Printable Bill of Sale Form for the State of Georgia

When engaging in a transaction involving the sale of personal property in Georgia, the Bill of Sale form serves as a crucial document for both buyers and sellers. This form not only provides a written record of the sale but also outlines essential details such as the identities of the parties involved, a description of the item being sold, and the agreed-upon purchase price. Additionally, it may include information about any warranties or guarantees provided by the seller, ensuring that both parties have a clear understanding of their rights and responsibilities. By documenting the transaction, the Bill of Sale helps protect both the buyer and seller from potential disputes in the future. It can also be useful for tax purposes and when registering the property with relevant authorities. Understanding the components and significance of this form can facilitate smoother transactions and foster trust between parties.

Check out Other Common Bill of Sale Templates for Different States

Vehicle Bill of Sale Illinois - The document can offer legal protection in case of claims regarding the item sold.

The ADP Pay Stub form is an essential tool for employees, offering clarity on earnings and deductions. To ensure accuracy in your financial planning, it's vital to understand every detail presented. If you're ready to complete your ADP Pay Stub, you can easily do so by visiting Fill PDF Forms for a seamless experience.

Ohio Bill of Sale Template - Creating a Bill of Sale doesn’t require legal expertise, just clear communication between parties.

Documents used along the form

The Georgia Bill of Sale is an important document for transferring ownership of personal property. However, several other forms and documents often accompany it to ensure a smooth transaction. Below is a list of commonly used documents that may be needed alongside the Bill of Sale.

- Title Transfer Document: This document officially transfers the ownership of a vehicle from the seller to the buyer. It includes details like the vehicle identification number (VIN) and the names of both parties.

- Odometer Disclosure Statement: Required for vehicle sales, this statement records the mileage of the vehicle at the time of sale. Both the seller and buyer must sign it to confirm the accuracy of the information.

- Purchase Agreement: This is a contract that outlines the terms of the sale, including the purchase price, payment method, and any warranties. It protects both the buyer and seller by clearly stating their obligations.

- Affidavit of Sale: This sworn statement confirms that the sale has occurred. It may be used to verify the transaction if any disputes arise later.

- Power of Attorney: If the seller cannot be present for the transaction, a power of attorney allows someone else to sign the Bill of Sale on their behalf. This document must be notarized.

- Vehicle Registration Application: After purchasing a vehicle, the buyer needs to register it with the state. This application is necessary to obtain a new title and license plates.

- Tax Form: Buyers may need to complete a tax form to report the sale to the state. This form ensures that any applicable sales tax is paid at the time of registration.

- Sworn Affidavit & Proof of Loss Statement: This document is vital for affirming the details of the transaction and asserting any claims related to the sale. It is particularly beneficial when trying to resolve disputes or clarifying ownership issues. More insights can be found in the Sworn Affidavit & Proof of Loss Statement.

- Inspection Certificate: Some vehicles may require a safety or emissions inspection before they can be sold. This certificate verifies that the vehicle meets state regulations.

Having these documents ready can help facilitate the transaction and protect the interests of both parties involved. Each document plays a vital role in ensuring that the sale is legitimate and complies with state laws.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Bill of Sale form is used to document the transfer of ownership of personal property between a seller and a buyer. |

| Governing Laws | The form is governed by Georgia state law, specifically under the Official Code of Georgia Annotated (OCGA) § 10-1-201. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Signatures Required | Both the seller and the buyer must sign the Bill of Sale for it to be valid, indicating their agreement to the terms. |

| Record Keeping | It is recommended that both parties keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

More About Georgia Bill of Sale

What is a Georgia Bill of Sale form?

