Printable Promissory Note Form for the State of Illinois

The Illinois Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending of money in a clear and structured manner. This legally binding document outlines the specific terms of a loan, including the principal amount borrowed, the interest rate applicable, and the repayment schedule. It also addresses the consequences of default, ensuring that both parties understand their rights and obligations. In Illinois, the form must meet certain legal requirements to be enforceable, such as being in writing and signed by the borrower. Additionally, the document may include provisions for prepayment, allowing borrowers the flexibility to repay the loan early without incurring penalties. Understanding the components of the Illinois Promissory Note is essential for anyone involved in a lending transaction, as it not only protects the lender’s interests but also provides the borrower with a clear framework for repayment. By adhering to the guidelines set forth in this form, parties can minimize misunderstandings and foster a more transparent lending relationship.

Check out Other Common Promissory Note Templates for Different States

Promissory Note Michigan - Both parties may wish to keep a copy of the signed Promissory Note for their records.

The New York Articles of Incorporation form serves as a fundamental document required to establish a corporation within the state. It outlines the necessary information about the corporation, including its name, purpose, and the details of its incorporators. This form initiates the formal process of acknowledging a business entity's legal existence under state law, and you can find further guidance on the preparation of this document at smarttemplates.net/fillable-new-york-articles-of-incorporation/.

Loan Note Template - A properly executed Promissory Note can enhance trust between borrowers and lenders.

Documents used along the form

When entering into a loan agreement in Illinois, a Promissory Note is a crucial document. However, it is often accompanied by other forms and documents that help clarify the terms of the loan and protect the interests of both the borrower and the lender. Here are seven important documents that are frequently used alongside an Illinois Promissory Note:

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the parties.

- Security Agreement: If the loan is secured by collateral, a Security Agreement details what the collateral is and the rights of the lender in case of default. This document protects the lender's interests.

- Personal Guarantee: This document may be required if the borrower is a business entity. It holds the individual owners personally responsible for the loan, ensuring that the lender has recourse if the business defaults.

- California Judicial Council Form: The All California Forms play an essential role in legal proceedings within California, standardizing the submission of vital information across court cases to ensure clarity and consistency.

- Disclosure Statement: This statement provides borrowers with important information about the loan, including fees, terms, and conditions. It ensures transparency and helps borrowers make informed decisions.

- Amortization Schedule: This document outlines each payment's breakdown over the life of the loan, showing how much goes toward principal and interest. It helps borrowers understand their repayment obligations.

- Loan Application: The Loan Application is typically completed by the borrower and includes personal and financial information. It helps the lender assess the borrower's creditworthiness.

- Default Notice: In the event of non-payment, a Default Notice is sent to the borrower. It formally notifies them of the default and outlines the lender's rights and potential actions.

Each of these documents plays a vital role in the lending process, ensuring that both parties are protected and that the terms of the loan are clear. Understanding these forms can help borrowers navigate their financial agreements more effectively.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois. |

| Parties Involved | The note involves two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Payment Terms | It typically specifies the amount to be paid, the due date, and any interest rate applicable. |

| Form Requirements | The document must be in writing and signed by the maker to be enforceable. |

| Transferability | Promissory notes can be transferred to others, allowing the payee to sell or assign the note. |

| Default Consequences | If the maker fails to pay as promised, the payee may take legal action to recover the owed amount. |

More About Illinois Promissory Note

What is a promissory note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It's a legal document that outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

Why would I need an Illinois promissory note?

If you are lending or borrowing money in Illinois, a promissory note provides clarity and security for both parties. It serves as evidence of the debt and the terms agreed upon, helping to prevent misunderstandings or disputes down the line.

What should be included in an Illinois promissory note?

Key elements of a promissory note include the names and addresses of the borrower and lender, the principal amount, interest rate, payment schedule, due date, and any penalties for late payments. Additionally, it’s wise to include provisions for what happens in case of default.

Is it necessary to have the promissory note notarized?

While notarization is not strictly required for a promissory note to be valid in Illinois, having it notarized can add an extra layer of authenticity. It can be beneficial if disputes arise, as a notarized document can serve as stronger evidence in court.

Can I modify the terms of a promissory note after it has been signed?

Yes, you can modify the terms of a promissory note after it has been signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the revised agreement to avoid future confusion.

What happens if the borrower defaults on the promissory note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may involve filing a lawsuit. The terms of the promissory note should outline the consequences of default, including late fees or acceleration of the debt.

Can I use a promissory note for personal loans?

Absolutely! Promissory notes are commonly used for personal loans between friends, family, or acquaintances. They help ensure that everyone is on the same page regarding repayment terms, making it easier to maintain personal relationships.

Are there any specific laws governing promissory notes in Illinois?

Yes, promissory notes in Illinois are governed by state laws, which outline the requirements for enforceability and the rights of both parties. It’s advisable to familiarize yourself with these laws or consult a legal professional to ensure compliance.

