Printable Deed Form for the State of Illinois

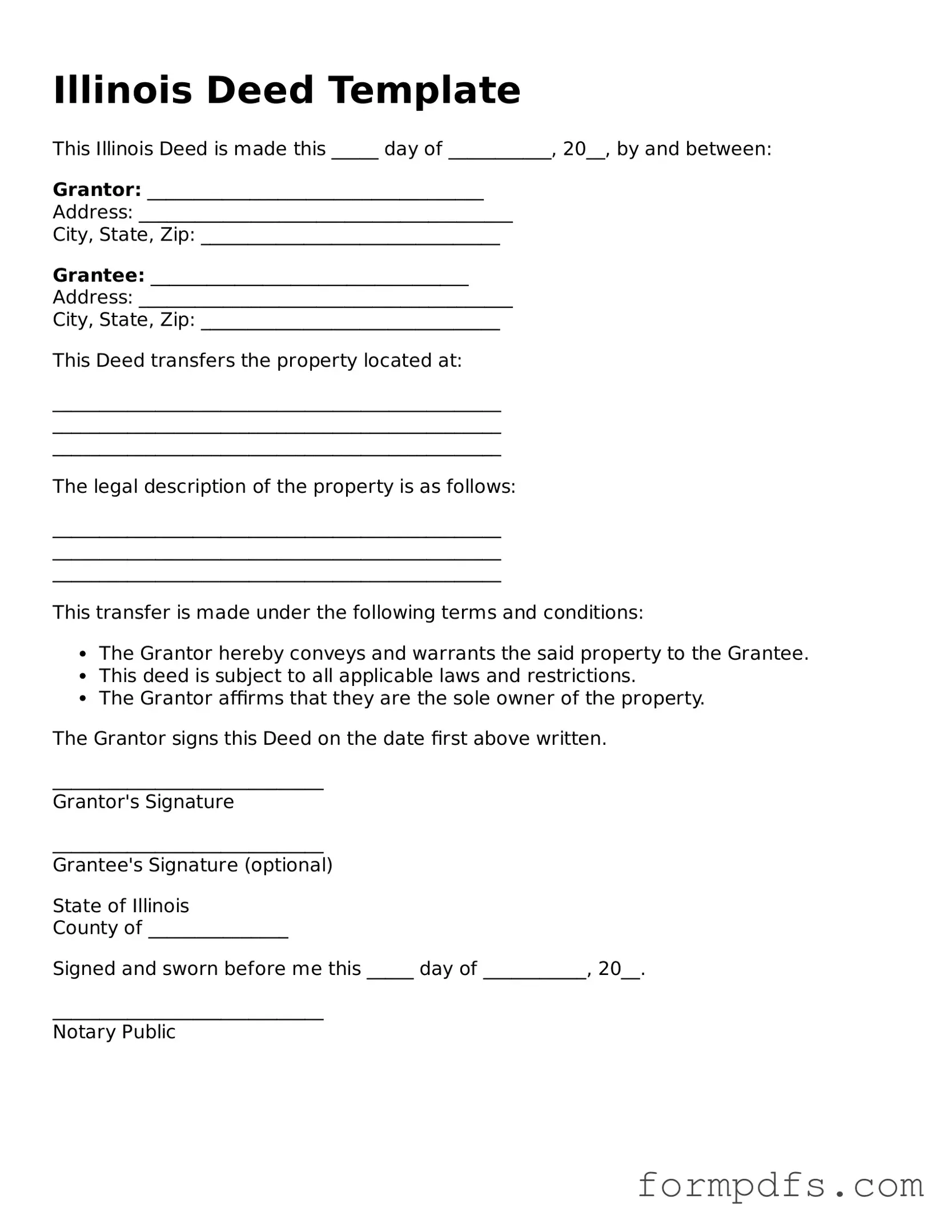

When engaging in real estate transactions in Illinois, understanding the Illinois Deed form is essential. This legal document serves as a critical tool for transferring property ownership from one party to another. The form encompasses several key elements, including the names of the grantor (the seller) and grantee (the buyer), a detailed description of the property being transferred, and the signature of the grantor. Additionally, the Illinois Deed form may require notarization to validate the transaction and ensure that it complies with state regulations. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving distinct purposes and offering varying levels of protection for the parties involved. Familiarity with these aspects not only streamlines the transfer process but also helps safeguard the interests of both buyers and sellers in the complex world of real estate. Understanding the nuances of this form can lead to smoother transactions and fewer legal complications down the line.

Check out Other Common Deed Templates for Different States

Georgia Quit Claim Deed - A deed can be used for residential, commercial, or agricultural properties.

What Does a Deed Look Like in Michigan - Can specify conditions or limitations on the property use.

For those looking to navigate the complexities of legal documentation in California, understanding the California Judicial Council form and its various components is crucial. Particularly, the MC-020 form serves as an invaluable resource, allowing parties to attach essential information to their filings. To ensure you have access to the most current information and resources, you can check out All California Forms, which provides a comprehensive overview of available forms and their uses.

Property Deed Form - Execute the deed according to your state’s specific legal guidelines.

