Printable Power of Attorney Form for the State of Illinois

The Illinois Power of Attorney form serves as a crucial legal document that allows individuals to designate someone they trust to make decisions on their behalf in various situations, particularly in the event of incapacity. This form can cover a wide range of responsibilities, including financial matters, healthcare decisions, and property management. It is important to understand that the authority granted through this document can be broad or limited, depending on the preferences of the individual creating the form, known as the principal. Additionally, the Illinois Power of Attorney includes specific provisions that outline the powers bestowed upon the agent, ensuring clarity and reducing the potential for disputes. The form must be executed in accordance with state laws, which typically require the signatures of the principal and the agent, as well as a witness or notary public. Given the complexities involved, individuals should carefully consider their choices and consult with professionals if necessary to ensure that their intentions are accurately reflected and legally binding.

Check out Other Common Power of Attorney Templates for Different States

Free Printable Nc Power of Attorney Form - In some cases, this form is required for practical matters like healthcare decisions.

Completing the ADP Pay Stub form accurately ensures that you have a clear understanding of your financial standing, as it highlights all relevant information regarding your earnings and deductions. To help you in this process, you can visit Fill PDF Forms for assistance with filling out your form efficiently.

Power of Attorney Form Michigan - The flexibility of this document allows you to customize your power delegation.

Documents used along the form

When preparing a Power of Attorney in Illinois, it’s important to consider additional documents that can complement this legal instrument. These documents can help ensure that your wishes are clearly articulated and legally upheld. Below are some commonly used forms that may be beneficial alongside a Power of Attorney.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment in case you become unable to communicate your wishes. It can specify the types of medical interventions you would or would not want.

- Living Will: Similar to an Advance Healthcare Directive, a Living Will specifically addresses end-of-life decisions. It provides guidance on whether to prolong life through medical procedures when recovery is not possible.

- HIPAA Release Form: This form allows designated individuals access to your medical records and health information. It ensures that your healthcare agent can make informed decisions on your behalf.

- Arizona Motorcycle Bill of Sale: To document the sale of a motorcycle, it's essential to utilize the official Arizona Motorcycle Bill of Sale form resources to ensure proper legal verification.

- Financial Power of Attorney: While a general Power of Attorney can cover financial matters, a specific Financial Power of Attorney focuses solely on financial decisions. It can be tailored to address particular financial needs.

- Will: A Will outlines how your assets should be distributed after your death. It can also designate guardians for minor children and is crucial for ensuring your wishes are followed.

- Trust Documents: If you create a trust, these documents specify how your assets will be managed during your lifetime and distributed after your death. Trusts can help avoid probate and provide privacy for your estate.

Considering these additional documents when drafting your Power of Attorney can provide a more comprehensive approach to managing your healthcare and financial decisions. Each document serves a unique purpose and can work together to reflect your wishes effectively.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | The Illinois Power of Attorney form allows one person to appoint another to make decisions on their behalf. |

| Governing Law | The form is governed by the Illinois Power of Attorney Act (755 ILCS 45/2-1 et seq.). |

| Types | There are two main types: Power of Attorney for Health Care and Power of Attorney for Property. |

| Requirements | The form must be signed by the principal and witnessed by two individuals or notarized. |

| Durability | The Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent. |

| Agent's Duties | The agent must act in the best interest of the principal and follow their wishes. |

| Legal Age | Both the principal and the agent must be at least 18 years old to create a valid Power of Attorney. |

More About Illinois Power of Attorney

What is a Power of Attorney in Illinois?

A Power of Attorney (POA) in Illinois is a legal document that allows one person, known as the agent or attorney-in-fact, to make decisions on behalf of another person, known as the principal. This can include financial decisions, healthcare choices, or other legal matters. The principal grants specific powers to the agent, which can be broad or limited based on the principal’s wishes.

Why should I create a Power of Attorney?

Creating a Power of Attorney is essential for ensuring that someone you trust can manage your affairs if you become unable to do so. This document provides peace of mind, knowing that your financial and healthcare decisions will be handled according to your preferences, even if you are incapacitated.

What types of Power of Attorney are available in Illinois?

Illinois recognizes several types of Power of Attorney: the Durable Power of Attorney for Health Care, which allows your agent to make medical decisions on your behalf, and the Durable Power of Attorney for Property, which enables your agent to manage your financial affairs. You can also create a Limited Power of Attorney, which grants specific powers for a defined period or purpose.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a significant decision. Select someone you trust implicitly, who understands your values and wishes. This could be a family member, friend, or professional. Ensure that the person is willing and able to take on this responsibility, as they will be making critical decisions on your behalf.

Do I need a lawyer to create a Power of Attorney in Illinois?

No, you do not necessarily need a lawyer to create a Power of Attorney in Illinois. However, consulting with a legal professional can help ensure that the document meets all legal requirements and accurately reflects your wishes. If your situation is complex, legal advice is highly recommended.

How do I revoke a Power of Attorney in Illinois?

To revoke a Power of Attorney in Illinois, you must create a written revocation document. This document should clearly state your intention to revoke the POA and be signed and dated by you. It is advisable to notify your agent and any institutions that had the previous POA on file to prevent any confusion.

Is a Power of Attorney valid if I become incapacitated?

Yes, a Durable Power of Attorney remains valid even if you become incapacitated. This is one of the key features of a Durable Power of Attorney. It allows your agent to act on your behalf without interruption, ensuring your affairs are managed according to your wishes.

