Valid Investment Letter of Intent Template

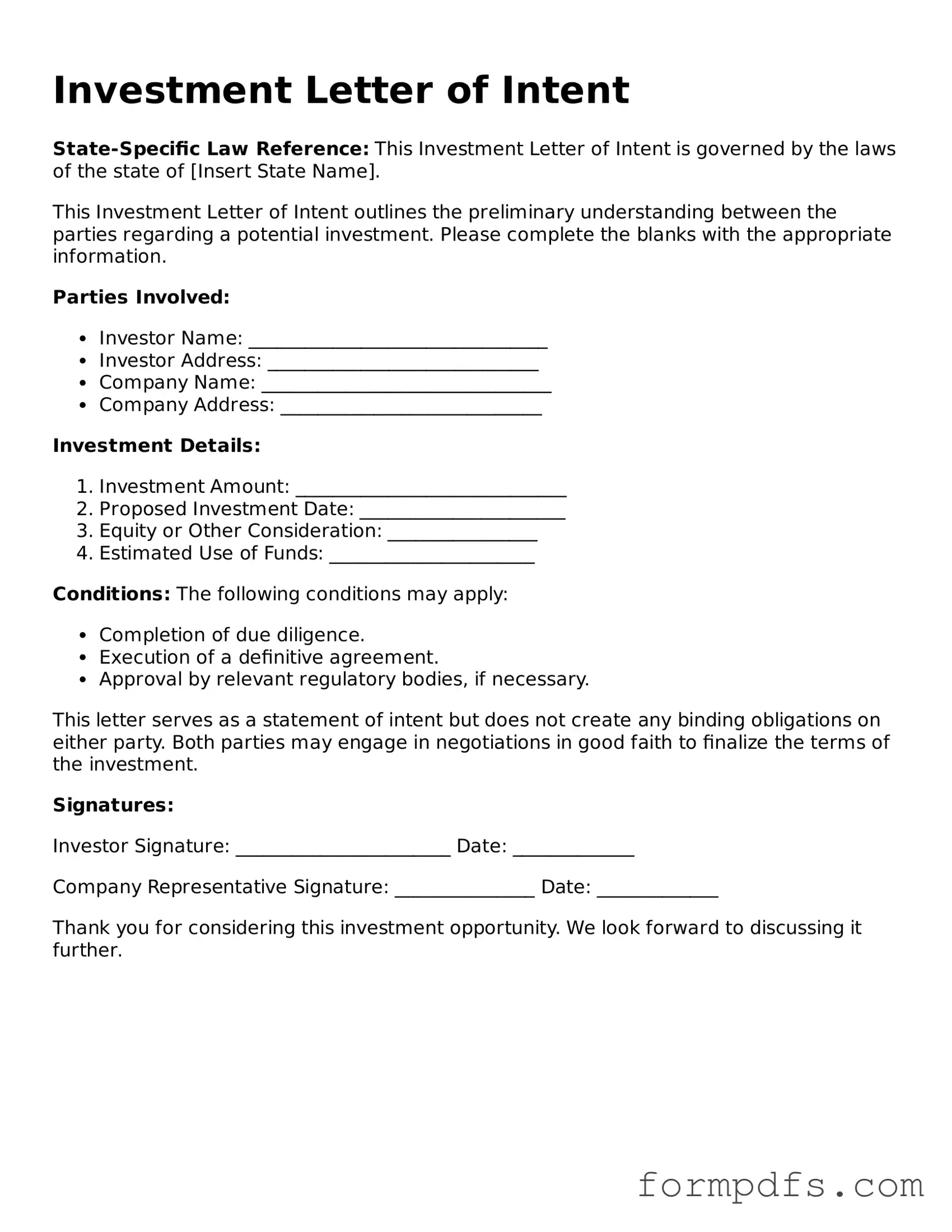

The Investment Letter of Intent (LOI) serves as a crucial document in the early stages of investment negotiations, acting as a preliminary agreement between parties interested in pursuing a potential investment opportunity. This form outlines the key terms and conditions that both the investor and the recipient agree to consider as they move forward in their discussions. Typically, the LOI includes essential elements such as the proposed investment amount, the intended use of funds, and any specific conditions or contingencies that must be met before finalizing the deal. Furthermore, it often addresses confidentiality concerns, ensuring that sensitive information shared during negotiations remains protected. By providing a framework for the investment process, the LOI not only clarifies expectations but also demonstrates the commitment of the parties involved. As negotiations progress, this document can evolve into a more detailed agreement, paving the way for a successful partnership. Understanding the nuances of the Investment Letter of Intent can significantly impact the outcome of investment discussions, making it an important tool for both investors and businesses alike.

Other Investment Letter of Intent Templates:

Intent to Buy Letter - A Letter of Intent outlines the buyer's intention to purchase a business.

Letter of Intent to Purchase Real Estate - This letter aids in keeping all parties informed during negotiation phases.

Documents used along the form

When considering an investment, various forms and documents play a crucial role in outlining the terms and intentions of the parties involved. The Investment Letter of Intent serves as a preliminary agreement, but it is often accompanied by other important documents that help clarify the investment process. Below are four commonly used forms and documents that work in conjunction with the Investment Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains protected. It establishes the boundaries of what can be disclosed and helps build trust during negotiations.

- Term Sheet: A term sheet outlines the basic terms and conditions of the investment. It serves as a summary of key points such as valuation, investment amount, and ownership structure, providing a clear framework for further discussions.

