Printable Real Estate Purchase Agreement Form for the State of Illinois

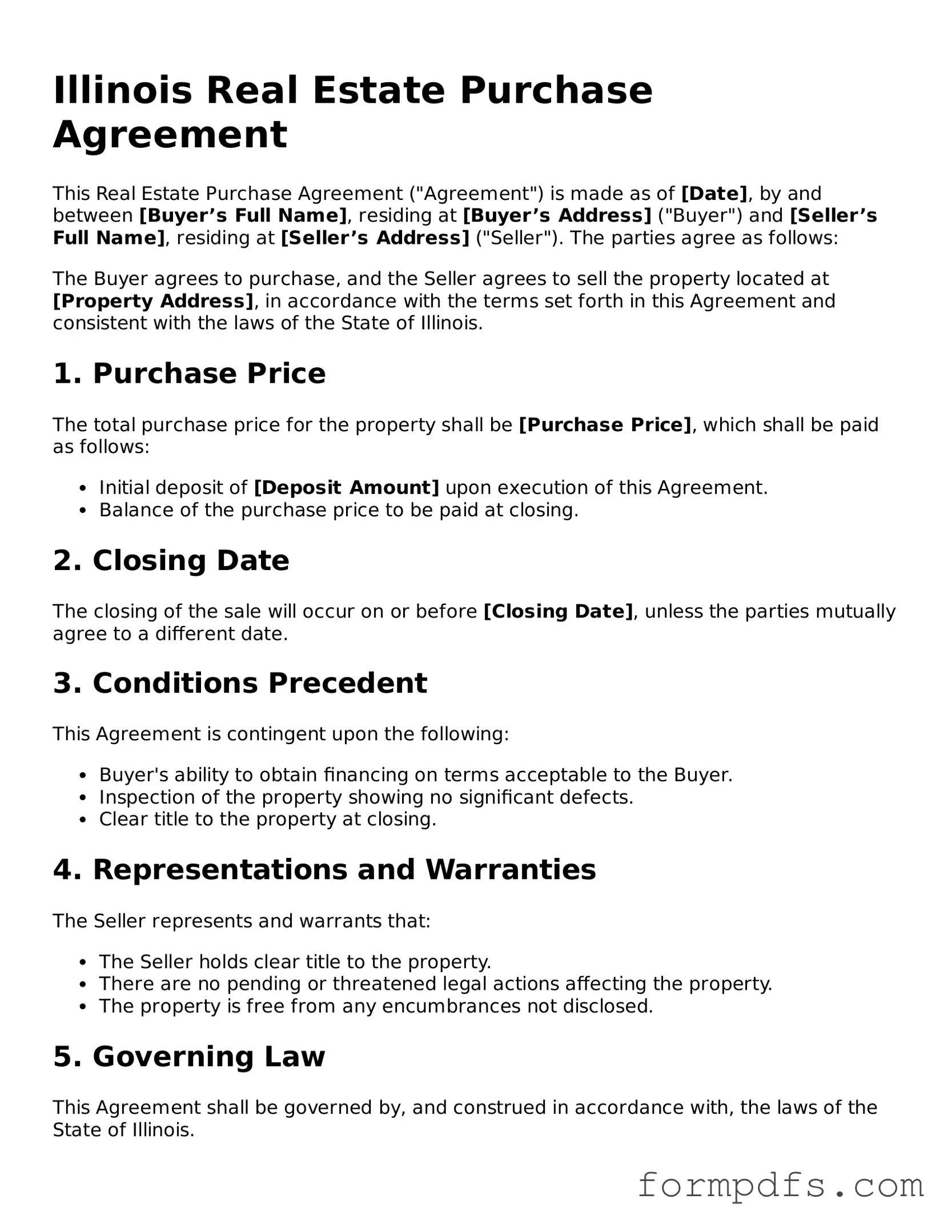

The Illinois Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property in the state. This form outlines the essential terms and conditions agreed upon by both the buyer and the seller. Key elements include the purchase price, financing details, and the closing date. Additionally, the agreement addresses contingencies, such as home inspections and financing approval, which protect both parties during the transaction. It also specifies the rights and responsibilities of each party, ensuring clarity and reducing the likelihood of disputes. By detailing the property description and including any applicable disclosures, the form helps to create a transparent framework for the transaction. Overall, the Illinois Real Estate Purchase Agreement is designed to facilitate a smooth transfer of property ownership while safeguarding the interests of all involved.

Check out Other Common Real Estate Purchase Agreement Templates for Different States

Michigan Real Estate Forms - Includes contingencies for financing or sale of another property.

To facilitate a smooth transaction, it is advisable to utilize a New York Bill of Sale form, which serves as a formal document that records the sale or transfer of personal property from one party to another within the state of New York. For an easy-to-use template, visit smarttemplates.net/fillable-new-york-bill-of-sale, where you can find indispensable evidence detailing the transaction, including information about the buyer, seller, and the item sold. This document is crucial for both legal protection and personal record-keeping.

