Printable Deed in Lieu of Foreclosure Form for the State of Georgia

In the state of Georgia, homeowners facing financial difficulties may find themselves considering various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal process that allows a borrower to transfer the ownership of their property back to the lender. This arrangement can provide a more streamlined and less stressful alternative to the lengthy foreclosure process. By voluntarily surrendering the property, homeowners may benefit from a quicker resolution and potentially mitigate the damage to their credit score. The Deed in Lieu of Foreclosure form outlines the terms and conditions of this agreement, detailing the responsibilities of both the borrower and the lender. It is crucial for homeowners to understand the implications of this form, including how it affects their mortgage obligations and any potential tax consequences. Additionally, the form may require specific documentation and disclosures, ensuring that both parties are fully informed throughout the transaction. Understanding these aspects can empower homeowners to make informed decisions during challenging financial times.

Check out Other Common Deed in Lieu of Foreclosure Templates for Different States

Deed in Lieu of Foreclosure Sample - Taking this step may lead to more favorable outcomes for those struggling financially.

In addition to the California Room Rental Agreement, it is advisable to have access to comprehensive documentation to ensure compliance with local regulations. For those looking for a wide range of legal templates, including the rental agreement, visit All California Forms to find the necessary resources for a smooth rental process.

Documents used along the form

When navigating the process of a Deed in Lieu of Foreclosure in Georgia, several other forms and documents may be necessary to ensure a smooth transaction. Each document serves a specific purpose and helps clarify the terms between the parties involved. Below is a list of commonly used documents in conjunction with the Georgia Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms, such as interest rates or payment schedules, to help the borrower avoid foreclosure.

- Notice of Default: A formal notification sent to the borrower indicating that they have failed to meet their loan obligations, often a precursor to foreclosure proceedings.

- Release of Liability: This document releases the borrower from any further obligation related to the loan after the Deed in Lieu is executed, providing peace of mind for the borrower.

- Property Inspection Report: A report detailing the condition of the property, which may be required by the lender to assess its value before accepting the deed.

- Affidavit of Title: A sworn statement confirming the seller's ownership of the property and that there are no undisclosed liens or claims against it.

- Motor Vehicle Bill of Sale: A vital document that records the sale and transfer of a vehicle. For more details, visit smarttemplates.net/fillable-motor-vehicle-bill-of-sale.

- Transfer of Ownership Form: This document facilitates the transfer of the property title from the borrower to the lender, ensuring that all legal requirements are met.

- Quitclaim Deed: A legal instrument by which the borrower relinquishes their interest in the property to the lender, often used in conjunction with the Deed in Lieu.

- Settlement Statement: A detailed breakdown of all financial transactions involved in the deed transfer, including any fees or costs associated with the process.

Understanding these documents can help both borrowers and lenders navigate the complexities of a Deed in Lieu of Foreclosure. Each plays a crucial role in protecting the interests of all parties involved, ensuring a clear and efficient transfer of property ownership.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The deed in lieu of foreclosure in Georgia is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-14-162. |

| Eligibility | Borrowers facing financial difficulties may qualify for a deed in lieu of foreclosure, provided they have exhausted other options. |

| Process | The borrower must request the deed in lieu, and the lender must agree to accept it as a resolution to the default. |

| Benefits | This option can help borrowers avoid the negative impact of foreclosure on their credit scores. |

| Risks | Borrowers may still be liable for any remaining debt if the property's value is less than the mortgage balance. |

| Documentation | Typically, a deed in lieu requires several documents, including a deed, a release of liability, and sometimes a financial statement. |

| Timeframe | The process can take several weeks to complete, depending on the lender's requirements and the situation. |

| Alternatives | Borrowers may consider alternatives such as loan modification or short sale before opting for a deed in lieu. |

More About Georgia Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Georgia?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. In Georgia, this process can help homeowners eliminate the burden of mortgage debt and avoid the lengthy and costly foreclosure process. By agreeing to this arrangement, the homeowner typically relinquishes all rights to the property, and the lender agrees to forgive the remaining mortgage balance, although terms can vary by lender.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One major benefit is that it can significantly reduce the negative impact on the homeowner's credit score compared to a foreclosure. The process is generally quicker and less expensive than going through foreclosure. Additionally, it allows homeowners to walk away from their mortgage debt without the hassle of a foreclosure sale. In some cases, lenders may also offer relocation assistance or other forms of financial support to help homeowners transition to new housing.

Are there any risks associated with a Deed in Lieu of Foreclosure?

Yes, there are potential risks. Homeowners may still be responsible for any outstanding debts, such as property taxes or homeowners association fees, even after the deed is transferred. Additionally, the lender may require the homeowner to provide financial documentation, which could involve disclosing personal financial information. It’s also important to ensure that the deed is properly executed to avoid any future legal complications. Consulting with a qualified professional can help mitigate these risks.

How do I initiate a Deed in Lieu of Foreclosure in Georgia?

