Printable Quitclaim Deed Form for the State of Illinois

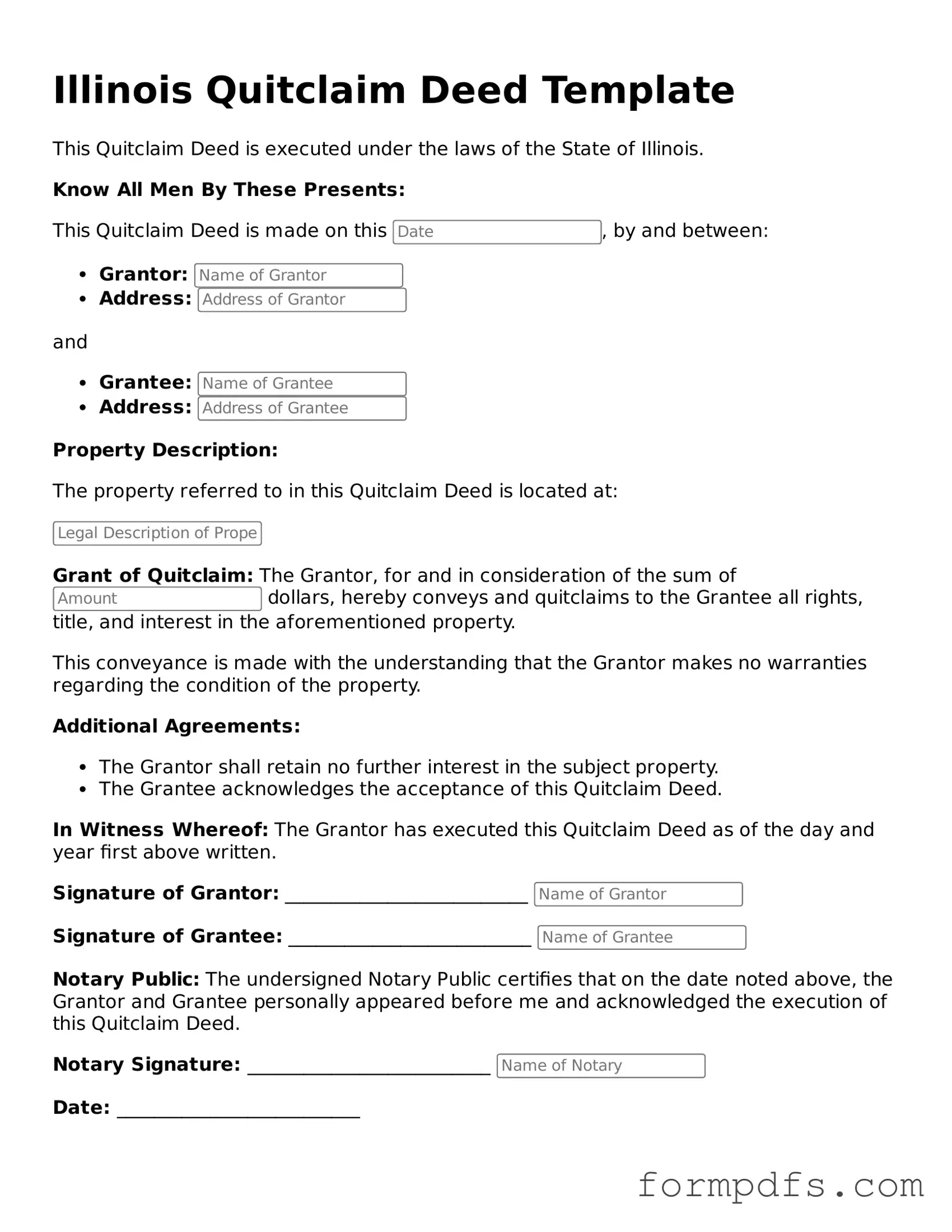

The Illinois Quitclaim Deed form serves as a vital legal document for property transfers, allowing individuals to convey their interest in real estate without guaranteeing the title's validity. This form is particularly useful in situations where the grantor, or the person transferring the property, may not have a clear title or when the transaction occurs between familiar parties, such as family members or friends. Unlike other types of deeds, a quitclaim deed does not provide any warranties, meaning the recipient, or grantee, assumes the risk associated with the property title. The form typically requires essential information, including the names of both the grantor and grantee, a legal description of the property, and the date of the transfer. Once completed, the deed must be signed by the grantor in the presence of a notary public, ensuring its legal validity. Additionally, filing the quitclaim deed with the appropriate county recorder's office is crucial for public record, which helps establish ownership and protect the rights of the new property owner.

Check out Other Common Quitclaim Deed Templates for Different States

Quit Claim Deed Ohio - The document must be signed by the grantor to be valid, but it does not necessarily require a witness or notarization, depending on state rules.

