Blank Gift Letter PDF Form

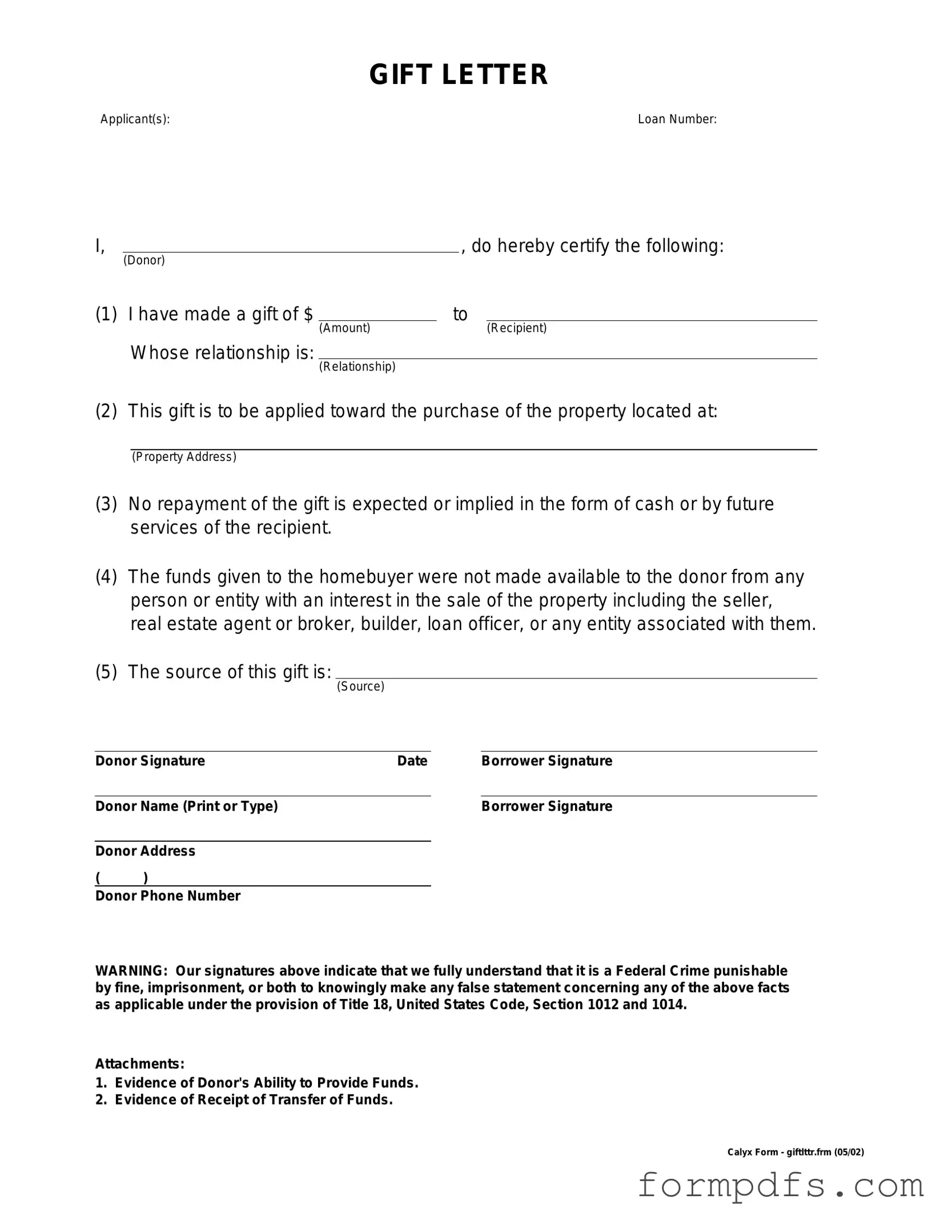

The Gift Letter form plays a crucial role in various financial transactions, particularly in the realm of real estate. When individuals receive monetary gifts to assist with a home purchase, a Gift Letter serves as an official document that outlines the nature of the gift. This form typically includes essential details such as the donor's name, the recipient's name, the amount of the gift, and a statement affirming that the funds are indeed a gift and not a loan. By clarifying that the money does not require repayment, the Gift Letter helps lenders assess the borrower’s financial situation more accurately. Additionally, it often includes the donor's relationship to the recipient, which can further validate the legitimacy of the gift. The form is not only a formality but also a protective measure for both parties involved, ensuring transparency and compliance with lending regulations. Understanding the significance of this document can facilitate smoother transactions and foster trust among all parties involved.

More PDF Templates

Form 589 - The I-589 form is an essential tool for those seeking safety and security in the U.S.

In New York State, when engaging in the purchase or sale of a dirt bike, it is essential to utilize a New York Dirt Bike Bill of Sale form to safeguard your investment and confirm the transaction has taken place. This document serves as a vital record that protects both the buyer and seller in case of future disputes. More information on how to obtain this form can be found at https://smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale.

96well Plate - This form is designed for multiple samples.

Documents used along the form

When it comes to securing a mortgage or financing a home purchase, a Gift Letter form is often required to document monetary gifts used for the down payment. However, several other forms and documents may also be necessary to ensure a smooth transaction. Below is a list of commonly used documents that complement the Gift Letter.

- Bank Statements: These statements provide proof of the donor's ability to give the gift. Lenders may want to see recent bank statements to verify that the funds are available and legitimate.