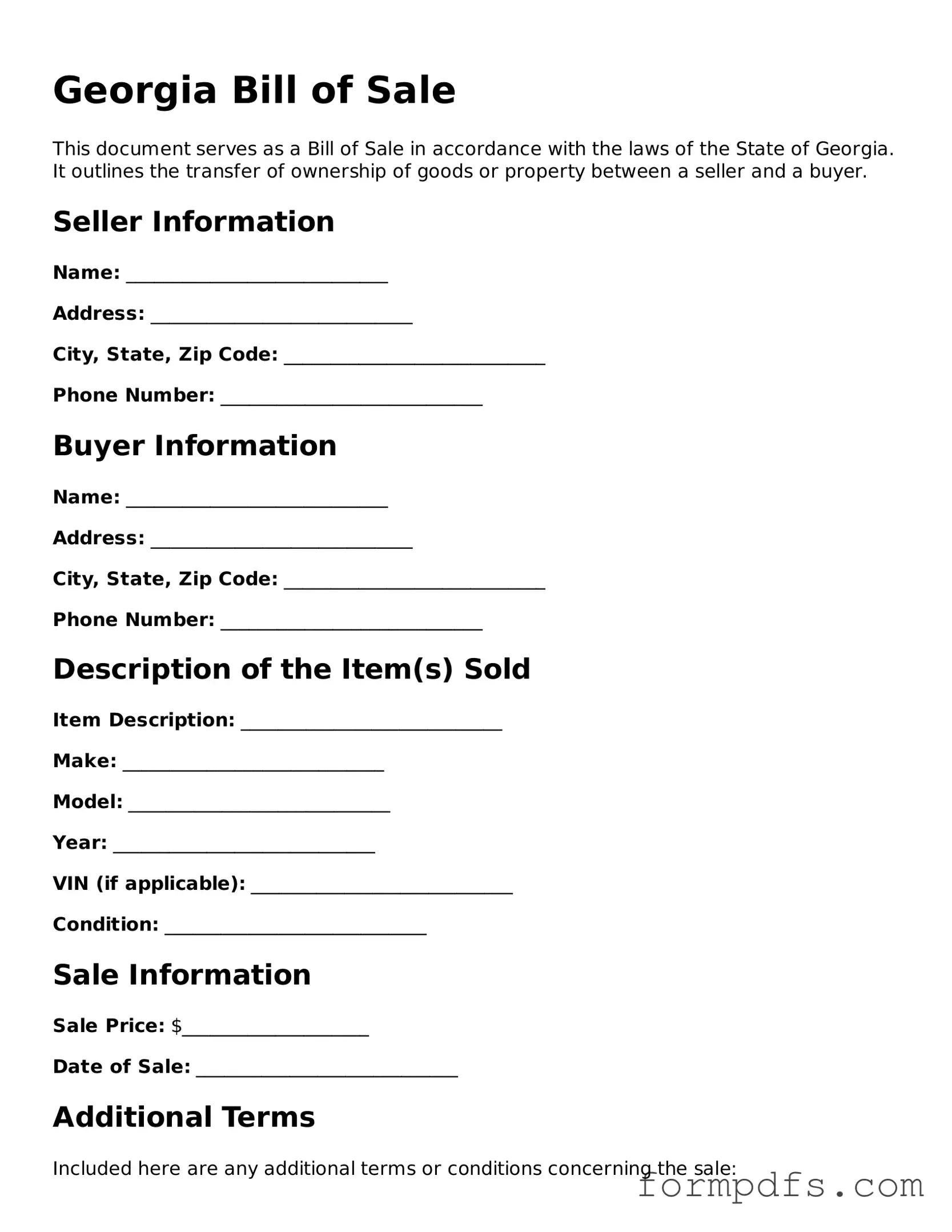

A Georgia Bill of Sale form is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction and can be used for various items, such as vehicles, boats, and other personal property. It typically includes details such as the names and addresses of both the buyer and seller, a description of the item being sold, the sale price, and the date of the transaction.

Is a Bill of Sale required in Georgia?

While a Bill of Sale is not legally required for all transactions in Georgia, it is highly recommended, especially for significant purchases. For vehicles, a Bill of Sale is necessary to register the vehicle with the Georgia Department of Revenue. This document can help protect both the buyer and seller by providing a clear record of the transaction, which can be useful in case of disputes or for tax purposes.

What information should be included in a Georgia Bill of Sale?

A comprehensive Georgia Bill of Sale should include the following information: the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, year, and VIN for vehicles), the sale price, and the date of the transaction. Additionally, both parties should sign and date the document to validate the agreement. Including any warranties or conditions of the sale can also be beneficial.

Can a Bill of Sale be used for gifting an item?

Yes, a Bill of Sale can be used to document the gifting of an item. In this case, the form should indicate that the transfer is a gift and may include a statement that no payment is involved. This documentation can help clarify the intent of the transfer and may be useful for tax purposes or in the event of any disputes regarding ownership in the future.

Georgia Bill of Sale: Usage Steps

Once you have the Georgia Bill of Sale form in hand, it’s time to complete it with the necessary information. This form is essential for documenting the sale of personal property, ensuring both the buyer and seller have a record of the transaction. Follow the steps below to accurately fill out the form.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Make sure to include any necessary contact information.

- Next, fill in the buyer's full name and address, ensuring it matches their identification.

- Describe the item being sold. Include details such as make, model, year, color, and any identifying numbers like VIN for vehicles.

- Indicate the purchase price of the item clearly. If there are any additional terms or conditions regarding the sale, note those as well.

- Both the seller and buyer should sign and date the form at the designated areas. This step is crucial as it signifies agreement to the terms outlined.

- If applicable, have a witness sign the form as well. This can help validate the transaction in the future.

After completing the form, ensure that both parties retain a copy for their records. This documentation will serve as proof of the transaction and can be useful for any future references or disputes.