Blank Independent Contractor Pay Stub PDF Form

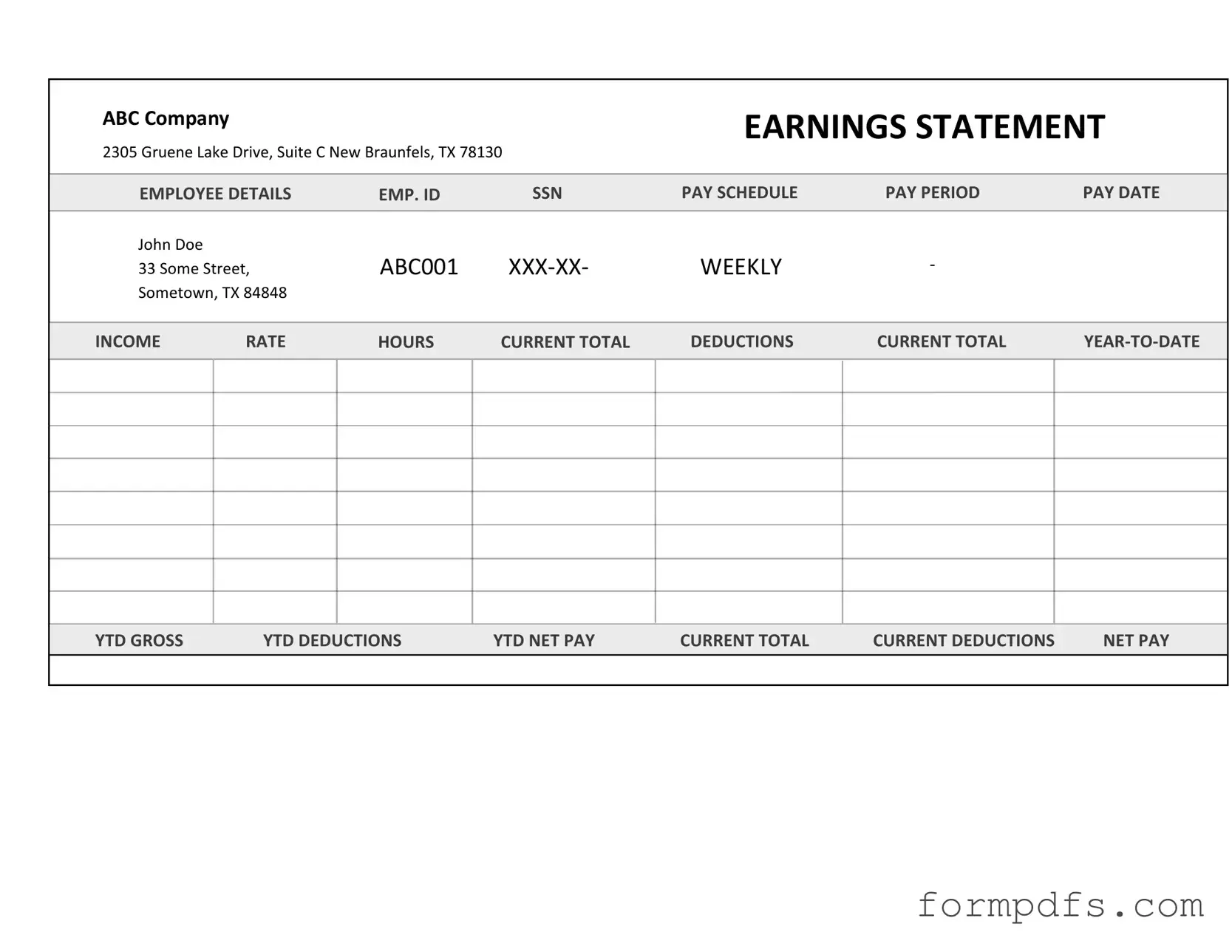

For many independent contractors, understanding the details of payment is crucial for both financial management and tax purposes. The Independent Contractor Pay Stub form serves as an essential tool in this process, providing a clear breakdown of earnings and deductions. This form typically includes vital information such as the contractor’s name, the pay period, and the total amount earned. Additionally, it may outline any deductions for taxes, benefits, or other contributions, offering transparency in the payment process. By using this form, contractors can easily track their income, ensuring they have accurate records for their financial statements and tax filings. Furthermore, it helps to establish a professional relationship between the contractor and the client, as it reflects a commitment to clear communication and proper documentation. Understanding how to read and utilize this pay stub can empower independent contractors to manage their finances more effectively.

More PDF Templates

Bpo Sample - Flood zone information is critical for assessing risk and insurance considerations.

Certifying Body for Your Health Occupation - Previous work experience in healthcare settings is also requested on the form.

An important resource for managing your licensing needs is the Address Change California form, which is crucial for individuals and firms licensed under the California Board of Accountancy. This form not only facilitates the prompt update of your address of record, which is vital for maintaining clear communication with the California Board of Accountancy (CBA), but it also includes an option to protect your personal information from being sold for mailing purposes. To find this and other necessary documents, you can refer to All California Forms, ensuring that you remain compliant and informed about your obligations.

Esa Papers - Clarify the purpose of your emotional support animal with this official letter.

