Printable Loan Agreement Form for the State of Georgia

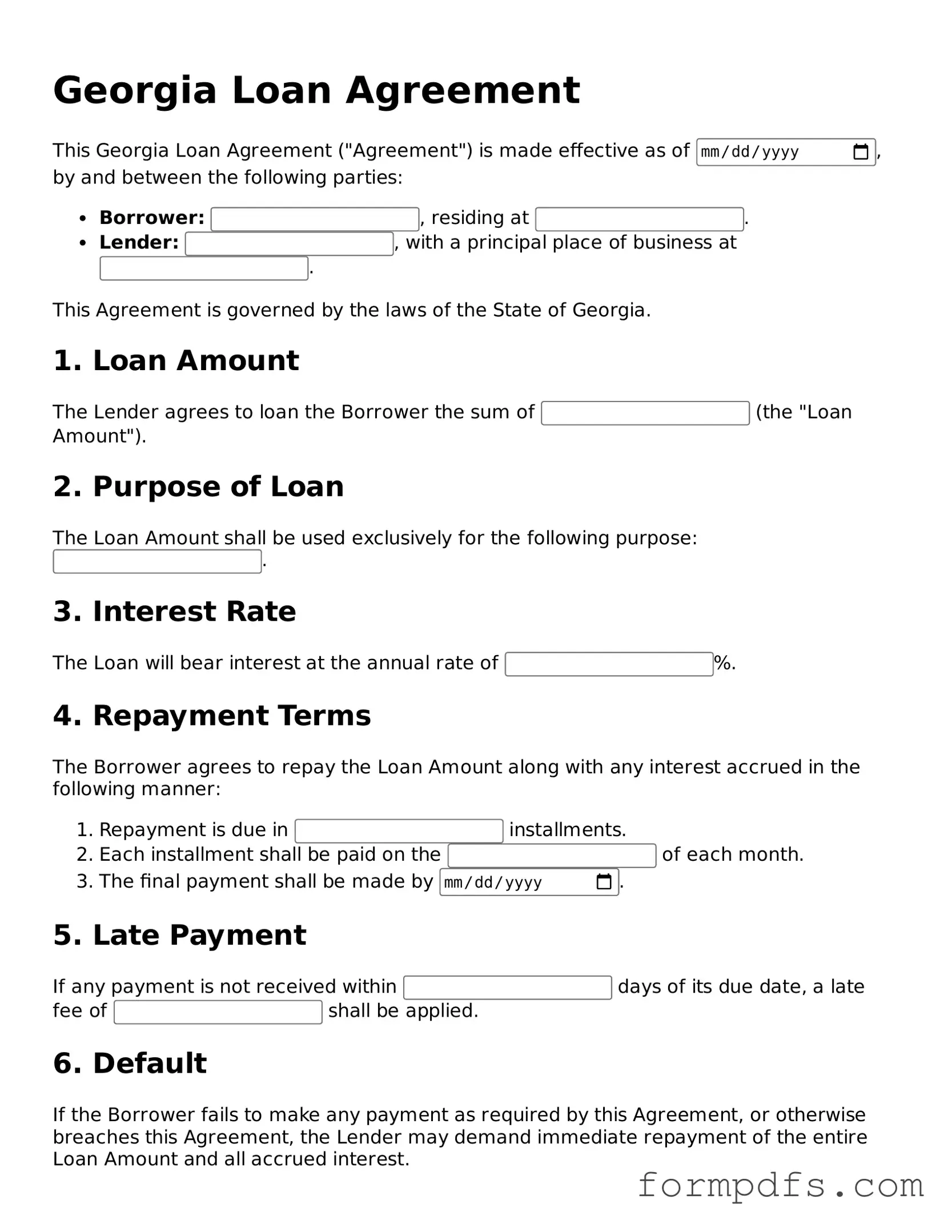

In Georgia, the Loan Agreement form plays a crucial role in formalizing the terms of a loan between a lender and a borrower. This document serves as a legally binding contract that outlines the specific details of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It is essential for both parties to clearly understand their rights and obligations under this agreement. Additionally, the form may include provisions for late payments, defaults, and remedies available to the lender in case of non-compliance. By documenting these terms, the Loan Agreement not only helps prevent misunderstandings but also provides a framework for resolving disputes should they arise. Understanding the nuances of this form can empower individuals to make informed financial decisions and foster trust in lending relationships.

Check out Other Common Loan Agreement Templates for Different States

Illinois Promissory Note - It can outline how disputes will be resolved between the parties.

Completing the USCIS I-864 form is essential for sponsors, as it solidifies their commitment to financially support the immigrant, thereby preventing them from relying on public assistance. For more information about the process and requirements, you can visit OnlineLawDocs.com, which offers detailed resources to assist applicants in navigating this important step in the immigration journey.

Documents used along the form

When entering into a loan agreement in Georgia, several additional forms and documents may be necessary to ensure clarity and compliance with local regulations. Each of these documents serves a specific purpose, helping to protect both the lender and the borrower throughout the loan process.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Loan Disclosure Statement: Required by federal law, this statement provides borrowers with essential information about the loan terms, including total costs and annual percentage rates (APRs), allowing for informed decision-making.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets pledged by the borrower. It details the rights of the lender in case of default.

