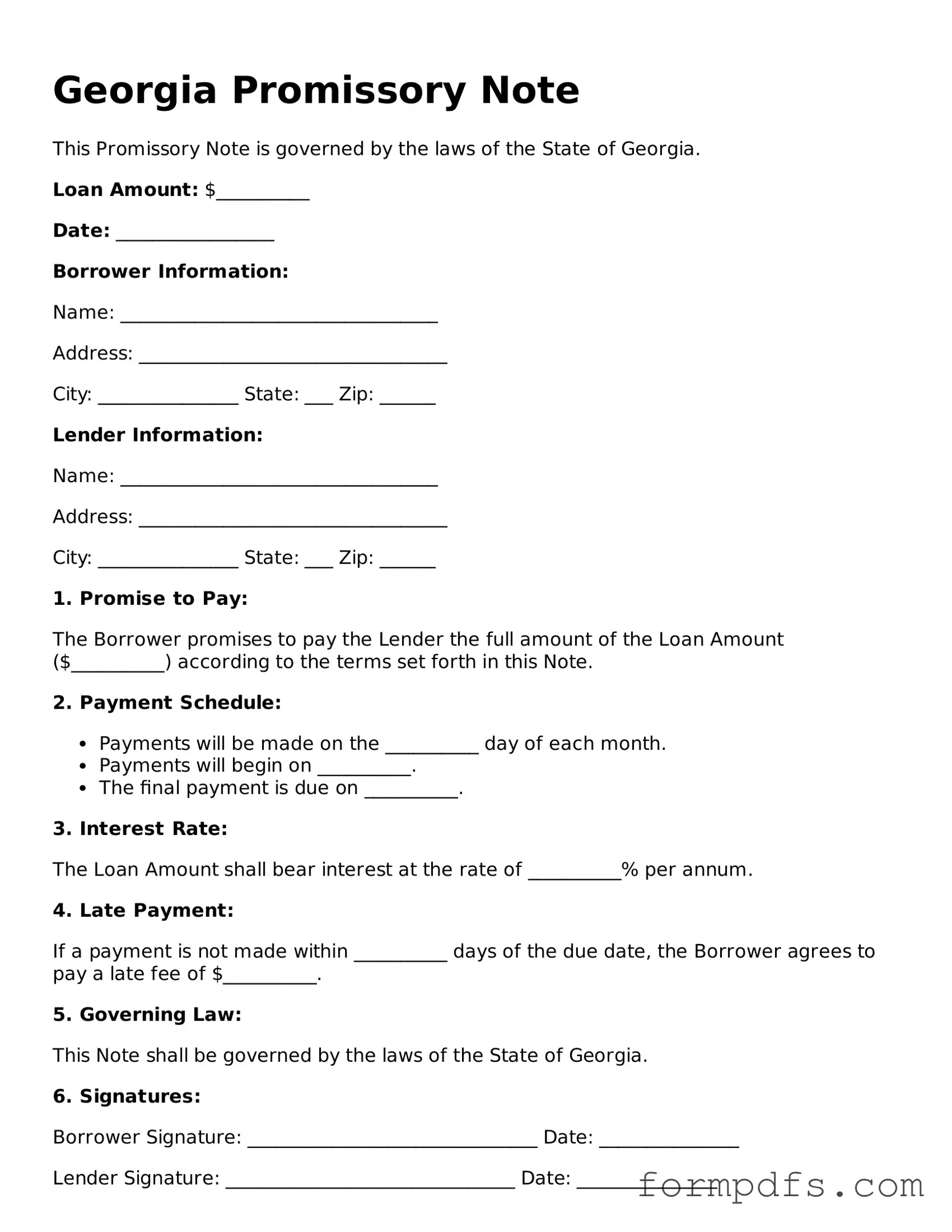

Printable Promissory Note Form for the State of Georgia

When entering into a loan agreement in Georgia, understanding the Promissory Note form is crucial for both lenders and borrowers. This document serves as a written promise to repay borrowed money under specified terms. It outlines key details such as the principal amount, interest rate, payment schedule, and any applicable fees. By clearly defining these terms, the Promissory Note helps prevent misunderstandings and disputes down the line. Additionally, it may include provisions for late payments and default, ensuring that both parties are aware of their rights and responsibilities. Familiarity with this form not only protects the lender's investment but also provides the borrower with a clear framework for repayment, making it an essential tool in financial transactions.

Check out Other Common Promissory Note Templates for Different States

Promissory Note Michigan - It can be customized to meet the specific needs of the borrowing parties.

The Ca DMV DL 44 form plays an essential role in the process of obtaining a driver's license or identification card in California, serving various needs such as new applications and renewals, as well as modifications like name corrections. It is crucial for applicants to provide accurate and comprehensive information, which may also include updates regarding voter registration or organ donation preferences. For additional resources, you can refer to All California Forms.

Promissory Note Template Ohio - The borrower signs the note to confirm their commitment to repay the borrowed funds.

