Valid Gift Deed Template

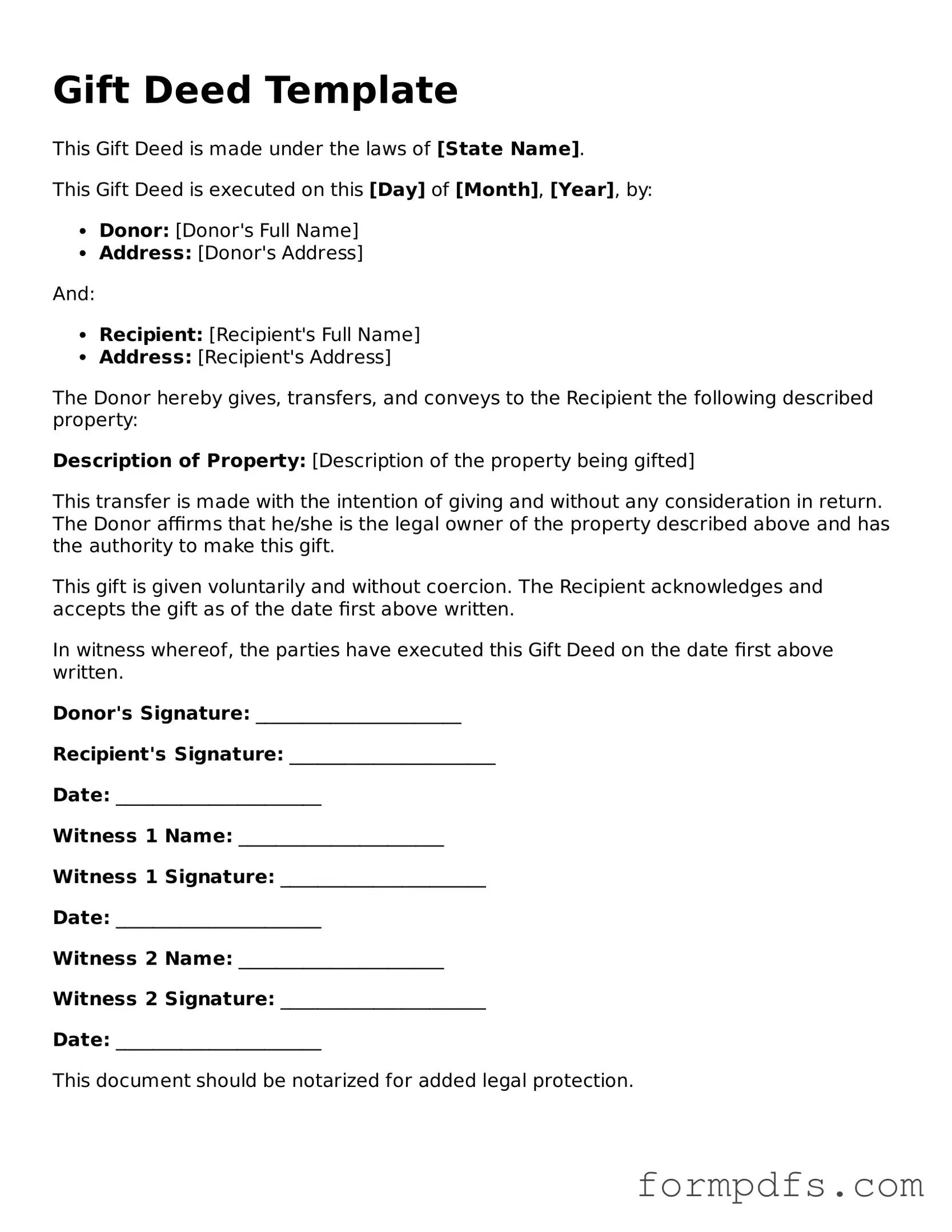

When considering the transfer of property or assets without any exchange of money, a Gift Deed form becomes an essential legal document. This form serves to formalize the intention of the giver, known as the donor, to transfer ownership to the recipient, referred to as the donee. It typically includes vital information such as the names and addresses of both parties, a clear description of the property being gifted, and any specific conditions attached to the gift. Importantly, the Gift Deed must be executed voluntarily, without any coercion, and should be signed in the presence of witnesses to ensure its validity. Additionally, the document may need to be notarized or recorded with local authorities, depending on the jurisdiction, to provide public notice of the transfer. Understanding these elements is crucial for anyone looking to navigate the process of gifting property, as it not only protects the interests of both parties but also ensures compliance with legal requirements.

Other Gift Deed Templates:

What Is Trust Deed in India - It can provide clarity in terms of what happens if the borrower misses payments.

In addition to the essential details required for the Ca DMV DL 44 form, it is important for applicants to stay informed about all necessary documents and procedures, which can be found by visiting All California Forms. This resource ensures that individuals are well-prepared and can efficiently navigate the process of obtaining their driver's license or identification card.

