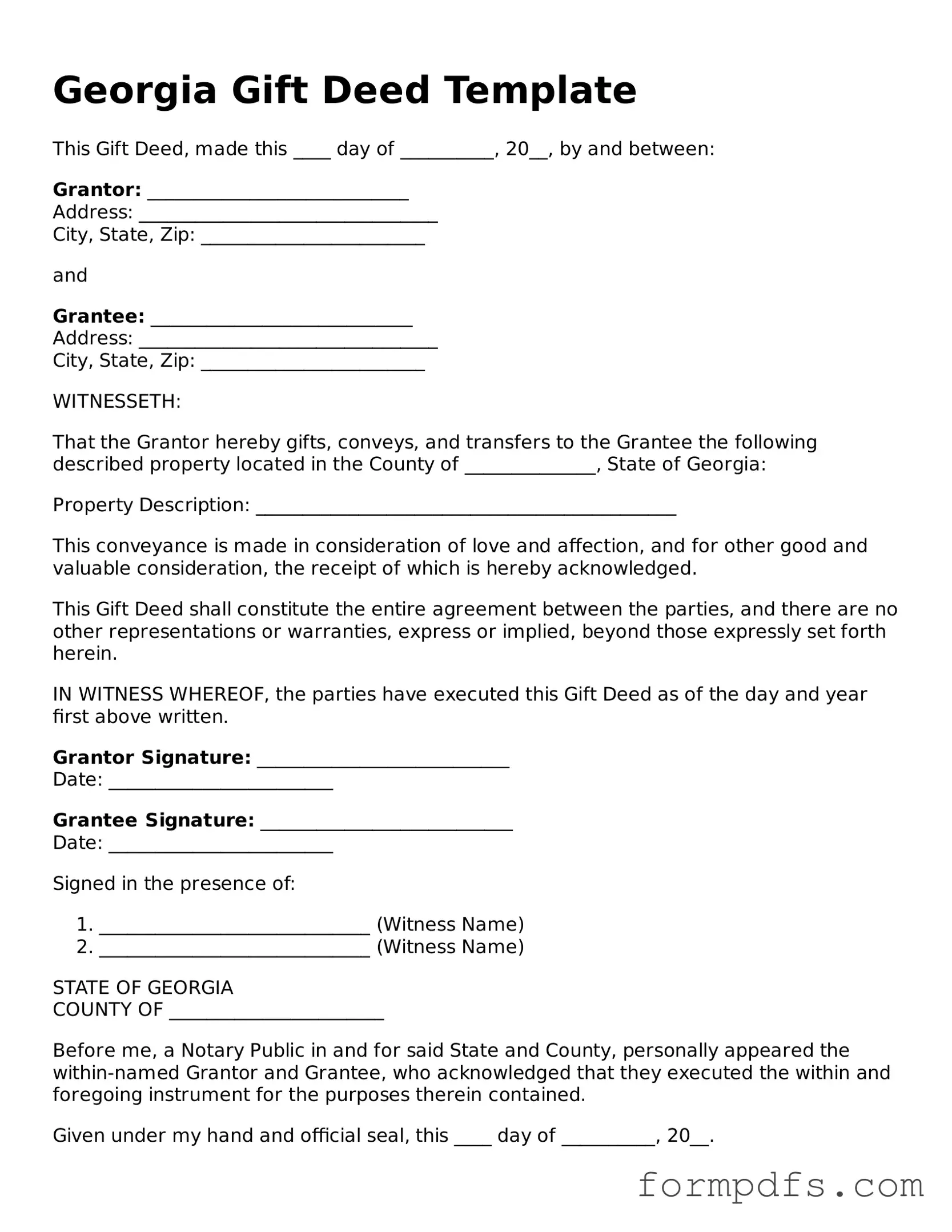

Printable Gift Deed Form for the State of Georgia

When it comes to transferring property without the exchange of money, the Georgia Gift Deed form serves as an essential legal tool. This document allows a property owner to gift real estate to another individual, typically a family member or close friend, without the complications of a sale. The form outlines the details of the property being gifted, including its legal description, the names of both the giver and the recipient, and any specific conditions attached to the gift. Importantly, the Georgia Gift Deed must be signed in the presence of a notary public, ensuring that the transaction is legally binding and recognized by the state. Additionally, it’s crucial to understand the potential tax implications associated with gifting property, as the IRS has specific guidelines regarding gift taxes. By utilizing this form correctly, individuals can facilitate a smooth transfer of ownership, fostering generosity while adhering to legal requirements.

Documents used along the form

When transferring property as a gift in Georgia, a Gift Deed form is a crucial document. However, several other forms and documents may accompany it to ensure a smooth and legally compliant transaction. Below is a list of commonly used documents that often accompany the Georgia Gift Deed.

- Affidavit of Gift: This document serves as a sworn statement confirming that the property is being given as a gift without any expectation of payment or compensation.

- Property Tax Exemption Application: If the gift of property qualifies for tax exemptions, this application can help the recipient avoid property taxes on the gifted property.

- Quitclaim Deed: Sometimes used alongside a Gift Deed, this document transfers any interest the giver has in the property to the recipient without making any guarantees about the title.