Free Purchase Agreement Form - The document specifies the responsibilities of both the buyer and seller.

Documents used along the form

When engaging in a real estate transaction in Illinois, several forms and documents accompany the Real Estate Purchase Agreement. Each document plays a vital role in ensuring a smooth process. Below is a list of common forms that you may encounter.

- Property Disclosure Statement: This document provides information about the condition of the property, including any known issues or defects. Sellers are required to disclose relevant details to potential buyers.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is necessary to inform buyers about the potential presence of lead-based paint, which can pose health risks.

- Home Inspection Report: After a buyer conducts a home inspection, this report outlines the findings. It helps buyers understand the property's condition and any necessary repairs.

- Financing Addendum: If a buyer is obtaining financing, this addendum details the terms of the loan, including the amount, interest rate, and any contingencies related to financing.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments. It is reviewed and signed at closing.

- Title Commitment: This document outlines the terms of the title insurance policy. It confirms that the seller has the right to sell the property and identifies any liens or encumbrances.

- Affidavit of Service: To ensure legal documents are properly delivered, utilize the crucial Affidavit of Service form for documentation that verifies the completion of service in legal proceedings.

- Earnest Money Agreement: This agreement specifies the amount of earnest money the buyer will deposit to show their commitment to the purchase. It outlines how the money will be handled if the deal falls through.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be recorded with the county to be effective.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and that there are no undisclosed claims or liens against it.

Understanding these documents can help you navigate the real estate process with confidence. Each form serves a specific purpose and contributes to a transparent and fair transaction. Always consider seeking professional guidance to ensure all your needs are met throughout this journey.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Real Estate Purchase Agreement is governed by the laws of the State of Illinois. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Standardization | The form is standardized to ensure that all necessary information is included, making it easier for both parties to understand their obligations. |

| Contingencies | It allows for various contingencies, such as financing and inspection, providing protection for the buyer. |

| Signature Requirements | Both parties must sign the agreement for it to be legally binding, ensuring mutual consent to the terms outlined. |

More About Illinois Real Estate Purchase Agreement

What is the Illinois Real Estate Purchase Agreement form?

The Illinois Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form serves as a binding contract once both parties sign it, detailing essential aspects such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized.

Who needs to use the Illinois Real Estate Purchase Agreement?

This form is primarily used by buyers and sellers of residential real estate in Illinois. Real estate agents and brokers often facilitate the process, but it is essential for both parties to understand the agreement's terms. Homebuyers, sellers, and their representatives should be familiar with this document to ensure a smooth transaction.

What key elements are included in the agreement?

The agreement typically includes several critical components, such as the property description, purchase price, earnest money deposit, financing details, contingencies (like home inspections or appraisals), and the closing date. It may also outline any specific conditions that need to be met for the sale to proceed.

Can I make changes to the Illinois Real Estate Purchase Agreement?

Yes, both parties can negotiate and make changes to the agreement before signing. Any modifications should be documented in writing and agreed upon by both the buyer and seller. This ensures that all parties are on the same page and helps prevent disputes later in the process.

What happens after the agreement is signed?

Once the agreement is signed by both parties, it becomes a legally binding contract. The buyer typically provides an earnest money deposit, which demonstrates their commitment to the purchase. The parties then work through the contingencies and finalize the details leading up to the closing date, when the property ownership is officially transferred.

Is it necessary to have a lawyer review the agreement?

What if the buyer or seller wants to back out of the agreement?

If either party wishes to back out of the agreement, they must refer to the contingencies outlined in the contract. If the contingencies are not met, a party may be able to withdraw without penalty. However, if there are no valid reasons to terminate the agreement, the withdrawing party could face legal consequences, including the loss of the earnest money deposit.

Illinois Real Estate Purchase Agreement: Usage Steps

After obtaining the Illinois Real Estate Purchase Agreement form, it’s essential to fill it out accurately to ensure a smooth transaction. Follow these steps to complete the form correctly.

- Start with the date: Write the date on which you are filling out the agreement.

- Identify the parties: Enter the names and contact information of both the buyer and the seller. Ensure that all names are spelled correctly.

- Property description: Provide a detailed description of the property being sold, including the address and any relevant parcel numbers.

- Purchase price: State the agreed-upon purchase price for the property. Be clear and precise.

- Earnest money: Specify the amount of earnest money the buyer will provide and the method of payment.

- Closing date: Indicate the desired closing date for the transaction. This is when ownership will officially transfer.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as financing or inspection requirements.

- Signatures: Both the buyer and seller must sign and date the agreement. Ensure all parties understand what they are signing.

Once you have completed the form, review it for accuracy. Make sure all information is correct and that both parties have signed. You may then proceed to submit the agreement as required for your transaction.