- Gift Tax Return (Form 709): If the gift exceeds a certain amount, the donor may need to file a gift tax return. This document reports the gift to the IRS and ensures compliance with tax regulations.

- Address Change Form: To maintain up-to-date contact information with lenders and other parties, it is important to submit an All California Forms when you change your address, as this keeps your records accurate and ensures you receive all necessary communications.

- Source of Funds Documentation: Lenders often require evidence of where the funds for the gift originated. This could include pay stubs, tax returns, or other financial documents that establish the donor's financial situation.

- Loan Application (Form 1003): This standard mortgage application form collects essential information about the borrower, including income, debts, and assets, providing a comprehensive view of their financial health.

- Purchase Agreement: This document outlines the terms of the sale between the buyer and seller. It is crucial for lenders to understand the specifics of the transaction.

- Credit Report: A credit report gives lenders insight into the borrower's credit history and financial responsibility. It is a key factor in determining loan eligibility and interest rates.

- Title Insurance Policy: This policy protects against potential disputes over property ownership. Lenders typically require it to ensure that the title is clear before finalizing the loan.

- Closing Disclosure: Provided at least three days before closing, this document details the final terms of the loan, including costs and fees, allowing the borrower to review the financial aspects of the transaction.

Understanding these documents can help streamline the home buying process and ensure that all parties are well-informed. Being prepared with the necessary paperwork can make a significant difference in achieving a successful transaction.

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Gift Letter is a document that verifies a monetary gift, often used in real estate transactions. |

| Purpose | It serves to confirm that the funds provided are a gift and not a loan, which can affect mortgage eligibility. |

| Common Use | Typically utilized by homebuyers receiving financial assistance from family members or friends. |

| Required Information | The letter usually includes the donor's name, the recipient's name, the amount gifted, and a statement of intent. |

| State-Specific Forms | Some states may have specific requirements for gift letters; it's essential to check local laws. |

| Governing Laws | In states like California, gift letters must comply with the California Civil Code regarding gift transactions. |

| Signature Requirement | Donors are often required to sign the letter to validate the gift and provide authenticity. |

| Tax Implications | Gifts above a certain threshold may have tax implications for the donor, which should be considered. |

| Documentation | It is advisable to keep a copy of the gift letter for personal records and future reference. |

More About Gift Letter

What is a Gift Letter form?

A Gift Letter form is a document used to confirm that a financial gift is being given to an individual, typically for the purpose of purchasing a home. This letter serves as proof that the funds are a gift and not a loan, which can be crucial for mortgage approval. It helps lenders understand the source of the down payment funds and ensures transparency in the transaction.

Who needs to provide a Gift Letter?

Generally, the person giving the gift, often a family member, must provide the Gift Letter. This letter is important for the borrower to submit to their lender as part of the mortgage application process. It helps clarify that the money does not need to be repaid, thereby reducing the borrower’s debt-to-income ratio.

What information should be included in a Gift Letter?

A well-crafted Gift Letter should include several key pieces of information. It should state the donor’s name, address, and relationship to the recipient. Additionally, it should specify the amount of the gift and confirm that the funds are a gift, not a loan. The letter should also include the date the gift was given and the donor’s signature.

Are there any limits on the amount of money that can be gifted?

While there are no federal limits on how much money can be gifted, the IRS does have annual gift tax exclusions. As of 2023, individuals can gift up to $17,000 per recipient without incurring gift tax. If a gift exceeds this amount, the donor may need to file a gift tax return, but it doesn’t necessarily mean they will owe taxes.

Do lenders require a Gift Letter for all types of loans?

Not all lenders require a Gift Letter, but many do, especially for conventional loans and FHA loans. It’s essential to check with the specific lender to understand their requirements. Some lenders may have different policies regarding gifts, so it’s always best to clarify what documentation is needed upfront.

Can a Gift Letter be used for other purposes besides home purchases?

While Gift Letters are most commonly associated with home purchases, they can also be used for other financial transactions where proof of a gift is necessary. This could include funding education, starting a business, or even covering medical expenses. However, the context and requirements may vary depending on the situation.

What happens if the Gift Letter is not provided?

If a Gift Letter is not provided when required, it could delay the mortgage approval process or even result in denial. Lenders need to ensure that the funds used for the down payment are legitimate and do not create additional debt for the borrower. Without this documentation, the lender may question the source of the funds.

Can I use a template for a Gift Letter?

Yes, many templates for Gift Letters are available online, and using one can simplify the process. However, it’s important to customize the template to reflect your specific situation and ensure that all necessary information is included. A personalized letter adds credibility and clarity to the transaction.

Is it necessary for the donor to be present when the Gift Letter is signed?

It is not necessary for the donor to be present when the Gift Letter is signed. The donor can prepare and sign the letter independently, then send it to the recipient. However, both parties should keep a copy for their records, as it may be needed during the mortgage application process.

Gift Letter: Usage Steps

Completing a Gift Letter form is a straightforward process that requires attention to detail. Once you have filled out the form, it will serve as a formal declaration of a gift, which may be necessary for financial or legal purposes. Follow these steps to ensure that your Gift Letter is filled out correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the donor, the person giving the gift.

- Next, enter the recipient's full name and address, the person receiving the gift.

- Clearly state the amount of the gift in both numerical and written form.

- Include a statement confirming that the gift is given freely and without expectation of repayment.

- Sign the form in the designated area. The donor's signature is essential.

- Finally, provide any additional information required, such as the relationship between the donor and recipient.