Printable Durable Power of Attorney Form for the State of Georgia

In Georgia, the Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to manage their financial and legal affairs when they are unable to do so themselves. This form remains effective even if the individual becomes incapacitated, providing peace of mind during uncertain times. By designating an agent, also known as an attorney-in-fact, the principal can ensure that their wishes regarding financial decisions, property management, and other important matters are carried out according to their preferences. The form outlines the powers granted to the agent, which can be broad or limited, depending on the principal's needs. It is crucial for individuals to understand the responsibilities of their chosen agent, as well as the implications of granting such authority. Additionally, the Durable Power of Attorney can be tailored to include specific instructions or limitations, making it a flexible tool for personal planning. Understanding this form is vital for anyone looking to secure their financial future and ensure their affairs are handled appropriately in the event of incapacity.

Check out Other Common Durable Power of Attorney Templates for Different States

Free Power of Attorney Form Nc - You can revoke the Durable Power of Attorney at any time while you are competent.

To ensure a smooth process when applying for a marriage license in Florida, couples should start by completing the required paperwork, which includes the essential All Florida Forms. This step is crucial, as it provides the necessary information for the marriage license and helps avoid any potential delays in their wedding plans.

Illinois Durable Power of Attorney - Granting power through this form is a proactive step in personal financial management.

Documents used along the form

A Durable Power of Attorney (DPOA) is a vital document that allows an individual to designate someone to make decisions on their behalf, particularly in financial or legal matters. In Georgia, this form is often accompanied by other important documents that can enhance its effectiveness and provide additional legal clarity. Here are some commonly used forms and documents that may accompany a Durable Power of Attorney:

- Advance Healthcare Directive: This document allows an individual to specify their healthcare preferences and appoint a healthcare agent. It is especially important if the individual becomes unable to communicate their wishes regarding medical treatment.

- Notice to Quit: In situations where a lease violation occurs, a landlord may issue a formal notice. For more details, refer to the Notice to Quit form, which provides essential information for handling such matters.

- Living Will: A living will outlines an individual's preferences regarding end-of-life medical care. This document complements the Durable Power of Attorney by providing guidance on the types of medical interventions the individual desires or wishes to avoid.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants authority over financial matters. It can be useful in situations where a broader scope of financial management is required.

- Will: A will outlines how an individual’s assets should be distributed after their death. While not directly related to the Durable Power of Attorney, it is an essential document for comprehensive estate planning.

Each of these documents serves a distinct purpose and can work together with the Durable Power of Attorney to ensure that an individual's wishes are honored in both healthcare and financial matters. It is advisable to consider these documents carefully to create a well-rounded plan for the future.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in Georgia allows an individual to appoint someone to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Georgia Durable Power of Attorney is governed by the Georgia Statutes, specifically O.C.G.A. § 10-6-140 et seq. |

| Durability | This form remains effective even if the principal becomes incapacitated, distinguishing it from a regular power of attorney that may become void under such circumstances. |

| Principal's Authority | The principal retains the right to revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Agent's Responsibilities | The agent, also known as the attorney-in-fact, has a fiduciary duty to act in the best interest of the principal and must manage the principal's affairs responsibly. |

| Execution Requirements | The form must be signed by the principal in the presence of a notary public and, if desired, two witnesses to ensure its validity. |

More About Georgia Durable Power of Attorney

What is a Durable Power of Attorney in Georgia?

A Durable Power of Attorney (DPOA) in Georgia is a legal document that allows an individual, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. The DPOA can cover various matters, including financial decisions, healthcare, and property management.

How do I create a Durable Power of Attorney in Georgia?

To create a DPOA in Georgia, you must complete a form that meets state requirements. The document must be signed by the principal in the presence of a notary public. It is advisable to clearly outline the powers granted to the agent and specify any limitations. After signing, the DPOA should be stored in a safe place, and copies should be provided to the agent and relevant institutions.

Can I revoke a Durable Power of Attorney in Georgia?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To revoke the DPOA, the principal should create a written notice of revocation and notify the agent and any institutions that may have relied on the original document. It is important to ensure that the revocation is clear and unambiguous.

What powers can I grant to my agent in a Durable Power of Attorney?

The powers granted in a DPOA can be broad or limited, depending on the principal's preferences. Common powers include managing bank accounts, handling real estate transactions, making investment decisions, and managing business operations. The principal can also specify any limitations or conditions regarding the agent’s authority.

What happens if I do not have a Durable Power of Attorney?

If a person becomes incapacitated without a DPOA in place, family members may need to seek guardianship or conservatorship through the court. This process can be lengthy, costly, and may not align with the individual's wishes. Having a DPOA allows individuals to designate someone they trust to make decisions on their behalf, avoiding potential disputes among family members.

Is a Durable Power of Attorney valid if I move to another state?

A Durable Power of Attorney executed in Georgia is generally valid in other states, but acceptance can vary. Some states may have specific requirements for DPOAs, so it is advisable to check the laws of the new state. If an individual plans to move, they may consider consulting an attorney in the new state to ensure their DPOA remains effective.

