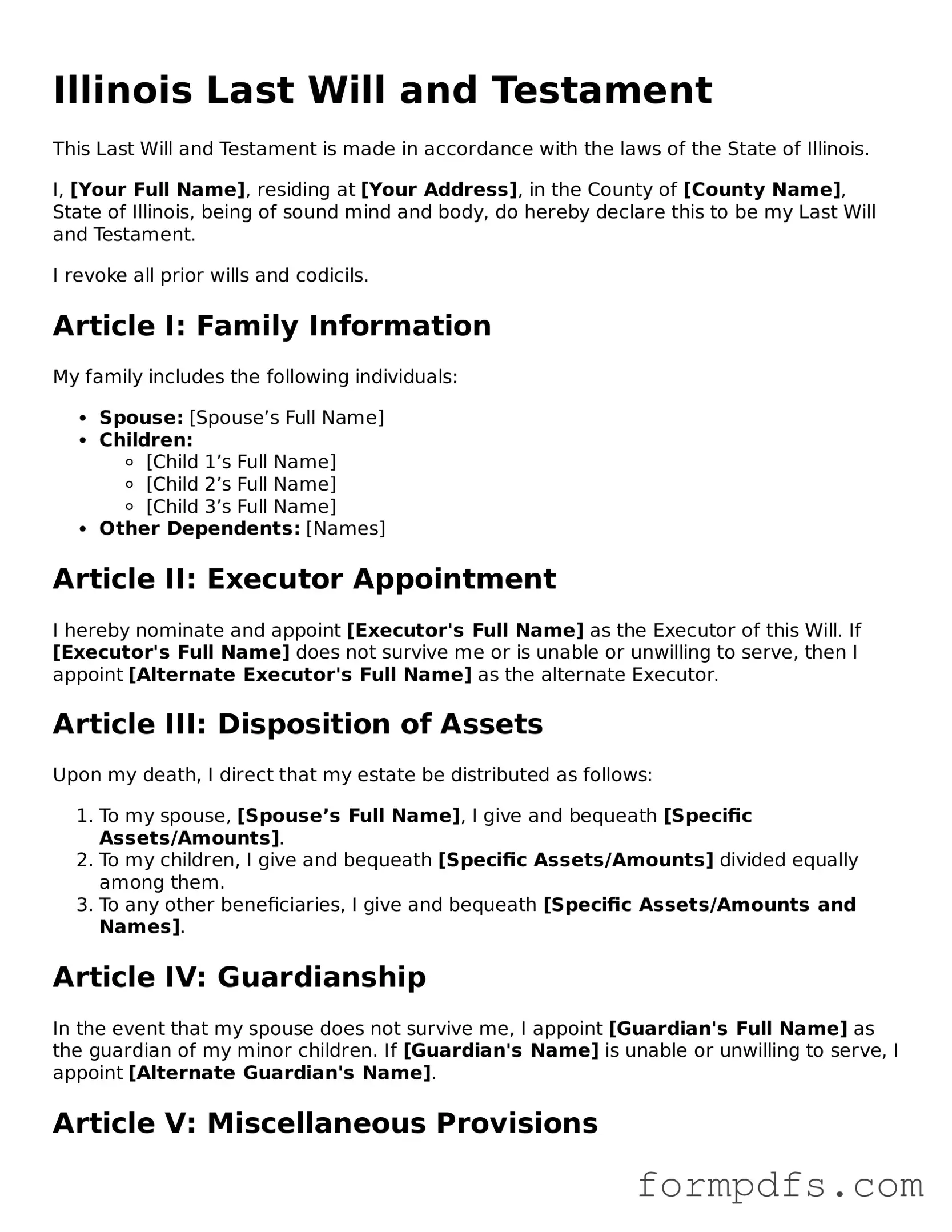

Printable Last Will and Testament Form for the State of Illinois

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Illinois, this legal document serves as a roadmap for distributing your assets, appointing guardians for minor children, and designating an executor to manage your estate. The form outlines essential details such as the names of beneficiaries, specific bequests, and any conditions attached to the distribution of your property. Additionally, it includes provisions for revoking any previous wills, ensuring that your most current intentions are clear. Understanding the components of the Illinois Last Will and Testament form can help individuals make informed decisions about their estate planning, allowing for peace of mind knowing that loved ones will be taken care of according to their wishes. This document not only reflects personal desires but also adheres to the legal standards set by the state, providing a structured approach to what can often be a complex process.

Check out Other Common Last Will and Testament Templates for Different States

Last Will and Testament Template Georgia - Provides families with guidance, reducing potential conflicts during grieving.

To facilitate your transactions, it is important to understand the significance of an "easy-to-use ATV Bill of Sale" that provides clear details about the sale and transfer of your vehicle in California, ensuring all legal requirements are satisfactorily met. For more information, visit this resource.

Nc Will Template - A will can help ensure a smooth transition of wealth from one generation to the next.

Documents used along the form

When preparing a Last Will and Testament in Illinois, several other documents may be needed to ensure that your estate planning is comprehensive and effective. Each of these documents serves a unique purpose and can help clarify your wishes and protect your interests. Below is a list of commonly used forms and documents that complement a Last Will and Testament.

- Durable Power of Attorney: This document allows you to appoint someone to make financial decisions on your behalf if you become incapacitated.

- Healthcare Power of Attorney: This form designates a person to make medical decisions for you when you are unable to do so.

