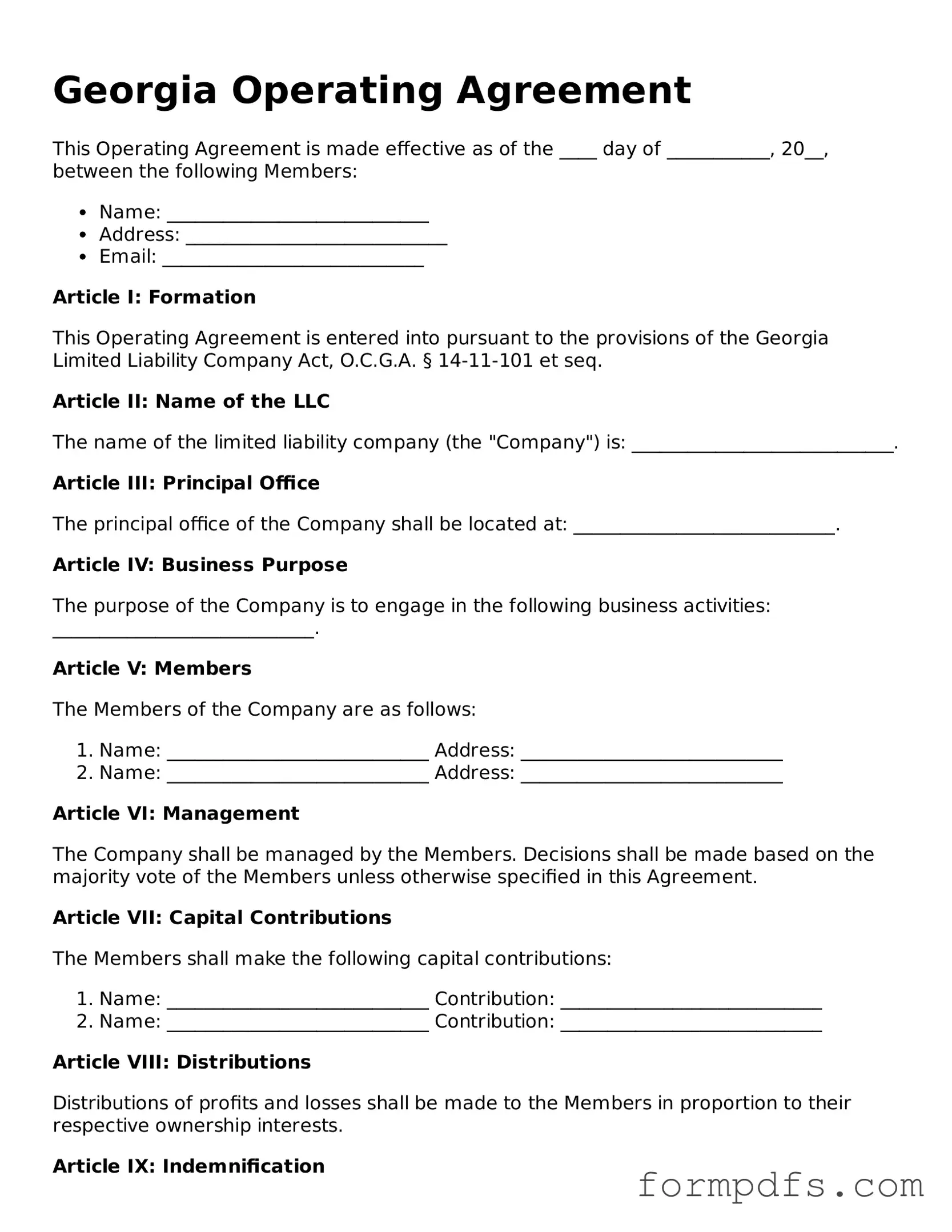

Printable Operating Agreement Form for the State of Georgia

The Georgia Operating Agreement form is a crucial document for anyone looking to establish a limited liability company (LLC) in the state of Georgia. This form outlines the structure and operating procedures of the LLC, ensuring that all members are on the same page regarding management, profit distribution, and decision-making processes. Key aspects include the identification of members, their roles, and responsibilities, as well as guidelines for meetings and voting. Additionally, the agreement addresses how to handle disputes and outlines the process for adding or removing members. By clearly defining these elements, the Operating Agreement helps prevent misunderstandings and conflicts among members, fostering a cooperative business environment. It is essential for compliance with state regulations and serves as a reference point for internal operations, making it a vital component of any LLC's formation. Understanding the importance of this document can save time and resources in the long run.

Check out Other Common Operating Agreement Templates for Different States

How to Make an Operating Agreement - It defines the rights of members to access company records and information.

Single Member Llc Operating Agreement Illinois - The Operating Agreement can include confidentiality clauses to protect sensitive information.

For individuals navigating the complexities of vehicle ownership transfers, understanding the importance of the California Form REG 262 is essential. This form not only facilitates the process but also ensures compliance with state regulations. It's vital to have this document ready along with the title when executing a transfer, as it captures all pertinent details about the transaction. For further assistance and access to a variety of essential documents, including this form, you can refer to All California Forms.

Llc in Michigan Form - Members can specify management structure, whether member-managed or manager-managed.