Gift Deed Forms for Specific US States

Documents used along the form

A Gift Deed is a legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. It is important to have additional documents to support the transaction and ensure clarity and legality. Below is a list of other forms and documents often used in conjunction with a Gift Deed.

- Letter of Gift Acceptance: This document confirms the recipient's acceptance of the gift. It serves as a record that the recipient agrees to receive the property or asset being gifted.

- Motor Vehicle Bill of Sale: Essential for documenting the sale and transfer of vehicles, this form serves as a legal receipt, confirming the transaction and change of ownership. For more details, visit smarttemplates.net/fillable-motor-vehicle-bill-of-sale.

- Affidavit of Gift: This sworn statement outlines the details of the gift, including the value and description of the property. It may be used to provide legal proof of the gift's intent.

- Property Title Transfer Document: This form is necessary to officially transfer ownership of real estate. It includes details about the property and the parties involved in the transaction.

- Tax Forms: Depending on the value of the gift, tax forms may be required for reporting purposes. This ensures compliance with federal and state tax regulations.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit, the donor may need to file this form with the IRS to report the gift for tax purposes.

- Notarization Certificate: This document serves as proof that the Gift Deed has been signed in the presence of a notary public, adding an extra layer of authenticity to the transaction.

- Witness Statements: Having witnesses sign the Gift Deed can provide additional verification of the transaction. Their statements may be required if the validity of the gift is ever questioned.

These documents work together to create a comprehensive record of the gift transaction, ensuring all parties understand their rights and responsibilities. Proper documentation is essential for a smooth transfer and to avoid potential disputes in the future.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property without any exchange of money. |

| Consideration | Unlike sales, no consideration is required in a Gift Deed; the transfer is made voluntarily. |

| Governing Law | In the United States, Gift Deeds are governed by state property laws, which can vary significantly. |

| Tax Implications | Gifts may have tax implications; donors should be aware of federal and state gift tax regulations. |

| Revocation | Once executed, a Gift Deed generally cannot be revoked unless specific conditions are met. |

| Witness Requirements | Most states require the signature of witnesses or a notary public for the Gift Deed to be valid. |

More About Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. This type of deed is commonly used for transferring real estate, vehicles, or personal property as a gift. The person giving the gift is known as the donor, while the recipient is referred to as the donee.

What information is required to complete a Gift Deed?

To complete a Gift Deed, you will need to provide several key pieces of information. This includes the names and addresses of both the donor and the donee, a description of the property being gifted, and any specific conditions or terms associated with the gift. Additionally, both parties may need to sign the document in the presence of witnesses or a notary public, depending on state requirements.

Are there any tax implications when giving a gift?

Yes, there can be tax implications when transferring property as a gift. The IRS allows individuals to give a certain amount each year without incurring gift tax. As of 2023, this annual exclusion amount is $17,000 per recipient. If the value of the gift exceeds this amount, the donor may need to file a gift tax return. It is advisable to consult with a tax professional to understand the specific implications based on your situation.

Can a Gift Deed be revoked or changed after it is executed?

Once a Gift Deed is executed and delivered, it generally cannot be revoked or changed. The transfer of ownership is typically considered final. However, if specific conditions were included in the deed or if the donor becomes incapacitated, there may be legal avenues to explore. Consulting with a legal expert can provide guidance on any potential options.

Do I need to have a lawyer to create a Gift Deed?

While it is not strictly necessary to hire a lawyer to create a Gift Deed, it is often recommended. A legal professional can ensure that the deed complies with state laws and meets all necessary requirements. This can help prevent any future disputes or complications regarding the gift. If you feel comfortable with the process, you can also find templates and resources to assist you in preparing the document yourself.

What happens if the Gift Deed is not recorded?

Recording a Gift Deed is important because it provides public notice of the transfer of ownership. If the deed is not recorded, the donee may face challenges in proving ownership, especially if disputes arise later. Additionally, failure to record the deed could lead to complications if the donor has other creditors or if the property is sold in the future. Recording the deed helps protect the rights of the donee and ensures clarity in ownership.

Gift Deed: Usage Steps

Once you have the Gift Deed form in hand, it’s important to fill it out accurately. This ensures that the transfer of property is legally recognized. Follow these steps carefully to complete the form.

- Obtain the form: Make sure you have the correct Gift Deed form for your state. You can usually find it online or at your local government office.

- Fill in the date: Write the date on which the deed is being executed at the top of the form.

- Identify the donor: Enter the full name and address of the person giving the gift.

- Identify the recipient: Provide the full name and address of the person receiving the gift.

- Describe the property: Clearly describe the property being gifted. Include details such as the address, legal description, and any identifying information.

- State the consideration: Indicate if there is any consideration (payment) involved. Typically, a gift is made without consideration, but this should be stated.

- Sign the form: The donor must sign the form. If applicable, have the recipient sign as well.

- Notarize the document: Take the completed form to a notary public for notarization. This step is often required for the deed to be legally valid.

- File the deed: Submit the notarized Gift Deed to your local county recorder’s office. Check if there are any filing fees.