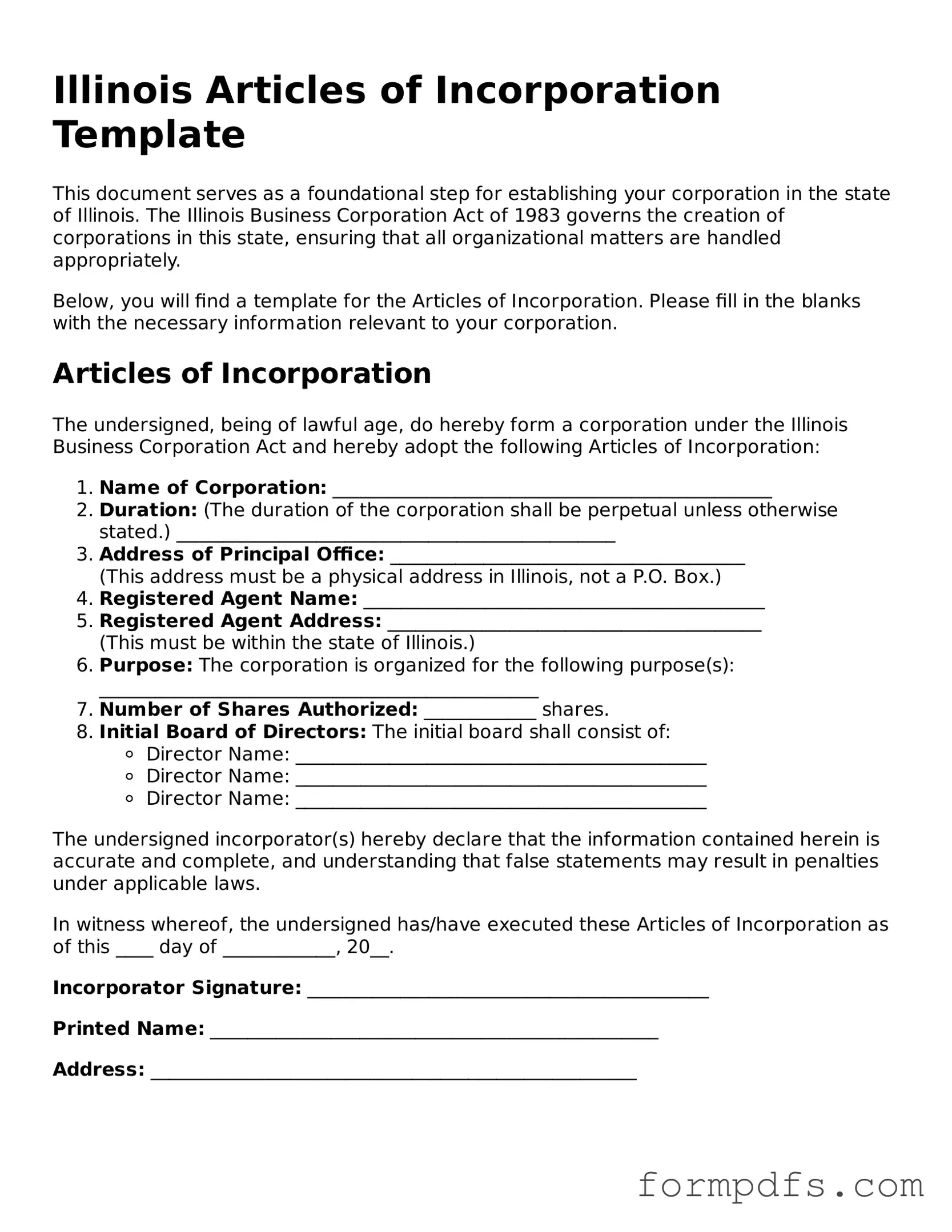

Printable Articles of Incorporation Form for the State of Illinois

The Illinois Articles of Incorporation form serves as a foundational document for individuals and groups seeking to establish a corporation in the state. This form outlines essential information about the corporation, including its name, purpose, and duration. It requires the designation of a registered agent, who will receive legal documents on behalf of the corporation. Additionally, the form mandates the inclusion of the names and addresses of the initial directors, ensuring transparency and accountability from the outset. The Articles also stipulate the number of shares the corporation is authorized to issue, which is crucial for potential investors and stakeholders. By completing and filing this form with the Illinois Secretary of State, founders formally initiate the process of incorporation, granting the corporation legal recognition and the ability to operate as a distinct entity. Understanding the requirements and implications of the Articles of Incorporation is vital for anyone looking to navigate the complexities of business formation in Illinois.

Check out Other Common Articles of Incorporation Templates for Different States

Ohio Llc Fees - A well-prepared Articles of Incorporation helps avoid future conflicts among owners.

Ga Corporation - The document could include provisions for the distribution of profits or dividends.

An Arizona Bill of Sale is a legal document used to transfer ownership of an item from one person to another. This form provides essential details about the transaction, including the parties involved and a description of the item being sold. For a smooth and secure transfer, consider filling out the form by visiting Top Document Templates for more information.

How to Incorporate in Nc - Articles can specify the rights of shareholders.

Documents used along the form

When forming a corporation in Illinois, the Articles of Incorporation are just the beginning. Several other forms and documents are often necessary to complete the incorporation process and ensure compliance with state laws. Below is a list of commonly used documents that you may encounter.

- Bylaws: These are the internal rules that govern how the corporation operates. Bylaws outline the roles and responsibilities of directors, officers, and shareholders, as well as procedures for meetings and decision-making.