- Personal Guarantee: This form may be required when a business borrows money. It holds an individual personally liable for the debt, ensuring that the lender has recourse if the business fails to repay.

- Lease Agreement: A crucial document that outlines the terms and conditions for renting property, ensuring clear communication between landlord and tenant. For more information, visit smarttemplates.net/fillable-lease-agreement/.

- Loan Application: This initial document collects information about the borrower’s financial situation, credit history, and the purpose of the loan. It helps lenders assess risk before approving the loan.

- Amortization Schedule: This document outlines the repayment plan for the loan, detailing each payment's principal and interest components over the loan's duration, helping borrowers understand their financial obligations.

- Loan Closing Statement: This document summarizes the final terms of the loan, including fees, costs, and the distribution of funds. It ensures that both parties are aware of the final agreement before the loan is disbursed.

Each of these documents plays a crucial role in the lending process, providing transparency and legal protection for both parties involved. Understanding their significance can lead to a smoother borrowing experience and help avoid potential disputes down the line.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Georgia. |

| Parties Involved | The form requires the names and contact information of both the lender and the borrower. |

| Loan Amount | The specific amount of money being borrowed must be clearly stated in the agreement. |

| Interest Rate | The agreement should specify the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details regarding how and when the borrower will repay the loan are essential components of the form. |

| Default Clauses | Provisions outlining what constitutes a default and the consequences of defaulting are included. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | The form allows for amendments, but they must be documented and signed by both parties. |

| Legal Compliance | The agreement must comply with federal and state lending laws to be enforceable. |

More About Georgia Loan Agreement

What is a Georgia Loan Agreement?

A Georgia Loan Agreement is a legal document that outlines the terms and conditions under which one party lends money to another in the state of Georgia. This agreement serves to protect both the lender and the borrower by clearly stating the loan amount, interest rate, repayment schedule, and any other relevant terms.

Who needs a Loan Agreement?

Anyone who is lending or borrowing money should consider using a Loan Agreement. This includes individuals, businesses, and even family members or friends. Having a written agreement helps prevent misunderstandings and provides a clear reference in case of disputes.

What information is typically included in a Georgia Loan Agreement?

A typical Georgia Loan Agreement includes the names and addresses of the lender and borrower, the loan amount, the interest rate, the repayment schedule, and any collateral involved. Additionally, it may outline the consequences of late payments or defaults, as well as any fees associated with the loan.

Is a Loan Agreement required by law in Georgia?

No, a Loan Agreement is not legally required for personal loans in Georgia. However, having a written document is highly recommended to ensure clarity and protect the rights of both parties. It serves as a legal record of the terms agreed upon.

Can I customize a Georgia Loan Agreement?

Yes, you can customize a Georgia Loan Agreement to fit your specific needs. While there are standard elements that should be included, you can add clauses that address unique circumstances or requirements. Just ensure that any modifications comply with Georgia law.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the agreement, the lender has the right to take legal action. This may include filing a lawsuit to recover the owed amount. The specific remedies available will depend on the terms of the agreement and Georgia law.

Do I need a lawyer to create a Loan Agreement?

While it is not necessary to hire a lawyer to create a Loan Agreement, consulting with one can be beneficial. A legal expert can help ensure that the agreement is comprehensive, legally binding, and compliant with state laws, reducing the risk of future disputes.

How can I ensure my Loan Agreement is enforceable?

To ensure your Loan Agreement is enforceable, both parties should sign and date the document. It is also advisable to have the agreement witnessed or notarized. Keeping a copy of the signed agreement for both parties can further solidify its validity.

Where can I find a Georgia Loan Agreement template?

You can find Georgia Loan Agreement templates online through legal websites, or you may choose to create one from scratch using guidelines available in legal resources. Ensure that any template you use is tailored to Georgia law and fits your specific needs.

Georgia Loan Agreement: Usage Steps

Filling out the Georgia Loan Agreement form is a straightforward process that requires attention to detail. Completing this form accurately is essential for ensuring that all parties understand the terms of the loan. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form. This should reflect the date you are completing the agreement.

- Fill in the names and addresses of both the borrower and the lender. Ensure that the information is complete and accurate.

- Specify the loan amount in the designated section. Clearly write the numerical value and spell it out in words for clarity.

- Indicate the interest rate applicable to the loan. This should be expressed as a percentage.

- Detail the repayment terms. Include the frequency of payments (e.g., monthly, quarterly) and the total duration of the loan.

- Provide information about any collateral, if applicable. Describe the item(s) being used as security for the loan.

- Include any additional terms or conditions that are relevant to the agreement. This may cover fees, penalties, or special agreements.

- Both the borrower and lender should sign and date the form at the bottom. Ensure that all signatures are clear and legible.

After completing the form, review it carefully to confirm that all information is accurate and complete. Retain copies for both parties for future reference.