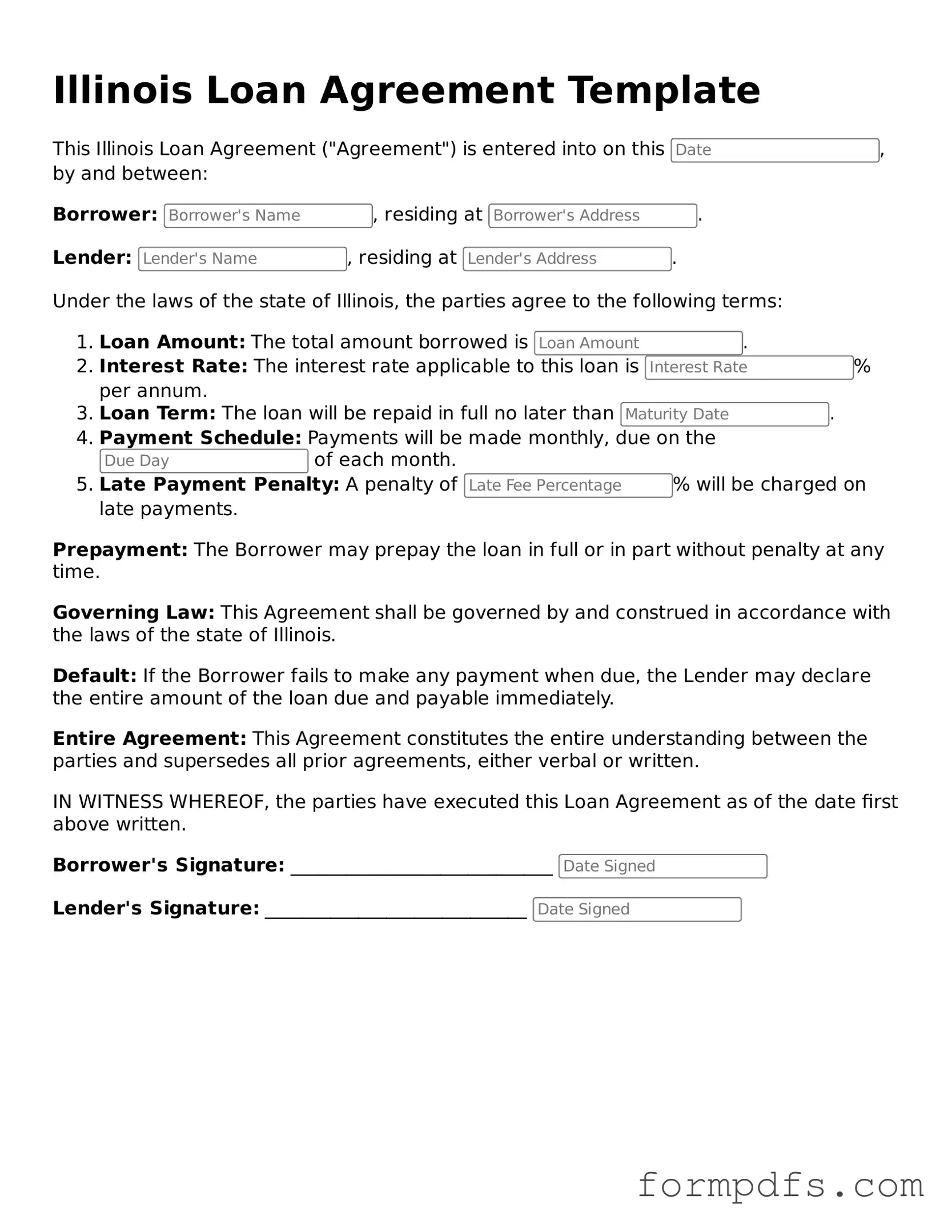

Printable Loan Agreement Form for the State of Illinois

When entering into a loan agreement in Illinois, it is essential to understand the key components that govern the terms of the loan. This agreement outlines the responsibilities of both the lender and the borrower, ensuring that each party is clear about their obligations. Major aspects of the form include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, the document may specify conditions under which the loan can be defaulted, along with the rights and remedies available to the lender in such cases. Clear communication is vital, as the agreement serves to protect both parties and establish a mutual understanding of the loan's terms. By carefully reviewing and completing the Illinois Loan Agreement form, individuals can help prevent misunderstandings and disputes, paving the way for a smoother financial transaction.

