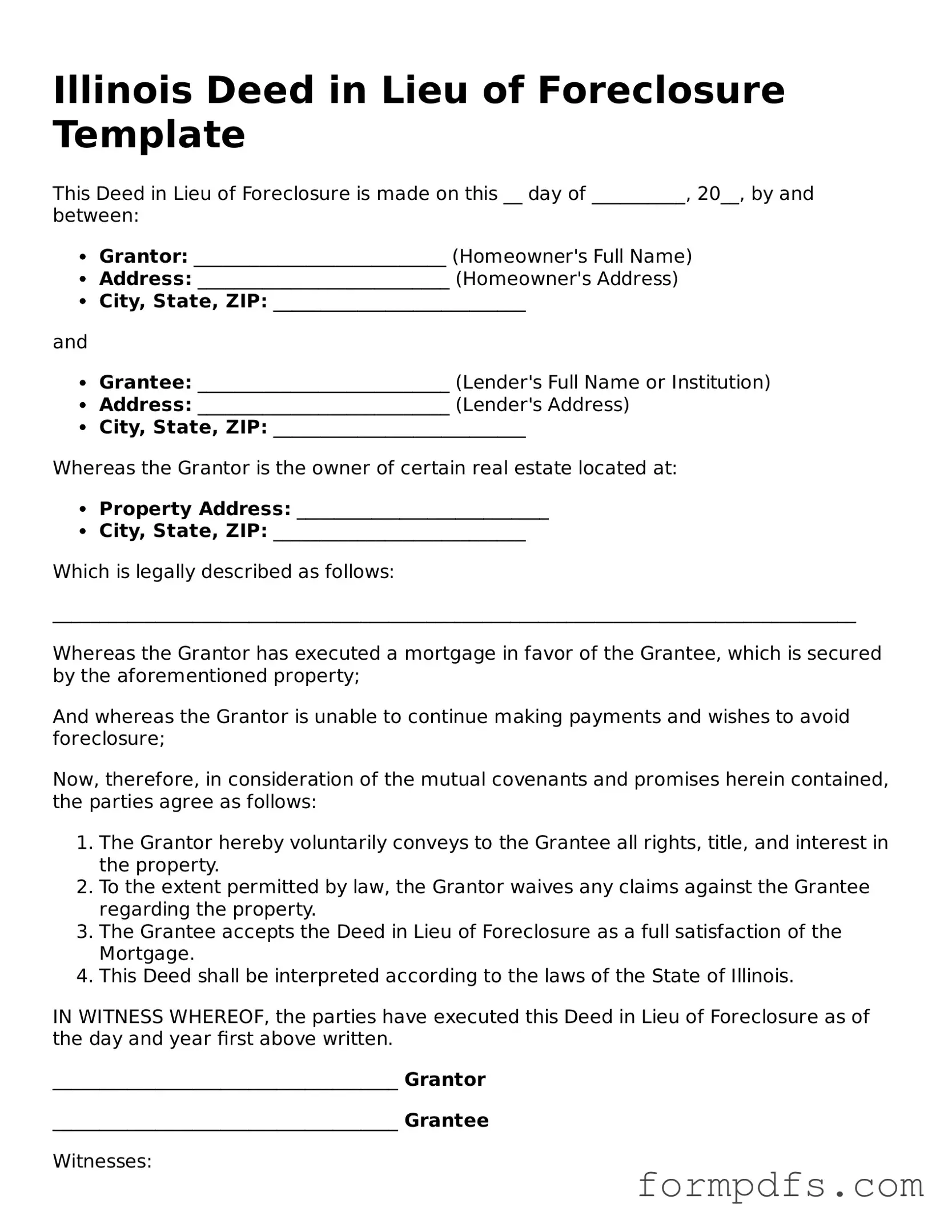

Printable Deed in Lieu of Foreclosure Form for the State of Illinois

In the state of Illinois, homeowners facing financial difficulties may find relief through the Deed in Lieu of Foreclosure process. This option allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often stressful foreclosure process. By signing the Deed in Lieu of Foreclosure form, the homeowner can settle their mortgage obligations more amicably, often resulting in a smoother transition for both parties involved. The form outlines essential details such as the property description, the parties involved, and the terms of the transfer. It is important to note that this process typically requires the lender's agreement and may involve negotiations regarding any remaining debt. Understanding the implications of this form can empower homeowners to make informed decisions about their financial futures, offering a potential path to regain stability and peace of mind.

Check out Other Common Deed in Lieu of Foreclosure Templates for Different States

Georgia Foreclosure - A Deed in Lieu can pave the way for a fresh start after financial difficulties.

When navigating the process of acquiring a driver's license or identification card in California, it is essential to familiarize yourself with the necessary paperwork, notably the Ca DMV DL 44 form. This form serves multiple purposes, including new applications, renewals, and modifications like name changes or driving classification updates. To ensure a smooth application process, applicants must provide accurate and comprehensive information, particularly regarding personal details and any changes in voter registration or organ donation preferences. For additional assistance, you can find helpful resources at All California Forms.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender in order to avoid foreclosure. Along with this form, several other documents may be necessary to complete the process. Below is a list of commonly used forms and documents that often accompany the Illinois Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the loan if the lender agrees to modify the existing mortgage instead of proceeding with foreclosure.

