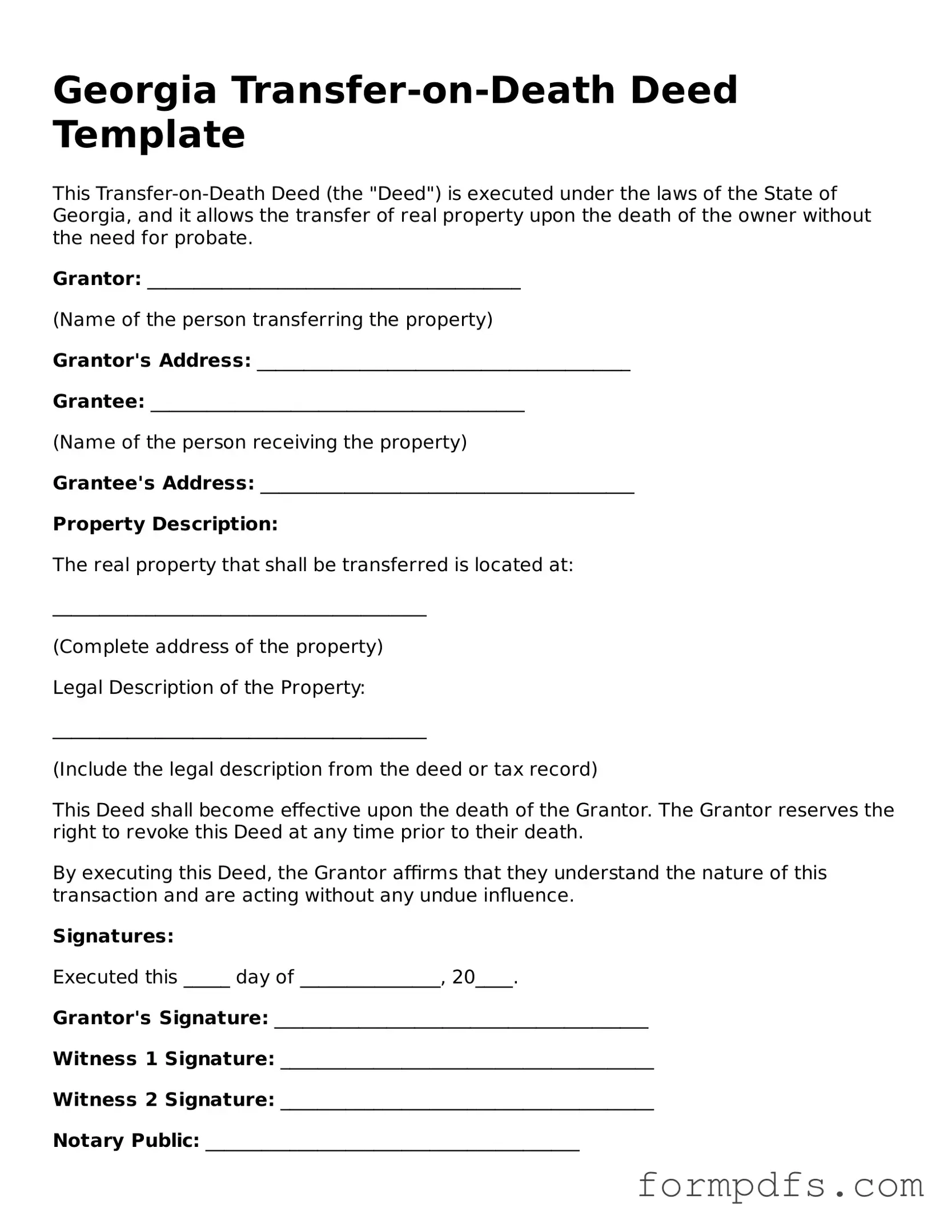

Printable Transfer-on-Death Deed Form for the State of Georgia

In the state of Georgia, the Transfer-on-Death Deed (TOD) serves as a valuable tool for property owners seeking to streamline the transfer of their real estate upon their passing. This legal document allows individuals to designate one or more beneficiaries who will automatically receive ownership of the property without the need for probate, simplifying the process for loved ones during a difficult time. By completing the TOD, property owners can maintain full control of their assets during their lifetime, while ensuring a seamless transition to their chosen heirs after death. Importantly, the form must be properly executed and recorded to be effective, and it can be revoked or amended at any point before the owner’s death. Understanding the nuances of this deed can empower property owners to make informed decisions that reflect their wishes and protect their family's interests.

Check out Other Common Transfer-on-Death Deed Templates for Different States

Ohio Transfer on Death Form - Unlike a will, this deed does not require a probate procedure, simplifying the transfer process.

Ensuring that you have a proper documentation for transactions is essential, and a New York Bill of Sale form is an effective way to achieve this. It not only simplifies the process of buying and selling personal property but also protects the interests of both parties involved. You can find a useful resource for creating this document at https://smarttemplates.net/fillable-new-york-bill-of-sale/, which provides a fillable template specifically designed for New York residents.

How to Gift Land to Family Member - The deed must be recorded in the county where the property is located.

Documents used along the form

When dealing with property transfers in Georgia, particularly through a Transfer-on-Death Deed, several other forms and documents may come into play. Understanding these documents can help ensure a smooth transition of property ownership and clarify the intentions of the property owner. Below is a list of commonly associated documents.