Where can I find a template for an Illinois promissory note?

You can find templates for Illinois promissory notes online, often provided by legal websites or financial institutions. However, it's important to review any template carefully and consider customizing it to fit your specific situation, or seek legal advice if needed.

Illinois Promissory Note: Usage Steps

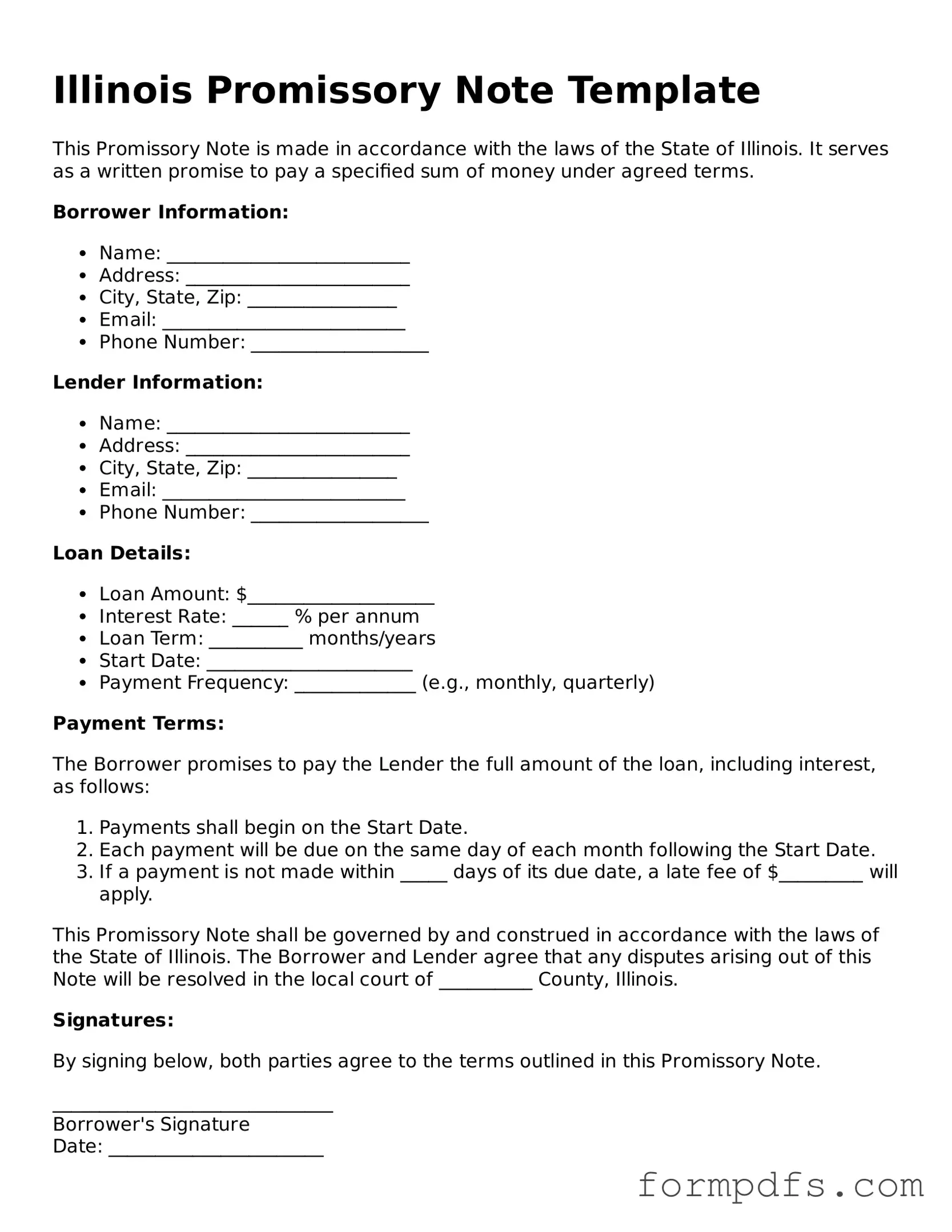

After obtaining the Illinois Promissory Note form, you will need to fill it out accurately. This process involves providing specific information about the loan agreement between the borrower and the lender. Once completed, the form should be signed and dated by both parties.

- Begin by entering the date at the top of the form. This date should reflect when the note is being created.

- Fill in the name and address of the borrower. This identifies the individual or entity receiving the loan.

- Next, enter the name and address of the lender. This identifies the individual or entity providing the loan.

- Specify the principal amount of the loan. This is the total amount borrowed by the borrower.

- Indicate the interest rate. This should be expressed as a percentage.

- Detail the repayment terms. Specify how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Provide a section for the borrower’s signature and date. This indicates acceptance of the terms.

- Include a section for the lender’s signature and date. This indicates agreement to the terms.