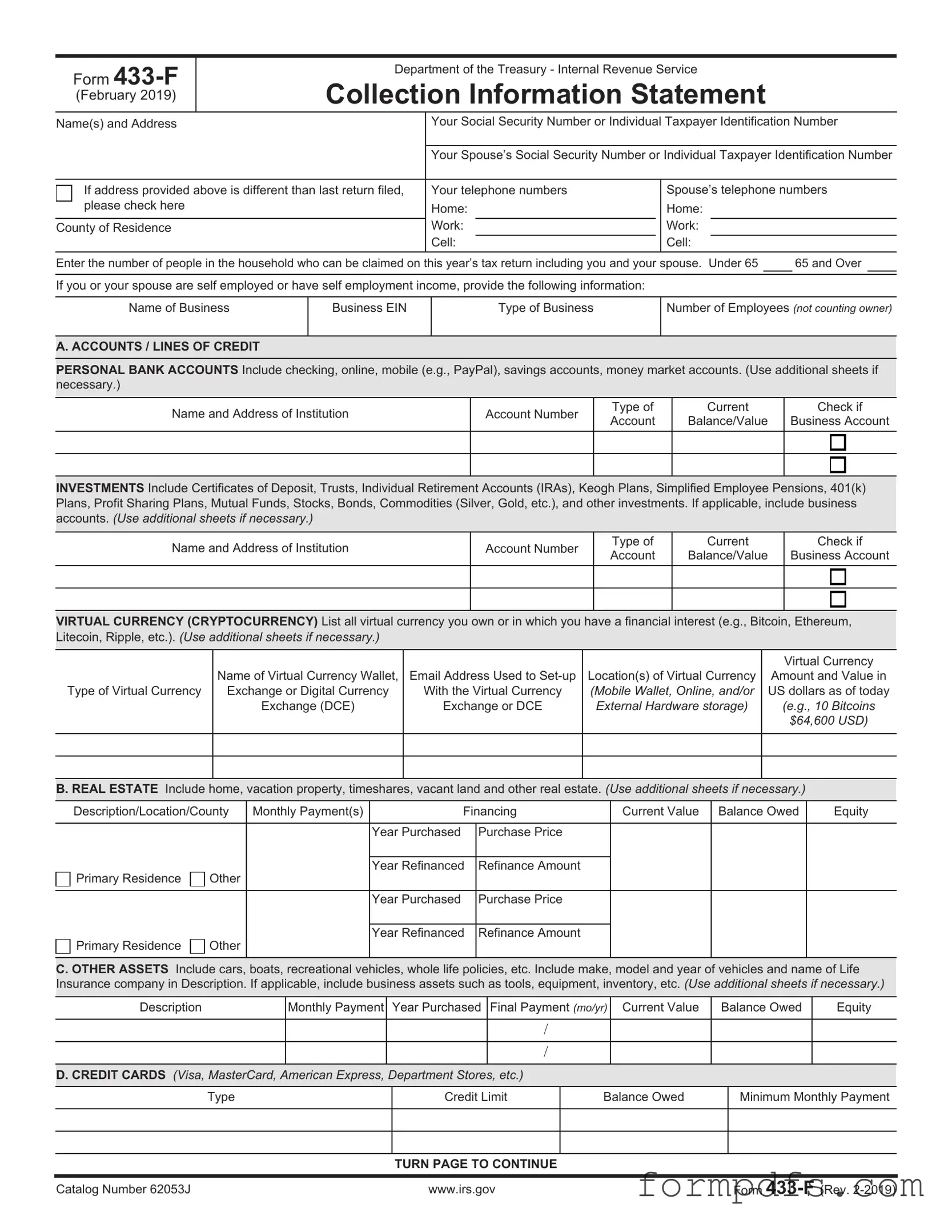

Blank IRS 433-F PDF Form

The IRS 433-F form plays a crucial role in the tax collection process, serving as a financial statement that provides the Internal Revenue Service with a comprehensive overview of an individual’s or business’s financial situation. This form is particularly significant for taxpayers who find themselves unable to pay their tax liabilities in full. By detailing income, expenses, assets, and liabilities, the 433-F enables the IRS to assess a taxpayer's ability to pay and to explore potential alternatives for settling tax debts. It is often utilized in various contexts, such as when individuals seek to establish an installment agreement or request an offer in compromise. Completing the form accurately is essential, as it not only informs the IRS of a taxpayer’s current financial status but also affects the negotiation process for resolving outstanding tax obligations. Furthermore, the 433-F form requires careful consideration of both current and past financial circumstances, making it a vital document for those navigating the complexities of tax compliance and resolution. Understanding its intricacies can empower taxpayers to make informed decisions regarding their financial responsibilities and potential repayment options.

More PDF Templates

Work Incident Report - Describe the employee’s role and responsibilities at the time of the accident.

Horse Training Contract Template - The Owner can store certain equipment at the Trainer's facility at their own risk.

Ensuring clarity in the rental process is critical, and utilizing a resource such as onlinelawdocs.com/ can help both landlords and tenants understand the intricacies of the California Residential Lease Agreement. This agreement not only outlines the essential terms but also serves to protect the rights of both parties throughout the lease term.

