Printable Transfer-on-Death Deed Form for the State of Illinois

The Illinois Transfer-on-Death Deed (TOD) form serves as a valuable estate planning tool that allows property owners to designate beneficiaries who will receive their real estate upon their death, without the need for probate. This straightforward legal document enables individuals to retain full control over their property during their lifetime, while ensuring a seamless transfer to chosen heirs after passing. By utilizing the TOD form, property owners can avoid the complexities and delays often associated with traditional inheritance processes. It is essential to understand the requirements for executing this deed, including proper notarization and recording, to ensure its validity. Additionally, the form allows for the designation of multiple beneficiaries, providing flexibility in estate planning. With the right approach, the Illinois Transfer-on-Death Deed can simplify the transfer of property and support the efficient management of one’s estate. Understanding its features and implications can empower property owners to make informed decisions regarding their assets and their legacy.

Check out Other Common Transfer-on-Death Deed Templates for Different States

How to Gift Land to Family Member - Joint owners can also utilize a Transfer-on-Death Deed for their share of the property.

In the realm of legal documentation, familiarity with the available resources is crucial for both practitioners and those involved in court processes. For those looking to navigate the complexities of court filings, the California Judicial Council's standardized forms play a vital role in ensuring clarity and efficiency. To access a comprehensive list of these essential documents, visit All California Forms, where you can find the MC-020 form and more, facilitating smoother legal proceedings.

Title Companies and Transfer on Death Deeds - Homeowners are encouraged to regularly review their estate planning documents, including Transfer-on-Death Deeds.

Documents used along the form

The Illinois Transfer-on-Death Deed (TODD) is a useful tool for individuals looking to transfer real estate upon their death without going through probate. However, there are several other forms and documents that may accompany or complement the TODD. Understanding these documents can help ensure a smooth transfer of property and clarify the intentions of the property owner.

- Will: A legal document that outlines how an individual’s assets, including real estate, should be distributed after their death. A will can provide additional instructions that may not be covered by a TODD.

- Motor Vehicle Bill of Sale Form: For those engaging in vehicle transactions, the recommended Motor Vehicle Bill of Sale form guidelines are essential for clarity and legal compliance.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person. It can be particularly helpful in situations where there is no will or when the estate is small.

- Power of Attorney: A legal document that allows one person to act on behalf of another in financial or legal matters. A durable power of attorney can be crucial if the property owner becomes incapacitated before their death.

- Deed of Gift: This document transfers ownership of property as a gift while the owner is still alive. It can be an alternative to a TODD if the owner wishes to give the property away before their death.

- Title Insurance Policy: This policy protects the property owner and their heirs from potential disputes over property ownership. It can be important to have this in place to avoid complications after the transfer of property.

Incorporating these documents into estate planning can provide clarity and security for both the property owner and their beneficiaries. Each document serves a specific purpose and can help streamline the process of property transfer, ensuring that the owner’s wishes are honored.

PDF Overview

| Fact Name | Description |

|---|---|

| What is a Transfer-on-Death Deed? | A Transfer-on-Death (TOD) Deed allows property owners in Illinois to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Illinois Transfer-on-Death Deed is governed by the Illinois Compiled Statutes, specifically 755 ILCS 27. |

| Eligibility | Any individual who owns real estate in Illinois can create a TOD Deed, as long as they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property. This designation can be changed or revoked at any time before the owner’s death. |

| Filing Requirements | The TOD Deed must be signed by the owner and witnessed by two individuals or notarized. It must then be recorded with the county recorder’s office where the property is located. |

| Effect on Property Taxes | Creating a TOD Deed does not affect property taxes during the owner's lifetime. The property remains part of the owner's estate until their death. |

| Limitations | A TOD Deed cannot be used for all types of property. For example, it cannot transfer personal property or property held in a trust. |

More About Illinois Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Illinois to transfer their real estate to beneficiaries upon their death, without the need for probate. This means that the property can pass directly to the named beneficiaries, simplifying the transfer process and potentially reducing costs and delays associated with probate court. The deed must be properly executed and recorded to be valid.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Illinois can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, it is important to ensure that the property is not subject to any liens or other legal claims that could complicate the transfer. Additionally, the owner must be of sound mind and legal age to execute the deed.

How do I create a Transfer-on-Death Deed?