An Employment Verification Form is a document used by employers to confirm the employment history of current or former employees. This form typically includes details such as the employee's job title, dates of employment, and sometimes salary information. Its primary purpose is to verify the accuracy of an applicant's employment history for new employers, lending institutions, or government agencies. For further details and access to the necessary documentation, visit https://onlinelawdocs.com/.

North Carolina Quit Claim Deed Pdf - This type of deed is not typically used for sales transactions in real estate.

Quit Claim Deed Ga - Certainty in property ownership can be complicated, but quitclaim deeds can simplify certain transfers.

Documents used along the form

When transferring property ownership in Illinois, the Quitclaim Deed is a commonly used document. However, it often accompanies several other forms and documents that help facilitate the process. Understanding these additional documents can provide clarity and ensure a smoother transaction.

- Property Transfer Tax Declaration: This form is required to report the transfer of property to local authorities. It provides information about the sale price and helps determine any applicable transfer taxes.

- Affidavit of Title: This document is a sworn statement by the seller confirming their ownership of the property and that there are no undisclosed liens or encumbrances. It serves to protect the buyer from future disputes.

- Title Insurance Policy: This policy protects the buyer against any claims or legal issues that may arise regarding the property’s title. It is a safeguard that provides peace of mind during the ownership period.

- Settlement Statement: Also known as the HUD-1 form, this document outlines all the costs and fees associated with the property transfer. It details the financial aspects of the transaction for both the buyer and seller.

- ATV Bill of Sale Form: For reliable documentation of your ATV transactions, refer to our comprehensive ATV Bill of Sale form guide to ensure all details are accurately recorded.

- Warranty Deed: While a Quitclaim Deed transfers ownership without guarantees, a Warranty Deed provides assurances about the title’s validity. It is often used in situations where the buyer seeks more security regarding the property’s title.

- Power of Attorney: In some cases, a seller may not be able to be present for the transaction. A Power of Attorney allows someone else to act on their behalf, ensuring that the transfer can still occur smoothly.

- Notice of Transfer: This document informs local government authorities about the change in property ownership. It helps update public records and ensures that future tax assessments are directed to the new owner.

Each of these documents plays a vital role in the property transfer process in Illinois. By familiarizing oneself with them, individuals can navigate the complexities of real estate transactions with greater confidence and understanding.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | In Illinois, quitclaim deeds are governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Use Cases | Commonly used in family transfers, property settlements, or to clear up title issues. |

| Parties Involved | The party transferring the property is known as the grantor, while the receiving party is the grantee. |

| No Guarantees | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property. |

| Filing Requirements | After signing, the deed must be recorded with the county recorder’s office to be effective against third parties. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public. |

| Tax Implications | Transfer taxes may apply, depending on the local jurisdiction and the value of the property. |

| Revocation | A quitclaim deed cannot be revoked once executed and recorded, unless a new deed is created to reverse the transaction. |

More About Illinois Quitclaim Deed

What is a Quitclaim Deed in Illinois?

A Quitclaim Deed is a legal document used to transfer ownership of real estate in Illinois. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the property title is free of claims or liens. Instead, it simply conveys whatever interest the grantor (the person transferring the property) has in the property at the time of the transfer. This type of deed is often used among family members or in situations where the grantor is unsure of the property’s title status.

How do I complete a Quitclaim Deed form in Illinois?

To complete a Quitclaim Deed form, you will need to provide specific information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. You can find templates online or at local legal offices. It’s essential to ensure that the form is filled out accurately to avoid any issues later. After completing the form, the grantor must sign it in the presence of a notary public to make it legally binding.

Do I need to file the Quitclaim Deed with the county?

Yes, after the Quitclaim Deed is signed and notarized, it must be filed with the county recorder’s office in the county where the property is located. Filing the deed officially updates the public record, reflecting the new ownership. There may be a small fee for filing, and it’s advisable to keep a copy of the filed deed for your records.

Are there any tax implications when using a Quitclaim Deed in Illinois?

While transferring property using a Quitclaim Deed itself does not typically trigger a tax event, it’s important to consider potential tax implications. For example, if the property is being transferred as part of a sale, capital gains tax may apply. Additionally, property taxes may change based on the new ownership. It is wise to consult with a tax professional or attorney to understand any tax responsibilities related to the transfer.

Illinois Quitclaim Deed: Usage Steps

After completing the Illinois Quitclaim Deed form, it is essential to ensure that all information is accurate and properly recorded. This document will need to be filed with the appropriate county office to finalize the transfer of property ownership.

- Obtain the Illinois Quitclaim Deed form. You can find it online or at your local county clerk's office.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Ensure that the names are spelled correctly.

- Provide the property description. This includes the address and legal description of the property. You may need to refer to the property’s deed or tax records for accuracy.

- Include the date of the transfer. This is the date when the grantor signs the deed.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness the signing.

- Check if there are any additional requirements for your specific county, such as additional signatures or forms.

- File the completed Quitclaim Deed with the county recorder’s office. There may be a filing fee, so be prepared to pay that at the time of submission.