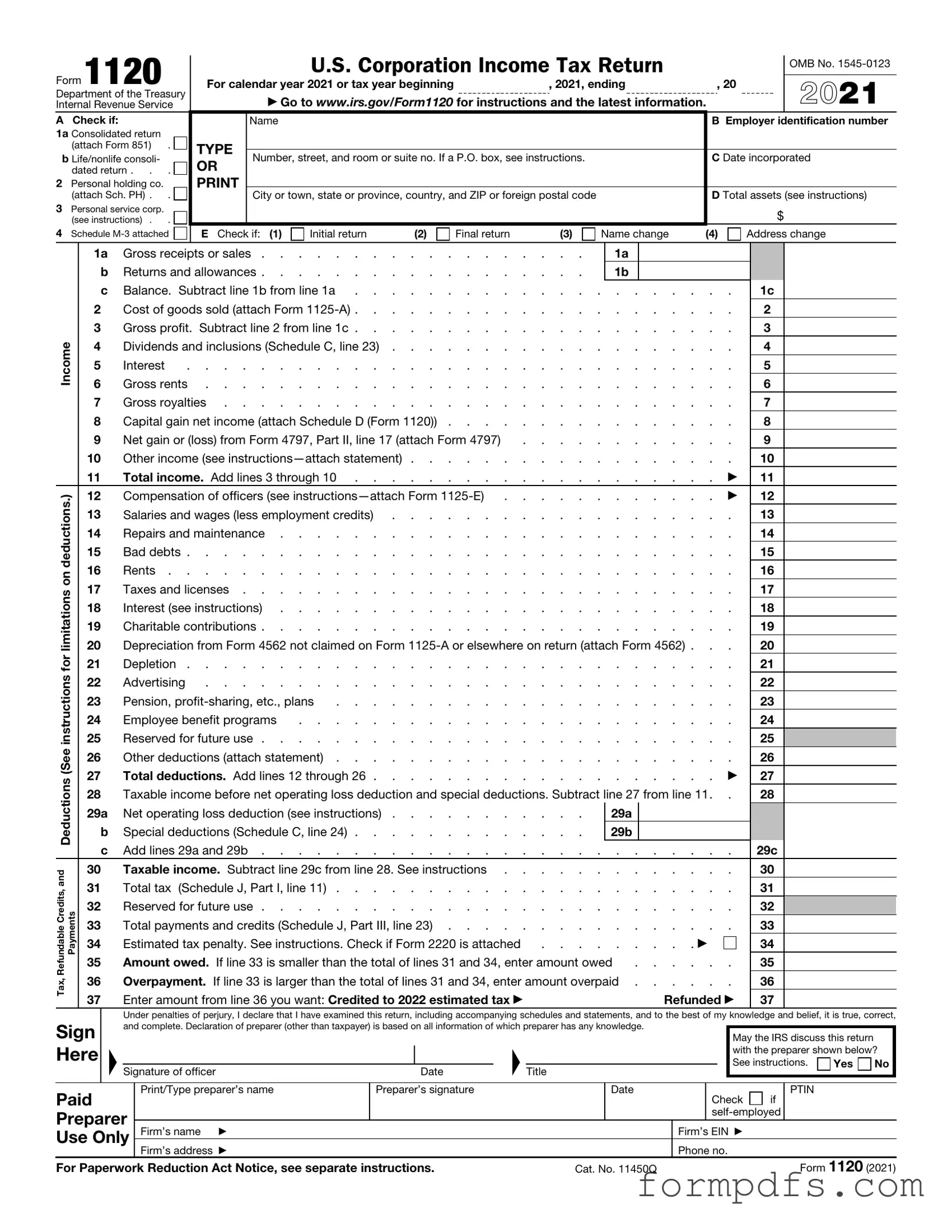

Blank IRS 1120 PDF Form

The IRS 1120 form plays a crucial role in the tax landscape for corporations operating in the United States. This form is primarily used by C corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. Filing the 1120 is not just a requirement; it also provides a comprehensive snapshot of a corporation's financial activities over the tax year. Corporations must detail their revenue streams, expenses, and any applicable tax credits, which can significantly affect their overall tax liability. The form also includes sections for calculating the corporation's taxable income, as well as specific adjustments that may apply. Understanding the intricacies of the 1120 is essential for ensuring compliance and optimizing tax outcomes. Timely and accurate filing can help corporations avoid penalties and take advantage of potential deductions that may reduce their tax burden. For many businesses, mastering the 1120 form is a vital step in maintaining financial health and meeting federal obligations.

More PDF Templates

Sports Physical Form Printable - Parents or guardians must also sign the form, confirming the accuracy of the information.

The Trailer Bill of Sale is a significant document that facilitates the official transfer of ownership between buyers and sellers of trailers. For those looking to learn more about the process, a reliable source is the comprehensive guide on Trailer Bill of Sale requirements found here. This guide outlines the necessary steps and provides valuable insights to ensure the transaction is conducted smoothly.

Report Writing Security Guard Daily Report Sample - Any incidents of fire must be reported promptly on this form.

Documents used along the form

The IRS Form 1120 is the U.S. Corporation Income Tax Return, which corporations must file annually to report their income, gains, losses, deductions, and credits. Several other forms and documents often accompany this form to provide additional information or fulfill specific requirements. Below is a list of these documents, each briefly described for clarity.

