Printable RV Bill of Sale Form for the State of Georgia

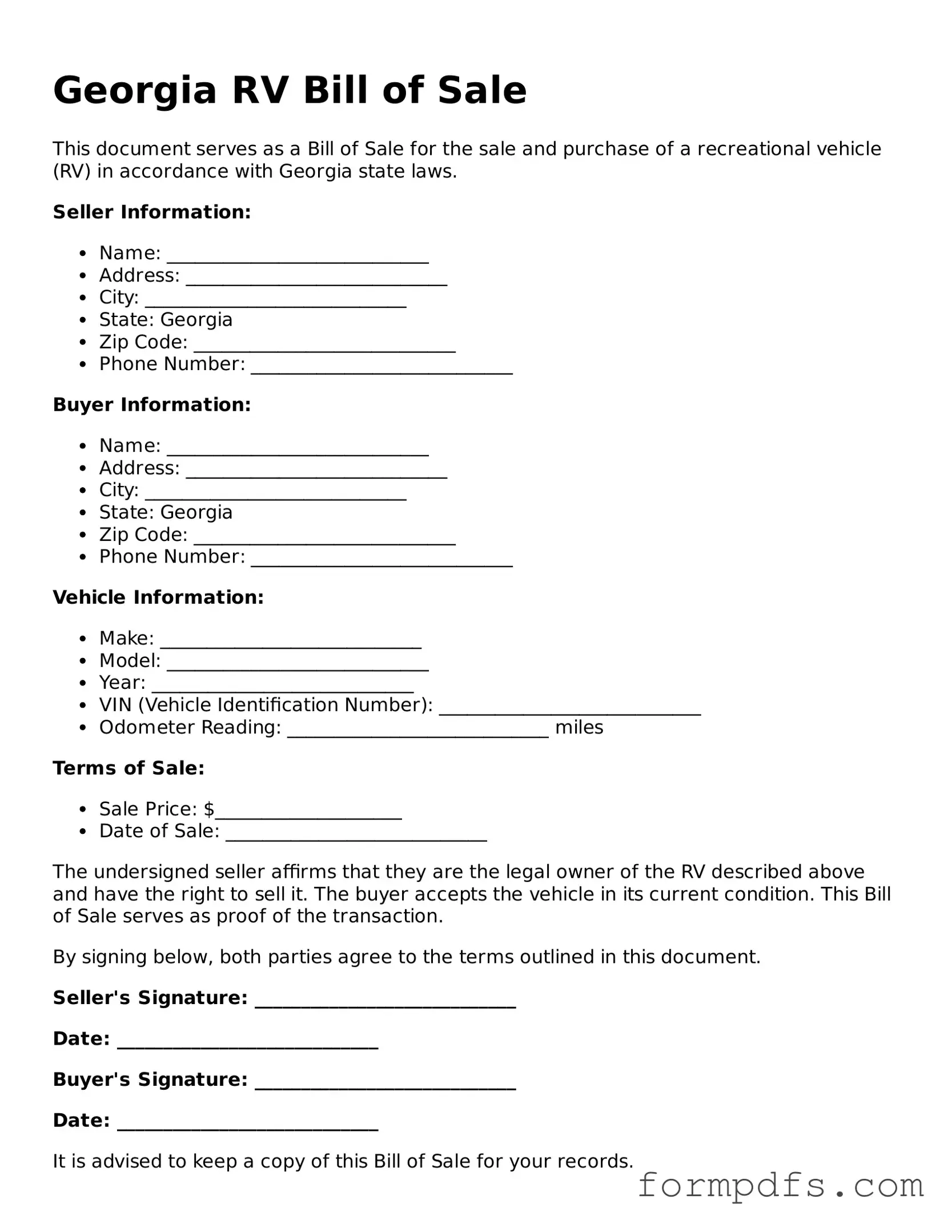

In Georgia, when buying or selling a recreational vehicle (RV), a Bill of Sale is an essential document that helps ensure a smooth transaction. This form serves as proof of the sale and outlines key details about the RV, including its make, model, year, and Vehicle Identification Number (VIN). Both the buyer and seller must provide their names and addresses, along with the sale price and the date of the transaction. Additionally, the form may include information about any warranties or guarantees, if applicable. Having a properly completed Bill of Sale can protect both parties by documenting the transfer of ownership and can be useful for future registration and title purposes. Understanding the importance of this document can help facilitate a successful sale and provide peace of mind for everyone involved.

Check out Other Common RV Bill of Sale Templates for Different States

Michigan Trailer Bill of Sale - The RV Bill of Sale can outline conditions regarding the RV's condition at the time of sale.

To facilitate the sale process, it is advisable to use a comprehensive template, such as the Manufactured Home Bill of Sale, which provides all necessary details required for the transaction, ensuring clarity and legality when transferring ownership of a mobile home.

Documents used along the form

When buying or selling an RV in Georgia, several important documents often accompany the RV Bill of Sale. These documents help ensure a smooth transaction and provide necessary information for both parties involved. Below is a list of commonly used forms and documents.