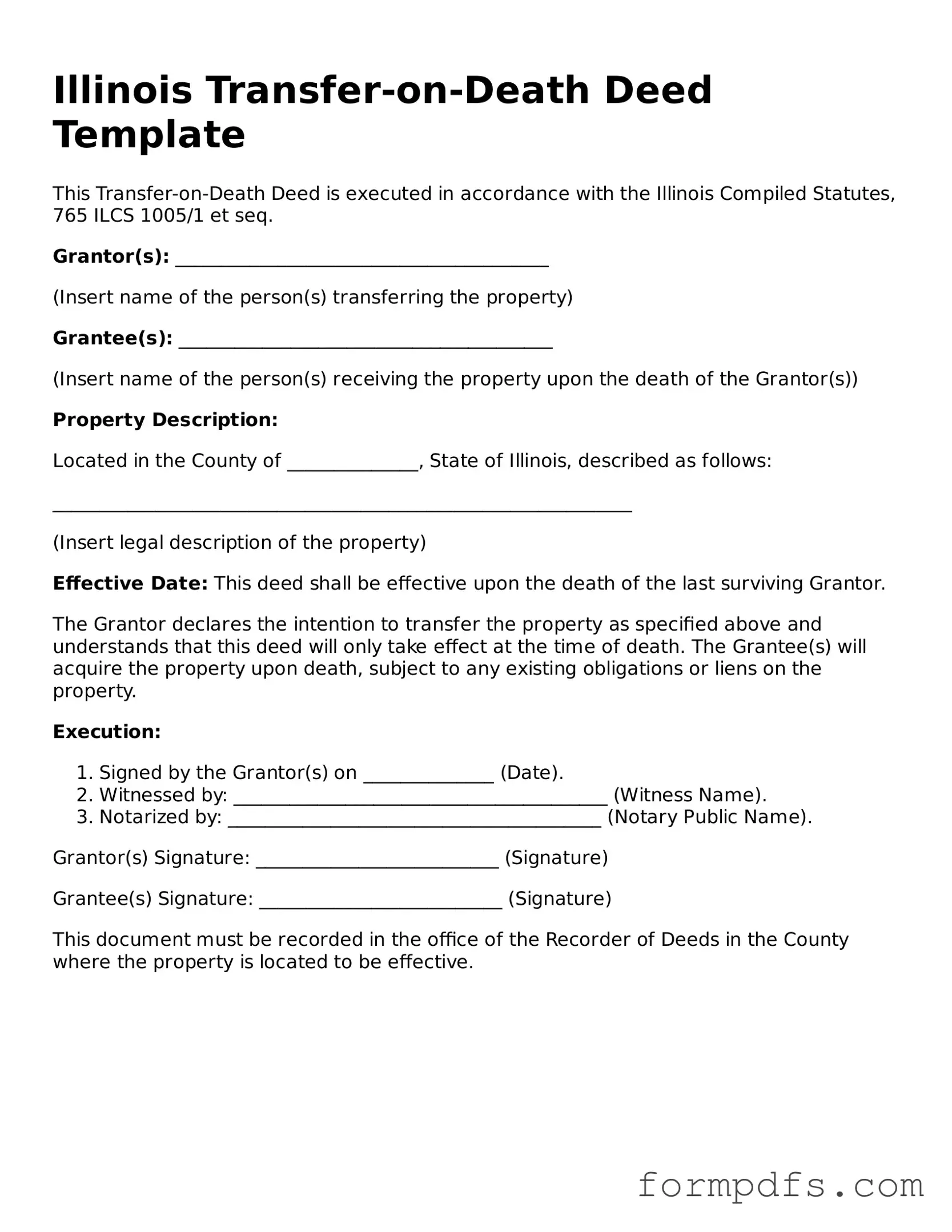

To create a Transfer-on-Death Deed, you will need to fill out a specific form that includes details about the property and the beneficiaries. The form must be signed in front of a notary public. After signing, the deed must be recorded with the appropriate county recorder's office where the property is located. This ensures that the deed is legally recognized and enforceable.

Can I change or revoke a Transfer-on-Death Deed after it is executed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must execute a new deed that either revokes the previous one or alters the beneficiaries. It is crucial to record any changes with the county recorder’s office to ensure that your wishes are accurately reflected in public records.

What happens if I do not name a beneficiary in the Transfer-on-Death Deed?

If no beneficiary is named in the Transfer-on-Death Deed, the property will be treated as if the deed did not exist. This means that the property will go through the probate process, and the court will determine how the property is distributed according to state law. Therefore, it is essential to name at least one beneficiary to avoid complications.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. The transfer occurs upon death, so the property is not considered part of the owner's taxable estate during their lifetime. However, beneficiaries may be subject to property taxes and other fees once the property is transferred. Consulting a tax professional can provide clarity on potential tax implications.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the distribution of property after death, a will goes through the probate process, while a Transfer-on-Death Deed allows for direct transfer without probate. This distinction can significantly affect the speed and cost of transferring property to heirs.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for real estate, such as homes, land, and commercial properties. It does not apply to personal property, bank accounts, or other types of assets. For those assets, different estate planning tools may be necessary to ensure they are transferred according to your wishes.

Illinois Transfer-on-Death Deed: Usage Steps

After you have gathered the necessary information, you can begin filling out the Illinois Transfer-on-Death Deed form. This deed allows you to designate a beneficiary who will receive your property upon your passing, without going through probate. Below are the steps to complete the form accurately.

- Begin by entering the name of the property owner(s) in the designated section. Make sure to include all owners if there are multiple.

- Next, provide the address of the property. This should be the complete address, including the city, state, and zip code.

- In the next section, list the name(s) of the beneficiary or beneficiaries. Ensure that the names are spelled correctly and are the legal names of the individuals you wish to designate.

- Include the date on which you are filling out the form. This is important for record-keeping purposes.

- Sign the form in the designated area. If there are multiple property owners, each must sign the deed.

- Have the deed notarized. A notary public must witness the signatures to validate the document.

- Finally, file the completed deed with the appropriate county recorder’s office where the property is located. This step is crucial to ensure the deed is legally recognized.