Printable Mobile Home Bill of Sale Form for the State of Georgia

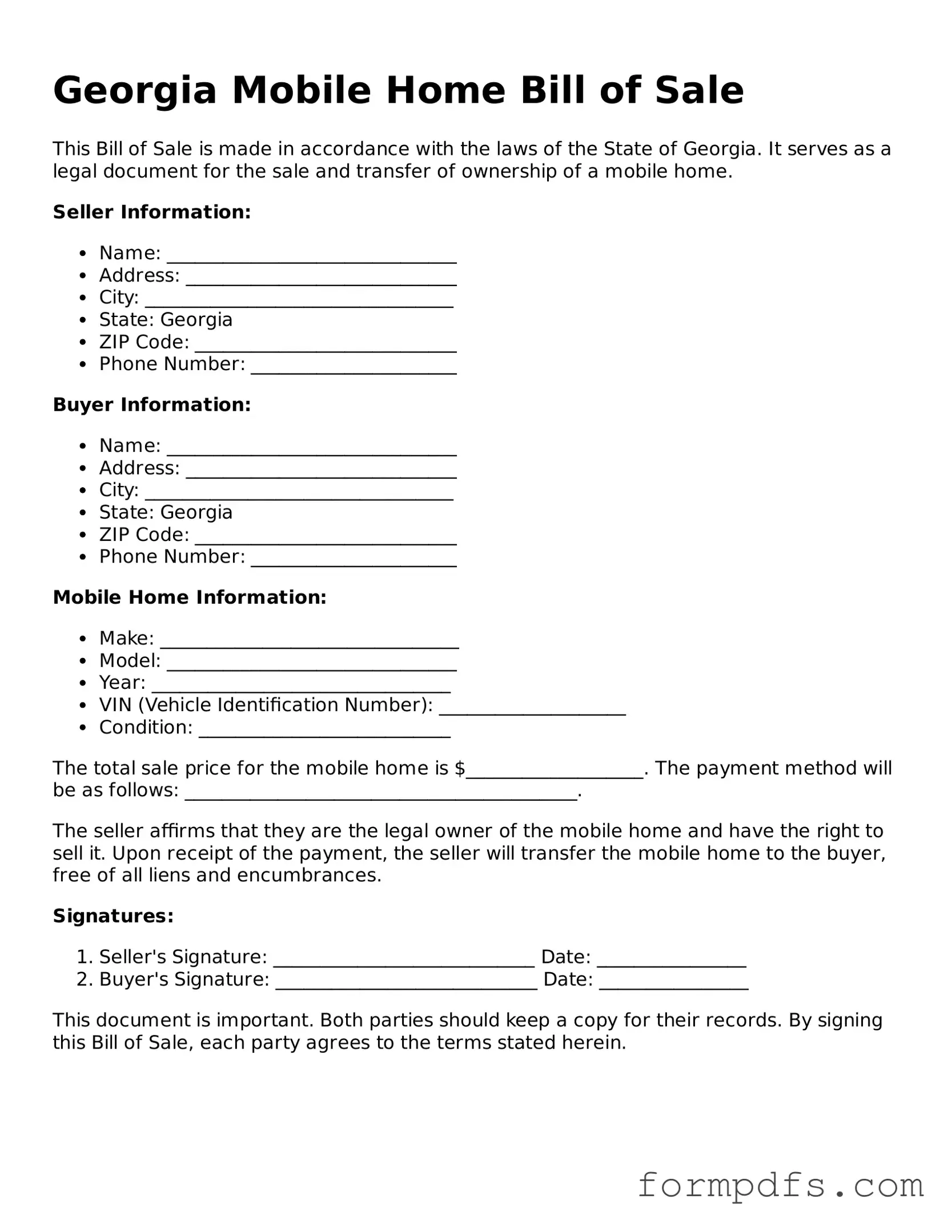

The Georgia Mobile Home Bill of Sale form serves as a crucial document in the transaction of mobile homes, ensuring that both buyers and sellers have a clear understanding of their rights and responsibilities. This form outlines essential details such as the names and addresses of the parties involved, a description of the mobile home, and the agreed-upon sale price. It also includes important information regarding the condition of the mobile home, which helps protect the interests of both parties. By providing a structured way to document the sale, this form helps to prevent disputes and misunderstandings. Additionally, it may require signatures from both the seller and buyer, signifying their agreement to the terms laid out in the document. Understanding how to properly fill out and utilize this form is vital for anyone involved in the sale or purchase of a mobile home in Georgia.

Check out Other Common Mobile Home Bill of Sale Templates for Different States

Bill of Sale for Mobile Home - The form can help avoid disputes over ownership in the future.

To ensure a smooth transaction, using a New York Bill of Sale form is essential, as it not only formalizes the sale but also helps prevent any ambiguities. For those looking to obtain this important document, you can find a fillable version at https://smarttemplates.net/fillable-new-york-bill-of-sale/, which provides all necessary details regarding the buyer, seller, and item sold.

Bill of Sale Mobile Home - It helps establish the mutual agreement on the sale price between the buyer and seller.

