Printable Tractor Bill of Sale Form for the State of Georgia

In Georgia, the Tractor Bill of Sale form plays a crucial role in the transfer of ownership for agricultural machinery. This document serves as a legal record, ensuring that both the buyer and seller have clear terms regarding the sale. It typically includes essential information such as the names and addresses of both parties, a detailed description of the tractor, and the sale price. Additionally, the form may outline any warranties or conditions related to the sale, providing protection for both sides. By utilizing this form, individuals can avoid disputes over ownership and maintain a transparent transaction process. Understanding the components of the Tractor Bill of Sale is essential for anyone involved in buying or selling tractors in Georgia, as it lays the foundation for a smooth and legally binding exchange.

Check out Other Common Tractor Bill of Sale Templates for Different States

Bill of Sale Tractor - Can assist with the sale of attachments or implements.

For those looking to navigate the complexities of vehicle transactions, our guide on how to properly fill out an ATV Bill of Sale can be invaluable. This resource offers insights into what details should be included and how to ensure a smooth transfer of ownership. You can access the guide here.

Documents used along the form

When buying or selling a tractor in Georgia, the Tractor Bill of Sale form is an essential document. However, several other forms and documents may also be necessary to ensure a smooth transaction. Here’s a list of some commonly used documents that complement the Tractor Bill of Sale.

- Title Certificate: This document proves ownership of the tractor. It must be transferred from the seller to the buyer during the sale.

- California LLC-1 Form: This essential document, officially known as the Articles of Organization, is necessary for establishing a limited liability company in California. It includes important details about the LLC and is subject to a filing fee. For more information, refer to All California Forms.

- Odometer Disclosure Statement: Required for certain vehicles, this form confirms the tractor's mileage at the time of sale, helping to prevent fraud.

- Affidavit of Heirship: If the tractor is inherited, this document may be needed to establish the new owner's rights to the property.

- Vehicle Registration Application: After purchasing the tractor, the buyer must complete this application to register the vehicle with the state.

- Sales Tax Form: This form is used to report and pay any applicable sales tax on the transaction, which is typically required by the state.

- Insurance Documents: Proof of insurance may be necessary before the tractor can be registered or operated legally.

- Loan Agreement: If financing the purchase, this document outlines the terms of the loan, including payment amounts and interest rates.

- Inspection Report: An inspection report may be required to confirm the tractor's condition before the sale, providing assurance to the buyer.

- Power of Attorney: If the seller cannot be present for the transaction, this document allows another person to sign on their behalf.

Having these documents ready can streamline the buying or selling process of a tractor in Georgia. Each document serves a specific purpose, ensuring that both parties are protected and that the transaction complies with state laws.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Tractor Bill of Sale form is used to document the sale of a tractor between a seller and a buyer. |

| Governing Law | This form is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 10-1-100 et seq. |

| Required Information | Essential details include the buyer's and seller's names, addresses, and signatures, as well as the tractor's make, model, and VIN. |

| Notarization | While notarization is not mandatory, it is recommended to enhance the document's validity and credibility. |

| Transfer of Ownership | The form serves as proof of ownership transfer from the seller to the buyer upon completion of the sale. |

| Tax Implications | Sales tax may apply to the transaction, and both parties should be aware of their tax obligations. |

| Record Keeping | Both the buyer and seller should keep a copy of the completed bill of sale for their records. |

| Usage | This form can be used for both private sales and transactions conducted through dealerships. |

More About Georgia Tractor Bill of Sale

What is a Georgia Tractor Bill of Sale form?

