Blank IRS 2553 PDF Form

The IRS Form 2553 is a crucial document for small business owners looking to elect S Corporation status for their entities. This form allows corporations and certain limited liability companies (LLCs) to be taxed as an S Corporation, which can lead to significant tax benefits, including the avoidance of double taxation on corporate income. To successfully file Form 2553, businesses must meet specific eligibility requirements, such as having no more than 100 shareholders and ensuring that all shareholders are U.S. citizens or residents. Timing is also essential; the form must be submitted within a designated period, typically within two months and 15 days of the beginning of the tax year. Additionally, the form requires detailed information about the corporation, including its name, address, and the tax year it wishes to adopt. Filing Form 2553 can streamline the tax process and enhance the financial health of a business, making it a vital step for those eligible to take advantage of the S Corporation structure.

More PDF Templates

Copy of Birth Certificate - In families where parents are not married, additional information may be required on the certificate.

For those looking to buy or sell an all-terrain vehicle in California, an important step is understanding the implications of the detailed ATV Bill of Sale documentation. This form not only protects both parties involved in the transaction but also ensures that all relevant details of the sale are properly recorded.

Availability Form Template - Clearly outlining your availability helps in developing efficient workforce strategies.

Stock Certificate Ledger - Keep this form secure to protect sensitive stockholder information.

Documents used along the form

When a business elects to be taxed as an S corporation, it must submit the IRS Form 2553. However, this form is not used in isolation. There are several other documents that often accompany it, each serving a specific purpose in the process of establishing and maintaining S corporation status. Understanding these forms can help ensure compliance and smooth operations.

- IRS Form 1120S: This is the annual income tax return for S corporations. It reports the income, deductions, and credits of the corporation. After electing S corporation status with Form 2553, businesses must file Form 1120S each year to maintain their status.

- Schedule K-1 (Form 1120S): This form is used to report each shareholder's share of income, deductions, and credits from the S corporation. It is essential for shareholders to accurately report their income on their personal tax returns.

- Asurion F-017-08 MEN Form: Understanding and utilizing the Asurion F-017-08 MEN form is crucial for effective customer service management, enhancing interactions with Asurion services. For additional resources, refer to Free Business Forms.

- Form SS-4: This form is the application for an Employer Identification Number (EIN). An EIN is necessary for S corporations to report taxes and other documents to the IRS. It is often required before submitting Form 2553.

- State S Corporation Election Form: Many states require a separate form to elect S corporation status at the state level. This form varies by state and is crucial for ensuring that the corporation is recognized as an S corporation for state tax purposes.

- Form 941: This form is the Employer's Quarterly Federal Tax Return. S corporations that have employees must file Form 941 to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It is necessary for S corporations that have employees to report and pay unemployment taxes at the federal level.

In summary, while the IRS Form 2553 is a critical component in electing S corporation status, it is just one piece of a larger puzzle. Familiarity with these accompanying forms and documents can help ensure that businesses comply with tax regulations and maintain their S corporation status effectively.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Form | The IRS Form 2553 is used by eligible small businesses to elect to be taxed as an S corporation, allowing for pass-through taxation. |

| Eligibility Requirements | To qualify, a corporation must meet specific criteria, including having no more than 100 shareholders and only one class of stock. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year in which the election is to take effect. |

| State-Specific Forms | Some states require additional forms for S corporation status. For example, California requires Form 100S, governed by California Revenue and Taxation Code Section 23802. |

| Impact on Taxes | By electing S corporation status, businesses can avoid double taxation on corporate income, as profits and losses are reported on shareholders' personal tax returns. |

More About IRS 2553

What is the IRS Form 2553?

The IRS Form 2553 is used by small businesses to elect to be treated as an S Corporation for tax purposes. This election allows the business to avoid double taxation on corporate income. Instead of the corporation paying taxes on its income, the income is passed through to the shareholders, who report it on their individual tax returns. This can lead to tax savings for the business owners.

Who is eligible to file Form 2553?

To file Form 2553, a business must meet certain criteria. It must be a domestic corporation with no more than 100 shareholders. All shareholders must be individuals, certain trusts, or estates. Additionally, the corporation can only have one class of stock. If these requirements are met, the business can elect S Corporation status by submitting Form 2553 to the IRS.

When should Form 2553 be filed?

Form 2553 should be filed within 75 days of the beginning of the tax year in which the S Corporation election is desired. If a business wants to be treated as an S Corporation for the current tax year, it must submit the form on time. However, if you miss the deadline, there may be options to request late election relief, depending on the circumstances.

What happens after filing Form 2553?

After filing Form 2553, the IRS will review the application. If approved, the corporation will be classified as an S Corporation for tax purposes. The IRS will send a confirmation notice. It is essential to keep this notice with your business records. If the election is denied, the business will continue to be taxed as a C Corporation. In that case, it is advisable to consult a tax professional for guidance on next steps.