Documents used along the form

The Independent Contractor Pay Stub form is a crucial document for tracking payments made to independent contractors. It provides a clear breakdown of earnings, deductions, and net pay. However, several other forms and documents are often used in conjunction with this pay stub to ensure proper record-keeping and compliance. Below is a list of related documents that may be utilized alongside the Independent Contractor Pay Stub form.

- Independent Contractor Agreement: This document outlines the terms and conditions of the working relationship between the contractor and the hiring entity, including payment terms, project scope, and duration of service.

- W-9 Form: Contractors complete this IRS form to provide their taxpayer identification number, which is necessary for tax reporting purposes.

- Invoice: An invoice is submitted by the contractor to request payment for services rendered, detailing the work completed and the amount due.

- 1099-MISC Form: At the end of the tax year, this form is issued to independent contractors to report earnings to the IRS, ensuring compliance with tax regulations.

- ATV Bill of Sale Form: For those selling or purchasing an ATV, the comprehensive ATV Bill of Sale documentation is essential to ensure a smooth and legal transaction.

- Timesheet: A timesheet records the hours worked by the contractor, which helps in calculating the total payment owed for the services provided.

- Expense Report: This document itemizes any business-related expenses incurred by the contractor during the course of their work, which may be reimbursed by the hiring entity.

- Confidentiality Agreement: Also known as a non-disclosure agreement, this document ensures that sensitive information shared during the project remains confidential.

These documents play an essential role in establishing a clear understanding between independent contractors and their clients. Properly managing these forms can help streamline the payment process and maintain compliance with tax obligations.

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors. |

| Purpose | This form helps contractors keep track of their income and provides a record for tax purposes. |

| Components | Typically includes the contractor's name, pay period, gross earnings, deductions, and net pay. |

| Tax Information | Independent contractors are responsible for paying their own taxes, unlike employees whose taxes are withheld by employers. |

| State-Specific Forms | Some states have specific requirements for pay stubs, governed by state labor laws. |

| Record Keeping | Contractors should keep copies of their pay stubs for at least three years for tax and legal purposes. |

| Client Obligations | Clients hiring independent contractors may be required to provide pay stubs under certain state laws. |

| Frequency of Issuance | Pay stubs can be issued weekly, bi-weekly, or monthly, depending on the agreement between the contractor and the client. |

| Governing Laws | In California, for example, the California Labor Code Section 226 requires employers to provide pay stubs to independent contractors. |

More About Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. It serves as a record of payment and can be used for tax purposes, providing transparency in financial transactions between the contractor and the hiring entity.

Who needs to use an Independent Contractor Pay Stub?

This form is essential for independent contractors who provide services to clients or companies. It helps ensure that both parties have a clear understanding of the payment details, which is crucial for tax reporting and financial management.

What information is typically included in the pay stub?

A standard Independent Contractor Pay Stub includes the contractor's name, address, and tax identification number. It also lists the pay period, total earnings, any deductions (if applicable), and the net amount paid. Additional details, such as the nature of the services rendered, may also be included.

How can I obtain an Independent Contractor Pay Stub?

Why is it important to keep a copy of the pay stub?

Keeping a copy of the pay stub is vital for record-keeping and tax purposes. It helps independent contractors track their income and expenses, ensuring accurate tax filings. Additionally, it can serve as proof of income when applying for loans or other financial services.

Are there any legal requirements for issuing a pay stub?

While there may not be federal laws mandating pay stubs for independent contractors, some states have specific regulations regarding payment documentation. It is advisable to check local laws to ensure compliance and avoid potential legal issues.

Can deductions be included on the pay stub?

Yes, deductions can be included on the pay stub. This may encompass taxes withheld, insurance premiums, or any other agreed-upon deductions. However, many independent contractors operate as self-employed individuals and may not have taxes withheld, which should be clearly stated on the pay stub.

How often should independent contractors issue pay stubs?

The frequency of issuing pay stubs can vary based on the terms of the contract. Some contractors may provide pay stubs after each payment, while others may do so on a monthly or bi-weekly basis. Consistency is key to maintaining clear financial records.

What should I do if I find an error on my pay stub?

If an error is found on a pay stub, it is important to address it promptly. Contact the client or company that issued the pay stub to discuss the discrepancy. Corrections should be made as soon as possible to ensure accurate financial records and tax reporting.

Can I use a pay stub as proof of income?

Yes, an Independent Contractor Pay Stub can serve as proof of income. It provides a documented history of earnings, which can be useful for loan applications, rental agreements, or any situation requiring verification of income. Ensure that the pay stub is clear and detailed for best results.

Independent Contractor Pay Stub: Usage Steps

After gathering all necessary information, you are ready to fill out the Independent Contractor Pay Stub form. Make sure to have your details, payment information, and any relevant dates at hand. Follow these steps carefully to ensure accuracy.

- Enter your name: Write your full name at the top of the form.

- Provide your address: Fill in your current mailing address below your name.

- Include your contact information: Add your phone number and email address.

- List the pay period: Specify the start and end dates of the payment period.

- State the total hours worked: Write down the total number of hours you worked during that pay period.

- Enter your hourly rate: Fill in the amount you earn per hour.

- Calculate gross pay: Multiply the total hours worked by your hourly rate and write the total in the gross pay section.

- Deduct any taxes: If applicable, enter the amount of taxes withheld from your pay.

- Calculate net pay: Subtract any deductions from your gross pay and write the final amount in the net pay section.

- Sign and date the form: Finally, sign your name and add the date at the bottom of the form.