Documents used along the form

When forming a limited liability company (LLC) in Georgia, the Operating Agreement is a crucial document that outlines the management structure and operational guidelines. However, it is often accompanied by several other important forms and documents that help establish and maintain the LLC's legal standing. Here are some of those documents:

- Articles of Organization: This is the official document filed with the Georgia Secretary of State to create the LLC. It includes essential information like the company name, address, and the names of the members.

- Boat Bill of Sale: Essential for recording the sale and purchase of a boat in New York, this document protects both parties involved in the transaction. For a detailed template, you can refer to smarttemplates.net/fillable-new-york-boat-bill-of-sale/.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They can cover a range of issues, from approving a new member to authorizing significant expenditures.

- Bylaws: While not required in Georgia, bylaws can be helpful for LLCs that wish to outline internal rules and procedures. They govern how the company operates, including voting rights and meeting protocols.

- Initial Capital Contribution Agreement: This document details the contributions made by each member when the LLC is formed. It clarifies how much each member is investing and can help avoid disputes later on.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company and can be useful for record-keeping.

- Operating Procedures Manual: This is an internal document that outlines day-to-day operations and procedures for the LLC. It can help streamline processes and ensure that all members are on the same page.

- Tax Registration Forms: Depending on the nature of the business, the LLC may need to file various tax forms with state and federal agencies. This ensures compliance with tax laws and helps in obtaining necessary permits.

Each of these documents plays a significant role in the formation and ongoing management of an LLC in Georgia. By ensuring that all necessary paperwork is in order, members can help protect their interests and foster a smooth operation of their business.

PDF Overview

| Fact Name | Details |

|---|---|

| Governing Law | The Georgia Operating Agreement is governed by the Georgia Limited Liability Company Act (O.C.G.A. § 14-11-101 et seq.). |

| Purpose | This form outlines the management structure and operating procedures of a limited liability company (LLC) in Georgia. |

| Member Rights | The agreement specifies the rights and responsibilities of each member, ensuring clarity in ownership and management roles. |

| Flexibility | Georgia law allows significant flexibility in how an LLC can be structured and operated, which is reflected in the Operating Agreement. |

| Default Provisions | In the absence of an Operating Agreement, Georgia law provides default rules that govern the LLC's operations. |

| Amendments | The Operating Agreement can be amended as needed, provided that the amendment process is outlined within the document itself. |

| Member Contributions | The agreement typically details the initial capital contributions of each member and how future contributions will be handled. |

| Distributions | It outlines how profits and losses will be distributed among members, which can be based on ownership percentages or other agreed-upon methods. |

| Management Structure | The Operating Agreement can establish whether the LLC will be member-managed or manager-managed, affecting decision-making processes. |

| Dispute Resolution | Provisions for dispute resolution, including mediation or arbitration, can be included to help resolve conflicts among members. |

More About Georgia Operating Agreement

What is a Georgia Operating Agreement?

A Georgia Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Georgia. It defines the roles and responsibilities of members and managers, as well as the rights and obligations of each party involved.

Is an Operating Agreement required in Georgia?

While Georgia law does not require an Operating Agreement for LLCs, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provide a clear framework for the operation of the business.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC. However, it is advisable to consult with a legal professional to ensure that all necessary provisions are included and that the document complies with state laws.

What should be included in the Operating Agreement?

Key elements of an Operating Agreement typically include the LLC's name, purpose, member contributions, profit distribution, management structure, voting rights, and procedures for adding or removing members. It may also address dispute resolution and dissolution procedures.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making amendments should be clearly outlined in the document itself. Usually, a majority vote of the members is required to approve any changes.

How does the Operating Agreement affect liability protection?

The Operating Agreement helps reinforce the limited liability status of the LLC. By clearly defining the roles and responsibilities of members, it can help protect personal assets from business liabilities, provided that the LLC is operated according to the terms of the agreement.

What happens if there is no Operating Agreement?

If there is no Operating Agreement, the LLC will be governed by Georgia's default laws. This may not align with the members' intentions and could lead to conflicts or misunderstandings regarding management and profit distribution.

How can members resolve disputes outlined in the Operating Agreement?

The Operating Agreement should include a dispute resolution clause. This may specify mediation or arbitration as preferred methods for resolving conflicts, which can help avoid costly litigation.

Is the Operating Agreement a public document?

No, the Operating Agreement is not filed with the state and is considered a private document. Only the members of the LLC and their legal advisors typically have access to it.

Can an Operating Agreement be used for LLCs in other states?

While the general principles of an Operating Agreement can apply to LLCs in other states, each state has specific laws governing LLCs. It is essential to ensure that the Operating Agreement complies with the laws of the state where the LLC is formed.

Georgia Operating Agreement: Usage Steps

After gathering the necessary information, you will be ready to complete the Georgia Operating Agreement form. This document is essential for outlining the management structure and operational procedures of your business. Follow these steps to ensure accurate completion of the form.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal office address. This should be a physical location, not a P.O. Box.

- List the names and addresses of all members involved in the LLC.

- Specify the purpose of the LLC. This should be a brief description of what the business will do.

- Outline the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Detail each member's ownership percentage. This shows how profits and losses will be shared.

- Include provisions for adding or removing members in the future.

- State the duration of the LLC. If it’s intended to exist indefinitely, indicate that as well.

- Have all members sign and date the document. This signifies agreement to the terms outlined in the Operating Agreement.