IRS 2553: Usage Steps

Filling out the IRS Form 2553 is an important step for businesses that want to elect S corporation status. After completing this form, the next steps involve submitting it to the IRS and ensuring compliance with all requirements for maintaining S corporation status. Follow these steps carefully to complete the form accurately.

- Obtain a copy of IRS Form 2553 from the IRS website or your tax professional.

- Enter the name of your corporation as it appears on your Articles of Incorporation.

- Provide the corporation's address, including city, state, and ZIP code.

- Fill in the Employer Identification Number (EIN) assigned to your corporation.

- Indicate the date of incorporation and the state where the corporation was formed.

- Choose the tax year for your corporation and specify whether it is a calendar year or a fiscal year.

- List the names and addresses of all shareholders, along with their percentage of ownership.

- Sign and date the form. Ensure that an authorized officer of the corporation signs it.

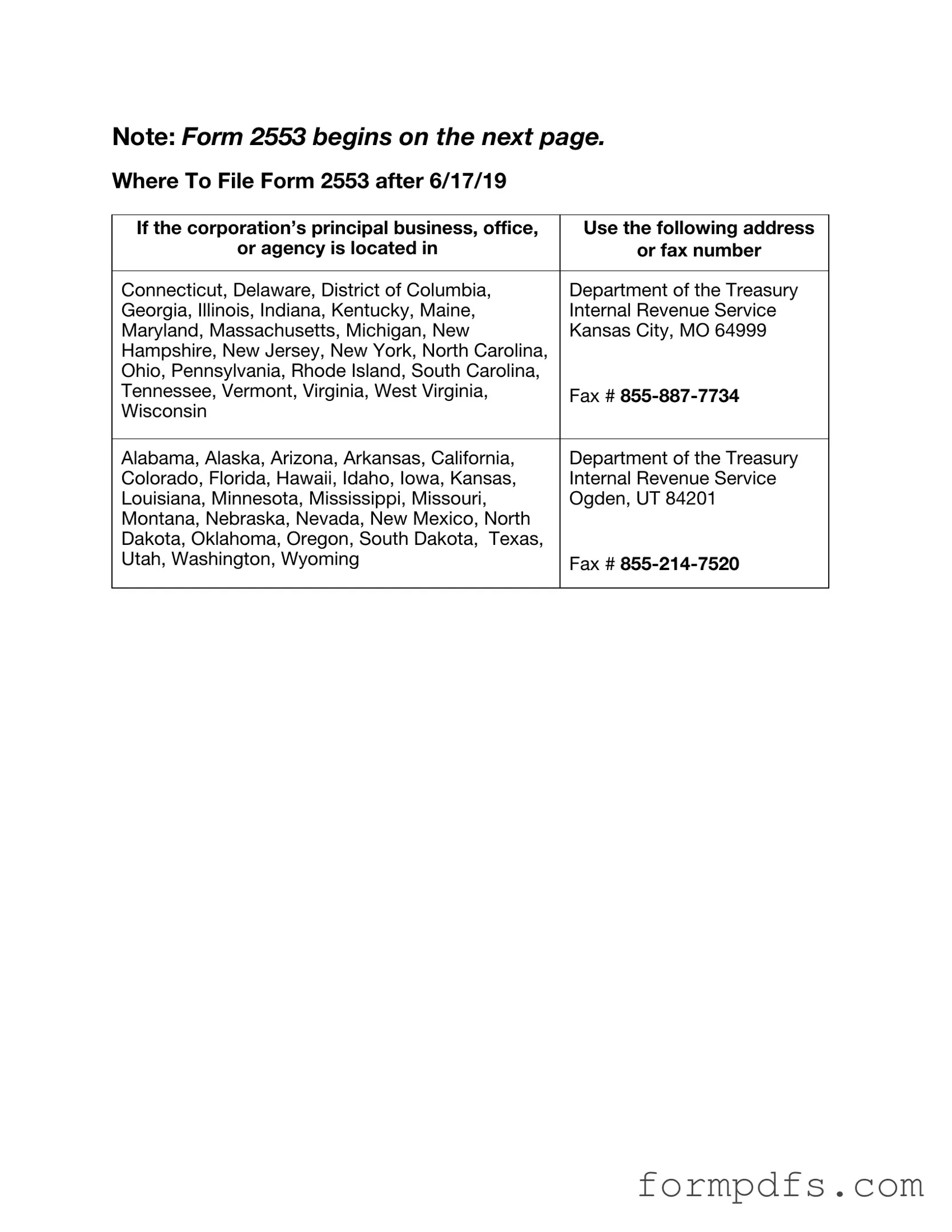

- Submit the completed form to the IRS. Make sure to do this within the required timeframe for your election to be valid.