- California Power of Attorney for a Child Form: Essential for allowing another adult to make decisions for a child when the parent or guardian is unavailable, detailed information can be found in All California Forms.

- Title Search Report: A report that verifies the current ownership of the property and checks for any liens or encumbrances that could affect the transfer.

- Closing Statement: This document outlines all financial transactions related to the property transfer, even if no money is exchanged in a gift transaction.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain threshold, the giver may need to file this federal tax form to report the gift to the IRS.

- Notice of Gift: This is a formal notification that can be sent to relevant parties, such as mortgage lenders, indicating that the property has been gifted.

- Deed of Trust: In some cases, a deed of trust may be used to secure a loan against the property, even if it was initially gifted.

Understanding these documents can facilitate a seamless property transfer process. Each plays a unique role in ensuring that the gift is legally recognized and properly recorded, protecting both the giver and the recipient.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property from one person to another without any exchange of money. |

| Governing Law | The Georgia Gift Deed is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30. |

| Requirements | The deed must be in writing, signed by the donor (the person giving the gift), and notarized. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from a sale deed. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient, including potential gift tax liabilities. |

| Revocation | Once executed, a gift deed is generally irrevocable unless specific conditions are met. |

| Recording | It is advisable to record the gift deed with the local county clerk’s office to provide public notice of the transfer. |

| Intended Use | Commonly used for transferring real estate, a gift deed can also apply to personal property. |

| Beneficiary Designation | The recipient of the property is known as the grantee, who will receive the property rights upon execution of the deed. |

| Legal Assistance | While not required, consulting a legal professional can help ensure the deed complies with all state laws and requirements. |

More About Georgia Gift Deed

What is a Georgia Gift Deed?

A Georgia Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. This type of deed is often used when someone wishes to give property, such as real estate, to a family member or friend as a gift. It is essential to follow the proper procedures to ensure that the transfer is valid and recognized by the state.

What are the requirements for a valid Gift Deed in Georgia?

For a Gift Deed to be valid in Georgia, it must meet several requirements. First, the deed must be in writing and signed by the donor (the person giving the gift). The property must be clearly described, and the recipient (the person receiving the gift) must be identified. Additionally, the deed should be notarized and recorded in the county where the property is located to provide public notice of the transfer.

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications when using a Gift Deed. The donor may be subject to federal gift tax if the value of the gift exceeds the annual exclusion limit set by the IRS. However, there are exemptions and exclusions available, so it is advisable to consult a tax professional to understand the potential tax consequences fully.

Can a Gift Deed be revoked or changed after it is executed?

Once a Gift Deed is executed and recorded, it generally cannot be revoked or changed unilaterally by the donor. The transfer of property is considered complete, and the recipient has full ownership rights. However, if both parties agree, they may execute a new document to reverse or modify the original gift.

Is it necessary to have a lawyer when creating a Gift Deed?

While it is not legally required to have a lawyer when creating a Gift Deed, it is highly recommended. A legal professional can help ensure that the deed is properly drafted, meets all legal requirements, and protects the interests of both the donor and the recipient. This can help prevent potential disputes or issues down the line.

What happens if the Gift Deed is not recorded?

If a Gift Deed is not recorded, the transfer of property may still be valid between the parties involved. However, failing to record the deed can create complications. Other parties, such as creditors or future buyers, may not be aware of the transfer, potentially leading to disputes over ownership. Recording the deed provides public notice and helps protect the recipient's rights.

Can a Gift Deed be used for personal property, or is it only for real estate?

A Gift Deed is primarily used for real estate transactions. However, the concept of gifting can also apply to personal property, such as vehicles or jewelry. Different forms or documents may be required for personal property transfers, so it's important to understand the specific requirements for each type of gift.

What should I do if I have further questions about Gift Deeds in Georgia?

If you have further questions about Gift Deeds in Georgia, consider consulting with a legal professional who specializes in property law. They can provide tailored advice based on your specific situation and help guide you through the process of creating and executing a Gift Deed.

Georgia Gift Deed: Usage Steps

Completing the Georgia Gift Deed form is an important step in transferring property ownership without any monetary exchange. Once the form is filled out correctly, it will need to be signed and notarized before being filed with the appropriate county office. Follow these steps to ensure that you complete the form accurately.

- Obtain the Georgia Gift Deed form from a reliable source, such as a legal website or local government office.

- Begin by filling in the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift). Ensure that the names are spelled correctly.

- Provide the current address of both the grantor and the grantee. This information is essential for identification purposes.

- Describe the property being gifted. Include the full legal description, which can usually be found on the property deed or tax records.

- Indicate any restrictions or conditions related to the gift, if applicable. This may include stipulations about the use of the property.

- Sign and date the form in the presence of a notary public. Both the grantor and grantee may need to be present for this step.

- After notarization, make copies of the completed form for your records.

- File the original Gift Deed with the county clerk’s office in the county where the property is located. There may be a filing fee, so be prepared for that.

Once you have completed these steps, you will have successfully filled out the Georgia Gift Deed form. Make sure to keep a copy for your records and follow any additional local requirements for property transfers.