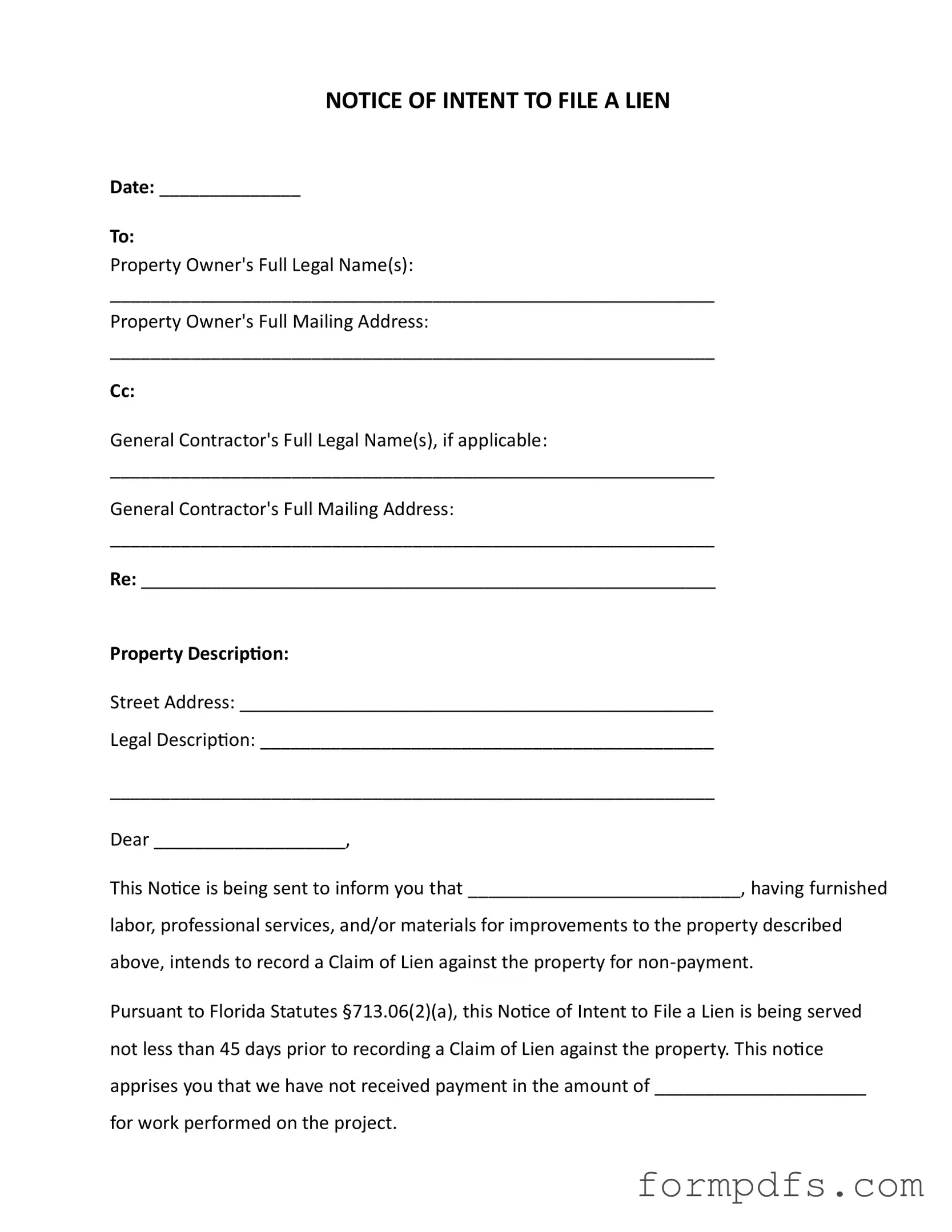

Blank Intent To Lien Florida PDF Form

The Intent To Lien Florida form serves as a crucial document for contractors and suppliers who have not received payment for their services or materials. This form is a formal notice that alerts property owners about the potential filing of a lien on their property due to non-payment. It includes essential details such as the date of the notice, the property owner's full legal name and mailing address, and the general contractor's information if applicable. The form outlines the specific amount owed for the work performed, providing transparency regarding the outstanding balance. Importantly, it complies with Florida Statutes §713.06(2)(a), mandating that the notice be sent at least 45 days before any lien is recorded. This advance notice is designed to give property owners a chance to address the payment issue before any legal action is taken. Failure to respond within 30 days can lead to significant consequences, including the possibility of foreclosure proceedings and additional financial burdens such as attorney fees and court costs. The form emphasizes the sender's desire to resolve the matter amicably, encouraging open communication to avoid further complications.

More PDF Templates

Restraining Order Template - Aims to prevent escalation of conflicts that could lead to physical harm.

Does Florida Have an Estate Tax - This affidavit mitigates the risk of financial liability for the personal representative in terms of estate taxation.