Can I use a Durable Power of Attorney for healthcare decisions?

While a Durable Power of Attorney can cover healthcare decisions, Georgia also provides a separate document called an Advance Directive for Health Care. This document specifically addresses healthcare preferences and appoints an agent for medical decisions. It is recommended to use both documents to ensure comprehensive coverage for both financial and healthcare matters.

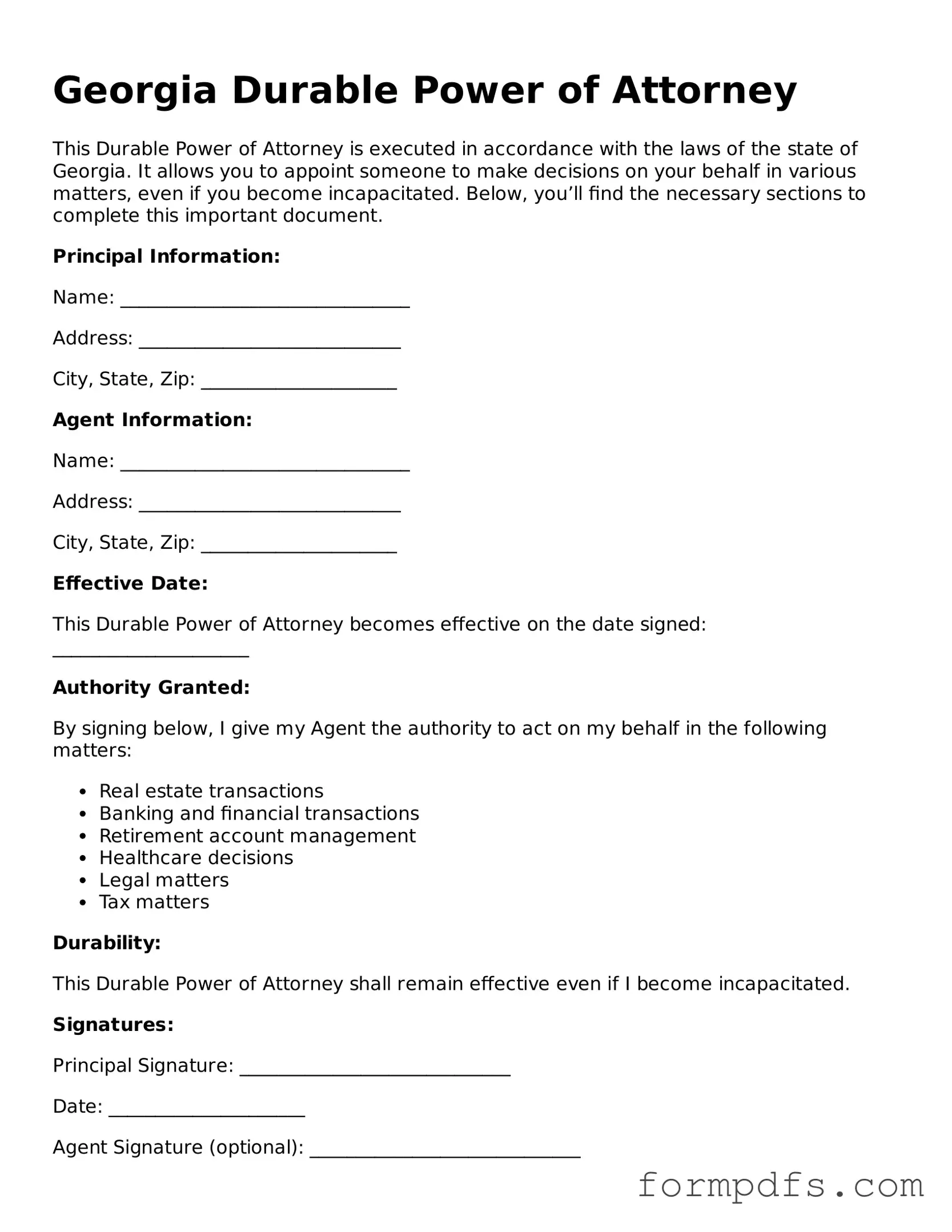

Georgia Durable Power of Attorney: Usage Steps

Filling out the Georgia Durable Power of Attorney form is an important step in designating someone to manage your financial and legal affairs. The process involves providing personal information, selecting an agent, and specifying the powers granted. Once completed, this document must be signed and witnessed to ensure its validity.

- Obtain the Georgia Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Begin by filling in your full name and address at the top of the form.

- Identify the person you wish to appoint as your agent. Provide their full name, address, and relationship to you.

- Clearly outline the powers you wish to grant your agent. This may include managing bank accounts, real estate, or making healthcare decisions.

- Decide if you want to name an alternate agent in case your primary agent is unable to serve. If so, provide their information as well.

- Review the form to ensure all information is accurate and complete.

- Sign the form in the presence of a notary public or two witnesses, depending on the requirements outlined in the form.

- Distribute copies of the completed form to your agent, alternate agent, and any relevant financial institutions or healthcare providers.