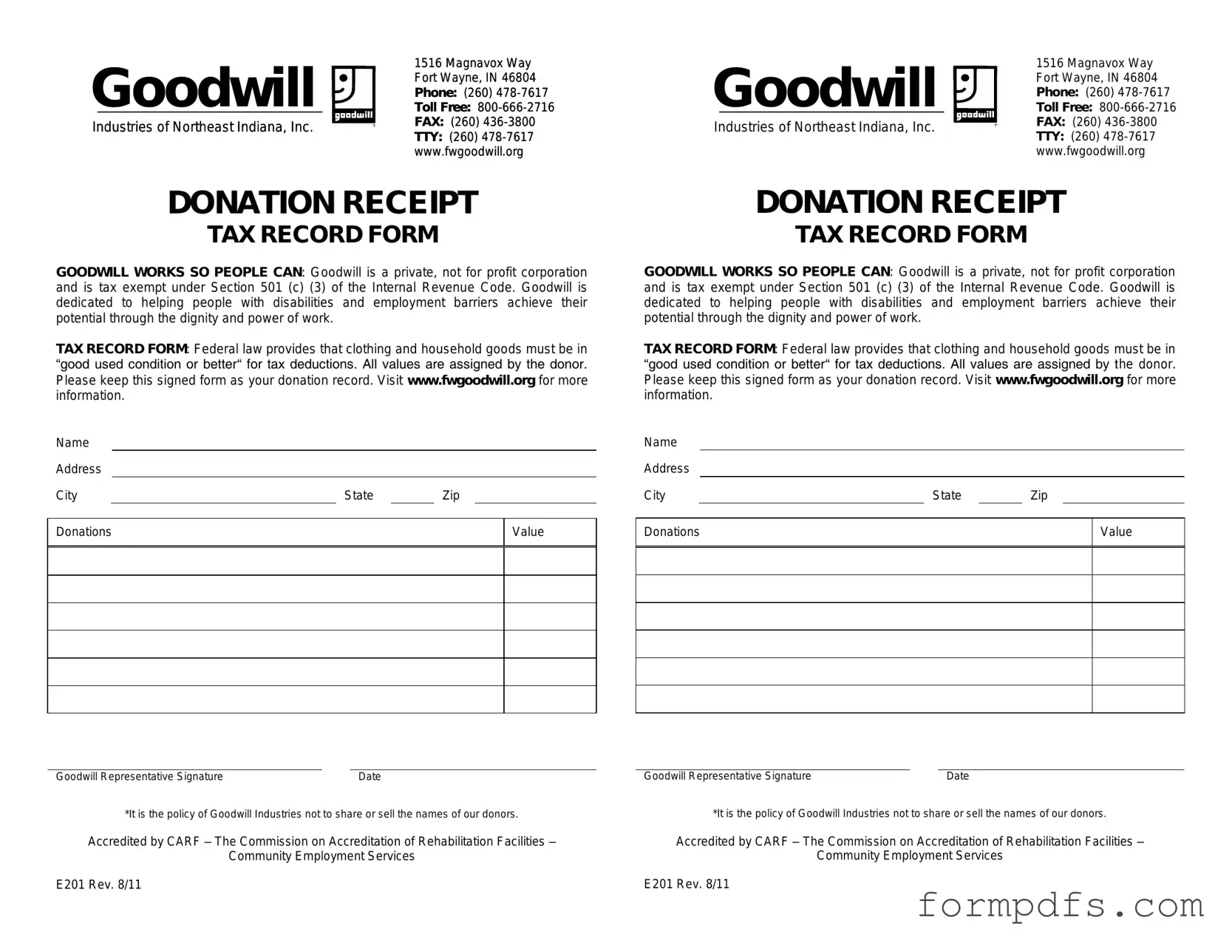

Blank Goodwill donation receipt PDF Form

When you donate items to Goodwill, you not only support a worthy cause but also gain the opportunity to claim a tax deduction. To facilitate this process, Goodwill provides a donation receipt form, which serves as proof of your contribution. This form typically includes essential details such as your name, the date of the donation, and a description of the items donated. It's important to note that while the receipt acknowledges your donation, it does not assign a specific value to the items. Instead, it’s up to you to determine the fair market value of what you’ve given. Additionally, the form may offer guidance on how to estimate the value of your donations, ensuring you have the necessary information for tax purposes. Keeping this receipt is crucial, as the IRS requires documentation for any deductions claimed on your tax return. Understanding the nuances of the Goodwill donation receipt form can enhance your giving experience and maximize your potential tax benefits.

More PDF Templates

Megger Test Report - It can be utilized for future reference during similar projects.

For those navigating legal processes, the essential Affidavit of Service documentation can be crucial in ensuring that all parties receive necessary court documents. You can find more information about this important form at a reliable source offering the Affidavit of Service guidelines.

Form 14653 - Change in information, such as mailing address changes, must be updated to reflect accurate records.

Roof Inspection Reports - Accessibility of this inspection form is essential for all stakeholders.

Documents used along the form

When donating items to Goodwill, several forms and documents may accompany the Goodwill donation receipt. Each of these documents serves a specific purpose, helping both the donor and the organization maintain clear records. Below is a list of common forms and documents that you might encounter.