For parents considering temporary arrangements, the California Power of Attorney for a Child form serves as an essential legal instrument, allowing the temporary transfer of parental rights to another adult. This not only facilitates immediate care but also ensures that a child's needs are adequately met in the absence of their primary caregiver. For further details and to access necessary documentation, refer to All California Forms.

Pdf Puppy Health Guarantee Template - The guarantee covers severe life-altering genetic defects diagnosed by a licensed vet.

Documents used along the form

The Intent to Lien Florida form is an essential document for those seeking to secure payment for services rendered or materials supplied. However, several other forms and documents often accompany this notice to ensure compliance with legal requirements and protect your rights. Below is a list of these documents, along with a brief description of each.

- Claim of Lien: This document formally establishes a lien against the property if payment is not received. It provides details about the debt owed and is recorded in the public records, making it a legal claim against the property.

- Notice of Non-Payment: This notice serves as a reminder to the property owner about unpaid invoices. It can be sent prior to filing a lien and emphasizes the urgency of the situation, potentially prompting quicker payment.

- Waiver and Release of Lien: This document is used to waive the right to a lien once payment is received. It protects the property owner by ensuring that no further claims can be made after the payment has been completed.

- Affidavit of Service: This affidavit verifies that the Notice of Intent to File a Lien was properly served to the property owner. It includes details about how and when the notice was delivered, which is crucial for legal compliance.

- Doctor's Excuse Note: Essential for verifying health-related absences, this document confirms a medical professional's recommendation to excuse an individual from obligations. More information can be found at https://onlinelawdocs.com/.

- Contractor's Statement: This document outlines the terms of the agreement between the contractor and the property owner. It details the scope of work, payment terms, and other important information that can support a lien claim if necessary.

Utilizing these documents effectively can help ensure that your rights are protected and that you have a clear path to recovering any outstanding payments. Prompt action is essential to avoid complications down the line. Keep these documents on hand as you navigate the lien process.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The form notifies property owners of an intent to file a lien for unpaid work or materials. |

| Governing Law | It is governed by Florida Statutes §713.06. |

| Notification Period | A minimum of 45 days notice is required before filing a lien. |

| Response Time | Property owners have 30 days to respond to avoid a lien being filed. |

| Consequences of Non-Payment | Failure to pay may lead to a lien and potential foreclosure proceedings. |

| Contact Information | Contact details for the sender must be included for communication. |

| Signature Requirement | The form must be signed by the person sending the notice. |

| Certificate of Service | A certificate must confirm the notice was delivered to the property owner. |

| Delivery Methods | Delivery can be made via certified mail, registered mail, hand delivery, or other methods. |

| Importance of Timeliness | Timely submission of this notice is crucial to protect the right to file a lien. |

More About Intent To Lien Florida

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal document used to notify property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice serves as a warning, giving the property owner a chance to settle any outstanding payments before a lien is officially recorded.

Who needs to file this form?

What are the consequences of ignoring this notice?

Ignoring the Intent to Lien notice can lead to serious consequences. If the property owner fails to respond or make payment within 30 days, the contractor or supplier may proceed to file a Claim of Lien against the property. This could result in foreclosure proceedings on the property, and the owner may become responsible for additional costs, including attorney fees and court expenses. It is crucial for property owners to take this notice seriously and respond promptly.

How much time does a property owner have to respond?

Property owners have 30 days from the date of receiving the Intent to Lien notice to respond. During this time, they should either make the necessary payment or communicate with the contractor or supplier to resolve the issue. Failing to take action within this timeframe could lead to the filing of a lien, which may complicate property ownership and financial responsibilities.

Can the lien be removed once it is filed?

Yes, a lien can be removed after it is filed, but it typically requires action from the property owner. The owner may need to pay the outstanding debt or negotiate a settlement with the contractor or supplier. In some cases, a legal process may be necessary to challenge or remove the lien if there are disputes about the validity of the claim. It is advisable to address the issue as soon as possible to avoid complications.

Intent To Lien Florida: Usage Steps

After completing the Intent to Lien form, the next steps involve ensuring that it is served correctly to the property owner and any relevant parties. This is important to maintain compliance with Florida statutes and to protect your rights regarding payment for services rendered.

- Date: Write the current date at the top of the form.

- Property Owner's Information: Fill in the full legal name(s) of the property owner(s) and their full mailing address.

- General Contractor's Information: If applicable, include the full legal name(s) of the general contractor and their mailing address.

- Property Description: Provide the street address of the property and the legal description of the property.

- Notice Content: In the designated area, state the name of the party intending to file the lien and the amount owed for the work performed.

- Signature: Sign the form, including your name, title, phone number, and email address.

- Certificate of Service: Fill in the date the notice was served, the name of the person served, and their address. Indicate the method of delivery by checking the appropriate box.

- Final Signature: Sign the certificate of service, including your name and signature.