Loan Note Template - A Promissory Note can specify whether payments will be made in installments or a lump sum.

Documents used along the form

When dealing with financial transactions in Georgia, a Promissory Note is often accompanied by several other important documents. These documents help clarify the terms of the agreement and protect the interests of all parties involved. Below is a list of commonly used forms that complement the Georgia Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being pledged. It provides legal protection to the lender in case the borrower defaults on the loan.

- Disclosure Statement: This document provides important information regarding the loan terms, including fees, interest rates, and payment schedules. It ensures that the borrower is fully informed before entering into the agreement.

- Trailer Bill of Sale Form: To ensure a smooth transition of ownership, utilize our essential trailer bill of sale form guide that outlines key transaction details.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from a third party, usually the borrower’s business partner or owner. This document holds the guarantor responsible for the loan if the borrower fails to make payments.

- Amortization Schedule: This schedule breaks down the loan repayment process into regular installments. It details how much of each payment goes toward interest and principal, helping borrowers understand their financial obligations over time.

Each of these documents plays a crucial role in ensuring that both lenders and borrowers have a clear understanding of their rights and responsibilities. By using these forms in conjunction with the Georgia Promissory Note, parties can create a more secure and transparent financial arrangement.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Georgia Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by Georgia law, specifically the Georgia Uniform Commercial Code (UCC). |

| Parties Involved | Typically, the parties involved are the borrower (maker) and the lender (payee). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, depending on the agreement between the parties. |

| Repayment Terms | Repayment terms outline how and when the borrower will repay the loan, including due dates and payment methods. |

| Default Clauses | Default clauses specify what happens if the borrower fails to make payments as agreed, including potential penalties. |

| Signatures | Both parties must sign the note for it to be legally binding. Witness signatures may also be required. |

| Notarization | While notarization is not always required, it can provide an extra layer of authenticity and may be necessary for certain transactions. |

More About Georgia Promissory Note

What is a Georgia Promissory Note?

A Georgia Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party at a defined time or on demand. It serves as a written record of the loan agreement and includes details such as the loan amount, interest rate, payment schedule, and any consequences for defaulting on the loan.

Who can use a Promissory Note in Georgia?

Any individual or business can use a Promissory Note in Georgia. This includes lenders, such as banks or private individuals, and borrowers, who may be individuals or businesses needing to secure a loan. It is important for both parties to understand the terms outlined in the note.

What information should be included in a Georgia Promissory Note?

A Georgia Promissory Note should include the following key elements: the names of the borrower and lender, the principal amount of the loan, the interest rate, the payment schedule, the due date, and any terms regarding default or late payments. It may also include provisions for prepayment and governing law.

Is a Georgia Promissory Note legally binding?

Yes, a properly executed Georgia Promissory Note is legally binding. Once both parties sign the document, they are obligated to adhere to the terms outlined in the note. If one party fails to meet their obligations, the other party may have legal grounds to pursue collection actions.

Do I need a lawyer to create a Promissory Note in Georgia?

While it is not required to have a lawyer draft a Promissory Note, consulting one can be beneficial. A lawyer can help ensure that the document meets legal requirements and adequately protects your interests. This is particularly important for larger loans or complex agreements.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both parties to avoid future disputes. Verbal agreements are generally not enforceable in this context.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may seek to collect the debt through negotiation or mediation. If these efforts fail, the lender can file a lawsuit to recover the owed amount. The terms of the Promissory Note will dictate the specific consequences of default, including any fees or interest that may apply.

Can a Promissory Note be secured or unsecured?

A Promissory Note can be either secured or unsecured. A secured note is backed by collateral, such as property or assets, which the lender can claim if the borrower defaults. An unsecured note does not have collateral backing it, making it riskier for the lender. The choice between secured and unsecured depends on the agreement between the parties involved.

Where can I find a template for a Georgia Promissory Note?

Templates for Georgia Promissory Notes can be found online through legal websites, document preparation services, or by consulting with a lawyer. It is essential to ensure that any template used complies with Georgia state laws and meets the specific needs of the parties involved.

Georgia Promissory Note: Usage Steps

After obtaining the Georgia Promissory Note form, it is essential to fill it out accurately to ensure that all necessary information is included. This will help in the proper documentation of the loan agreement between the parties involved.

- Begin by entering the date at the top of the form. This should be the date on which the note is being created.

- Fill in the name and address of the borrower. Ensure that this information is complete and accurate.

- Next, provide the name and address of the lender. This should also be thorough to avoid any confusion later.

- Specify the principal amount of the loan in the designated space. This is the total amount being borrowed.

- Indicate the interest rate, if applicable. This is usually expressed as a percentage.

- State the repayment terms. Include details on how and when the borrower will repay the loan.

- If there are any late fees or penalties for missed payments, clearly outline these terms in the appropriate section.

- Both parties should sign and date the form at the bottom. This confirms their agreement to the terms outlined in the note.

Once the form is completed and signed, it is advisable to keep copies for both the borrower and lender. This ensures that both parties have a record of the agreement for future reference.