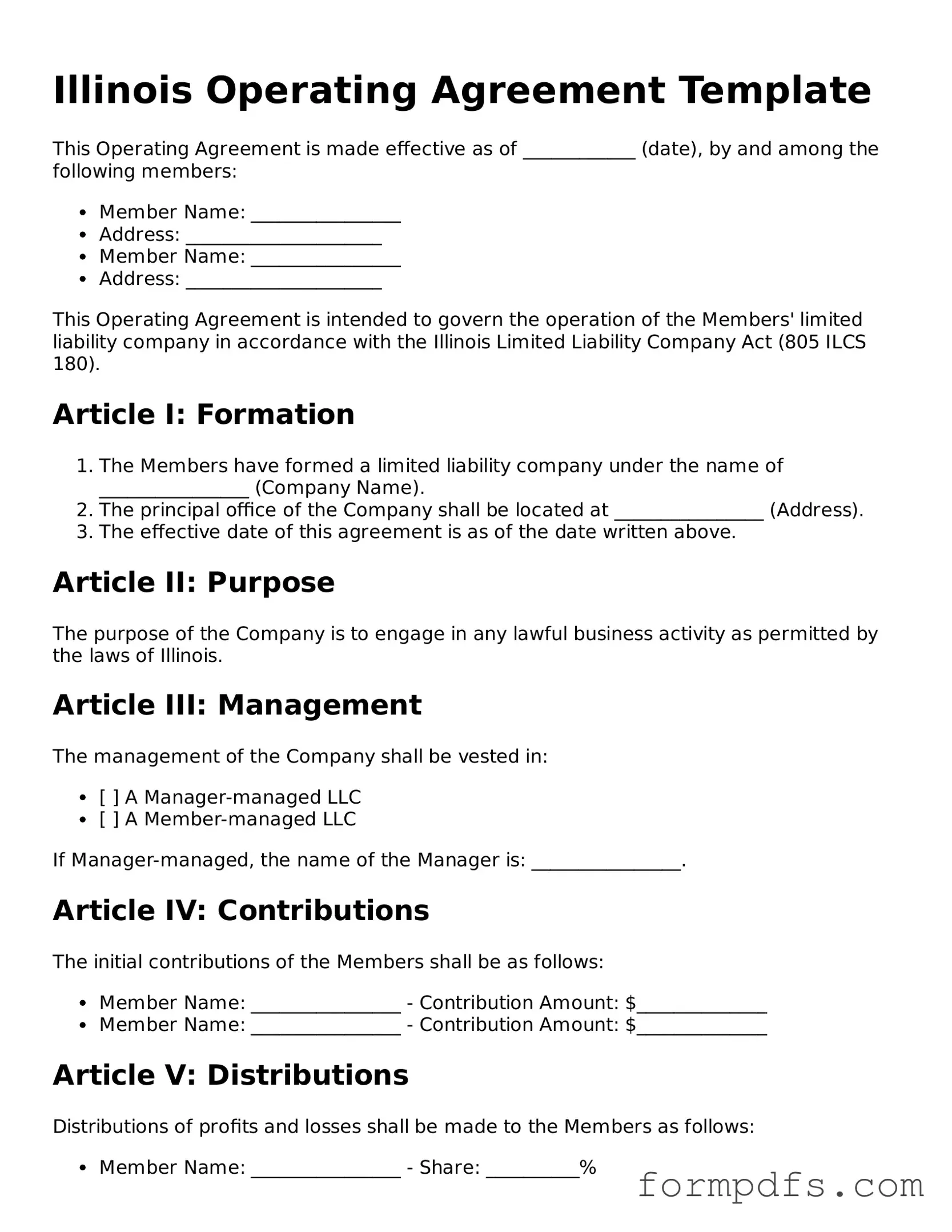

Printable Operating Agreement Form for the State of Illinois

The Illinois Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal rules and regulations that govern the company, providing clarity on various aspects such as management structure, member responsibilities, and profit distribution. By establishing these guidelines, the Operating Agreement helps to minimize disputes among members and ensures that everyone is on the same page regarding the company's operations. Additionally, it can address how decisions are made, how new members can be added, and what happens if a member wants to leave the company. Having a well-drafted Operating Agreement is not just a legal formality; it is a strategic tool that can enhance the stability and longevity of an LLC. Without it, members may face uncertainty and potential conflicts, making the Operating Agreement an essential component of any successful business venture in Illinois.

Check out Other Common Operating Agreement Templates for Different States

How to Make an Operating Agreement - It can help streamline operations by providing clear guidelines for everyday business matters.

How to Create an Operating Agreement - It offers protection against personal liability for business debts incurred by the LLC.

Llc in Michigan Form - It often includes a confidentiality agreement among members.

Completing the transaction of a boat in New York requires proper documentation, and understanding the importance of the New York Boat Bill of Sale form is essential. This form not only records the sale but also protects the interests of both the buyer and seller by providing thorough details necessary for legal compliance. To facilitate this, you can find a fillable version of the form at https://smarttemplates.net/fillable-new-york-boat-bill-of-sale/, ensuring you have all the needed information accurately represented.