Documents used along the form

When buying or selling a mobile home in Georgia, several documents accompany the Mobile Home Bill of Sale. These forms help ensure that the transaction is clear and legally binding. Below is a list of common documents used in this process.

- Title Transfer Form: This form officially transfers ownership of the mobile home from the seller to the buyer. It is crucial for registering the new owner with the state.

- Affidavit of Affixation: If the mobile home is permanently attached to real property, this document confirms that it is no longer considered personal property. It helps in clarifying property taxes and ownership.

- Manufacturer's Certificate of Origin (MCO): This document proves the mobile home’s origin and is often required for registration. It is usually issued by the manufacturer.

- Sales Agreement: This contract outlines the terms of the sale, including price, payment method, and any contingencies. It protects both parties by clearly stating their obligations.

- Bill of Sale for Personal Property: In addition to the Mobile Home Bill of Sale, this document may be needed for any personal items included in the sale, such as appliances or furniture.

- Inspection Report: This report details the condition of the mobile home. It can help buyers understand any potential issues before finalizing the sale.

- Commercial Lease Agreement: For those considering leasing commercial space, it's vital to understand the terms outlined in a All California Forms to ensure a well-informed rental process.

- Loan Documents: If financing is involved, these documents outline the terms of the loan, including interest rates and payment schedules. They are essential for buyers using loans to purchase the mobile home.

Having these documents prepared and organized can streamline the buying or selling process. Ensure that all parties understand their roles and responsibilities to facilitate a smooth transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Mobile Home Bill of Sale form serves as a legal document to transfer ownership of a mobile home from one party to another. |

| Governing Law | This form is governed by the Georgia Uniform Commercial Code, specifically Title 11 of the Official Code of Georgia Annotated (O.C.G.A. § 11-2-101 et seq.). |

| Parties Involved | Typically, the form includes details about the seller (current owner) and the buyer (new owner) of the mobile home. |

| Property Description | A thorough description of the mobile home, including make, model, year, and Vehicle Identification Number (VIN), must be provided. |

| Purchase Price | The form should state the agreed-upon purchase price for the mobile home, ensuring clarity in the transaction. |

| Signatures | Both the seller and the buyer must sign the form to validate the transfer of ownership. |

| Date of Transfer | The date on which the ownership transfer takes place should be clearly indicated on the document. |

| Notarization | While notarization is not always required, having the form notarized can provide additional legal protection and verification. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed form for their records, as it serves as proof of the transaction. |

| Additional Documents | Depending on the transaction, other documents, such as a title or registration, may need to be presented alongside the Bill of Sale. |

More About Georgia Mobile Home Bill of Sale

What is a Georgia Mobile Home Bill of Sale form?

The Georgia Mobile Home Bill of Sale form is a legal document that records the transfer of ownership of a mobile home from one party to another. This form serves as proof of the transaction and includes essential details such as the names of the buyer and seller, the mobile home's identification number, and the sale price. It is crucial for ensuring that both parties have a clear understanding of the terms of the sale.

Is the Georgia Mobile Home Bill of Sale required for all transactions?

While it is not legally required to use a Bill of Sale for every mobile home transaction in Georgia, it is highly recommended. This document provides legal protection for both the buyer and seller by documenting the sale and its terms. Without it, disputes may arise regarding ownership or the specifics of the transaction, making it more difficult to resolve any issues that may occur later.

What information should be included in the form?

The form should include several key pieces of information. This includes the full names and addresses of both the buyer and seller, the mobile home's make, model, year, and vehicle identification number (VIN). Additionally, the sale price and the date of the transaction should be clearly stated. Both parties should sign the document to validate the agreement.

Do I need to have the Bill of Sale notarized?

No, notarization is not required for a Georgia Mobile Home Bill of Sale. However, having the document notarized can provide an extra layer of security and authenticity. It may help prevent disputes in the future, as a notary public verifies the identities of the parties involved and their willingness to sign the document.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer should also take the document to their local county tax office to register the mobile home in their name. This step is essential for ensuring that the mobile home is legally recognized as the buyer's property and for tax purposes. Failure to register may lead to complications down the line.

Georgia Mobile Home Bill of Sale: Usage Steps

After gathering the necessary information, you are ready to complete the Georgia Mobile Home Bill of Sale form. This document serves as a record of the transaction between the buyer and seller. Ensuring that all details are filled out accurately will help facilitate a smooth transfer of ownership.

- Begin by entering the date of the transaction at the top of the form.

- Provide the full name and address of the seller. Make sure to include any relevant contact information.

- Next, fill in the buyer’s full name and address, also including contact details.

- Clearly describe the mobile home being sold. Include details such as the make, model, year, size, and any identifying numbers like the VIN (Vehicle Identification Number).

- State the purchase price of the mobile home. Be specific and ensure that it matches any agreed-upon amount.

- If applicable, indicate any terms of the sale, such as payment methods or conditions that must be met.

- Both the seller and buyer should sign and date the form at the designated areas. This signifies their agreement to the terms outlined.

- Finally, consider making copies of the completed form for both parties to retain for their records.