- Schedule C: This schedule is used to report the corporation's income, deductions, and expenses related to its business activities. It provides a detailed breakdown of the financial performance of the corporation.

- Schedule J: This schedule outlines the corporation's tax computation. It includes information on the tax rates applied and any credits claimed, helping to determine the total tax liability.

- Schedule K: This schedule provides information about the corporation's shareholders, including their ownership percentages and any distributions made during the tax year.

- Trader Joe's Application Form: For those interested in employment opportunities, completing the OnlineLawDocs.com provides crucial insights into the application process and required details.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is filed quarterly and is essential for payroll tax compliance.

- Form 1125-A: This form is used to report the cost of goods sold. It helps to calculate gross profit by detailing inventory and direct costs associated with producing goods sold by the corporation.

- Form 1125-E: This form is necessary for reporting compensation of officers. It ensures transparency regarding the salaries and benefits provided to corporate officers, which can impact tax calculations.

- Form 4562: This form is used to claim depreciation and amortization deductions. It provides details on the corporation’s assets and the methods used to calculate their depreciation over time.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Corporations must issue this form to independent contractors and other payees for services rendered, ensuring proper reporting of income to the IRS.

Understanding these additional forms and documents is crucial for corporations to ensure compliance with tax regulations. Properly completing and submitting these forms can help avoid penalties and facilitate a smoother tax filing process.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Requirement | Corporations must file Form 1120 annually, regardless of whether they owe any taxes. This ensures compliance with federal tax laws. |

| Due Date | The form is generally due on the 15th day of the fourth month after the end of the corporation's tax year. For calendar year corporations, this means April 15. |

| State-Specific Forms | Many states require their own corporate income tax forms. For example, California uses Form 100, governed by the California Revenue and Taxation Code. |

| Estimated Tax Payments | Corporations may need to make estimated tax payments throughout the year. These payments help to avoid penalties for underpayment when filing Form 1120. |

| Amendments | If a corporation discovers an error after filing, it can amend its return using Form 1120-X. This allows for corrections to be made to previously reported information. |

More About IRS 1120

What is the IRS 1120 form?

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits. It is essential for C corporations, which are separate legal entities from their owners, to file this form annually. By doing so, they ensure compliance with federal tax regulations.

Who needs to file Form 1120?

Any corporation classified as a C corporation must file Form 1120. This includes domestic corporations and certain foreign corporations engaged in business in the United States. If your business is structured as an S corporation, you would use Form 1120S instead.

When is Form 1120 due?

Form 1120 is typically due on the 15th day of the fourth month after the end of the corporation’s tax year. For most corporations operating on a calendar year, this means the form is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

What information is required on Form 1120?

The form requires detailed information about the corporation's income, including gross receipts, dividends, interest, and capital gains. Additionally, it asks for expenses, deductions, and any applicable tax credits. Corporate officers must also provide information about the corporation's assets and liabilities.

Can Form 1120 be filed electronically?

Yes, Form 1120 can be filed electronically. The IRS encourages electronic filing as it is faster and more efficient. Corporations can use tax software or work with a tax professional to submit the form electronically. Paper filing is still an option but may take longer to process.

What happens if a corporation fails to file Form 1120?

Failing to file Form 1120 can lead to penalties and interest on unpaid taxes. The IRS may impose a failure-to-file penalty, which can be significant depending on how late the return is. It is crucial to file on time to avoid these consequences.

Can a corporation request an extension for filing Form 1120?

Yes, a corporation can request an automatic six-month extension to file Form 1120 by submitting Form 7004. However, this extension only applies to the filing deadline, not the payment of any taxes owed. Corporations must estimate and pay any taxes due by the original due date to avoid penalties.

Is there a specific way to report losses on Form 1120?

Yes, corporations can report losses on Form 1120. If a corporation incurs a net operating loss (NOL), it can carry that loss back to offset income from previous years or carry it forward to future tax years. Proper documentation and calculations are necessary to take advantage of these provisions.

Where can I find more information about Form 1120?

For more information about Form 1120, including instructions and resources, visit the IRS website. The site provides comprehensive guidance, including updates and changes to tax laws that may affect filing. Consulting a tax professional can also be beneficial for specific questions related to your corporation.

IRS 1120: Usage Steps

Completing the IRS 1120 form is essential for corporations to report their income, gains, losses, deductions, and credits. After filling out the form, ensure all information is accurate before submitting it to the IRS. This process requires careful attention to detail.

- Gather necessary documents, including financial statements, income records, and expense receipts.

- Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Fill in the date of incorporation and the total assets at the end of the tax year.

- Report income on Line 1 by entering the total gross receipts or sales.

- Deduct returns and allowances on Line 2, if applicable.

- Calculate and enter the total income on Line 3 by subtracting Line 2 from Line 1.

- List all deductions in the appropriate sections, including salaries, wages, and other business expenses.

- Calculate taxable income by subtracting total deductions from total income.

- Complete the tax computation section to determine the tax owed.

- Sign and date the form, ensuring the signature is from an authorized officer of the corporation.

- Submit the completed form to the IRS by the deadline, along with any required payment.