- Title Transfer Form: This document officially transfers ownership of the RV from the seller to the buyer. It must be completed and submitted to the Georgia Department of Revenue.

- Vehicle Registration Application: This form is needed to register the RV in the buyer's name. It includes information about the vehicle and the new owner.

- Odometer Disclosure Statement: This statement records the RV's mileage at the time of sale. It is required by federal law for vehicles under 10 years old.

- Sales Tax Form: This form is used to report and pay any sales tax due on the purchase of the RV. It ensures compliance with state tax laws.

- Power of Attorney: If someone is handling the sale on behalf of the owner, this document grants them the authority to act on the owner's behalf.

- Insurance Verification: Buyers may need to provide proof of insurance coverage for the RV before registration can be completed.

- Motorcycle Bill of Sale: To officially transfer ownership when selling or buying a motorcycle in New York, it is essential to complete the Motorcycle Bill of Sale form, which includes important details such as the motorcycle's description and sale price.

- Inspection Certificate: Some buyers may require an inspection of the RV to ensure it meets safety and operational standards before the sale is finalized.

- Financing Agreement: If the buyer is financing the RV, this document outlines the terms of the loan and the responsibilities of both parties.

- Warranty Documents: If the RV comes with a warranty, these documents detail the coverage and terms, providing peace of mind to the buyer.

- Affidavit of Sale: This document serves as a sworn statement confirming the sale and can be useful in case of disputes or for record-keeping.

Having these documents ready can make the buying or selling process more efficient. Each form serves a specific purpose, helping to protect the interests of both the buyer and the seller. Always ensure that all paperwork is completed accurately to avoid any issues down the line.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The Georgia RV Bill of Sale form is used to document the sale of a recreational vehicle in the state of Georgia. |

| Governing Law | This form is governed by the Official Code of Georgia Annotated (OCGA) § 40-2-20. |

| Required Information | It requires details such as the buyer's and seller's names, addresses, and the vehicle's identification number (VIN). |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Notarization | While notarization is not mandatory, it is recommended to enhance the document's credibility. |

| Tax Implications | The sale may be subject to sales tax, which the buyer is responsible for paying upon registration. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

| Transfer of Ownership | The Bill of Sale serves as proof of ownership transfer and is often required for registration with the Georgia Department of Revenue. |

More About Georgia RV Bill of Sale

What is a Georgia RV Bill of Sale?

A Georgia RV Bill of Sale is a legal document that records the sale of a recreational vehicle (RV) in the state of Georgia. It serves as proof of the transaction between the buyer and the seller, detailing essential information about the RV and the parties involved.

What information is included in the RV Bill of Sale?

The RV Bill of Sale typically includes the following information: the names and addresses of the buyer and seller, the RV's make, model, year, Vehicle Identification Number (VIN), sale price, and the date of the transaction. It may also include any warranties or conditions of the sale.

Is the RV Bill of Sale required in Georgia?

Do I need to have the RV Bill of Sale notarized?

Notarization is not required for the RV Bill of Sale in Georgia. However, having it notarized can add an extra layer of authenticity and may help prevent disputes in the future.

Can I create my own RV Bill of Sale?

Yes, you can create your own RV Bill of Sale. Ensure it includes all necessary information, such as the buyer and seller details, vehicle information, and terms of the sale. Various templates are also available online to assist you.

What should I do after completing the RV Bill of Sale?

After completing the RV Bill of Sale, both the buyer and seller should keep a signed copy for their records. The seller should also provide the buyer with the title of the RV, which is necessary for registration with the Georgia Department of Revenue.

Is there a fee associated with the RV Bill of Sale?

There is no fee to create an RV Bill of Sale itself. However, there may be fees associated with transferring the title and registering the RV with the state. Check with your local Department of Revenue for specific fee information.

What if the RV has a lien on it?

If the RV has a lien, it is crucial to address this before completing the sale. The seller must pay off the lien and obtain a lien release from the lender. This release should be attached to the Bill of Sale to ensure the buyer receives clear title.

Can the RV Bill of Sale be used for tax purposes?

Yes, the RV Bill of Sale can be used for tax purposes. It serves as proof of the purchase price, which may be necessary when calculating sales tax or for future tax filings. Keep it with your other important documents.

What should I do if I lose my RV Bill of Sale?

If you lose your RV Bill of Sale, you can create a new one, but both parties must agree to the terms again. It's advisable to keep multiple copies of important documents to avoid this situation in the future.

Georgia RV Bill of Sale: Usage Steps

Filling out the Georgia RV Bill of Sale form is a straightforward process that helps document the sale of a recreational vehicle. After completing the form, you will have a legal record of the transaction, which can be important for both the buyer and seller. Make sure to keep a copy for your records.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller.

- Next, fill in the buyer's full name and address.

- Include a detailed description of the RV. This should consist of the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the RV clearly.

- Both the seller and buyer should sign and date the form at the designated areas.

- Finally, make sure to keep copies of the completed form for both parties.