Printable Power of Attorney Form for the State of Georgia

The Georgia Power of Attorney form is an essential legal document that allows individuals to appoint someone else to act on their behalf in various matters, such as financial transactions, healthcare decisions, or legal affairs. This form can be tailored to fit specific needs, offering flexibility in how powers are granted. In Georgia, the form can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be non-durable, which means it is only valid while the principal is competent. Additionally, the document can be general, granting broad authority, or limited, focusing on specific tasks. Understanding the different types of powers and the responsibilities of both the principal and the agent is crucial. The process of creating and executing this form involves certain legal requirements, including the need for signatures and, in some cases, notarization. This ensures that the document is valid and recognized by institutions and individuals alike. By being informed about the nuances of the Georgia Power of Attorney form, individuals can make empowered decisions about their personal and financial affairs.

Check out Other Common Power of Attorney Templates for Different States

Who Can Be a Power of Attorney - A legal document allowing one person to act on behalf of another.

Free Printable Nc Power of Attorney Form - It is important to communicate your wishes with your chosen agent clearly.

For anyone looking to understand the importance of an ATV Bill of Sale during a transaction, exploring this essential documentation is crucial to ensure a smooth process. You can find more information about this important form at California ATV Bill of Sale requirements.

Power of Attorney Form Michigan - A thoughtful selection of an agent makes a Power of Attorney effective.

Ohio Power of Attorney Requirements - This legal tool facilitates decision-making when an individual cannot manage their own affairs.

Documents used along the form

When preparing a Power of Attorney in Georgia, several additional forms and documents may be beneficial to ensure comprehensive legal coverage. These documents can serve various purposes, from healthcare decisions to financial management. Below is a list of commonly used forms that often accompany a Power of Attorney.

- Advance Directive for Health Care: This document allows individuals to outline their healthcare preferences in advance. It includes instructions about medical treatment and appoints a healthcare agent to make decisions on their behalf if they become unable to communicate.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the principal becomes incapacitated. It grants the agent authority to manage financial affairs, ensuring that the principal’s interests are protected at all times.

- Living Will: A Living Will is a specific type of advance directive that focuses solely on end-of-life care. It provides guidance on the type of medical treatment an individual wishes to receive or refuse in situations where they cannot express their wishes.

- California 1285.65 form: This form is crucial for requesting modifications to Wage and Earnings Assignment Orders, particularly in cases such as child or spousal support adjustments, and can be accessed through All California Forms.

- Financial Power of Attorney: This form allows a designated individual to handle financial matters on behalf of the principal. It can include tasks such as managing bank accounts, paying bills, and making investment decisions, ensuring that financial responsibilities are met even if the principal is unavailable.

Understanding these additional forms can provide clarity and peace of mind when establishing a Power of Attorney. Each document serves a unique purpose and can work together to create a comprehensive plan for managing both health and financial decisions.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Georgia Power of Attorney form allows one person to grant authority to another person to make decisions on their behalf. |

| Governing Law | The Georgia Power of Attorney is governed by the Georgia Uniform Power of Attorney Act (O.C.G.A. § 10-6B-1 et seq.). |

| Types | There are several types of Power of Attorney forms, including General, Durable, and Limited Power of Attorney. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Signing Requirements | The form must be signed by the principal and witnessed by two individuals or notarized. |

| Revocation | A Power of Attorney can be revoked at any time by the principal, as long as they are competent. |

| Agent Responsibilities | The agent must act in the best interest of the principal and follow their instructions. |

| Limitations | Some actions, like making a will or certain medical decisions, cannot be delegated through a Power of Attorney. |

| Filing | There is no requirement to file the Power of Attorney with the state, but it may be necessary for certain transactions. |

| Use Cases | This form is commonly used for financial decisions, real estate transactions, and healthcare decisions. |

More About Georgia Power of Attorney

What is a Power of Attorney in Georgia?

A Power of Attorney (POA) in Georgia is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, called the principal. This arrangement enables the agent to make decisions regarding financial, legal, or medical matters when the principal is unable to do so themselves.

Why should I create a Power of Attorney?

Creating a Power of Attorney is important because it ensures that someone you trust can manage your affairs if you become incapacitated or unable to make decisions. This can help avoid complications and delays in handling your financial or medical needs.

What types of Power of Attorney are available in Georgia?

In Georgia, there are several types of Power of Attorney. The most common are: 1. General Power of Attorney, which grants broad powers to the agent. 2. Limited Power of Attorney, which restricts the agent’s authority to specific tasks. 3. Durable Power of Attorney, which remains in effect even if the principal becomes incapacitated. 4. Medical Power of Attorney, which allows the agent to make healthcare decisions on behalf of the principal.

Do I need a lawyer to create a Power of Attorney in Georgia?

No, you do not need a lawyer to create a Power of Attorney in Georgia. However, it is often beneficial to consult with a legal professional to ensure that the document meets your specific needs and complies with state laws.

How do I execute a Power of Attorney in Georgia?

To execute a Power of Attorney in Georgia, the principal must sign the document in the presence of a notary public. If the document is for healthcare decisions, it may also require witnesses. It’s important to follow the proper procedures to ensure that the Power of Attorney is valid.

Can I revoke a Power of Attorney in Georgia?

Yes, you can revoke a Power of Attorney in Georgia at any time as long as you are mentally competent. To revoke it, you should create a written document stating your intention to revoke the previous Power of Attorney and notify your agent and any relevant institutions.

What happens if I don’t have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy, costly, and may not align with your wishes.