Documents used along the form

When dealing with property transactions in Illinois, a deed form is just one piece of the puzzle. Several other documents are typically used alongside the deed to ensure a smooth transfer of ownership and to comply with legal requirements. Below is a list of commonly used forms and documents in conjunction with the Illinois Deed form.

- Title Insurance Policy: This document protects the buyer from any claims against the property that may arise after the purchase. It ensures that the buyer has clear ownership and can provide peace of mind regarding any potential issues with the title.

- Property Transfer Tax Declaration: This form is required to report the transfer of property and to calculate any applicable transfer taxes. It provides information about the sale price and the parties involved in the transaction.

- Affidavit of Title: This sworn statement confirms that the seller has the legal right to sell the property and discloses any known liens or encumbrances. It serves to assure the buyer of the seller’s ownership and the condition of the title.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document outlines all the financial details of the transaction, including fees, taxes, and the final amount due at closing. It provides transparency for both the buyer and seller.

- Bill of Sale: In cases where personal property is included in the sale, a bill of sale is used to transfer ownership of those items. This document lists the items being sold and serves as proof of the transaction.

- Power of Attorney: If the seller cannot be present at the closing, a power of attorney allows another person to act on their behalf. This document grants specific legal authority to the designated individual to sign necessary documents.

- Articles of Incorporation: Essential for establishing a corporation in New York, this document provides necessary corporate information, including its name and purpose. For more details, refer to smarttemplates.net/fillable-new-york-articles-of-incorporation.

- Lease Agreements: If the property is being sold with existing tenants, lease agreements will be important. They outline the terms of tenancy and help ensure that the buyer understands their obligations regarding current tenants.

Each of these documents plays a crucial role in the property transfer process in Illinois. They help protect the interests of both buyers and sellers, ensuring that all legal requirements are met and that the transaction proceeds smoothly. Understanding these forms can make the process less daunting and more manageable.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Deed form is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Types of Deeds | Common types of deeds in Illinois include Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. |

| Execution Requirements | Deeds must be signed by the grantor and notarized to be valid in Illinois. |

| Recording | To protect ownership rights, the deed should be recorded with the county recorder's office where the property is located. |

| Consideration | Illinois law requires that consideration (the value exchanged) be stated in the deed. |

| Legal Description | A complete legal description of the property must be included in the deed for it to be enforceable. |

| Transfer Tax | Illinois imposes a transfer tax on real estate transactions, which must be paid at the time of recording. |

| Title Insurance | While not mandatory, obtaining title insurance is recommended to protect against potential title issues. |

| Form Availability | Illinois Deed forms can be obtained from legal stationery stores, online legal services, or local government offices. |

More About Illinois Deed

What is an Illinois Deed form?

An Illinois Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Illinois. This form outlines the details of the property being transferred, including its legal description, the names of the grantor (seller) and grantee (buyer), and any conditions or restrictions related to the transfer. It is essential for ensuring that the transfer is legally recognized and recorded with the appropriate county office.

What types of Deeds are available in Illinois?

Illinois offers several types of Deeds, each serving different purposes. The most common include the Warranty Deed, which guarantees that the grantor has clear title to the property; the Quitclaim Deed, which transfers whatever interest the grantor has without warranties; and the Special Warranty Deed, which provides limited warranties only for the time the grantor owned the property. Choosing the right type of Deed depends on the circumstances of the transfer and the level of protection desired by the grantee.

How do I complete an Illinois Deed form?

To complete an Illinois Deed form, start by filling in the names and addresses of both the grantor and grantee. Next, provide a complete legal description of the property, which can usually be found on the property’s tax bill or deed. After that, specify the consideration, or payment, involved in the transfer. Finally, both parties must sign the form in front of a notary public. Once completed, the Deed must be recorded with the county recorder’s office to be effective against third parties.

Are there any fees associated with filing an Illinois Deed?

Yes, there are typically fees associated with filing an Illinois Deed. These fees can vary by county, so it’s important to check with the local recorder’s office for specific amounts. Additionally, there may be transfer taxes that apply based on the value of the property being transferred. It’s advisable to budget for these costs when planning a property transfer to avoid any surprises.

Illinois Deed: Usage Steps

After you have gathered the necessary information, you are ready to fill out the Illinois Deed form. This process requires attention to detail, as accuracy is crucial for the document to be valid. Follow these steps carefully to ensure that all information is correctly entered.

- Begin by writing the date at the top of the form. Use the format month/day/year.

- Identify the grantor, the person transferring the property. Provide their full name and address.

- Next, identify the grantee, the person receiving the property. Include their full name and address as well.

- Describe the property being transferred. This includes the legal description, which can usually be found on the property’s current deed or tax records.

- Indicate the type of deed being used. Common types include warranty deed or quitclaim deed. Select the appropriate option based on your situation.

- Include any special provisions or conditions related to the transfer, if applicable.

- Sign the document in the presence of a notary public. The notary will verify your identity and witness your signature.

- After notarization, ensure that all parties receive a copy of the signed deed for their records.

Once the form is completed and notarized, it is important to file it with the appropriate county recorder’s office. This step finalizes the transfer of property and makes it a matter of public record.