Affidavit of Support - Consideration of all debts and expenses is necessary for the I-864.

Documents used along the form

The IRS 433-F form is a crucial document used by taxpayers to provide the IRS with a detailed financial statement. When dealing with tax matters, especially those involving payment plans or offers in compromise, several other forms and documents may be required to support your case. Here are six commonly used forms and documents that often accompany the IRS 433-F form.

- Form 656: This is the Offer in Compromise form. It allows taxpayers to propose a settlement for less than the full amount owed to the IRS. Submitting this form alongside the IRS 433-F can help the IRS evaluate your financial situation in the context of your offer.

- Form 9465: This form is used to request a monthly installment agreement. If you owe taxes and cannot pay in full, this form allows you to propose a payment plan, making it easier to manage your tax debt.

- Form 1040: This is the standard individual income tax return form. It provides a comprehensive overview of your income, deductions, and tax liability. Including your most recent Form 1040 can give the IRS a clearer picture of your financial situation.

- California Motorcycle Bill of Sale: This form is vital for recording the sale and transfer of motorcycle ownership in California. For those looking to complete this transaction, a blank form is here.

- Form 433-A: This is a detailed financial statement for individuals. It requires more information than the 433-F and is often used for more complex financial situations. It can help the IRS assess your ability to pay.

- Form 433-B: Similar to Form 433-A, this form is designed for businesses. It collects financial information from businesses to help the IRS evaluate their ability to pay tax debts.

- Tax Returns for Previous Years: Providing copies of your tax returns from previous years can support your financial claims. These documents help illustrate your income trends and financial stability over time.

Understanding these forms and documents can streamline the process of working with the IRS. Each one plays a role in presenting your financial situation accurately and effectively, aiding in negotiations regarding your tax obligations.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS 433-F form is used to collect financial information from individuals or businesses to evaluate their ability to pay tax debts. |

| Filing Requirement | This form is typically required when taxpayers are applying for an installment agreement or an offer in compromise with the IRS. |

| Information Required | The form requires detailed information about income, expenses, assets, and liabilities to assess financial status. |

| Submission Method | Taxpayers can submit the IRS 433-F form electronically or by mailing a paper copy to the appropriate IRS office. |

| State-Specific Forms | Some states may have their own forms for financial disclosure; these forms are governed by state tax laws. |

| Confidentiality | Information provided on the IRS 433-F form is confidential and protected under federal privacy laws. |

More About IRS 433-F

What is the IRS 433-F form?

The IRS 433-F form, also known as the Collection Information Statement, is a document used by the Internal Revenue Service to collect financial information from individuals and businesses. This form helps the IRS assess a taxpayer’s ability to pay their tax liabilities. It requires detailed information about income, expenses, assets, and liabilities. Completing this form accurately is crucial, as it can influence the IRS’s decision regarding payment plans or offers in compromise.

Who needs to fill out the IRS 433-F form?

Typically, individuals or businesses that owe taxes and are seeking to establish a payment plan or negotiate a settlement with the IRS need to complete the IRS 433-F form. This includes those who have received a notice from the IRS regarding their tax debt or are unable to pay their taxes in full. It is essential for anyone in this situation to provide a truthful and comprehensive account of their financial situation to facilitate a fair assessment by the IRS.

How do I complete the IRS 433-F form?

To complete the IRS 433-F form, you will need to gather various financial documents. Start by listing your income sources, including wages, self-employment income, and any other earnings. Next, detail your monthly expenses, such as housing, utilities, and transportation costs. You will also need to provide information about your assets, like bank accounts, real estate, and vehicles, as well as any outstanding debts. It is advisable to review the form thoroughly to ensure all information is accurate and complete before submission.

What happens after I submit the IRS 433-F form?

Once you submit the IRS 433-F form, the IRS will review the information provided to determine your financial situation. This review process may take some time, during which the IRS might contact you for additional information or clarification. Depending on the assessment, the IRS may propose a payment plan, accept an offer in compromise, or suggest other options for resolving your tax debt. It is important to respond promptly to any communications from the IRS during this time to ensure a smooth resolution of your case.

IRS 433-F: Usage Steps

Filling out the IRS 433-F form requires careful attention to detail. This form is used to provide the IRS with information about your financial situation. Completing it accurately will help facilitate communication with the IRS regarding your tax obligations.

- Start by downloading the IRS 433-F form from the IRS website or obtaining a physical copy.

- Enter your personal information at the top of the form, including your name, address, and Social Security number.

- Provide details about your employment status, including your employer's name and address.

- List all sources of income, including wages, self-employment income, and any other revenue streams.

- Detail your monthly expenses. This includes housing costs, utilities, food, transportation, and other necessary expenses.

- Document your assets, such as bank accounts, real estate, vehicles, and any other valuable items.

- Review the form for accuracy. Ensure that all information is complete and correct.

- Sign and date the form at the designated area.

- Submit the form to the appropriate IRS address, either by mail or electronically, if applicable.