The first step is to contact your lender to express your interest in a Deed in Lieu of Foreclosure. They will provide you with the necessary forms and information about the process. It’s advisable to prepare your financial documents, as lenders will typically require proof of your financial situation. After reviewing your application, the lender will assess whether to accept the deed. If approved, both parties will sign the deed, and it will be recorded with the local county clerk’s office.

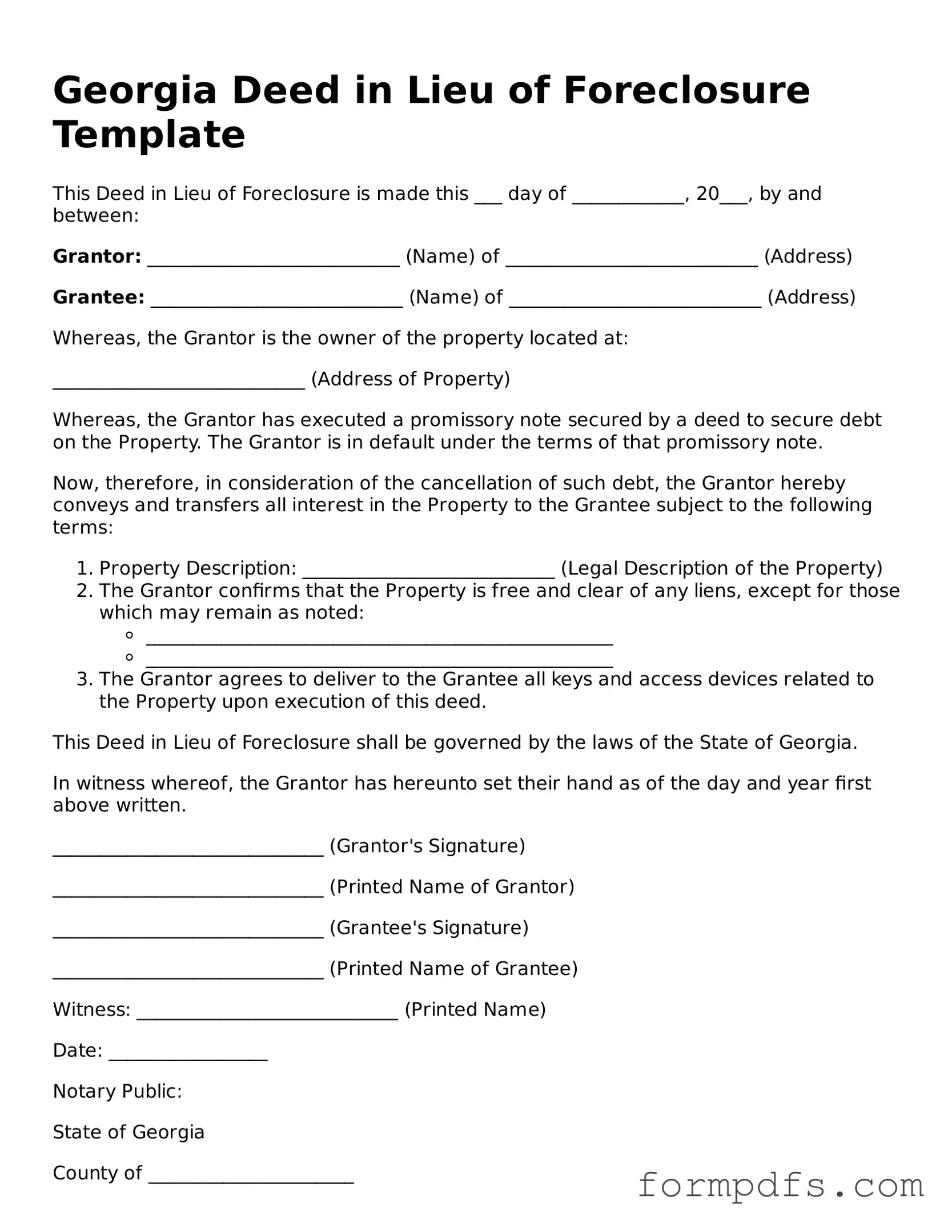

Georgia Deed in Lieu of Foreclosure: Usage Steps

Once you have the Georgia Deed in Lieu of Foreclosure form in hand, it’s essential to fill it out accurately to ensure that the transfer of property rights is clear and legally binding. After completing the form, it will need to be signed, notarized, and then recorded with the appropriate county office. This process is crucial for protecting your interests and ensuring that the transaction is recognized by local authorities.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor, which is typically the current property owner.

- List the name of the grantee, usually the lender or bank receiving the property.

- Include the full legal description of the property. This can often be found on your property deed or tax records.

- Indicate the address of the property, including the city and county.

- Clearly state the reason for the deed in lieu of foreclosure, explaining the circumstances that led to this decision.

- Sign the form in the presence of a notary public. Ensure that all signatures are dated.

- Have the notary public complete their section, confirming that they witnessed the signing.

- Make copies of the completed form for your records before proceeding to record it.

- Submit the original form to the county clerk’s office where the property is located for recording.