- Warranty Deed: This document transfers ownership of real estate from one party to another, guaranteeing that the title is clear of any liens or encumbrances.

- Quitclaim Deed: Unlike a warranty deed, this form transfers whatever interest the grantor has in the property without making any guarantees about the title's validity.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased property owner, providing a sworn statement that identifies the rightful heirs.

- California Commercial Lease Agreement: This legally binding document is critical for landlords and business tenants in California, outlining key rental terms and responsibilities, ensuring a clear understanding of the agreement. For more information, check All California Forms.

- Last Will and Testament: This legal document outlines how a person's assets, including real estate, should be distributed upon their death, which can sometimes intersect with transfer-on-death provisions.

- Property Tax Records: These records are essential for verifying property ownership and assessing any taxes owed on the property, which can affect the transfer process.

- Title Insurance Policy: This insurance protects against losses arising from defects in the title to the property, providing peace of mind for both the grantor and the grantee.

- Notice of Transfer: While not always required, this document may be filed to formally notify interested parties of the transfer of property ownership.

Each of these documents plays a vital role in the property transfer process, ensuring clarity and legal compliance. Familiarity with them can aid individuals in navigating the complexities of real estate transactions in Georgia.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Georgia to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Georgia Code § 44-6-80 to § 44-6-85. |

| Eligibility | Any individual who owns real property in Georgia can create a Transfer-on-Death Deed. |

| Execution Requirements | The deed must be signed by the owner in the presence of a notary public and recorded in the county where the property is located. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the owner's death by executing a new deed or by recording a revocation document. |

| Beneficiary Rights | Beneficiaries have no rights to the property until the owner passes away, ensuring the owner retains full control during their lifetime. |

More About Georgia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real property to a designated beneficiary upon the owner's death. This deed avoids probate, simplifying the process of transferring property to heirs. It is particularly useful for individuals looking to ensure their property passes directly to their chosen beneficiaries without court involvement.

Who can create a Transfer-on-Death Deed?

Any individual who holds title to real property in Georgia can create a Transfer-on-Death Deed. This includes homeowners and property owners, as long as they are of legal age and mentally competent to make such decisions. Additionally, the property must be located in Georgia for the deed to be valid under state law.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, the owner must fill out the form with relevant information, including the property description and the names of the beneficiaries. It is crucial to ensure that all details are accurate and complete. After filling out the form, the owner must sign it in the presence of a notary public to make it legally binding.

Is it necessary to record the Transfer-on-Death Deed?

Yes, recording the Transfer-on-Death Deed with the appropriate county clerk's office is essential. This step makes the deed a matter of public record, which is important for ensuring the transfer of property occurs smoothly after the owner's death. Failure to record the deed may result in complications during the transfer process.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The property owner may revoke the deed at any time before their death. This can be done by executing a new deed that explicitly states the revocation or by recording a formal revocation document with the county clerk's office. It is advisable to consult with a legal professional when revoking a deed to ensure compliance with state laws.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed will typically become void unless the deed specifies alternate beneficiaries. In such cases, the property may pass according to the owner’s will or, if there is no will, according to Georgia's intestacy laws.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax implications for the property owner. However, beneficiaries may be subject to capital gains taxes upon the sale of the property after the owner's death. It is advisable for both property owners and beneficiaries to consult a tax professional to understand potential tax liabilities.

Can multiple beneficiaries be named in a Transfer-on-Death Deed?

Yes, property owners can name multiple beneficiaries in a Transfer-on-Death Deed. The deed should clearly specify how the property will be divided among the beneficiaries. If the deed does not provide specific instructions, the property may be divided equally among all named beneficiaries.

What types of property can be transferred using a Transfer-on-Death Deed?

A Transfer-on-Death Deed can be used to transfer various types of real property, including residential homes, commercial properties, and vacant land. However, it cannot be used for personal property such as vehicles or bank accounts. Only real estate interests are eligible for transfer under this deed.

Do I need a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to have a lawyer to create a Transfer-on-Death Deed, seeking legal advice is recommended. A legal professional can provide guidance on the implications of the deed, ensure that it complies with state laws, and help avoid potential issues in the future.

Georgia Transfer-on-Death Deed: Usage Steps

Filling out the Georgia Transfer-on-Death Deed form is a straightforward process. After completing the form, you will need to ensure it is properly executed and recorded with the county clerk's office to make it effective. Here are the steps to follow:

- Obtain the Form: Download the Georgia Transfer-on-Death Deed form from a reliable source or visit your local county clerk's office to get a physical copy.

- Fill in the Grantor's Information: Write your full name, address, and any other required identifying information as the grantor (the person transferring the property).

- Identify the Property: Clearly describe the property you wish to transfer. Include the address and any legal description that may be necessary.

- List the Beneficiaries: Write the names and addresses of the beneficiaries who will receive the property upon your death. Be specific about how the property will be divided if there are multiple beneficiaries.

- Sign the Form: As the grantor, sign and date the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public complete their section of the form, confirming your identity and signature.

- Record the Deed: Take the completed and notarized form to the county clerk's office where the property is located. Pay any required fees to have the deed recorded.

Once recorded, the Transfer-on-Death Deed will take effect upon your passing, allowing the designated beneficiaries to inherit the property without going through probate. It’s important to keep a copy of the recorded deed for your records and inform your beneficiaries of its existence.