- Due Diligence Checklist: This checklist helps investors gather necessary information about the company or project. It often includes financial statements, legal documents, and operational details, ensuring that all relevant aspects are reviewed before finalizing the investment.

- Subscription Agreement: This agreement is a formal contract between the investor and the company, detailing the terms of the investment. It typically includes the amount being invested, the type of securities being purchased, and the rights and obligations of both parties.

These documents collectively enhance the investment process, providing clarity and legal protection for all parties involved. By understanding each component, investors can navigate the complexities of investment agreements more effectively.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | An Investment Letter of Intent outlines the preliminary agreement between parties interested in a potential investment opportunity. |

| Non-Binding Nature | Typically, the letter serves as a non-binding document, indicating the intent to negotiate terms without creating a legal obligation. |

| Key Components | Common elements include the investment amount, proposed terms, and timelines for due diligence. |

| Confidentiality | It often includes clauses to protect sensitive information shared during negotiations. |

| Governing Law | The governing law can vary by state; for example, in California, the laws of California would apply. |

| Parties Involved | The letter typically involves at least two parties: the investor and the recipient of the investment. |

| Due Diligence | Investors often use the letter to outline the due diligence process, which is critical before finalizing any investment. |

| Expiration Date | Many letters specify an expiration date, indicating how long the terms remain valid for consideration. |

| Negotiation Framework | The document provides a framework for further negotiations, helping to clarify expectations between parties. |

| Legal Review | It is advisable for parties to have the letter reviewed by legal counsel to ensure clarity and compliance with applicable laws. |

More About Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties regarding a potential investment. It serves as a starting point for negotiations and indicates the intent to move forward with a deal, although it is not legally binding. The LOI typically includes key terms such as the amount of investment, the structure of the deal, and timelines for due diligence and closing.

Who typically uses an Investment Letter of Intent?

Investment Letters of Intent are commonly used by investors, including individuals, venture capitalists, and private equity firms. Startups and companies seeking funding also utilize LOIs to formalize discussions with potential investors. The document helps both parties clarify their intentions before entering into more detailed agreements.

Is an Investment Letter of Intent legally binding?

Generally, an Investment Letter of Intent is not legally binding, although certain provisions within it can be enforceable. For instance, confidentiality clauses or exclusivity agreements may carry legal weight. However, the primary purpose of an LOI is to express intent and facilitate negotiations, not to create a legally enforceable contract.

What should be included in an Investment Letter of Intent?

An effective Investment Letter of Intent should include essential details such as the names of the parties involved, the amount of investment, the proposed structure of the deal, timelines for due diligence, and any conditions that must be met before finalizing the investment. Including a clear outline of expectations can help prevent misunderstandings later on.

How does an Investment Letter of Intent differ from a term sheet?

While both an Investment Letter of Intent and a term sheet outline the key terms of a potential investment, they serve slightly different purposes. An LOI is often broader and may focus on the intent to invest, while a term sheet is more detailed and includes specific terms and conditions of the investment. A term sheet is usually the next step after an LOI, moving closer to a binding agreement.

Can an Investment Letter of Intent be revoked?

Yes, an Investment Letter of Intent can typically be revoked by either party before a formal agreement is reached. Since an LOI is not legally binding, either party can withdraw their intent without facing legal repercussions, provided that any binding provisions, such as confidentiality, are respected.

What are the benefits of using an Investment Letter of Intent?

Using an Investment Letter of Intent offers several benefits. It helps clarify the intentions of both parties, sets the stage for further negotiations, and can expedite the process of reaching a formal agreement. Additionally, an LOI can help establish a framework for due diligence and provide a sense of security for both investors and companies seeking funding.

How long does it take to negotiate an Investment Letter of Intent?

The time it takes to negotiate an Investment Letter of Intent can vary widely based on the complexity of the investment and the parties involved. Some LOIs can be drafted and agreed upon in a matter of days, while others may take weeks or longer, especially if there are significant terms to negotiate or if multiple parties are involved.

What happens after an Investment Letter of Intent is signed?

After an Investment Letter of Intent is signed, the parties typically move forward with due diligence. This process involves a thorough examination of the company’s financials, operations, and legal standing. Following due diligence, the parties will negotiate a more detailed agreement, such as a purchase agreement or investment agreement, to finalize the investment.

Investment Letter of Intent: Usage Steps

After gathering the necessary information and understanding the purpose of the Investment Letter of Intent form, you are ready to proceed with filling it out. This form is crucial for outlining your intentions regarding an investment opportunity. Follow these steps carefully to ensure all required details are accurately provided.

- Begin by entering your full name in the designated field. Make sure to use your legal name as it appears on official documents.

- Next, provide your contact information, including your phone number and email address. Double-check for accuracy to avoid any communication issues.

- Fill in the date on which you are completing the form. This helps establish a timeline for your intent.

- Identify the investment opportunity by clearly stating its name or title. This ensures clarity about what you are intending to invest in.

- Outline the amount you intend to invest. Be specific and use numerical figures to avoid confusion.

- In the next section, describe any conditions or terms that are important to you regarding the investment. This could include timelines, expected returns, or other relevant details.

- Sign the form to indicate your agreement with the contents and your commitment to the investment. Make sure your signature is clear.

- Finally, date your signature to confirm when you signed the document.

Once you have completed the form, review all entries for accuracy and completeness. This will help ensure that your intentions are clearly communicated and can move forward without delays.