- Living Will: A living will outlines your preferences for medical treatment and end-of-life care, guiding your healthcare providers and loved ones.

- Revocable Living Trust: This legal entity holds your assets during your lifetime and specifies how they should be distributed after your death, often avoiding probate.

- Address Change California Form: It is essential to promptly report any changes to your address to maintain accurate records with the California Board of Accountancy. For more information, you can visit All California Forms, which provides access to the necessary forms and details regarding the address change process.

- Beneficiary Designations: These forms specify who will receive certain assets, such as life insurance policies and retirement accounts, upon your death.

- Pet Trust: This document ensures that your pets are cared for according to your wishes after you pass away.

- Letter of Instruction: Although not a legal document, this letter provides guidance to your loved ones regarding your wishes, funeral arrangements, and other personal matters.

- Affidavit of Heirship: This document helps establish the identity of heirs and can simplify the transfer of property when someone dies without a will.

- Guardianship Designation: If you have minor children, this document allows you to appoint a guardian to care for them in the event of your death.

By considering these additional documents, you can create a well-rounded estate plan that addresses various aspects of your life and ensures that your wishes are honored. Each document plays a crucial role in protecting your interests and those of your loved ones.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Last Will and Testament is governed by the Illinois Probate Act (760 ILCS 5). |

| Legal Age | Individuals must be at least 18 years old to create a valid will in Illinois. |

| Witness Requirement | A will must be signed by at least two witnesses who are present at the same time. |

| Revocation | A will can be revoked by creating a new will or by destroying the original document. |

| Holographic Wills | Illinois recognizes holographic wills, which are handwritten and signed by the testator. |

| Executor Appointment | The testator can appoint an executor to manage the estate and ensure the will is carried out. |

| Probate Process | Wills typically go through probate, a legal process to validate the will and distribute assets. |

More About Illinois Last Will and Testament

What is a Last Will and Testament in Illinois?

A Last Will and Testament is a legal document that outlines how a person’s assets and property should be distributed after their death. It can also designate guardians for minor children and specify final wishes regarding funeral arrangements. In Illinois, having a valid will can help ensure that your wishes are honored and can simplify the probate process for your loved ones.

Who can create a Last Will and Testament in Illinois?

In Illinois, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that the individual must understand the nature of their actions and the consequences of creating a will. It is important to ensure that the will reflects the true intentions of the individual.

What are the requirements for a valid will in Illinois?

For a will to be considered valid in Illinois, it must be in writing and signed by the testator (the person making the will). Additionally, it should be witnessed by at least two individuals who are present at the same time. These witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest.

Can I change or revoke my will in Illinois?

Yes, you can change or revoke your will at any time while you are still alive. To make changes, you can create a new will or add a codicil, which is an amendment to the existing will. If you wish to revoke your will completely, you can do so by destroying it or stating your intention to revoke in writing.

What happens if I die without a will in Illinois?

If a person dies without a will, they are considered to have died "intestate." In this case, Illinois law dictates how the deceased person's assets will be distributed. Generally, assets will be divided among surviving relatives according to a predetermined hierarchy, which may not align with the deceased’s wishes.

Can I write my own will in Illinois?

Yes, you can write your own will in Illinois, known as a holographic will. However, it must be entirely in your handwriting and signed by you. While it is legal, it is often recommended to seek legal advice to ensure that the will meets all necessary requirements and accurately reflects your intentions.

Is it necessary to have an attorney to create a will in Illinois?

While it is not legally required to have an attorney to create a will in Illinois, consulting one can be beneficial. An attorney can provide guidance on legal requirements, help clarify your wishes, and ensure that your will is properly executed to avoid potential disputes or complications in the future.

How can I ensure my will is properly executed?

To ensure your will is properly executed, follow Illinois requirements: sign the will in front of two witnesses who are not beneficiaries. Keep the original document in a safe place and inform your loved ones of its location. Additionally, consider discussing your wishes with your family to prevent misunderstandings.

What should I include in my will?

In your will, you should include details about how you want your assets distributed, who will be the executor of your estate, and any guardianship arrangements for minor children. It is also wise to specify any personal wishes, such as funeral arrangements or specific bequests to individuals or charities.

How do I make my will official?

Your will becomes official once it is signed and witnessed according to Illinois law. It is advisable to store the original document in a secure place, such as a safe deposit box or with an attorney. Informing your executor and family members about its location can help ensure that your wishes are carried out smoothly after your passing.

Illinois Last Will and Testament: Usage Steps

Filling out your Illinois Last Will and Testament form is an important step in ensuring your wishes are carried out after your passing. Once you've completed the form, you'll need to sign it in the presence of witnesses and possibly a notary, depending on your preferences. This ensures that your will is legally valid and recognized by the state.

- Begin by gathering all necessary information, including your full name, address, and date of birth.

- Identify your beneficiaries. List the names and addresses of those you wish to inherit your assets.

- Decide on an executor. This person will be responsible for carrying out the terms of your will. Include their name and contact information.

- Clearly specify how you want your assets distributed. Be detailed to avoid any confusion.

- Include any specific bequests, such as personal items or monetary gifts, to particular individuals.

- Consider including provisions for guardianship if you have minor children.

- Review the form for accuracy. Ensure all names, dates, and details are correct.

- Sign the document in front of at least two witnesses. They must be present when you sign.

- Have your witnesses sign the will as well, including their names and addresses.

- Optionally, you may choose to have the will notarized for added legal protection.