Check out Other Common Loan Agreement Templates for Different States

Georgia Promissory Note Template - A well-constructed Loan Agreement can make refinancing or modification of terms more manageable in the future.

For those looking to rent a room in California, it is essential to utilize the appropriate documentation to protect both parties involved. The California Room Rental Agreement serves not only as a legal contract but also as a clear communication tool that outlines the expectations and responsibilities of the landlord and tenant. To ensure you have all necessary paperwork, you can refer to All California Forms for a comprehensive selection of agreements that can cater to your rental needs.

Documents used along the form

When entering into a loan agreement in Illinois, several additional documents may be necessary to ensure clarity and protect the interests of both parties. These documents provide essential information and establish terms that complement the loan agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, including the interest rate, payment schedule, and any penalties for late payments. It serves as a formal acknowledgment of the debt.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets that back the loan. It details the rights of the lender in case of default and provides a legal claim to the collateral.

- Motor Vehicle Bill of Sale: When finalizing vehicle transactions, it's important to have the official vehicle bill of sale form guide to ensure all details are properly recorded and legally binding.

- Loan Disclosure Statement: This statement provides borrowers with essential information about the loan terms, including fees, interest rates, and total repayment amounts. It ensures transparency and helps borrowers make informed decisions.

- Personal Guarantee: In some cases, lenders may require a personal guarantee from a third party, usually the borrower’s business partner or owner. This document holds the guarantor responsible for the loan if the primary borrower defaults.

These documents work together with the Illinois Loan Agreement to create a comprehensive framework for the lending arrangement. Understanding each document's role can help both parties navigate their rights and responsibilities effectively.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Loan Agreement is governed by the laws of the State of Illinois. |

| Purpose | This form is used to outline the terms of a loan between a lender and a borrower. |

| Loan Amount | The specific amount of money being borrowed must be clearly stated in the agreement. |

| Interest Rate | The agreement must specify the interest rate applicable to the loan. |

| Repayment Terms | Details regarding repayment schedules and due dates are required. |

| Default Clauses | The form should include terms that outline what constitutes a default on the loan. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

| Dispute Resolution | The agreement may include provisions for resolving disputes, such as mediation or arbitration. |

More About Illinois Loan Agreement

What is the Illinois Loan Agreement form?

The Illinois Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is made between a lender and a borrower. It includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This form serves to protect both parties by clearly defining their rights and responsibilities throughout the loan period.

Who should use the Illinois Loan Agreement form?

This form is suitable for individuals or businesses looking to formalize a loan arrangement in Illinois. Whether you are lending money to a friend, family member, or a business entity, using this agreement can help prevent misunderstandings and disputes. It is advisable for both lenders and borrowers to utilize this document to ensure that all terms are clearly stated and agreed upon.

What are the key components of the Illinois Loan Agreement form?

Key components of the Illinois Loan Agreement include the names and addresses of both parties, the total loan amount, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. Additionally, it may specify the purpose of the loan and any conditions that must be met by the borrower. Including these details helps to create a comprehensive understanding between both parties.

Is it necessary to have a lawyer review the Illinois Loan Agreement form?

Illinois Loan Agreement: Usage Steps

Once you have the Illinois Loan Agreement form in hand, it’s time to fill it out accurately. This form is essential for documenting the terms of a loan between a lender and a borrower. Following the steps below will help ensure that all necessary information is included and correctly formatted.

- Begin by entering the date at the top of the form.

- In the first section, write the full name and address of the lender. Make sure to include any relevant contact information.

- Next, provide the full name and address of the borrower. Include their contact information as well.

- Specify the loan amount in the designated field. Be clear and precise with the figures.

- Indicate the interest rate that will apply to the loan. This is typically expressed as a percentage.

- Fill in the loan term, which is the duration over which the borrower will repay the loan. Specify whether it’s in months or years.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, bi-weekly) and the due date for the first payment.

- Include any late fees or penalties that will apply if payments are not made on time.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are clear and legible.

After completing the form, review it carefully to confirm that all information is accurate. Both the lender and borrower should keep a copy for their records. This documentation will be crucial for any future reference regarding the loan.