- Initial Report: In Illinois, corporations must file an initial report within 60 days of incorporation. This document provides the state with updated information about the corporation, including the names and addresses of officers and directors.

- Employer Identification Number (EIN): This number, issued by the IRS, is essential for tax purposes. It allows the corporation to hire employees, open bank accounts, and file tax returns.

- Business Licenses and Permits: Depending on the nature of the business, various licenses or permits may be required at the local, state, or federal level. These documents ensure that the corporation complies with industry regulations.

- Motorcycle Bill of Sale: For those engaging in motorcycle transactions, the comprehensive Motorcycle Bill of Sale form ensures all ownership transfers are legally documented.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders. It can cover issues such as the transfer of shares, voting rights, and what happens in the event of a shareholder's death or departure.

- Annual Reports: Corporations in Illinois are required to file annual reports with the Secretary of State. These reports provide updated information about the corporation and ensure that it remains in good standing.

Understanding these documents is crucial for anyone looking to establish a corporation in Illinois. Each plays a vital role in ensuring that your business operates smoothly and legally. Taking the time to prepare and file these documents correctly can save you time and trouble down the road.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Articles of Incorporation are governed by the Illinois Business Corporation Act. |

| Purpose | The form is used to officially create a corporation in the state of Illinois. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for forming a corporation in Illinois. |

| Information Needed | The form requires the corporation's name, purpose, and registered agent information. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the state. |

| Processing Time | The processing time for the Articles of Incorporation can vary, typically taking a few business days. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment with the state. |

| Corporate Name | The chosen name must be unique and not already in use by another corporation in Illinois. |

| Initial Directors | The form may require information about the initial directors of the corporation. |

More About Illinois Articles of Incorporation

What are the Articles of Incorporation in Illinois?

The Articles of Incorporation are legal documents that establish a corporation in Illinois. They provide essential information about your business, including its name, purpose, and structure. Filing these documents is a crucial step in the process of forming a corporation in the state.

Who needs to file the Articles of Incorporation?

Anyone looking to create a corporation in Illinois must file the Articles of Incorporation. This includes businesses of all sizes, whether they are small startups or larger enterprises. If you plan to operate as a corporation, this filing is necessary to gain legal recognition.

What information is required in the Articles of Incorporation?

When completing the Articles of Incorporation, you will need to provide several key pieces of information. This includes the name of the corporation, the purpose of the business, the registered agent’s name and address, and the number of shares the corporation is authorized to issue. Additionally, you will need to include the names and addresses of the initial directors.

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation in Illinois either online or by mail. If you choose to file online, you will need to visit the Illinois Secretary of State’s website. For mail submissions, you can download the form, complete it, and send it to the appropriate office along with the required filing fee.

What is the filing fee for the Articles of Incorporation in Illinois?

The filing fee for the Articles of Incorporation in Illinois is typically around $150, but it may vary depending on specific circumstances or additional services requested. It’s always a good idea to check the Illinois Secretary of State’s website for the most current fee information before submitting your application.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If changes are necessary, such as altering the corporation's name or increasing the number of shares, you must file an amendment with the Illinois Secretary of State. This ensures that your corporation’s records remain accurate and up to date.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation can vary. Typically, if filed online, you might receive confirmation within a few business days. Mail submissions may take longer, often up to several weeks. To ensure timely processing, consider filing online if possible.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, your corporation is officially formed. You will receive a certificate of incorporation, which serves as proof of your business's legal existence. After this, you can proceed with obtaining necessary licenses, setting up bank accounts, and conducting business activities.

Do I need an attorney to file the Articles of Incorporation?

While it is not required to hire an attorney to file the Articles of Incorporation, many people choose to do so for guidance and to ensure compliance with all legal requirements. If you feel comfortable navigating the process on your own, you can complete the filing without legal assistance.

What is a registered agent, and why do I need one?

A registered agent is an individual or business entity designated to receive legal documents on behalf of your corporation. In Illinois, having a registered agent is mandatory. This ensures that your corporation has a reliable point of contact for important legal communications, helping to maintain good standing with the state.

Illinois Articles of Incorporation: Usage Steps

Once you have the Illinois Articles of Incorporation form, you will be ready to fill it out. Completing this form accurately is crucial for establishing your corporation. Follow the steps below to ensure you provide all necessary information correctly.

- Obtain the Form: Download the Illinois Articles of Incorporation form from the Illinois Secretary of State's website or request a physical copy.

- Enter the Corporation Name: Write the name of your corporation. Make sure it is unique and complies with Illinois naming requirements.

- Provide the Registered Agent Information: Fill in the name and address of your registered agent. This person or entity will receive legal documents on behalf of the corporation.

- List the Incorporators: Include the names and addresses of the individuals who are forming the corporation. This can be one or more people.

- State the Purpose: Describe the business activities your corporation will engage in. Be clear and concise.

- Specify the Duration: Indicate whether the corporation will exist indefinitely or for a specific period.

- Provide Additional Provisions: If applicable, include any additional information or provisions relevant to your corporation.

- Sign and Date: The incorporators must sign and date the form. Ensure that all signatures are in place.

- Submit the Form: Send the completed form to the Illinois Secretary of State's office along with the required filing fee.

After submitting the Articles of Incorporation, you will receive confirmation of your filing. Keep this confirmation for your records, as it serves as proof that your corporation has been established in Illinois. You may also want to consider obtaining an Employer Identification Number (EIN) from the IRS for tax purposes.