- Donation Inventory List: This list details all the items donated, including descriptions and estimated values. It helps donors keep track of what they gave and can be useful for tax purposes.

- Tax Deduction Worksheet: This worksheet assists donors in calculating the potential tax deductions for their charitable contributions. It outlines the rules and limits for deductions based on the value of the donated items.

- Charitable Contribution Form: This form is often used to report donations on tax returns. It may include information about the donor, the charity, and the value of the donated items.

- Commercial Lease Agreement Form: This form is crucial for businesses entering rental agreements, ensuring both landlord and tenant understand their rights and responsibilities. For comprehensive resources, refer to All California Forms.

- Appraisal Form: If the donated items are of significant value, an appraisal form may be necessary. This form provides an official assessment of the item's worth, which can be important for tax deductions.

- Thank You Letter: Goodwill often sends a thank you letter to donors. This letter acknowledges the donation and may include details about how the items will be used to support the community.

- Nonprofit Status Verification: This document confirms that Goodwill is a registered nonprofit organization. It can provide assurance to donors about the legitimacy of their contributions.

- Drop-off Log: When items are dropped off at a Goodwill location, a drop-off log may be used to record the date, time, and type of items donated. This helps maintain accurate records for both the donor and Goodwill.

- Donation Agreement: In some cases, a donation agreement may be signed, outlining the terms of the donation. This can clarify expectations and responsibilities for both parties.

- Item Condition Guide: This guide helps donors assess the condition of their items before donating. It provides criteria for what is acceptable and what may not be suitable for donation.

These forms and documents work together to ensure that the donation process is smooth and transparent. Keeping organized records can help both donors and Goodwill maximize the benefits of charitable giving.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Goodwill donation receipt form is used to document charitable contributions for tax purposes. |

| Tax Deduction | Donors can claim a tax deduction for the fair market value of donated items. |

| Itemization | Donors should list each item donated on the receipt for accurate reporting. |

| Value Estimation | It is the donor's responsibility to determine the fair market value of the items. |

| State-Specific Forms | Some states may have specific requirements for donation receipts, including California and New York. |

| IRS Guidelines | The IRS provides guidelines on how to value and report donated items. |

| Non-Cash Donations | Non-cash donations over $500 require additional IRS Form 8283. |

| Record Keeping | Donors should keep a copy of the receipt for their tax records. |

| Goodwill's Role | Goodwill provides the receipt upon request at the time of donation. |

| Expiration | The receipt does not expire but should be retained as long as needed for tax purposes. |

More About Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided by Goodwill Industries to individuals who donate items. This form serves as a record of the donation and can be used for tax purposes. It typically includes details such as the date of the donation, a description of the items donated, and the donor’s information.

Why do I need a donation receipt?

A donation receipt is essential for tax purposes. When you donate to a qualified charitable organization like Goodwill, you may be eligible for a tax deduction. The receipt acts as proof of your contribution, which the IRS requires if you plan to claim a deduction on your tax return.

How do I obtain a Goodwill donation receipt?

When you make a donation at a Goodwill location, you will typically receive a donation receipt on-site. If you forget to ask for one, you can request it from a staff member. For larger donations or if you are donating items through a pickup service, you can also request a receipt during the scheduling process.

What information is included on the receipt?

The receipt usually includes the donor’s name, address, the date of the donation, a list of the donated items, and a statement indicating that no goods or services were provided in exchange for the donation. This information is vital for accurately reporting your donation to the IRS.

Can I estimate the value of my donated items?

Yes, donors are allowed to estimate the fair market value of their donated items. Goodwill provides guidelines and resources to help you determine the value. However, it’s important to remember that the IRS requires you to be reasonable in your valuation. For high-value items, consider obtaining a professional appraisal.

What if I lose my donation receipt?

If you lose your donation receipt, you can contact the Goodwill location where you made your donation. While they may not be able to provide a duplicate receipt, they can often help you verify your donation through their records. It’s a good practice to keep a copy of your receipt in a safe place for future reference.

Are there any limits on the amount I can deduct for my donations?

There are limits on the amount you can deduct, which depend on your adjusted gross income (AGI) and the type of property donated. Generally, you can deduct up to 50% of your AGI for cash donations and 30% for donations of appreciated property. For specific guidance, consult a tax professional or refer to IRS guidelines.

Goodwill donation receipt: Usage Steps

After gathering your items for donation, it's time to fill out the Goodwill donation receipt form. This form will help you keep track of your donations for your records, and it may also be useful for tax purposes. Follow the steps below to complete the form accurately.

- Begin by writing the date of your donation at the top of the form.

- Next, fill in your name and address in the designated fields. Make sure to include your full name, street address, city, state, and ZIP code.

- List the items you are donating. Be specific about each item, and if possible, include the quantity. This can help in case you need to reference the items later.

- Estimate the fair market value of each item. You can do this by considering what similar items sell for at thrift stores or online marketplaces.

- If you have any additional notes about the items or your donation, include them in the comments section.

- Finally, sign and date the form to confirm your donation.

Once you have completed the form, keep a copy for your records. This will be helpful for future reference or if you need to verify your donation later. You can then drop off your items at your local Goodwill location.