Operating Agreement for Llc Georgia - The agreement is instrumental in defining the company’s mission and vision.

Documents used along the form

When forming a Limited Liability Company (LLC) in Illinois, the Operating Agreement is a crucial document. However, it is often accompanied by several other forms and documents that help establish the structure and compliance of the LLC. Below is a list of commonly used documents that you may need to consider alongside the Illinois Operating Agreement.

- Articles of Organization: This document is filed with the Illinois Secretary of State to officially create the LLC. It includes essential information such as the LLC's name, address, and registered agent.

- Member Consent Agreement: This agreement outlines the initial decisions made by the members of the LLC before the formal establishment. It can cover topics like management structure and initial capital contributions.

- Bylaws: While not always required for LLCs, bylaws can provide additional rules for the operation of the company. They typically cover the roles of members, voting procedures, and meeting protocols.

- Operating Procedures: This document details the day-to-day operations of the LLC. It may include processes for decision-making, record-keeping, and handling disputes among members.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They can be useful for tracking ownership percentages and capital contributions.

- Tax Registration Forms: Depending on the nature of the business, various tax registration forms may need to be filed with state and federal agencies. This ensures compliance with tax obligations.

- Employer Identification Number (EIN) Application: Obtaining an EIN from the IRS is essential for tax purposes, especially if the LLC plans to hire employees or open a business bank account.

- California Civil Form: This form is essential for legal proceedings within California's civil court system, facilitating applications for lawsuits and responses to complaints. For more information on related forms, refer to All California Forms.

- Annual Reports: Illinois requires LLCs to file annual reports to maintain good standing. This document updates the state on the LLC's status and any changes in membership or management.

Each of these documents plays a vital role in the formation and operation of an LLC in Illinois. Ensuring that all necessary forms are completed accurately and filed promptly can help prevent legal issues and promote smooth business operations.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Operating Agreement outlines the management structure and operational procedures of an LLC. |

| Governing Law | This agreement is governed by the Illinois Limited Liability Company Act. |

| Members' Rights | It specifies the rights and responsibilities of each member, ensuring clarity in decision-making. |

| Flexibility | Illinois allows LLCs to customize their Operating Agreements to suit their unique needs. |

| Filing Requirement | While the Operating Agreement is not filed with the state, it is crucial for internal governance. |

| Amendments | Members can amend the agreement as needed, provided all members consent to the changes. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, promoting harmony. |

More About Illinois Operating Agreement

What is an Illinois Operating Agreement?

An Illinois Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Illinois. It serves as a foundational document that details the rights and responsibilities of the members, how profits and losses are distributed, and the decision-making processes within the company. While not required by law, having an Operating Agreement can help prevent disputes among members and provide clarity on how the LLC will operate.

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement is beneficial for several reasons. First, it helps establish clear guidelines for how your LLC will function, which can be particularly important if there are multiple members involved. This document can also protect your personal assets by reinforcing the separation between your personal finances and the business. Additionally, in the event of disputes or changes in membership, the Operating Agreement provides a framework for resolution, potentially avoiding costly legal battles.

Do I need a lawyer to draft my Operating Agreement?

While it is not strictly necessary to hire a lawyer to draft your Operating Agreement, it can be a wise choice, especially if your LLC has multiple members or complex operations. A lawyer can ensure that the document complies with Illinois laws and addresses specific needs unique to your business. However, there are also templates available online that can guide you through the process if you prefer to draft it yourself. Just be sure to tailor the agreement to fit your LLC's specific situation.

Can I change my Operating Agreement after it has been created?

Yes, you can change your Operating Agreement after it has been created. In fact, it’s a good practice to review and update the agreement regularly, especially if there are significant changes in your business, such as adding or removing members, changes in management structure, or shifts in business strategy. To make changes, follow the amendment process outlined in your original Operating Agreement. This typically involves a vote among members and documenting the changes in writing.

Illinois Operating Agreement: Usage Steps

Filling out the Illinois Operating Agreement form is a crucial step for any business owner looking to establish a limited liability company (LLC). This document outlines the management structure and operational guidelines for your LLC. Once completed, it serves as a foundational blueprint for how your business will operate, helping to prevent misunderstandings among members.

- Begin by entering the name of your LLC at the top of the form. Ensure that the name matches what you registered with the state.

- Provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members of the LLC. Each member's role and contribution to the company should be clearly stated.

- Specify the management structure of the LLC. Indicate whether it will be member-managed or manager-managed.

- Outline the ownership percentages for each member. This section should clearly indicate how profits and losses will be distributed.

- Include any initial capital contributions made by each member. This helps clarify the financial commitment of each member to the LLC.

- Detail the voting rights of each member. This will determine how decisions are made within the company.

- Address the procedures for adding new members or removing existing ones. This ensures that all members are aware of how changes can occur.

- Include a section on how disputes will be resolved. This can help avoid conflicts in the future.

- Finally, have all members sign and date the agreement. Ensure that each member receives a copy for their records.