- Notice of Default: A formal notice sent to the borrower indicating that they have defaulted on their mortgage payments and outlining the consequences.

- Property Inspection Report: A report detailing the condition of the property, which the lender may require to assess its value before accepting the deed.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the deed is transferred to the lender.

- Trailer Bill of Sale Form: When purchasing or selling a trailer, utilize the necessary trailer bill of sale documentation to ensure a legal and smooth transaction.

- Title Search Report: A report that verifies the ownership of the property and checks for any liens or claims against it, ensuring the lender receives clear title.

- Affidavit of Title: A sworn statement by the borrower confirming their ownership of the property and that there are no undisclosed claims against it.

- Authorization to Release Information: A form that allows the lender to obtain necessary information from third parties, such as credit agencies or previous lenders.

- Closing Statement: A document that summarizes the financial aspects of the transaction, including any fees or costs associated with the deed transfer.

- Settlement Agreement: A document outlining any terms and conditions agreed upon by both parties regarding the transfer of the property.

- Deed of Trust: A legal document that secures a loan by transferring the title of the property to a trustee until the loan is paid off.

Each of these documents plays a crucial role in the process of transferring property ownership and ensuring that both parties are protected. It is important to have all necessary paperwork in order to facilitate a smooth transaction and avoid potential legal issues.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document in which a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The Illinois Deed in Lieu of Foreclosure is governed by the Illinois Compiled Statutes, specifically 735 ILCS 5/15-1401 et seq. |

| Eligibility | To qualify, the borrower must be experiencing financial hardship and must have no other liens on the property that the lender would not agree to subordinate. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process while allowing them to walk away from the property with less damage to their credit score. |

| Process | The borrower must submit a request to the lender, which includes financial documentation. If approved, the lender will prepare the deed for the borrower to sign. |

| Tax Implications | Borrowers may face tax consequences if the lender forgives any debt. It is advisable to consult a tax professional before proceeding. |

| Impact on Credit | A deed in lieu of foreclosure is generally less damaging to a borrower’s credit score than a foreclosure, but it will still have a negative impact. |

More About Illinois Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Illinois?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure. Instead of going through the lengthy and often stressful foreclosure process, homeowners can negotiate with their lender to hand over the property. This option can help protect the homeowner's credit score and may provide a smoother transition out of the home.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure generally depends on the lender’s policies and the homeowner's financial situation. Typically, homeowners facing financial hardship, such as job loss or medical expenses, may qualify. However, the property must be free of other liens, and the homeowner must be willing to surrender the property voluntarily. Lenders will often require documentation of the homeowner’s financial situation to assess eligibility.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Opting for a Deed in Lieu of Foreclosure can provide several advantages. Firstly, it may minimize the impact on the homeowner's credit score compared to a traditional foreclosure. Secondly, it allows for a more dignified exit from the property, as the process is typically quicker and less adversarial. Homeowners may also be able to negotiate terms with the lender, such as the possibility of remaining in the home for a short period after the deed transfer.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides to consider. One significant drawback is that homeowners may still face tax implications. The IRS may consider any forgiven debt as taxable income, which could lead to a tax bill. Additionally, lenders may not accept a Deed in Lieu if the property has other liens, making the process more complicated. Homeowners should carefully weigh these factors before proceeding.

How does the process of completing a Deed in Lieu of Foreclosure work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will review the homeowner's financial situation and the property’s condition. If both parties agree, the homeowner will sign a deed transferring ownership to the lender. It is crucial to ensure that all paperwork is completed correctly to avoid any legal issues. Consulting with a real estate attorney can help navigate this process smoothly.

Can a Deed in Lieu of Foreclosure affect future home buying?

Yes, a Deed in Lieu of Foreclosure can impact future home buying. While it is generally less damaging to credit than a foreclosure, it can still remain on the homeowner's credit report for several years. This record may make it more challenging to qualify for a mortgage in the future. However, many lenders may consider the circumstances surrounding the deed and the homeowner's overall credit profile when making lending decisions.

Illinois Deed in Lieu of Foreclosure: Usage Steps

After completing the Illinois Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties, typically your lender. They will review the form and initiate the process of transferring ownership of the property. It's important to keep a copy for your records and follow up to ensure everything is processed correctly.

- Obtain the Illinois Deed in Lieu of Foreclosure form. You can find it online or request it from your lender.

- Fill in the property address. Make sure to include the full address, including city, state, and zip code.

- Provide the name of the current property owner. This should be the name(s) of the person(s) who hold the title to the property.

- Enter the name of the lender or mortgage company. This is the financial institution that holds the mortgage on the property.

- Indicate the date of the deed execution. This is the date you are signing the document.

- Sign the form. Ensure that you sign in the designated area, and if there are multiple owners, all must sign.

- Have the signature(s) notarized. This step is essential for verifying the authenticity of the signatures.

- Submit the completed form to your lender. You may want to keep a copy for your records.