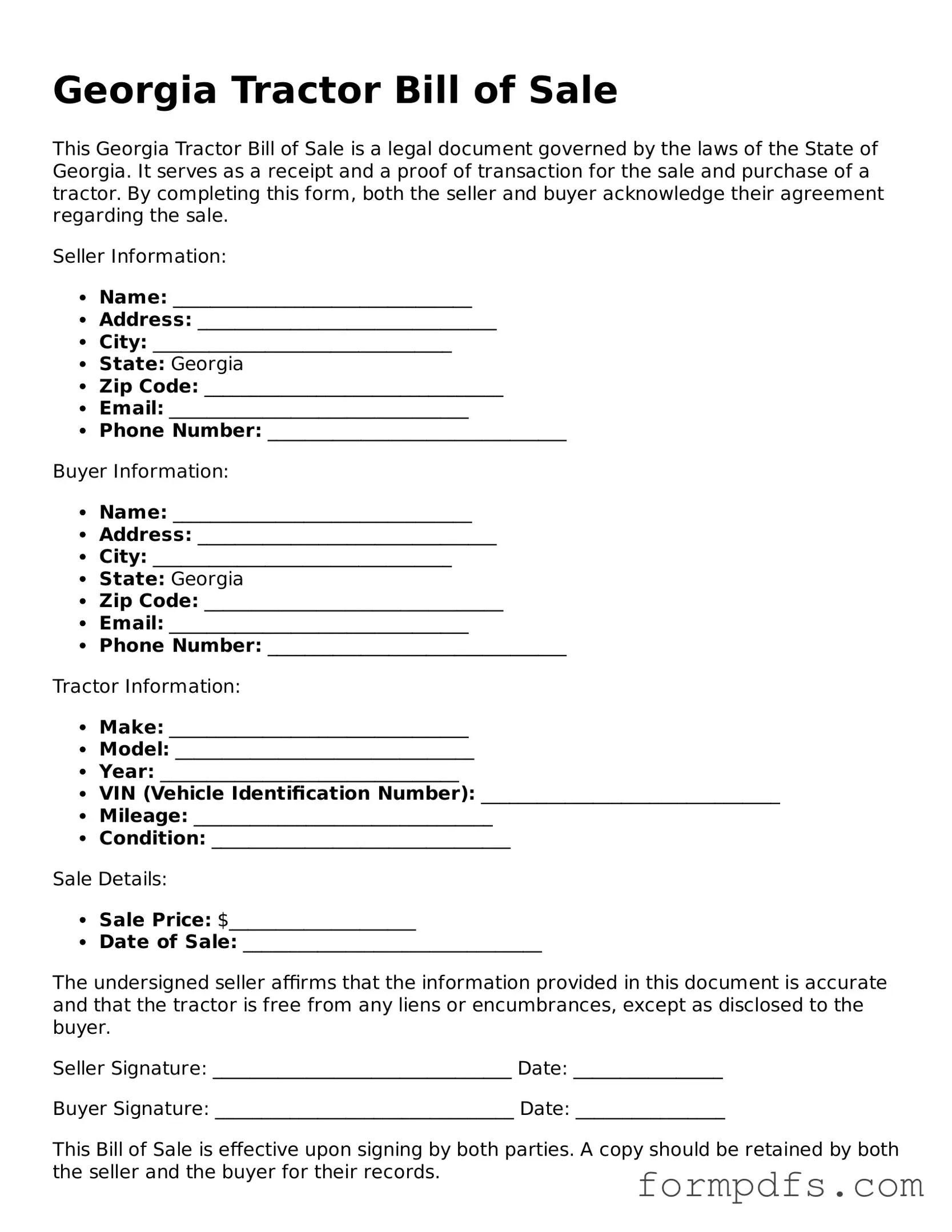

The Georgia Tractor Bill of Sale form is a legal document used to record the sale and transfer of ownership of a tractor in the state of Georgia. This form serves as proof of the transaction between the seller and the buyer, detailing important information about the tractor, the parties involved, and the terms of the sale. Having this document helps protect both the buyer and seller by providing a clear record of the sale.

What information is typically included in the form?

A typical Georgia Tractor Bill of Sale includes essential details such as the names and addresses of the buyer and seller, the date of the sale, and a description of the tractor. This description often encompasses the make, model, year, Vehicle Identification Number (VIN), and any other relevant specifications. Additionally, the sale price and payment method may also be documented to ensure clarity in the transaction.

Is a bill of sale required for selling a tractor in Georgia?

While a bill of sale is not legally required in Georgia for every transaction, it is highly recommended. Having a bill of sale provides both parties with a written record of the sale, which can be helpful for future reference, especially if any disputes arise. Furthermore, if the buyer intends to register the tractor, having a bill of sale may be necessary to prove ownership.

How can I obtain a Georgia Tractor Bill of Sale form?

You can obtain a Georgia Tractor Bill of Sale form from various sources. Many legal websites offer downloadable templates that you can customize. Additionally, some local government offices or agricultural departments may provide official forms. It's important to ensure that the form you use complies with Georgia state laws to avoid any issues during the sale process.

Do I need to have the bill of sale notarized?

In Georgia, notarization of the bill of sale is not mandatory for the sale of a tractor. However, having the document notarized can add an extra layer of authenticity and security to the transaction. If both parties agree, they may choose to have the bill of sale notarized to confirm their identities and the validity of the agreement.

What should I do after completing the bill of sale?

Once the bill of sale is completed and signed by both parties, it is advisable to keep copies for your records. The seller should provide the buyer with the original document, which the buyer may need for registration or insurance purposes. If the tractor is being registered, the buyer should check with the Georgia Department of Revenue for any additional requirements related to the registration process.

Georgia Tractor Bill of Sale: Usage Steps

After obtaining the Georgia Tractor Bill of Sale form, you’ll need to complete it accurately to ensure a smooth transfer of ownership. Follow these steps to fill out the form correctly.

- Start by entering the date of the sale at the top of the form.

- Fill in the name and address of the seller. Make sure to include the city, state, and zip code.

- Next, provide the name and address of the buyer, also including the city, state, and zip code.

- In the section for the tractor details, write down the make, model, year, and VIN (Vehicle Identification Number) of the tractor.

- Indicate the sale price of the tractor in the designated area.

- Both the seller and buyer must sign the form. Include the date of each signature.

- If applicable, provide any additional information in the notes section.

Once you have completed the form, ensure that both parties keep a copy for their records. This document serves as proof of the transaction and can be useful for future reference.