How can I choose the right agent for my Power of Attorney?

Choosing the right agent is crucial. Look for someone you trust, who is responsible, and understands your values and wishes. It’s also wise to discuss your decision with the person you choose to ensure they are willing to take on this responsibility.

Is a Power of Attorney valid in other states?

A Power of Attorney created in Georgia may be recognized in other states, but it is essential to check the specific laws of the state where it will be used. Some states may have different requirements for validity, so consulting with a local attorney is advisable.

Can I use a Power of Attorney for financial transactions?

Yes, a Power of Attorney can be used for financial transactions. The agent can handle banking, investments, and other financial matters on behalf of the principal. However, the extent of these powers depends on the specific terms outlined in the Power of Attorney document.

Georgia Power of Attorney: Usage Steps

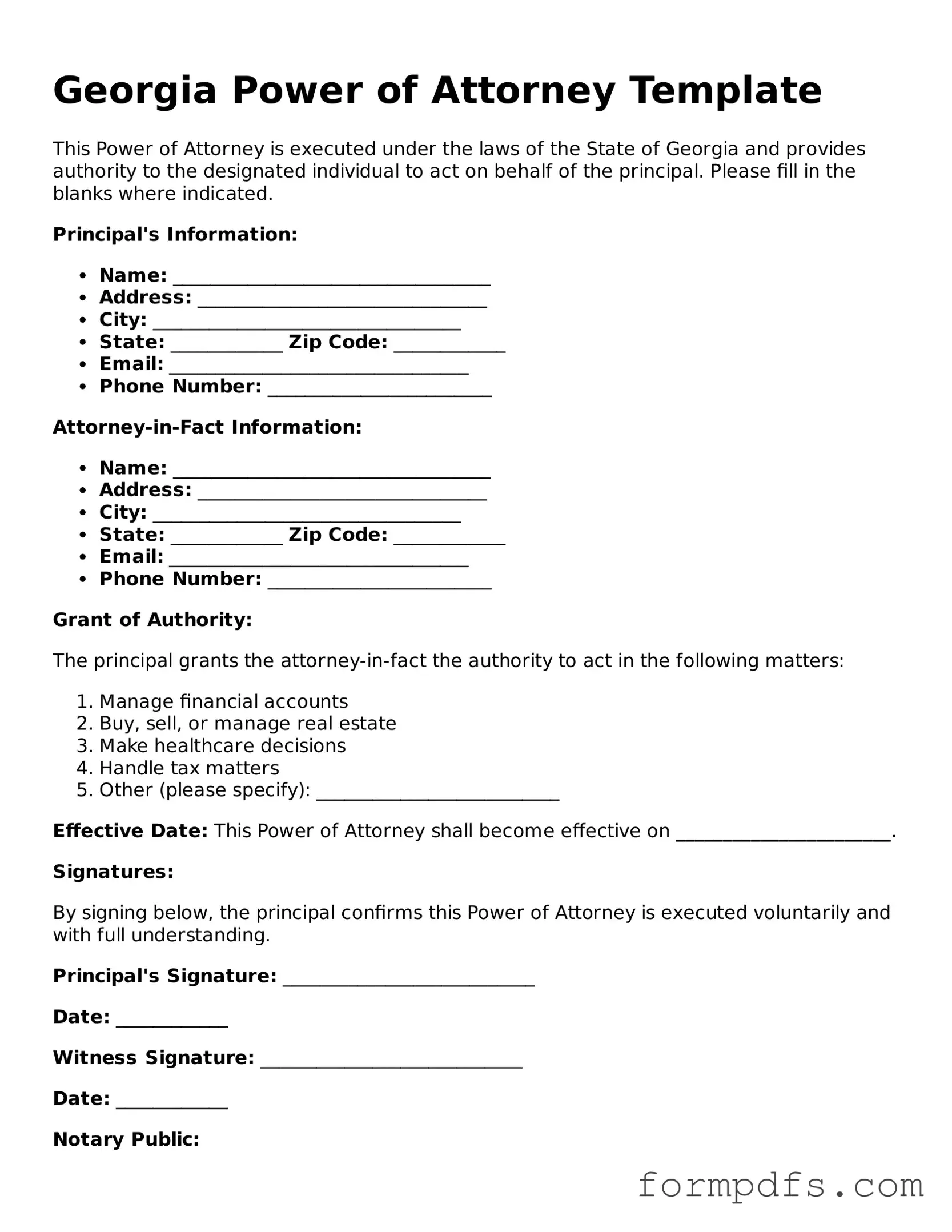

Once you have the Georgia Power of Attorney form in hand, you’re ready to begin the process of filling it out. This form allows you to designate someone to act on your behalf in various matters. It’s essential to ensure that all information is accurate and complete, as this will help avoid any potential issues down the line.

- Start by clearly writing your full name and address at the top of the form. Make sure this information is legible.

- Next, identify the person you are appointing as your agent. Write their full name and address in the designated area.

- Specify the powers you wish to grant to your agent. You can choose general powers or limit them to specific tasks. Be precise in your descriptions.

- Indicate the duration of the Power of Attorney. You can choose to make it effective immediately or specify a start date. You can also state if it will remain in effect until revoked or if it has a specific end date.

- Sign and date the form in the appropriate section. Your signature must match the name you provided at the top.

- Have the form notarized. This step is crucial as it adds an extra layer of verification to your document.

- Finally, provide copies of the completed form to your agent and any relevant institutions or individuals who may need it.