Can I change my Power of Attorney once it is created?

Yes, you can change your Power of Attorney at any time, as long as you are mentally competent. To make changes, you should create a new Power of Attorney document or amend the existing one. Be sure to revoke the previous version to avoid any confusion regarding your wishes.

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, your loved ones may have to go through a lengthy court process to obtain guardianship. This can be time-consuming and costly. Having a Power of Attorney in place can prevent this situation and ensure your preferences are respected.

Illinois Power of Attorney: Usage Steps

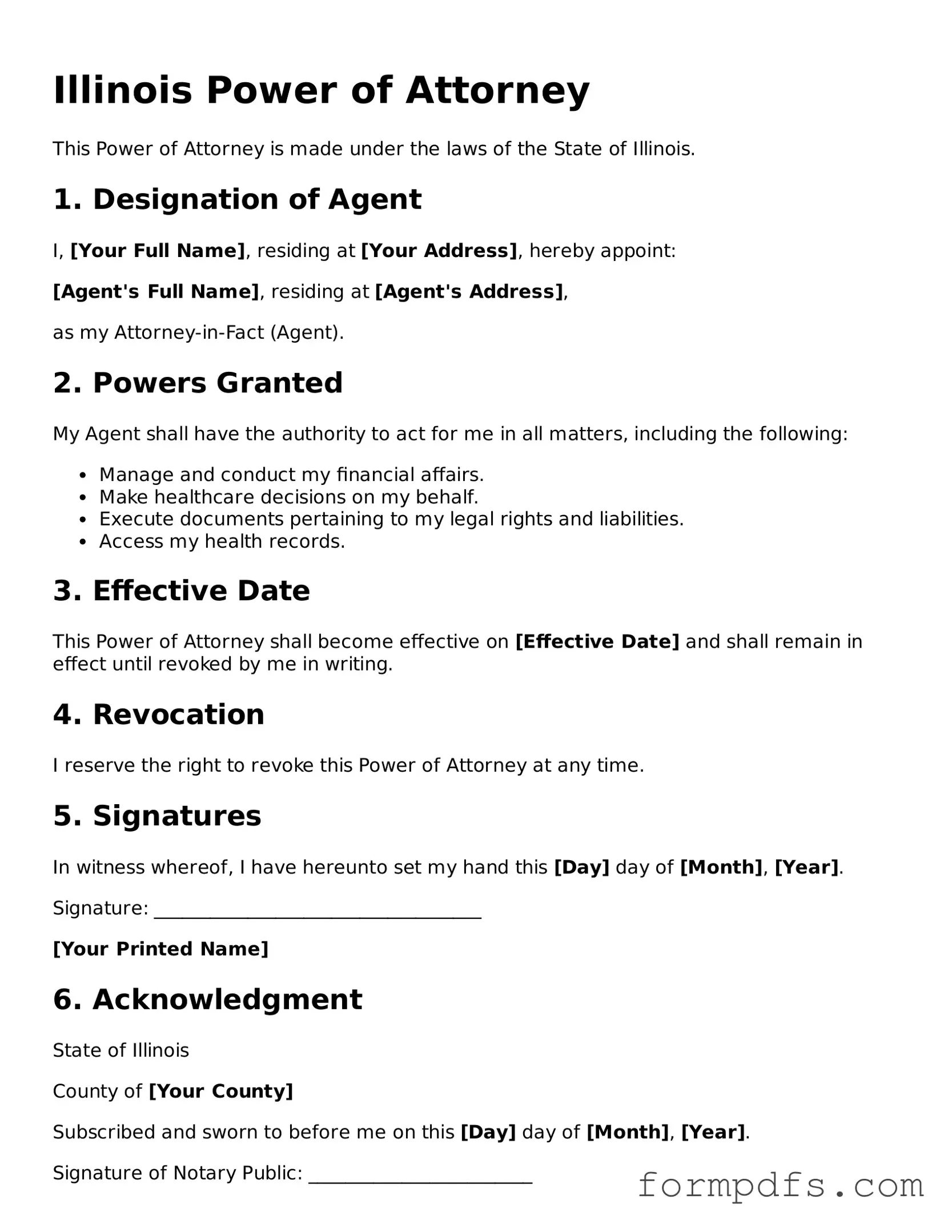

Filling out the Illinois Power of Attorney form is a straightforward process. It is essential to complete the form accurately to ensure that your wishes are clearly documented. Follow the steps below to fill out the form correctly.

- Obtain the Illinois Power of Attorney form. You can download it from the official state website or request a copy from a legal office.

- Read through the entire form to understand the sections that need your input.

- Begin with the first section, which typically requires your name and address. Fill in your full legal name and current address accurately.

- Next, identify the agent you are appointing. Provide their full name, address, and any relevant contact information.

- Specify the powers you wish to grant your agent. This may include financial decisions, healthcare decisions, or other specific authorities. Be clear and precise.

- Review the section regarding the duration of the Power of Attorney. Indicate whether it is effective immediately or under certain conditions.

- Sign and date the form in the designated area. Your signature must match the name you provided at the beginning of the form.

- Have the form witnessed by at least one adult who is not named in the document. They should also sign and date the form in the appropriate spaces.

- If required, consider having the document notarized. This adds an extra layer of verification to the form.

- Make copies of the completed form for your records and distribute copies to your agent and any relevant parties.